North America Burial Insurance Market: Industry Analysis and Forecast (2025-2032)

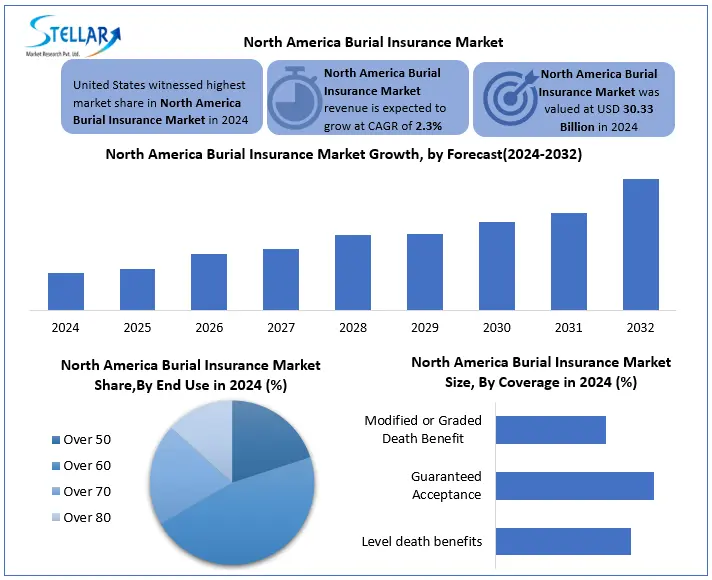

North America Burial Insurance Market was valued at USD 30.33 Billion in 2024 and the total North America Burial Insurance Market revenue is expected to grow by CAGR 2.3% from 2024 to 2032 and reach nearly USD 36.38 Billion in 2032.

Format : PDF | Report ID : SMR_2877

North America Burial Insurance Market Overview

Burial insurance is a low-cost life insurance policy that pays a fixed benefit to cover specific end-of-life expenses like funeral services, burial plots, and related costs. It usually simplified underwriting and smaller coverage amounts, designed to ensure these expenses are paid without financial strain on beneficiaries.

North America Burial Insurance Market experienced steady growth in 2024, with an aging population fuel, increase in funeral expenses and awareness around the final expenditure plan. U.S. The market dominates, supported by a senior population of over 56 million. Major drivers include simplified policies such as guaranteed acceptance schemes, strong insurance broker networks, and faster adopting digital insurance platforms that streamlines access and approval processes. Opportunities are emerging through targeted expansion in weak rural and lower areas, where insurance coverage is limited. integrating AI-operated digital tools and enhances the product appeal offering bundle services such as grief support or healthcare ad-on. These elements collectively grow in the region and enter the market.

Trade and tariff policies indirectly affect the insurance North America burial insurance market, such as the cost related to the funeral, such as caskets and medical supply. It demands burial insurance as families want financial security. increasing costs due to tariffs and low disposable income can opt for consumers to a low-value or simplified policies, which can slow down the premium growth.

To get more Insights: Request Free Sample Report

North America Burial Insurance Market Dyanamics

Growing Awareness of Final Expense Planning to Drive the Market Growth

Raising awareness about the final expenditure plan, which is running significantly in the North America burial insurance market in North America. According to the National Funeral Directors Association (NFDA), the U.S. surveys indicate that more than 65% of American adults aged 50 and above are now actively planning for life expenses from 52% in 2018. This increase is due to an increase in outreach efforts by insurers, financial planners and community programs. Public education campaigns and simplified products offerings have improved consumer understanding, increasing the rates of high policy between senior and medium income houses, which leads to a continuous increase in the North America market.

Digital Platform Integration to Boost the Market Opportunity

Integration of digital platforms is an important opportunity in the North America burial insurance market. Increasing adoption of mobile apps and online tool has improved a lot of policy access and engagement, especially between young demographics. According to the report of 2023 Limara, more than 60% of life insurance buyers under 45 years of age prefer online or hybrid purchase channels. Digital platforms allow users to compare quotes, obtain immediate approval and manage policies without in-commercial meetings. This feature is expanding access to the facility, AI-operated recommendations and transparent pricing, expanding access, reducing the cost of acquisition, and running the market growth through better customer experience.

Lack of Consumer Awareness and Mistrust to Impact the Market Growth

Lack of consumer awareness about available products and their benefits, especially low income and elderly population. Many individuals are unaware that buried insurance is present as a low cost alternative, or they confuse it with traditional life insurance. there is mistrust towards insurance companies, often due to hidden fees or previous experiences with complex words. Lack of confidence and understanding may hesitate to buy policies, slow down North America burial insurance market growth. Inadequate financial literacy leads the issue, it makes it difficult for potential customers to bury or commit insurance products.

