Global Manuka Honey Market Size, Share & Trends Analysis Report (2026–2032) Growth Drivers, Counterfeit Challenges, Key Segments by Grade, Application & Distribution Channel, and Regional & Competitive Outlook

Global Manuka Honey Market Size was estimated at USD 513.12 Mn in 2025, and it is expected to reach USD 818.58 Mn in 2032. The Market CAGR is expected to be around 6.9% during the forecast period (2026-2032).

Format : PDF | Report ID : SMR_2668

Manuka Honey Market Overview

Manuka honey is a premium, high-quality honey produced primarily in New Zealand, made by a bee pollinating the Manuka bush. Its demand is for its high methylglyoxal content, which makes it a strong antibacterial and the product with healing properties, which are utilized for wound care, sore throats, and gut health. It contains sugar, proteins, enzymes, and the amino acids that differ depending on where it comes from and how it is processed.

Post-pandemic trends reveal strong demand for functional foods containing Manuka honey, for instance, lozenges, herbal teas, and supplements aimed at boosting immunity. Premiumization is especially characteristic of North America and Europe, where customers are willing to spend more on high-quality products with UMF 20+ and MGO 400+ ascribed to them. Abstract grade honey produced in New Zealand and parts of Australia faces several challenges, since almost 30-50% of said supply is estimated to be counterfeit, along with other supply side constraints. Climate change and strict regulations in major markets such as the EU and US make business even more difficult.

To respond, top brands such as Comvita and Manuka Health are adopting sophisticated authentication methods, such as blockchain tracing, while Australian producers are stepping up as competitive producers of honey alongside New Zealand.

Most of the honey production is carried out in New Zealand and Australia. Europe consumes the most honey, with a market share due to high demand for natural products and good online retail presence.

The Asia Pacific region is the fastest-growing, with China taking the lead due to Tmall and JD.com driving online sales. DNA testing and strict origin labeling are now mandated by the EU to fight counterfeit Manuka honey, after finding 30% of imported Manuka honey was adulterated. Similarly, the U.S. FDA now requires UMF/MGO certification with up to $10,000 penalties for adulteration or labelling. Competitive realities reveal that Comvita from New Zealand leads the premium market share. Authentication technologies, sustainability credentials, and clinical validation represent key differentiators, and all these are heavily invested in by the major players to stay relevant in this high-value, fast-changing market.

.webp)

To get more Insights: Request Free Sample Report

Manuka Honey Market Dynamics

Increasing Demand for Natural Health and Wellness Products to Drive Market Growth

Growing consumer awareness of the unique antibacterial properties and high methylglyoxal (MGO) content, with the unique Manuka Factor (UMF) increases the demand for Manuka Honey. Post-pandemic trends show special power in immunity-boosting products, which include Manuka Honey in functional foods such as lozenges, teas, and supplements. Markets are also benefiting from premiumization trends, especially in North America and Europe, where consumers are willing to pay premium prices for high-grade UMF 20+ and MGO 400+ products.

Counterfeiting & Supply Constraints: A Major Challenge for the Manuka Honey Market

The industry is facing significant challenges that may disrupt its growth. The fake products in the market are a major issue, with estimates that 30–50% of the Manuka Honey sold globally may be adulterated or fake. Lack of supply also another challenge, as the actual Manuka Honey can only be produced in New Zealand and Australia, where the production is unsafe due to climate variations and bee health issues. Regulatory barriers, especially strict export standards, were implemented by the Ministry for Primary Industries of New Zealand and the European Union, and the U.S. Such as labeling requirements in major markets, add complexity and cost to market participation.

The market is responding to these challenges with many new strategies, Sustainable apiculture practices are being adopted to protect the delicate Manuka ecosystem, while Australian manufacturers are emerging as a viable alternative to New Zealand-sourced honey. In product development, there is a thrilling expansion in medical and skincare applications. Manuka is innovating with formats such as Honey gummies and Protein Bar, while e-commerce platforms are making authentic products globally accessible. Further, the ability to combat counterfeiting through industry technology, maintain permanent production practices, and continue demonstrating clinical efficacy will be important in realizing the market's complete growth capacity through 2032.

