North America Dysmenorrhea Treatment Market Industry Analysis and Forecast (2025-2032)

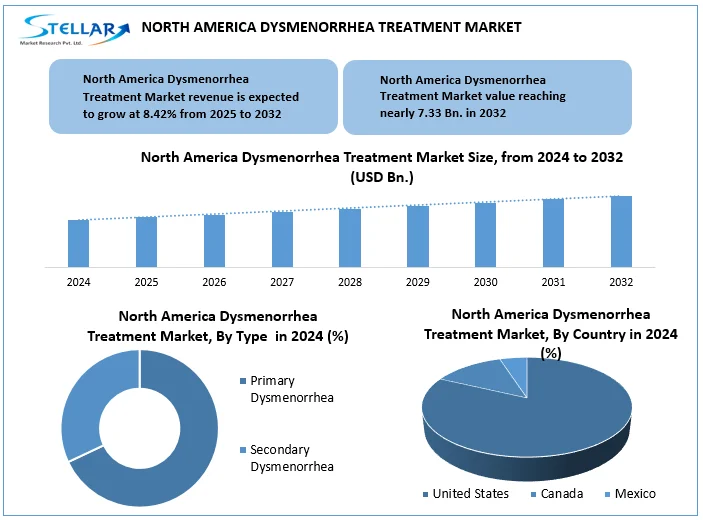

North America Dysmenorrhea Treatment Market was valued at USD 3.84 Bn. in 2024. The Total North America Dysmenorrhea Treatment Market revenue is expected to grow by CAGR 8.42% from 2024 to 2032 and reach nearly USD 7.33 Bn. in 2032.

Format : PDF | Report ID : SMR_2870

North America Dysmenorrhea Treatment Market Overview:

Dysmenorrhea treatment is a process of managing and relieving menstrual pain due to uterine contractions, which are usually experienced during menstruation. This includes medical, hormonal, physical and sometimes surgical intervention. it depends on whether the condition is primary or secondary.

The North America Dysmenorrhea treatment market has been increasing due to rising menstrual health awareness, innovative treatment options and strong healthcare infrastructure and better access through telemedicine. Menstrual pain and awareness increase to promote dysmenorrhea treatment market. Major trends in the Dysmenorrhea treatment market in North America include increasing use of NSAID and hormonal therapy, increasing demand for non-invasive options such as heat patches and vaginal gels and increase in telemedicine and Fintech app for personal care.

The United States is largest consumer in the North America Dysmenorrhea Treatment Market in 2024. The United States dominates the North America Dysmenorrhea Treatment Market in 2024. The North America Dysmenorrhea Treatment Market key players are Bayer AG, Novartis AG, Abbott Laboratories, F. Hoffmann-La Roche Ltd, and Sanofi S.A. In 15 June 2023, AbbVie in the United States (US) launched a major awareness campaign for Mirena (levonorgestrel IUD), which promotes its off-labeled use to dysmenorrhea and emphasizes its hormonal, long-term solutions in women's reproductive health.

To get more Insights: Request Free Sample Report

North America Dysmenorrhea Treatment Market Dynamics:

Rising Menstrual Pain Cases and Awareness to Boost the Dysmenorrhea Treatment Market

As more women experience menstrual pain (dysmenorrhea), mainly in of young age groups, required effective treatment options. At the same time, awareness about menstruation is increasing due to education, media and public health initiatives. This combination is encouraging more women to receive medical treatments, which drives dysmenorrhea treatment and increases growth in the market. About 45% of individuals need medical care, and up to 50% miss school or work during menstruation, which disrupts the quality of life and contributes to anxiety or depression. Health campaigns, school programs and media efforts have reduced the stigma and encouraged women to seek medical help. Also, progress in treatment, like NSAIDs and hormonal contraceptives, are extended options for non-pharmacological options such as acupuncture and supplements. This is accelerating market growth, with support for assistant healthcare policies and women's health priorities.

R&D in Non-Hormonal & Herbal Therapies to Boost the Dysmenorrhea Treatment Market Growth

Many women are rapidly hesitant to depend on the long-term use of NSAIDs or hormonal contraceptives due to concerns about gastrointestinal, heart, or reproductive side effects. As a result, research institutes and pharmaceutical manufacturers are investing in non-hormonal and herbal remedies, such as ginger, fennel, cinnamon, chamomile and traditional East Asian formulas, which are gaining momentum because research values ??their therapeutic ability for dysmenorrhea. For example, ginger and fennel reduced menstrual pain, with ginger, comparable effectiveness appears for NSAIDs such as herbal extracts. These innovations not only diversify the treatment scenario, but also open the market for a few areas, such as women or traditional measures in areas with limited access to pharmaceuticals. Clinical testing and integrated medical studies make the efficacy of these treatments more valid, which helps them to obtain approval in mainstream gynaecological care.