North America Burial Insurance Market Segmentate Analysis

Based on the Coverage the market is segmented into the level death benefits, guaranteed acceptance, and modified or graded death benefit. The guaranteed acceptance segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. This North America burial insurance market dominance is governed by its simplified Age Demographics process, which requires no medical examination or health questions, making it highly appealed to the increasing elderly population and persons with already existing health conditions. According to the United Nations, people aged 65 years and above represent about 10.1% of the population in 2024 - for more than 800 million individuals. The demand for an average of $ 6,000 to $ 12,000 with north america funeral expenses continues to promote the adoption of guaranteed acceptance policies worldwide.

Based on the Age Demographics, the market is segmented into Over 50, Over 60, Over 70, Over 80. The over 60 segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. The burial insurance industry Which represents 14.7% of the population, and especially had significant impact on consumer trends in healthcare, insurance and financial services. More than 60 population become increasingly active, economically stable and health-conscious, contributing to the increasing demand for medical services, long-term care solutions and retirement plan products. they control more than 40% consumer expenses, especially in areas such as pharmaceuticals, wellness and insurance. The growing North America burial insurance market opportunities have also expanded by increasing the digital devices for telehealth, health monitoring, and financial management. As life expectancy increases and aging population increases, especially in areas such as North America, Europe and East Asia, expected to maintain its leading position in more than 60 segments, running innovation and investment in age-focused industries.

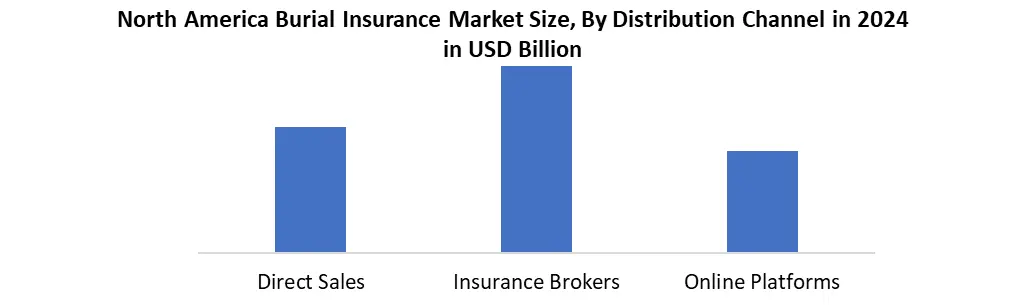

Based on Distribution Channel, the market is segmented into Direct sales, insurance brokers, online platforms. The insurance brokers segment dominated the market in 2024 & expected to hold the largest market share during the forecast period. Inspired by personal service, confidence-based relationships and ability to direct consumers-especially through senior-complex policy options. more than 55% of the 60+ age groups prefer to buy insurance through brokers due to their experience and assurance. Brokers play an important role in educating customers, clarifying conditions and planning for personal needs. This North America burial insurance market approach to the hands makes them particularly valuable in regions such as North America and Europe, where an aging population demands a reliable, directed decision making in the plan of life.

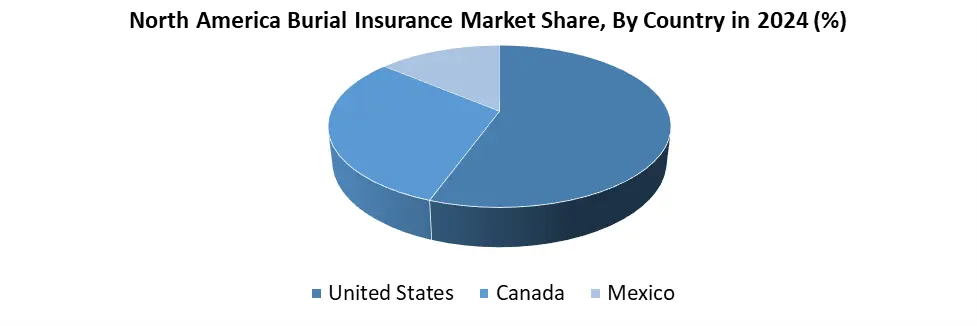

Based on Country, This leadership is inspired by a combination of demographic, economic and industry-specific factors. With more than 17% of the population of 65 and above, the demand for financial planning solutions of America's life faces increasing demand. The country also benefits from a well -established insurance infrastructure, with comprehensive broker networks, digital platforms, and financial advisors actively promote burial policies. Combined with strong consumer awareness, simplified policy options and regulatory support, this North America burial insurance market segment contributes to the dominance of the United States.

