North America Aesthetic Medical Devices Market Demand, Innovation and Forecast 2032

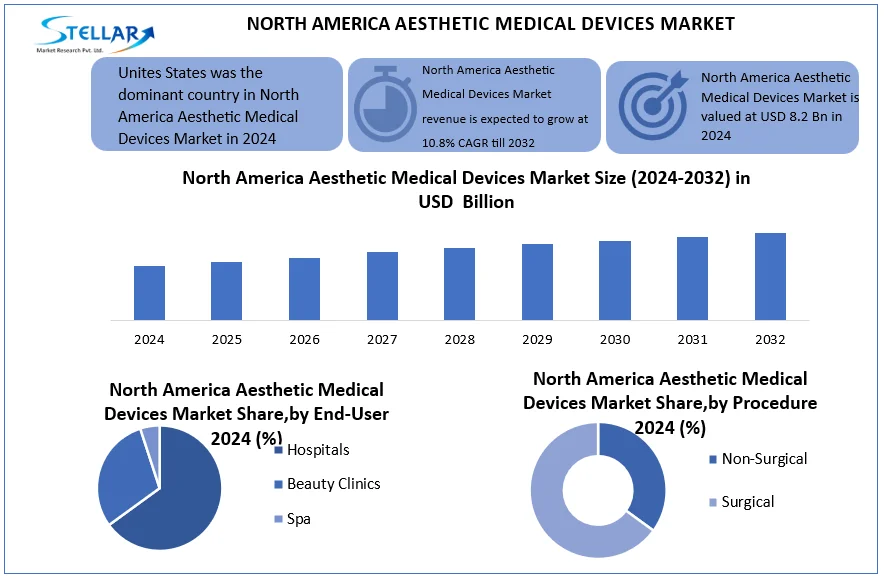

North America Aesthetic Medical Devices Market at 8.2 billion in 2024 and to reach USD 18.63 billion by 2032 at 10.8% CAGR, driven by non-invasive procedures, AI tech, and aging population demand.

Format : PDF | Report ID : SMR_2719

North America Aesthetic Medical Devices Market Overview:

North America Aesthetic Medical Devices Market includes equipment used in cosmetic procedures to enhance physical appearance, including devices for skin tightening, fat reduction, hair removal, wrinkle treatment and body contouring. These devices are typically used in dermatology clinics, med spas and plastic surgery centers. The market growing by rising consumer demand for non-invasive aesthetic procedures, increasing awareness of appearance related wellness and a growing aging population seeking anti-aging solutions. Key drivers include the surge in RF-based and laser devices, AI-assisted skin analysis and popularity of customizable, touchless systems post-COVID. Regulatory approvals from regulatory body like U.S. FDA further support clinical adoption.