Manuka Honey Market Segmentation

Based on Grade, the Manuka Honey Market segment includes by grade into UMF-certified (Unique Manuka Factor), MGO-rated (Methylglyoxal content), and non-certified/standard Manuka Honey, each of which serves various consumer and medical purposes. UMF-certified Manuka Honey leads the premium segment globally because it ensures authenticity and strength, especially in medical and therapeutic applications. The MGO-rated category growing fast, particularly in the Asia-Pacific region and North America, where the consumers are demanding transparent potency labels. Non-certified Manuka Honey, though less expensive, has 30% market share but is plagued by questions over authenticity, with mounting regulatory enforcement in the EU and U.S.

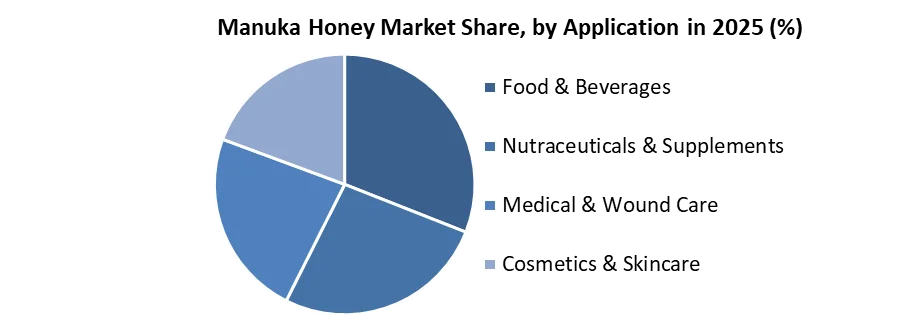

Based on the Application, like food & beverages, nutraceuticals & supplements, medical & wound care, and cosmetics, addressing particular demand drivers. Food & Beverages account for the largest share of the market, fueled by rising health-conscious consumption. The nutraceutical & supplements business is the most rapidly expanding business because Manuka Honey is being more and more utilized in immunity-boosting gummies, capsules, and protein powders. Medical & wound care uses, although niche, are high-value, with hospital-grade UMF 20+ honey being used in FDA-cleared wound dressings. The cosmetics industry is growing with Manuka-infused skincare products (creams, serums) particularly in luxury beauty segments.

Based on Distribution Channel, the market is distributed across supermarkets/hypermarkets, pharmacies & health stores, e-commerce, and direct-to-consumer (DTC) channels. E-commerce dominates the distribution channel, driven by websites like Amazon, Tmall, and brand sites offering global accessibility. Pharmacies & health stores contribute second second-largest dominating distribution channel, due to their favored use for purchasing clinical-grade, while supermarkets are used for food-grade products.

Manuka Honey Regional Analysis

New Zealand, Holds the largest share in the global manuka honey production, contributing the largest world supply. New Zealand industry is heavily controlled by the Ministry for Primary Industries, which controls the stringent export requirements, including UMF a Unique Manuka Factor certification, and DNA analysis. Australia, the second-largest producer of manuka honey, Australian manuka honey is often priced competitively, which makes it more accessible to middle-income consumers as compared to New Zealand’s ultra-premium manuka honey products. This dominance is due to the true Manuka honey is made by only the indigenous Leptospermum scoparium plant. Asia-Pacific is the most rapidly growing region. China's market alone grew by 28% in 2023, led by e-commerce websites like Tmall and JD.com. Japan and South Korea are becoming key markets, with demand for MGO 250+ grades

Manuka Honey Market Competitive Landscape

Comvita, a leading Manuka honey producer in New Zealand holds highest market share, has adopted blockchain-enabled traceability technology to verify and ensure the quality of products. Customers can easily track the path of the product from the hive to the shelf, guaranteeing its true UMF (Unique Manuka Factor) value and enhancing trust in the brand among customers. In October 2023 True Honey Co. introduced a Manuka honey product that boasts a record-breaking 2050+ MGO and 34 UMF, pushing the industry standards to new levels. The product was rolled out initially with 1,000 jars on Tmall Global, keeping in mind the brand's dedication to delivering premium-quality Manuka honey. Another popular New Zealand brand Manuka Health, grew its portfolio by introducing new line of Manuka honey skincare products launched in 2023.

