North America Keloid Treatment Market Size, U.S. Leadership, Aesthetic Trends

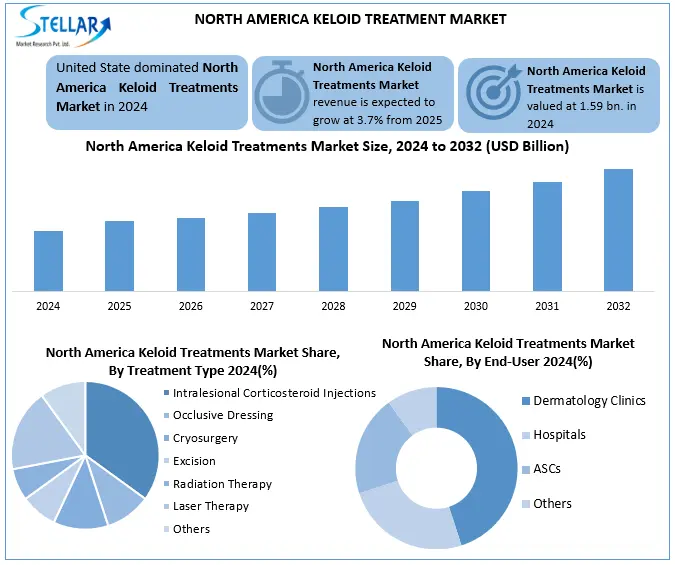

North America Keloid Treatment Market size was valued at USD 1.59 billion in 2024 and the total North America Keloid Treatment Market size is expected to grow at a CAGR of 3.7% from 2025 to 2032, reaching nearly USD 2.11 billion by 2032.

Format : PDF | Report ID : SMR_2862

North America Keloid Treatment Market Overview

Keloid treatment refers to medical, surgical, or non-invasive methods used to manage or reduce abnormal scar tissue growth that extends beyond the original wound. Treatments include corticosteroid injections, laser therapy, silicone gels, and surgical removal.

North America keloid treatment market has been experiencing strong demand by their high aesthetic awareness and rising scar-related consultations. Advanced treatments, including corticosteroid injections, laser therapy, and silicone-based products, are widely available through hospitals, dermatology clinics, and pharmacies. United States dominated regional market by its high volume of cosmetic procedures, diverse at-risk population and access to FDA-approved therapies backed by insurance coverage.

Key players like Mederma, Pfizer, Johnson & Johnson, RXi Pharmaceuticals, and Sonoma Pharmaceuticals contribute significantly through innovation and product variety. Hospitals and clinics remain major end-users, while retail consumers are increasingly turning to over-the-counter scar care products for convenient, home based treatment solutions. This combination of clinical strength and consumer accessibility continues to fuel North America keloid treatment market growth.

To get more Insights: Request Free Sample Report

North America Keloid Treatment Market Dynamics

Aesthetic Focus to Drive the North America Keloid Treatment Market Growth

In North America keloid treatment market is increasing by their strong focus on physical appearance and aesthetic wellness. Region sees high rates of cosmetic procedures like tattoos, piercings, and surgeries like C-sections, which often lead to keloid formation mainly among individuals with darker skin tones. Social media trends and beauty standards are influencing younger consumers to seek scar prevention and treatment options. Availability of advanced dermatological care, along with high disposable income and insurance coverage, supports access to laser therapy, steroid injections, and other treatments. Non invasive solutions like silicone sheets, scar creams, and lase based therapies are gaining popularity for their low risk and fast recovery. E-commerce and over the counter products are also expanding consumer access to home-based scar care.

|

Gender |

Market Role |

|

Female Consumers |

Drive the majority of cosmetic keloid treatments due to higher aesthetic concerns and skincare routines |

|

Male Consumers |

Increasing participation, especially for post-acne scarring, post-gym injuries, and cosmetic surgeries (e.g., hair transplant, chest surgeries) |

Treatment Variability to Restrain the North America Keloid Treatment Market Growth

In the North America keloid treatment market, a key challenge is unpredictable efficacy and side effects of current therapies. Treatment outcomes vary widely by their individual factors like genetic predisposition, immune response, and skin type.

