North America Heparin Market: Industry Analysis and Forecast (2025-2032)

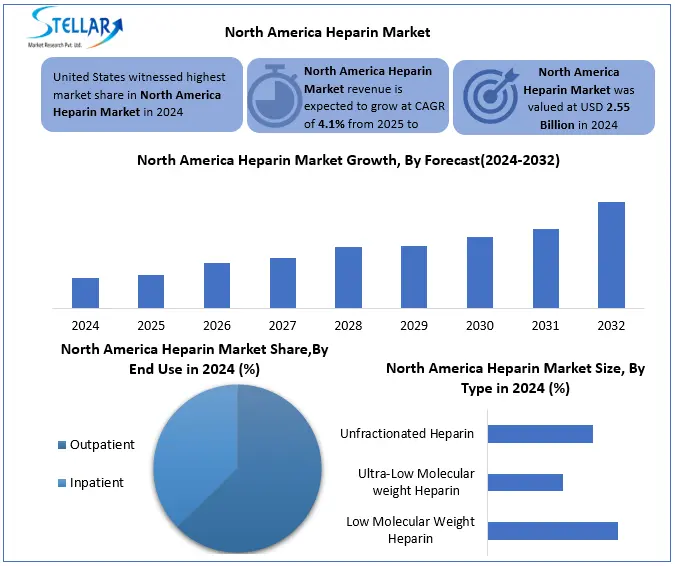

North America Heparin Market was valued at USD 2.55 Billion in 2024 and the total North America Heparin Market revenue is expected to grow by CAGR 4.1% from 2024 to 2032 and reach nearly USD 3.52 Billion in 2032.

Format : PDF | Report ID : SMR_2860

North America Heparin Market Overview

Heparin is an anticoagulant used to prevent and treat blood clots. It is mainly taken from the pig intestines and works by increasing the antithrombin III activity to disrupt blood clotting factors. Heparin is widely used for surgery, dialysis and conditions such as DVT and PE. It is available in two types unfamiliar heparin and low molecular load heparin.

Global North America Heparin Market, anticoagulant is extensively used to prevent blood clots and treat, surgery, dialysis and deep vein is essential in conditions such as thrombosis and pulmonary embolism. North America Heparin Market growth is powered by strong healthcare infrastructure, advanced medical facilities and comprehensive insurance coverage, especially the US. and in Canada. Increasing preference for outpatient and home-based care has created demand for user friendly formulations such as pre filtered syringes, reduced the cost of hospital tour and health care. Opportunities in prefilled syringe innovations, biosynthetic heparin development, and bovine-sourced alternatives. Key segments include LMWH, intravenous administration, and hospital usage, with growing adoption in dialysis care.

Trade and tariffs mainly affect the North America heparin market due to dependence on crude heparin imported from China and Europe. Tariff hikes or trade restrictions increase production costs, disrupt supply chains, and value volatility. This dependence causes vulnerability, pushing companies to detect local production, although high cost and regulatory barriers limit this change.

To get more Insights: Request Free Sample Report

North America Heparin Market Dynamics

Strong Healthcare Infrastructure to Drive the Heparin Market Growth

The strong healthcare infrastructure of North America supports the Heparin market. The region claims advanced medical facilities including specialized hospitals and surgical centres, often use heparin in processes such as dialysis, cardiovascular surgery and intensive care treatment. comprehensive insurance coverage in countries such as the US and Canada ensures high cost higher access to hospital-grade drugs, reducing financial burden on patients. Government -backed healthcare programs and private insurance schemes make it easy for healthcare providers to adopt effective anticoagulants like Heparin. This strong infrastructure technological progress and combined with efficient medical professionals, increases constant demand for heparin throughout the region.

Growing Demand for Home-Based Care to Unlocks New Opportunities in the North America Heparin Market

The rising preference for outpatient care and home-based healthcare in North America is creating important opportunities for the North America Heparin market. With the increasing number of patients managing chronic conditions such as Deep Wayne thrombosis (DVT), atrium fibrillation, and surgical recovery at home, the demand for user-friendly and self-administrative anticoagulant therapy is increasing. This trend is running to adopt pre filled heparin syringes and easily used leather, which continuously reduces hospital tour and low health care costs. Progress to drug distribution technologies is also enabling safe and more effective home administration. tributaries for home care treatment, telehealth expansion and insurance coverage further encourage this change. Pharmaceutical companies are focusing on rapid packaging solutions and training resources that increase patient compliance and safety. Overall, the increase in outpatients and home healthcare presents a high-development avenue for heparin manufacturers in the North American heparin market.