|

Manuka Honey Market Scope |

|

|

Market Size in 2025 |

USD 513.12 Mn. |

|

Market Size in 2032 |

USD 818.58 Mn. |

|

CAGR (2026-2032) |

6.9% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Grade UMF-Certified MGO-Rated Non-Certified |

|

By Application Food & Beverages Nutraceuticals & Supplements Medical & Wound Care Cosmetics & Skincare |

|

|

By Distribution Channel E-Commerce Supermarkets/Hypermarkets Pharmacies/Drugstores Direct-to-Consumer |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Manuka Honey Market Key Players

North America

- Wedderspoon (USA)

- Kiva (USA)

- Manuka Honey USA (USA)

- Manuka Honey Canada (Canada)

Europe

- Manuka Doctor (UK)

- Pure Honey (UK)

- Nature's Greatest (UK)

- Manuka Pharm (Germany)

- Manuka Bio (Germany)

Asia Pacific

- Comvita (New Zealand)

- Manuka Health (New Zealand)

- Watson & Son (New Zealand)

- Capilano Honey (Australia)

- Steens Honey (New Zealand)

- Nature's Way (Australia)

- Happy Valley (New Zealand)

- Arataki Honey (New Zealand)

- Wild Cape Manuka (New Zealand)

- Australian Manuka Honey (Australia)

- Three Peaks (New Zealand)

- Airborne Honey (New Zealand)

- First Light Honey (New Zealand)

- Manuka South (New Zealand)

- Kora Organics (Australia)

- Manuka Guard (New Zealand)

- Manuka Biotic (New Zealand)

- Manuka Honey Singapore (Singapore)

- Manuka Honey Japan (Japan)

- Manuka Honey Hong Kong (China)

Middle East & Africa

- Manuka Honey Dubai (UAE)

Frequently Asked Questions

Asia-Pacific is catching up fast, with China’s health-conscious consumers driving annual growth.

UMF-certified (premium medical grade), MGO-rated (potency-measured), and non-certified (budget options), each appealing to different buyers.

Fake Manuka Honey makes up to approximately 30% of online sales, pushing brands like Comvita to use blockchain tracking to prove authenticity.

New Zealand’s Comvita and Manuka Health dominate, followed by Australia’s Capilano and U.S. brands like Wedderspoon.

1. Manuka Honey Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Manuka Honey Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2025)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Manuka Honey Market: Dynamics

3.1. Manuka Honey Market Trends by Region

3.1.1. North America Manuka Honey Market Trends

3.1.2. Europe Manuka Honey Market Trends

3.1.3. Asia Pacific Manuka Honey Market Trends

3.1.4. Middle East and Africa Manuka Honey Market Trends

3.1.5. South America Manuka Honey Market Trends

3.2. Manuka Honey Market Dynamics

3.2.1. Manuka Honey Market Drivers

3.2.2. Manuka Honey Market Restraints

3.2.3. Manuka Honey Market Opportunities

3.2.4. Manuka Honey Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Manuka Honey Industry

4. Manuka Honey Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Manuka Honey Market Size and Forecast, By Grade (2025-2032)

4.1.1. UMF-Certified

4.1.2. MGO-Rated

4.1.3. Non-Certified

4.2. Manuka Honey Market Size and Forecast, By Application (2025-2032)

4.2.1. Food & Beverages

4.2.2. Nutraceuticals & Supplements

4.2.3. Medical & Wound Care

4.2.4. Cosmetics & Skincare

4.3. Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

4.3.1. E-Commerce

4.3.2. Supermarkets/Hypermarkets

4.3.3. Pharmacies/Drugstores

4.3.4. Direct-to-Consumer

4.4. Manuka Honey Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Manuka Honey Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. North America Manuka Honey Market Size and Forecast, By Grade (2025-2032)

5.1.1. UMF-Certified

5.1.2. MGO-Rated

5.1.3. Non-Certified

5.2. North America Manuka Honey Market Size and Forecast, By Application (2025-2032)

5.2.1. Food & Beverages

5.2.2. Nutraceuticals & Supplements

5.2.3. Medical & Wound Care

5.2.4. Cosmetics & Skincare

5.3. North America Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

5.3.1. E-Commerce

5.3.2. Supermarkets/Hypermarkets

5.3.3. Pharmacies/Drugstores

5.3.4. Direct-to-Consumer

5.4. North America Manuka Honey Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Manuka Honey Market Size and Forecast, By Grade (2025-2032)