In mainly, darker-skinned populations common in U.S. especially among African-American and Hispanic communities are more prone to keloid formation and may experience different reactions to steroid injections or laser therapies. This variability makes it difficult to establish a universal treatment approach, highlighting need for personalized regimens and greater clinical research focused on diverse skin types.

Keloid treatments- effectiveness, recurrence rate, and side effects

|

Treatment |

Effectiveness |

Recurrence Rate |

Common Side Effects |

|

Intralesional Steroid Injections |

Moderate to High |

33%–50% |

Skin thinning, hypopigmentation, pain at injection site |

|

Surgical Excision (alone) |

Low |

70%–100% |

Recurrence, infection, bleeding |

|

Surgical Excision + Steroids/Radiation |

Moderate to High |

10%–30% |

Wound healing delay, pain, radiation side effects |

|

Cryotherapy |

Moderate |

25%–50% |

Skin blistering, pigment loss, temporary swelling |

|

Laser Therapy (e.g., PDL, CO?) |

Moderate |

20%–45% |

Redness, burning, hyper/hypopigmentation |

Personalized & Combination Therapies to Create Opportunities in North America Keloid Treatment Market Growth

In the North America keloid treatment market, a key opportunity is personalized and combination therapies. Customized plans use a mix of treatments like steroid injections, laser therapy, radiation, and silicone dressings to enhance effectiveness and reduce recurrence. Designed to individual skin type and keloid severity, regimens offer better outcomes than single method approaches. North America keloid treatment companies like Lumenis, Sonoma Pharmaceuticals, and Smith & Nephew are actively developing like integrated therapies. Growing patient demand and clinical support are driving their adoption, mainly among darker-skinned populations prone to keloid recurrence.

A recent North American case combined Kenalog injections, 5-FU, V-Beam laser, and silicone sheets, achieving 95% keloid flattening in 10 months, demonstrating the effectiveness of personalized, multi-modal therapies in reducing recurrence.

North America Keloid Treatment Market Segment Analysis

Based on Treatment Type, North America Keloid Treatment market is segmented into Intralesional corticosteroid injections, occlusive dressing, cryosurgery, excision, radiation therapy, laser therapy and others. Intralesional Corticosteroid Injections segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. They are widely regarded as first-line, cost-effective, and highly accessible option for reducing a inflammation, flattening raised scars, and relieving symptoms like itching or pain. These injections, mainly triamcinolone acetonide, are commonly used dermatologists by their well established safety profile, clinical efficacy, and compatibility with a combination therapies like cryotherapy or laser. Minimally invasive nature and relatively fast results make them a preferred choice among both patients and physicians.

Based on End-User Type, North America Keloid Treatment market is segmented into Hospitals, dermatology clinics, ASCs and others. Dermatology clinics segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. These clinics are preferred by their specialization in skin conditions and access to advanced, non-invasive technologies like laser therapy, cryosurgery, and topical treatments. Patients often choose dermatology clinics for cosmetic concerns by their offer personalized care, shorter wait times and outpatient procedures. Growing popularity of med spas and aesthetic dermatology in urban areas has further boosted patient footfall, making dermatology clinics leading choice for keloid treatment.

North America Keloid Treatment Market Country Insights

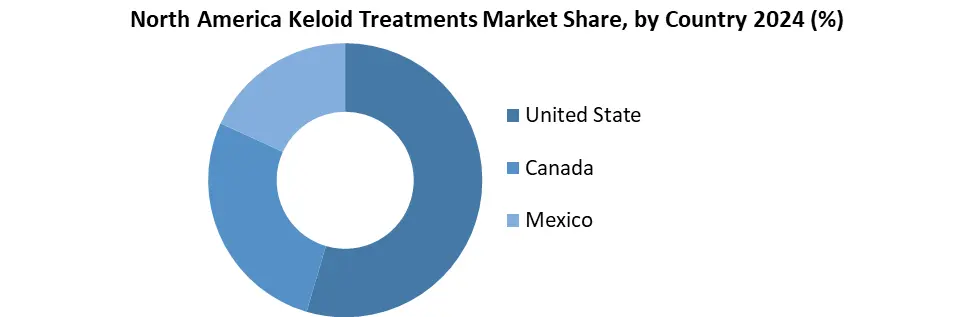

U.S. Led North America Keloid Treatment Market with High Demand and Diverse Population

The United States dominated North America keloid treatment market by its high volume of cosmetic procedures like piercings and surgeries, which raise keloid risks. Its diverse population, mainly among African-American and Hispanic groups, is more prone to keloids.