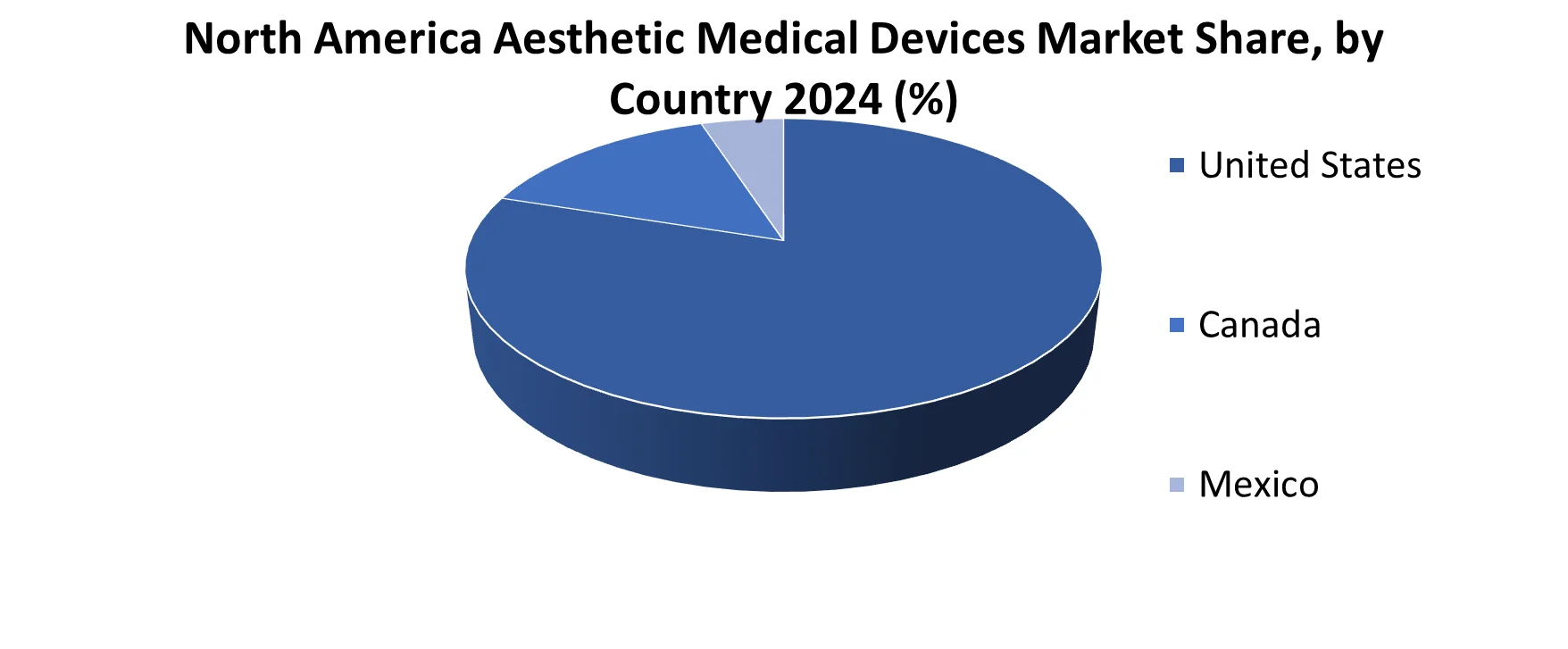

United States leads the North America aesthetic medical devices market, driven by advanced infrastructure and high per capita spending on cosmetic procedures. The market faces hurdles such as U.S. Section 301 tariffs on imported components and stricter NSF/ANSI 61 and MDR regulations, which have impacted pricing, supply chains, and device certifications.

North America Aesthetic Medical Devices Market Recent Developments

|

Date |

Company |

Product/Technology |

Description |

|

May 14, 2024 |

Acclaro Medical (Smithfield, RI, USA) |

UltraClear 2910?nm Fiber Laser |

FDA 510(k) clearance granted on May 8, 2024 decision announced May 14, 2024 for treating benign pigmented lesions and vascular dyschromia |

|

May 14, 2024 |

Profound Medical (Toronto, Canada) |

TULSA-AI Contouring Assistant |

FDA 510(k) clearance for an AI module enabling automated treatment planning for prostate TULSA-PRO procedures. |

|

July 17, 2024 |

InMode Ltd. (Irvine, CA, USA) |

Morpheus8 FRF Micro needling |

FDA 510(k) clearance expands the indication to include soft tissue contraction via fractional radiofrequency microneedling . |

|

August 14, 2024 |

Candela Corp. (Marlborough, MA, USA) |

Matrix Pro RF Micro needling Applicator |

FDA 510(k) clearance for reducing facial wrinkles (Fitzpatrick I?IV) via the Matrix RF skin platform. |

|

April 09, 2025 |

Cynosure?Lutronic Inc. (Westford, MA, USA / Canada) |

XERF RF Skin-Tightening Device |

Health Canada clearance for non-invasive, multi-frequency monopolar RF skin tightening technology. |

To get more Insights: Request Free Sample Report

North America Aesthetic Medical Devices Market Dynamics:

Evolving Beauty Trends to Fuel North America Aesthetic Medical Devices Market Demand