High Capital and Regulatory Costs to Limit Local Heparin Manufacturing in North America

The installation of heparin manufacturing facilities in North America requires adequate capital investment due to the complexity of the production process and the need for special equipment. manufacturers should follow strict regulatory standards set by agencies such as FDA, including expensive quality control, verification and ongoing inspections. These high compliance costs increase operational expenses, making local production less economically attractive, lower than importing raw materials from suppliers installed abroad. many companies hesitate to invest in domestic manufacturing, limit the self sufficiency of the region and depend on the north America heparin market imports, which induce the risk to the supply of stability.

North America Heparin Market Segment Analysis

Based on Type, the market is segmented into Low Molecular Weight Heparin, Ultra Low Molecular Weight Heparin, and Unfractionated Heparin. The low molecular weight segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. The North America heparin market, its favourable safety profile and other heparin types are easily motivated to administration. Low molecular load heparin is associated with a minor phenomenon of adverse effects such as heparin induced thrombocytopenia and flow of blood complications, which are more prevalent with unfamiliar heparin. Low molecular load heparin provides predicted anticoagulant action and is administered through subcutaneous injections, eliminating the requirement of regular laboratory monitoring. Its long half life dosage enables decrease in frequency, which increases the patient compliance and convenience. These advantages, inhibiting thromboembolic disorders, inhibit and treat with their widespread custom in the treatment such as deep vein thrombosis and pulmonary embolism, less molecular weight heparin.

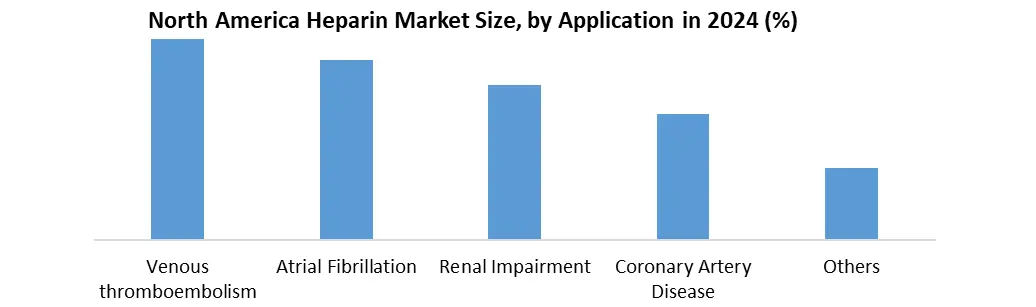

Based on Application, the market is segmented into venous thromboembolism, atrial fibrillation, renal impairment, coronary artery disease, others. The venous thromboembolism segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. The venous thromboembolism, including deep vein thrombosis and pulmonary embolism, has develop a major cause of heart disease and mortality worldwide. Oral thromboembolism, especially in hospitalized, surgical, cancer and immobile patients have greatly improved the request for effective anticoagulation therapy. Heparin, especially low molecular load heparin, is roughly used as the first row treatment and preventive agent, which is produced by rapid start of action, predicting pharmacokinetics and installation of clinical efficacy. Strong recommendations of global healthcare organizations and clinical guidelines support the use of heparin in venous thromboembolism management. Its cost effectiveness and reliability, as well as the frequent use of heparin in both these patients and outpatient care settings, confirms the dominance of the arterial thromboembolism segment in the North America heparin market.

Based on End Users, the market is segmented into Outpatient, Inpatient. The inpatient segment dominated the market in 2024 and is expected to hold the largest market share during the forecast period. Heparin is mainly used in hospital settings where immediate and controlled anticoagulation is compulsory. It plays an significant role in handling acute conditions during major surgery such as venous thrombosis, pulmonary embolism, atrial fibrillation and orthopaedic or heart processes. In these scenarios, unaffected heparin and low molecular load heparin are preferred due to their rapid start and ease of dose adjustment under medical supervision. In addition, procedures such as dialysis and post operative prophylaxis depend on heparin in heavy care. Wants immediate feedback for close monitoring, risk management and adverse effects takes care of the leading environment for heparin administration.