Adverse Effects of Long-Term Use of NSAIDs to Retrain the North America Dysmenorrhea Treatment Market

Dysmenorrhea is associated with adverse effects such as prolonged application of NSAIDs and hormonal therapy, gastrointestinal bleeding, kidney dysfunction, blood clots and hormonal imbalances. These risk decreases the patient's adherence, caution in determining the physician, and tens of equipment and herbal remedies, such as safe, non-pharmacological alternatives like TENS devices and herbal remedies. In addition, regulatory advice in the borders of North America, especially American FDA, to limit long-term use, collectively disrupts the development of traditional dysmenorrhea treatment in the region.

Innovative Therapies to Create Opportunity in the North America Dysmenorrhea Treatment Market

Increasing awareness about adverse effects associated with traditional dysmenorrhea remedies, such as NSAIDs and hormonal therapy, is driving for safe and more innovative options across North America. This change is creating a strong market opportunity for the development of non-hormonal, non-opioid and plant-based treatments, providing relief from effective pain with less side effects. In addition, progress in biotechnology and pain management research is enabling the manufacture of targeted remedies that address the underlying causes rather than only symptoms. Digital health equipment, wearable pain relief devices and expansion of telemedicine services increase and extend access to especially among the young and technical-lover population. These trends are in the position of North America as a highly-affected area for companies starting the next generation dysmenorrhea treatment to North America.

North America Dysmenorrhea Treatment Market Segment Analysis:

Based on Treatment Type, the North America Dysmenorrhea Treatment Market is segmented into Non-steroidal Anti-inflammatory Drugs (NSAIDs), Hormonal Therapy and others. The Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) dominated the North America Dysmenorrhea Treatment Market in 2024 and are expected to dominate in the forecast period (2025-2032). 70% of women with primary dysmenorrhea illness use NSAIDs as the primary method of pain relief due to menstrual pain, comprehensive availability and quick effectiveness at relieving relatively low cost. Also, NSAIDs work by preventing prostaglandin synthesis, substances such as hormones responsible for uterine contractions and pain during menstruation. Therefore, they are often the primary treatment recommended by healthcare providers. Their over-the-counter access in most areas also contributes to their widespread use, especially among individuals who manage dysmenorrhea without formal medical consultation.

Based on type, the North America Dysmenorrhea Treatment Market is segmented into primary dysmenorrhea and secondary dysmenorrhea. Primary dysmenorrhea dominated the North American dysmenorrhea treatment market in 2024 and is expected to continue dominating the forecast period (2025–2032). This form of menstrual discomfort, is occurs without any primary pelvic pathology in women and girls, is more common than secondary dysmenorrhea and usually begins during adolescence. More than 90% of adolescent girls and more than 50% of women of reproductive age experience primary dysmenorrhea. Its high circulation is the main driver of market dominance, as it produces adequate demand for both over-the-counter and prescribed pain relief treatment.

North America Dysmenorrhea Treatment Market Regional Analysis

The United States Dominated the North America Dysmenorrhea treatment market in 2024 and is expected

In 2024, the United States is an advanced healthcare infrastructure, high awareness about menstrual health and a strong presence of major pharmaceutical companies. An important part of the female population actively needs treatment for menstrual pain cramps, supported by extensive access to OB-GYN experts and strong insurance coverage. The US government and health organizations also run awareness campaigns that encourage early diagnosis and medical intervention. Also, constant R&D investment has led to the development of safe and more effective remedies, including non-opioid painkillers, hormonal therapy and innovative distribution systems. These factors collectively make the US the largest and most influential consumer in the regional Dysmenorrhea treatment market.

North America Dysmenorrhea Treatment Market Competitive Landscape

In 2024, the North America Dysmenorrhea Treatment Market key players are Bayer AG, Novartis AG, Abbott Laboratories, F. Hoffmann-La Roche Ltd, and Sanofi S.A. Important contribution through product innovation, market access and strategic attention. Novartis is accompanied by an estimated 12–15% market share, which offers a wide range of menstrual pain remedies and takes advantage of its strong distribution capabilities. Roche follows closely, holding about 10–12.5% ??stake, mainly through a strong pipeline of hormonal therapy. Bayer AG remains a major force with a comprehensive portfolio that includes NSAIDs such as naproxen, which are widely used for primary dysmenorrhea. Abbott laboratory focus on innovative distribution systems to increase the patient's convenience, adding over-the-counter and prescription NSAID products.

Recent Developments

In December 1, 2022, Pfizer in the United state submitted a new application for primary dysmenorrhea for an extended-release NSAID, offering a 12-hour relief with fewer doses, enhanced compliance and expanding the pain management portfolio of their non-opioid women.