Shifting beauty standards are important factor driving growth in North America aesthetic medical devices market. Cultural perceptions of attractiveness change, more people turning towards cosmetic treatments to match with modern ideals. Non-surgical procedures dominate, with Botox and dermal fillers accounting for over 60% of treatments, while body sculpting devices like CoolSculpting surged by 22% in demand. Social Media influence, celebrity culture and fashion trends push individuals toward various aesthetic enhancements. It fuels trends, with 1 in 3 Americans considering cosmetic procedures influenced by influencers. The U.S. alone contributes 38% of global medical aesthetics revenue, as innovations in laser tech and minimally invasive devices cater to rising demand for youthful, sculpted features.

Sustainability demands to Boost North America Aesthetic Medical Devices Market

Eco-friendly North America aesthetic medical devices demand is creating exciting growth opportunities. Increase in environmental awareness, consumers prefer devices made with sustainable materials and energy-efficient manufacturing. Green practices are adopted by companies which can attract conscious buyers while supporting global sustainability goals. Innovations like reduced waste, lower energy use, and recyclable components position brands as industry leaders in responsible business. By prioritizing sustainability, manufacturers not only appeal to a growing customer base but also strengthen their market reputation and competitive advantages.

Insurance Barriers to Restrain North America Aesthetic Medical Devices Market Growth

North America aesthetic medical devices industry major challenge is the lack of insurance coverage for most cosmetic procedures. These treatments are often considered elective, patients must bear full cost, creating a financial hurdle. High expenses can reduce potential customers, especially those with limited budgets. This coverage gap limits accessibility, preventing many from pursuing treatment even when they have medical or personal reasons for doing so. Without insurance support, market growth slows and socioeconomic disparities in aesthetic care persist. Solutions like expanded insurance policies or flexible financing options could help bridge this gap and make treatments more inclusive. Aesthetic Medical Devices Market Segmentation.