Country also benefits from advanced healthcare infrastructure and high consumer awareness of aesthetic treatments. Key companies like Sonoma Pharmaceuticals and Sientra are based in U.S., driving innovation and product availability. Also, supportive FDA regulations and insurance coverage improve access to treatment options.

North America Keloid Treatment Market Competitive Landscape

In the North America keloid treatment market, key players like Mederma (by HRA Pharma), Pfizer, Johnson & Johnson, and RXi Pharmaceuticals hold a dominant position by their strong innovation and regional market penetration. Mederma leads over the counter segment with its widely trusted scar gels, mainly popular in U.S. retail and e-commerce channels. Pfizer and Johnson & Johnson leverage their expansive dermatology and wound care portfolios, offering clinical grade solutions used in hospitals and dermatology clinics across U.S.

RXi Pharmaceuticals is advancing RNA based therapies targeting scar gene expression an innovation gaining traction in clinical research settings. Sonoma Pharmaceuticals headquartered in California, plays a vital role with its topical antimicrobial and wound healing products. Companies growing in North America by capitalizing on high aesthetic awareness, advanced healthcare systems, and consumer demand for non-invasive, effective scar care solutions.

Recent Developments in the North America Keloid Treatment Market

- Mederma In May 7, 2025, featured by Allure as one of the top scar creams, highlighting Mederma Advanced Scar Gel for its onion extract formula and efficacy in reducing older scars in 2–3 months.

- Sonoma?Pharmaceuticals In January 4, 2023, launched new office-dispense products—Regenacyn Plus, Reliefacyn Plus, and Rejuvacyn Plus—targeting keloid and hypertrophic scars with hypochlorous acid formulations.

- Sensus Healthcare In January 30, 2025, presented its SRT-100 Vision superficial radiotherapy for keloid and skin cancer treatment at The Microcap Conference on January 30, 2025.

|

North America Keloid Treatment Market Scope |

|

|

Market Size in 2024 |

USD 1.59 billion. |

|

Market Size in 2032 |

USD 2.11 billion. |

|

CAGR (2024-2032) |

3.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Injectables Laser Products Topical Products |

|

By Treatment Type Intralesional Corticosteroid Injections Occlusive Dressing Cryosurgery Excision Radiation Therapy Laser Therapy Others |

|

|

By End-User Hospitals Dermatology Clinics ASCs Others |

|

North America Keloid Treatment Market Key Players

- Mederma (New York, USA)

- Pfizer Inc. (New York, USA)

- Merck & Co., Inc. (New Jersey, USA)

- Bristol?Myers Squibb (New York, USA)

- Mylan N.V. (Canonsburg, USA)

- RXi Pharmaceuticals (Massachusetts, USA)

- Sonoma Pharmaceuticals (California, USA)

- Sensus Healthcare (Florida, USA)

- Avita Medical Inc. (New Jersey, USA)

- Valeant Pharmaceuticals (Bridgewater, USA)

- Revitol Corporation (New York, USA)

- Johnson & Johnson (New Brunswick, USA)

Frequently Asked Questions

Intralesional corticosteroid injections (first-line treatment due to cost-effectiveness, fast results, and minimal invasiveness).

Dermatology clinics (specialized care, advanced technology, and shorter wait times for cosmetic concerns).

High cosmetic procedure rates, diverse population (higher keloid risk in African-American/Hispanic groups), strong healthcare infrastructure, and FDA support.