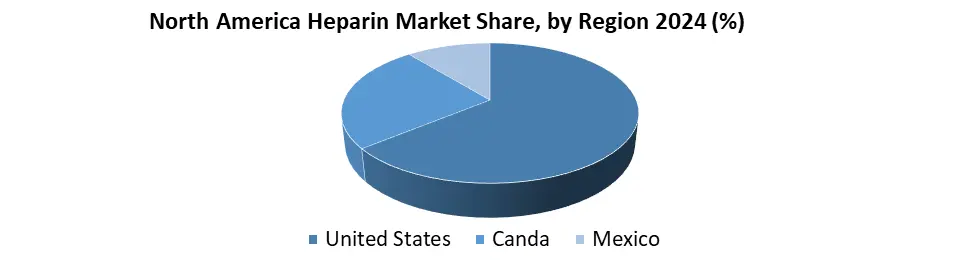

Based on Country, United States dominated the heparin market in 2024 and is expected to hold largest share during the forecast period. holding approximately 75-80% of the total market share. This leadership is inspired by a large patient population, advanced healthcare infrastructure and high proliferation of heart diseases. The country's strong regulatory structure, surgery, dialysis, and other treatments supported by the FDA facilitates widespread use of heparin. comprehensive insurance coverage improves the patient's access to these treatments. which leads to a steady growth supported by healthcare investment and increase in chronic disease awareness. the US remains a primary development driver in the North America heparin market.

North America Heparin Market Competitive Landscape

Pfizer Inc. And Amphastar Pharmaceuticals, Inc. Heparin is a major player in the market. Physics has a strong global appearance with a comprehensive product range and regulatory approval. It focuses on innovation, biosimilars and broad international distribution. Amphastar specializes in cost effective injection, especially in the US market. Its major strength is in house API production and vertical integration. While Fizer is globally, Amphastar dominates the American hospital area. The advantage of physic is on the global scale, while the Amphastar provides pricing efficiency. Both contribute significantly to the development of the North America heparin market through various strategies.

North America Heparin Market Key Development

- In March 2024, Pfizer Inc. signed a long-term agreement with Chinese suppliers to secure porcine mucosa-based API for heparin supply in the U.S. This deal strengthens Pfizer’s supply chain, ensuring a reliable supply of the essential anticoagulant amid global risks.

- In July 2024, Amphastar Pharmaceuticals, Inc. received FDA approval for its generic Heparin Sodium Injection (USP), enabling expanded hospital and emergency use across the U.S.

- In February 2024, Baxter International Inc. expanded its U.S. distribution agreements to ensure a steady supply of injectable anticoagulants, including heparin, to hospitals nationwide.

|

The North America Heparin Market Scope |

|

|

Market Size in 2024 |

USD 2.55 Billion |

|

Market Size in 2032 |

USD 3.52 Billion |

|

CAGR (2025-2032) |

4.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Low Molecular Weight Heparin Ultra-Low Molecular Weight Heparin Unfractionated Heparin |

|

By Application venous thromboembolism Atrial fibrillation Renal impairment Coronary artery disease Others |

|

|

By End User Inpatient Outpatient |

|

|

Regional Scope |

North America- US, Canada, and Mexico |

Key players in the North America Heparin Market

- Pfizer Inc. (New York)

- Amphastar Pharmaceuticals, Inc. (California)

- Baxter International Inc. (Illinois)

- Fresenius Kabi USA (Illinois)

- Sanofi S.A. (Paris)

- Bio-Rad Laboratories, Inc. (California)

- Johnson & Johnson (Janssen Pharmaceuticals) (New Jersey)

- LFB Group (Lille)

- Mylan N.V. (Viatris Inc.) (Pennsylvania)

- Haemtech, Inc. (New York)

Frequently Asked Questions

The North America Heparin Market was valued at USD 2.55 billion in 2024.

The United States dominates the market with about 75-80% of the market share.

High capital investment, strict regulatory requirements, and expensive compliance costs limit local manufacturing, causing dependence on imports from China and Europe.

1. North America Heparin Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Heparin Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America Heparin Market: Dynamics

3.1. North America Heparin Market Trends

3.2. North America Heparin Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America Heparin Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America Heparin Market Size and Forecast, By Type (2024-2032)

4.1.1. Low Molecular Weight Heparin

4.1.2. Ultra-low molecular Weight Heparin

4.1.3. Unfractionated Heparin

4.2. North America Heparin Market Size and Forecast, By Application (2024-2032)

4.2.1. Venous thromboembolism

4.2.2. Atrial fibrillation

4.2.3. Renal impairment

4.2.4. Coronary artery disease

4.2.5. others

4.3. North America Heparin Market Size and Forecast, By End-User (2024-2032)

4.3.1. Inpatient

4.3.2. Outpatient

4.4. North America Aesthetic Heparin Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1. Pfizer Inc.

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Development

5.2. Amphastar Pharmaceuticals, Inc.

5.3. Baxter International Inc.

5.4. Fresenius Kabi USA

5.5. Sanofi S.A.

5.6. Bio-Rad Laboratories, Inc.

5.7. Johnson & Johnson (Janssen Pharmaceuticals)

5.8. LFB Group

5.9. Mylan N.V. (Viatris Inc.)

5.10. Haemtech, Inc.

6. Key Findings

7. Analyst Recommendations