North America Aesthetic Medical Devices Market Segment Analysis

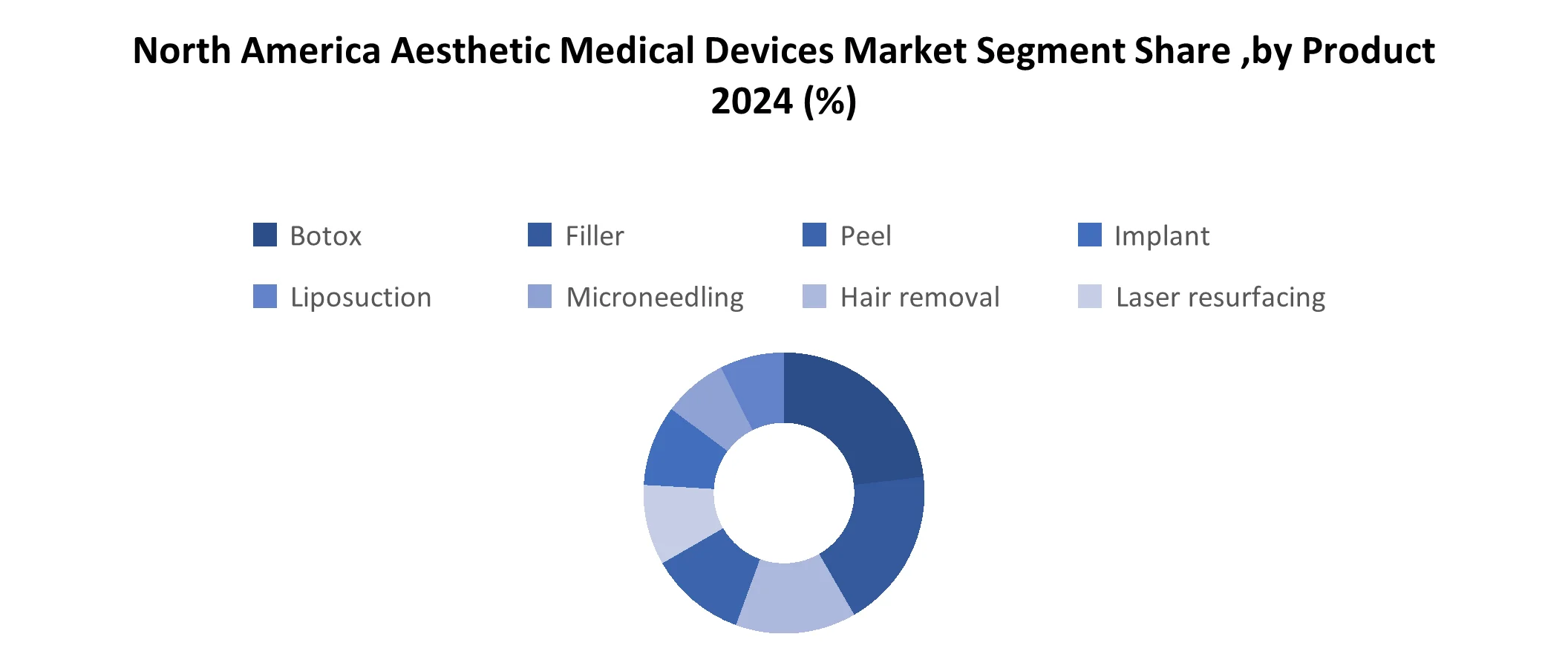

Based on product, North America aesthetic medical devices market is segmented in Botox, fillers, peels, implants, liposuction, micro-needling, hair removal, laser resurfacing, RF, and phototherapy. Botox dominates the North America aesthetic medical devices market, holding over 40% of the neurotoxin segment due to its effectiveness in wrinkle reduction and facial contouring. Dermal fillers are the fastest growing category, driven by non-surgical lip augmentation and facial volumizing, with the U.S. alone accounting for 48% of global filler demand.

Laser hair removal captures 30% of the non-surgical device market in North America, as consumers shift from temporary solutions to permanent reduction. Radiofrequency (RF) devices and laser resurfacing technologies are surging, fueled by anti-aging concerns, while surgical options like implants, liposuction remain stable in medical tourism hubs like Mexico and the U.S. Minimally invasive alternatives like micro-needling and chemical peels cater to demand for affordable rejuvenation, while phototherapy gains traction for acne/psoriasis treatment. The market is shifting towards combination therapies, with 55% of U.S. patients now blending surgical and non-surgical approaches for optimized results, driven by tech innovation and shorter recovery times.

Based on end-user, North America aesthetic medical devices market is segmented into Hospitals, Beauty Clinics and Spa. The hospitals segment holds highest market share in 2024, Hospitals and freestanding surgical centers are primarily visited for aesthetic and reconstructive surgeries. In developed countries, better reimbursement facilities are provided for cosmetic procedures, augmenting growth of hospitals and surgery centers segment. Surgeries at hospitals also give doctors and patients time to address any complications due to surgery. So, the overall segment is believed to witness high growth. Beauty clinics and aesthetic doctors, sometimes referred to by public as aesthetic physicians, are general practitioners with a special interest in aesthetic medicine.

These physicians attend certificate, diploma, or even masters courses to study and train in this branch. Aesthetic doctors provide non-invasive and minimally invasive procedures, like botulinum toxin injection, dermal fillers, chemical peels and various lasers. These physicians cannot practice aesthetic surgeries as require high precision and experience. Most plastic surgeons perform these minimal invasive aesthetic procedures in private practices.

North America Aesthetic Medical Devices Market Regional Analysis

United States is dominant country of North America aesthetic medical devices and is expected to hold this position during the forecast period. Leadership is driven by high demand for cosmetic procedures, advanced healthcare infrastructure and presence of industry players like AbbVie (Allergan), Bausch Health and Cynosure. The Strong preference for minimal invasive treatments like Botox, laser therapy and derma filler, mainly among aging adults and working professionals, fuels steady market expansion. High disposable income, widespread use of social media and cultural acceptance of aesthetic enhancements further contribute to sustained consumer interest and spending.