1. North America Keloid Treatment Market: Research Methodology

2. North America Keloid Treatment Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. North America Keloid Treatment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. North America Keloid Treatment Market: Dynamics

4.1. Keloid Treatment Market Trends

4.2. Keloid Treatment Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

4.7. Advancements in Renewable Energy Cables

5. North America Keloid Treatment Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. North America Keloid Treatment Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Injectables

5.1.2. Laser Products

5.1.3. Topical Products

5.2. North America Keloid Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.2.1. Intralesional Corticosteroid Injections

5.2.2. Occlusive Dressing

5.2.3. Cryosurgery

5.2.4. Excision

5.2.5. Radiation Therapy

5.2.6. Laser Therapy

5.2.7. Others

5.3. North America Keloid Treatment Market Size and Forecast, By End-User (2024-2032)

5.3.1. Hospitals

5.3.2. Dermatology Clinics

5.3.3. ASCs

5.3.4. Others

5.4. North America Keloid Treatment Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. North America Keloid Treatment Market Size and Forecast, by Country (2024-2032)

6.1.1. United States

6.1.1.1. United States Keloid Treatment Market Size and Forecast, By Product Type (2024-2032)

6.1.1.1.1. Injectables

6.1.1.1.2. Laser Products

6.1.1.1.3. Topical Products

6.1.1.2. United States Keloid Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.1.1.2.1. Intralesional Corticosteroid Injections

6.1.1.2.2. Occlusive Dressing

6.1.1.2.3. Cryosurgery

6.1.1.2.4. Excision

6.1.1.2.5. Radiation Therapy

6.1.1.2.6. Laser Therapy

6.1.1.2.7. Others

6.1.1.3. United States Keloid Treatment Market Size and Forecast, By End-User (2024-2032)

6.1.1.3.1. Hospitals

6.1.1.3.2. Dermatology Clinics

6.1.1.3.3. ASCs

6.1.1.3.4. Others

6.1.2. Canada

6.1.2.1. Canada Keloid Treatment Market Size and Forecast, By Product Type (2024-2032)

6.1.2.1.1. Injectables

6.1.2.1.2. Laser Products

6.1.2.1.3. Topical Products

6.1.2.2. Canada Keloid Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.1.2.2.1. Intralesional Corticosteroid Injections

6.1.2.2.2. Occlusive Dressing

6.1.2.2.3. Cryosurgery

6.1.2.2.4. Excision

6.1.2.2.5. Radiation Therapy

6.1.2.2.6. Laser Therapy

6.1.2.2.7. Others

6.1.2.3. Canada Keloid Treatment Market Size and Forecast, By End-User (2024-2032)

6.1.2.3.1. Hospitals

6.1.2.3.2. Dermatology Clinics

6.1.2.3.3. ASCs

6.1.2.3.4. Others

6.1.3. Mexico

6.1.3.1. Mexico Keloid Treatment Market Size and Forecast, By Product Type (2024-2032)

6.1.3.1.1. Injectables

6.1.3.1.2. Laser Products

6.1.3.1.3. Topical Products

6.1.3.2. Mexico Keloid Treatment Market Size and Forecast, By Treatment Type (2024-2032)

6.1.3.2.1. Intralesional Corticosteroid Injections

6.1.3.2.2. Occlusive Dressing

6.1.3.2.3. Cryosurgery

6.1.3.2.4. Excision

6.1.3.2.5. Radiation Therapy

6.1.3.2.6. Laser Therapy

6.1.3.2.7. Others

6.1.3.2.8. Mexico Keloid

6.1.3.3. Mexico Keloid Treatment Market Size and Forecast, By End-User (2024-2032)

6.1.3.3.1. Hospitals

6.1.3.3.2. Dermatology Clinics

6.1.3.3.3. ASCs

6.1.3.3.4. Others

6. Company Profile: Key Players

6.1. Mederma (New York, USA)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Pfizer Inc. (New York, USA)

6.3. Merck & Co., Inc. (New Jersey, USA)

6.4. Bristol Myers Squibb (New York, USA)

6.5. Mylan N.V. (Canonsburg, USA)

6.6. RXi Pharmaceuticals (Massachusetts, USA)

6.7. Sonoma Pharmaceuticals (California, USA)

6.8. Sensus Healthcare (Florida, USA)

6.9. Avita Medical Inc. (New Jersey, USA)

6.10. Valeant Pharmaceuticals (Bridgewater, USA)

6.11. Revitol Corporation (New York, USA)

6.12. Johnson & Johnson (New Brunswick, USA)

7. Key Findings

8. Industry Recommendations