North America Burial Insurance Competitive Landscape

Mutual of Omaha and Globe Life Inc. stands out as two major players in the United States, each with different competitive strength. Mutual of Omaha has created a strong reputation for trust and reliability, especially among senior citizens between 45 and 85 years of age, offered guaranteed issues and level benefits buried insurance with flexible payment options. The company takes advantage of a hybrid distribution model of agents, direct mail and digital platforms, and in 2024, it introduced a platform to issue a completely digital policy, which increased the user experience and reduced processing time. On the other hand, Globe Life Inc. captured a large part of the North America burial insurance market through its highly effective direct-to-consumer model, which depends much more on direct mail, online platforms and phone-based sales. It focuses on the burial policies of the simplified issue with low premiums, which targets moderate income houses. While the two companies capture similar market shares -in personal service Omaha Excel's 8-9% Summitulia, while globe life moves forward in strength and quantity of the burial insurance market.

North America Burial Insurance Key Development

- In March 14, 2024, Mutual of Omaha launched a fully digital guaranteed issue burial insurance platform. The platform enables customers to buy and get approved for policies online in under 10 minutes, improving speed, convenience, and accessibility for tech-savvy seniors.

- In February 22, 2024, Globe Life Inc. expanded its automated underwriting system to enable faster burial insurance approvals via mobile and call center sales. This move strengthened its direct-to-consumer model by speeding up policy issuance, particularly for middle-income customers seeking quick and convenient coverage.

- In April 10, 2024, Foresters Financial launched community-based burial insurance plans that include wellness benefits and grief support for beneficiaries. This innovative offering aims to increase policy retention and add social value by addressing both financial and emotional needs.

|

The North America Burial Insurance Market Scope |

|

|

Market Size in 2024 |

USD 30.33 Billion |

|

Market Size in 2032 |

USD 36.38 Billion |

|

CAGR (2025-2032) |

2.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Coverage Level Death benefits Guaranteed Acceptance Modified or graded death benefit |

|

By Age Group Over 50 Over 60 Over 70 Over 80 |

|

|

By Distribution Channel Direct Sales Insurance Brokers Online Platforms |

|

|

Country Scope |

US, Canada, and Mexico |

Key Players in Burial Insurance Market

- Mutual of Omaha (USA)

- Globe Life Inc. (USA)

- Colonial Penn Life Insurance Company (USA)

- AIG (American International Group) (USA)

- Fidelity Life Association (USA)

- Transamerica Corporation (USA)

- Gerber Life Insurance Company (USA)

- Foresters Financial (Canada)

- Assurity Life Insurance Company (USA)

- Lincoln Heritage Life Insurance Company (USA)

Frequently Asked Questions

Guaranteed acceptance plans dominate due to easy approval without medical exams.

People over 60 years old lead the market due to increased focus on end-of-life planning.

The United States leads the market due to its large aging population and developed insurance infrastructure.

1. North America Burial Insurance Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Burial Insurance Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Burial Insurance Market: Dynamics

3.1. North America Burial Insurance Market Trends

3.2. North America Burial Insurance Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Burial Insurance Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Burial Insurance Market Size and Forecast, By Coverage (2024-2032)

4.1.1. Level Death Benefits

4.1.2. Guaranteed Acceptance

4.1.3. Modified or Graded Death Benefit

4.2. North America Burial Insurance Market Size and Forecast, By Age Group (2024-2032)

4.2.1. Over 50

4.2.2. Over 60

4.2.3. Over 70

4.2.4. Over 80

4.3. North America Burial Insurance Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Direct Sales

4.3.2. Insurance Brokers

4.3.3. Online Platforms

4.4. North America Aesthetic Burial Insurance Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1. Mutual of Omaha

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Development

5.2. Globe Life Inc.

5.3. Colonial Penn Life Insurance Company

5.4. AIG (American International Group)

5.5. Fidelity Life Association

5.6. Transamerica Corporation

5.7. Gerber Life Insurance Company

5.8. Foresters Financial

5.9. Assurity Life Insurance Company

5.10. Lincoln Heritage Life Insurance Company

6. Key Findings

7. Analyst Recommendations