Canada is fastest growing market for North America aesthetic medical devices in region. The growth of country is driven by increasing awareness of aesthetic procedures, rising income levels and widespread network of certified aesthetic clinics and spa. Market is smaller compared to U.S., it benefits from high regulatory standards set by Health Canada, ensuring product safety and patient trust. Treatments like body contouring, laser skin resurfacing and facial rejuvenation are gaining popularity, particularly among younger demographics and urban populations in cities like Toronto, Vancouver and Montreal.

North America Aesthetic Medical Devices Market Competitive Landscape

North America aesthetic medical devices market is dominated by industry leaders AbbVie Inc., Cynosure and Candela Medical, which collectively control over 50% of the North American market.

AbbVie leads with its USD 5.2 billion aesthetics portfolio in 2023, driven by Botox 70% U.S. wrinkle treatment market share and its expanding dermal filler line. Cynosure follows with USD 1.8 billion in revenue from its innovative laser and radiofrequency platforms like SculpSure and TempSure, while Candela holds a strong 30% U.S. laser market share through its specialized Vbeam and GentleMax Pro systems.

These companies maintain dominance through continuous innovation, AbbVies next-generation fillers, Cynosures FDA-cleared skin tightening technologies, and Candelas strategic partnerships like its pro-bono Vbeam treatments with the Vascular Birthmarks Foundation. Their leadership stems from combining cutting-edge R&D with extensive clinic networks, addressing both medical and cosmetic needs through devices offering faster results and minimal downtime. The market evolution continues to be shaped by these players strategic analysis to merge technological advancements with proven clinical efficacy and strong brand recognition.

|

North America Aesthetic Medical Devices Market Scope |

|

|

Market Size in 2024 |

USD 8.2 billion. |

|

Market Size in 2032 |

USD 18.63 billion. |

|

CAGR (2025-2032) |

10.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments

|

By Product Botox Filler Peel Implant Liposuction Micro needling Hair removal Laser Resurfacing RF Phototherapy |

|

By Procedure Surgical Non-Surgical |

|

|

By End-user Hospital Beauty Clinic Spa |

|

|

Regional Scope

|

North America- United States, Canada, and Mexico |

North America Aesthetic Medical Devices Market Key Players

USA

- Allergan Aesthetics Abbvie Company (USA)

- Cutera, Inc. (USA)

- Cynosure, LLC (USA)

- Lumenis Inc. (USA)

- Solta Medical (USA)

- Candela, Inc. (USA)

- InMode Ltd. (USA)

- Apyx Medical Corporation (USA)

Canada

- Bausch Health Companies Inc. (Canada)

- Venus Concept Inc. (Canada)

Frequently Asked Questions

The United States leads due to its advanced healthcare infrastructure, high disposable income, strong demand for minimally invasive procedures like Botox and laser therapies, and the presence of key players such as AbbVie, Cynosure, and Bausch Health.

Canada's market is growing rapidly due to increasing awareness, rising income levels, expanding networks of med spas, and high safety standards from Health Canada, which boost consumer trust in non-invasive treatments like skin resurfacing and body contouring.

Key trends include the rise of RF-based and laser devices, AI-assisted skin analysis, demand for eco-friendly and customizable equipment, and a growing interest in touchless, non-invasive systems post-COVID.

The main challenges include lack of insurance coverage for most procedures, high costs of treatment, regulatory barriers such as U.S. Section 301 tariffs and stricter safety standards, which affect pricing, imports, and product approvals.