In August 24, 2021, the FDA approved Orilissa (elagolix) of Bayer in Germany for a moderate-to-serious dysmenorrhea, which is one of the first oral GnRH antagonists in this space and is a significant expansion beyond its OTC product line.

In 15 June 2023, AbbVie in the United States (US) launched a major awareness campaign for Mirena (levonorgestrel IUD), which promotes its off-labeled use to dysmenorrhea and emphasizes its hormonal, long-term solutions in women's reproductive health.

|

The North America Dysmenorrhea Treatment Market Scope |

|

|

Market Size in 2024 |

USD 3.84 Bn. |

|

Market Size in 2032 |

USD 7.33 Bn. |

|

CAGR (2025-2032) |

8.42% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Treatment Non-steroidal Anti-inflammatory Drugs (NSAIDs) Hormonal Therapy |

|

By Sales Channel Hospitals Clinics retail pharmacy Online pharmacy |

|

|

By Type Primary Dysmenorrhea Secondary Dysmenorrhea |

|

|

Regional Scope |

North America- United States, Canada, and Mexico |

North America Dysmenorrhea Treatment Market Key players:

North America

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Abbott Laboratories (United States)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Sanofi S.A. (France)

- Pfizer Inc. (United States)

- Johnson & Johnson (United States)

- GlaxoSmithKline plc (GSK) (United Kingdom)

- Organon & Co. (United States)Teva Pharmaceutical Industries Ltd. (Israel)

Frequently Asked Questions

The United States dominated in North America Dysmenorrhea Treatment Market in 2024.

Rising menstrual pain cases and awareness and R&D in Non-Hormonal & Herbal Therapies are driving the North America Dysmenorrhea Treatment Market.

Bayer AG, Novartis AG, Abbott Laboratories, F. Hoffmann-La Roche Ltd, and Sanofi S.A. are the Key Players in the global North America Dysmenorrhea Treatment Market.

1. North America Dysmenorrhea Treatment Market: Research Methodology

2. North America Dysmenorrhea Treatment Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global North America Dysmenorrhea Treatment Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarters

3.2.3. Service Segment

3.2.4. Application Segment

3.2.5. Revenue (2024)

3.2.6. Geographical Presence

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. North America Dysmenorrhea Treatment Market: Dynamics

4.1. North America Dysmenorrhea Treatment Market Trends

4.2. North America Dysmenorrhea Treatment Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Regulatory Landscape by Region

4.6. Key Opinion Leader Analysis for the Global Industry

4.7. Analysis of Government Schemes and Initiatives for Industry

5. North America Dysmenorrhea Treatment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.1.2. Hormonal Therapy

5.2. North America Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.2.1. Primary Dysmenorrhea

5.2.2. Secondary Dysmenorrhea

5.3. North America Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.3.1. Hospitals

5.3.2. Clinics retail pharmacy

5.3.3. Online pharmacy

5.4. North America Dysmenorrhea Treatment Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.1.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.1.1.2. Hormonal Therapy

5.4.1.2. United States Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.1.2.1. Primary Dysmenorrhea

5.4.1.2.2. Secondary Dysmenorrhea

5.4.1.3. United States Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.1.3.1. Hospitals

5.4.1.3.2. Clinics retail pharmacy

5.4.1.3.3. Online pharmacy

5.4.2. Canada

5.4.2.1. Canada Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.2.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.2.1.2. Hormonal Therapy

5.4.2.2. Canada Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.2.2.1. Primary Dysmenorrhea

5.4.2.2.2. Secondary Dysmenorrhea

5.4.2.3. Canada Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.2.3.1. Hospitals

5.4.2.3.2. Clinics retail pharmacy

5.4.2.3.3. Online pharmacy

5.4.3. Mexico

5.4.3.1. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Treatment Type (2024-2032)

5.4.3.1.1. Non-steroidal Anti-inflammatory Drugs (NSAIDs)

5.4.3.1.2. Hormonal Therapy

5.4.3.2. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Type (2024-2032)

5.4.3.2.1. Primary Dysmenorrhea

5.4.3.2.2. Secondary Dysmenorrhea

5.4.3.3. Mexico Dysmenorrhea Treatment Market Size and Forecast, By Sales Channel (2024-2032)

5.4.3.3.1. Hospitals

5.4.3.3.2. Clinics retail pharmacy

5.4.3.3.3. Online pharmacy

6. Company Profile: Key Players

6.1. Bayer AG (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Novartis AG (Switzerland)

6.3. Abbott Laboratories (United States)

6.4. F. Hoffmann-La Roche Ltd (Switzerland)

6.5. Sanofi S.A. (France)

6.6. Pfizer Inc. (United States)

6.7. Johnson & Johnson (United States)

6.8. GlaxoSmithKline plc (GSK) (United Kingdom)

6.9. Organon & Co. (United States)

6.10. Teva Pharmaceutical Industries Ltd. (Israel)

7. Key Findings

8. Industry Recommendations