1. North America Aesthetic Medical Devices Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Aesthetic Medical Devices Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Aesthetic Medical Devices Market: Dynamics

3.1. North America Aesthetic Medical Devices Market Trends

3.2. North America Aesthetic Medical Devices Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Aesthetic Medical Devices Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Aesthetic Medical Devices Market Size and Forecast, By Product (2024-2032)

4.1.1. Botox

4.1.2. Filler

4.1.3. Peel

4.1.4. Implant

4.1.5. Liposuction

4.1.6. Micro needling

4.1.7. Hair removal

4.1.8. Laser Resurfacing

4.1.9. RF

4.1.10. Phototherapy

4.2. North America Aesthetic Medical Devices Market Size and Forecast, By Procedure (2024-2032)

4.2.1. Surgical

4.2.2. Non-Surgical

4.3. North America Aesthetic Medical Devices Market Size and Forecast, By End-user (2024-2032)

4.3.1. Hospital

4.3.2. Beauty Clinic

4.3.3. Spa

4.4. North America Aesthetic Medical Devices Market Size and Forecast, by Country (2024-2032)

4.4.1. United States

4.4.1.1. United States Aesthetic Medical Devices Market Size and Forecast, By Product (2024-2032)

4.4.1.1.1. Botox

4.4.1.1.2. Filler

4.4.1.1.3. Peel

4.4.1.1.4. Implant

4.4.1.1.5. Liposuction

4.4.1.1.6. Micro needling

4.4.1.1.7. Hair removal

4.4.1.1.8. Laser Resurfacing

4.4.1.1.9. RF

4.4.1.1.10. Phototherapy

4.4.1.2. United States Aesthetic Medical Devices Market Size and Forecast, By Procedure (2024-2032)

4.4.1.2.1. Surgical

4.4.1.2.2. Non-Surgical

4.4.1.3. United States Aesthetic Medical Devices Market Size and Forecast, By End-user (2024-2032)

4.4.1.3.1. Hospital

4.4.1.3.2. Beauty Clinic

4.4.1.3.3. Spa

4.4.2. Canada

4.4.2.1. Canada Aesthetic Medical Devices Market Size and Forecast, By Product (2024-2032)

4.4.2.1.1. Botox

4.4.2.1.2. Filler

4.4.2.1.3. Peel

4.4.2.1.4. Implant

4.4.2.1.5. Liposuction

4.4.2.1.6. Micro needling

4.4.2.1.7. Hair removal

4.4.2.1.8. Laser Resurfacing

4.4.2.1.9. RF

4.4.2.1.10. Phototherapy

4.4.2.2. Canada Aesthetic Medical Devices Market Size and Forecast, By Procedure (2024-2032)

4.4.2.2.1. Surgical

4.4.2.2.2. Non-Surgical

4.4.2.3. Canada Aesthetic Medical Devices Market Size and Forecast, By End-user (2024-2032)

4.4.2.3.1. Hospital

4.4.2.3.2. Beauty Clinic

4.4.2.3.3. Spa

4.4.3. Mexico

4.4.3.1. Mexico Aesthetic Medical Devices Market Size and Forecast, By Product (2024-2032)

4.4.3.1.1. Botox

4.4.3.1.2. Filler

4.4.3.1.3. Peel

4.4.3.1.4. Implant

4.4.3.1.5. Liposuction

4.4.3.1.6. Micro needling

4.4.3.1.7. Hair removal

4.4.3.1.8. Laser Resurfacing

4.4.3.1.9. RF

4.4.3.1.10. Phototherapy

4.4.3.2. Mexico Aesthetic Medical Devices Market Size and Forecast, By Procedure (2024-2032)

4.4.3.2.1. Surgical

4.4.3.2.2. Non-Surgical

4.4.3.3. Mexico Aesthetic Medical Devices Market Size and Forecast, By End-user (2024-2032)

4.4.3.3.1. Hospital

4.4.3.3.2. Beauty Clinic

4.4.3.3.3. Spa

5. Company Profile: Key Players

5.1. Allergan Aesthetics AbbVie Company (USA)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Cutera, Inc. (USA)

5.3. Cynosure, LLC (USA)

5.4. Bausch Health Companies Inc. (Canada)

5.5. Venus Concept Inc. (Canada)

5.6. Lumenis Inc. (USA)

5.7. Solta Medical (USA)

5.8. Sientra Inc. (USA)

5.9. InMode Ltd. (USA)

5.10. Apyx Medical Corporation (USA)

6. Key Findings & Industry Recommendations

7. North America Aesthetic Medical Devices Market: Research Methodology