5.4.1.1.1. UMF-Certified

5.4.1.1.2. MGO-Rated

5.4.1.1.3. Non-Certified

5.4.1.2. United States Manuka Honey Market Size and Forecast, By Application (2025-2032)

5.4.1.2.1. Food & Beverages

5.4.1.2.2. Nutraceuticals & Supplements

5.4.1.2.3. Medical & Wound Care

5.4.1.2.4. Cosmetics & Skincare

5.4.1.3. United States Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1.3.1. E-Commerce

5.4.1.3.2. Supermarkets/Hypermarkets

5.4.1.3.3. Pharmacies/Drugstores

5.4.1.3.4. Direct-to-Consumer

5.4.2. Canada

5.4.2.1. Canada Manuka Honey Market Size and Forecast, By Grade (2025-2032)

5.4.2.1.1. UMF-Certified

5.4.2.1.2. MGO-Rated

5.4.2.1.3. Non-Certified

5.4.2.2. Canada Manuka Honey Market Size and Forecast, By Application (2025-2032)

5.4.2.2.1. Food & Beverages

5.4.2.2.2. Nutraceuticals & Supplements

5.4.2.2.3. Medical & Wound Care

5.4.2.2.4. Cosmetics & Skincare

5.4.3. Canada Manuka Honey Market Size and Forecast, By Distribution Channel Industry (2025-2032)

5.4.3.1.1. E-Commerce

5.4.3.1.2. Supermarkets/Hypermarkets

5.4.3.1.3. Pharmacies/Drugstores

5.4.3.1.4. Direct-to-Consumer

5.4.4. Mexico

5.4.4.1. Mexico Manuka Honey Market Size and Forecast, By Grade (2025-2032)

5.4.4.1.1. UMF-Certified

5.4.4.1.2. MGO-Rated

5.4.4.1.3. Non-Certified

5.4.4.2. Mexico Manuka Honey Market Size and Forecast, By Application (2025-2032)

5.4.4.2.1. Food & Beverages

5.4.4.2.2. Nutraceuticals & Supplements

5.4.4.2.3. Medical & Wound Care

5.4.4.2.4. Cosmetics & Skincare

5.4.4.3. Mexico Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.4.3.1. E-Commerce

5.4.4.3.2. Supermarkets/Hypermarkets

5.4.4.3.3. Pharmacies/Drugstores

5.4.4.3.4. Direct-to-Consumer

6. Europe Manuka Honey Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Europe Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.2. Europe Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.3. Europe Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4. Europe Manuka Honey Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.1.2. United Kingdom Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.1.3. United Kingdom Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.2. France

6.4.2.1. France Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.2.2. France Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.2.3. France Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.3.2. Germany Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.3.3. Germany Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.4.2. Italy Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.4.3. Italy Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.5.2. Spain Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.5.3. Spain Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.6.2. Sweden Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.6.3. Sweden Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.7.2. Austria Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.7.3. Austria Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Manuka Honey Market Size and Forecast, By Grade (2025-2032)

6.4.8.2. Rest of Europe Manuka Honey Market Size and Forecast, By Application (2025-2032)

6.4.8.3. Rest of Europe Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7. Asia Pacific Manuka Honey Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.2. Asia Pacific Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.3. Asia Pacific Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4. Asia Pacific Manuka Honey Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.1.2. China Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.1.3. China Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.2.2. S Korea Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.2.3. S Korea Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.3.2. Japan Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.3.3. Japan Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.4. India

7.4.4.1. India Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.4.2. India Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.4.3. India Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.5.2. Australia Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.5.3. Australia Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.6.2. Indonesia Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.6.3. Indonesia Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.7.2. Philippines Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.7.3. Philippines Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.8.2. Malaysia Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.8.3. Malaysia Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.9.2. Vietnam Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.9.3. Vietnam Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.10.2. Thailand Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.10.3. Thailand Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Manuka Honey Market Size and Forecast, By Grade (2025-2032)

7.4.11.2. Rest of Asia Pacific Manuka Honey Market Size and Forecast, By Application (2025-2032)

7.4.11.3. Rest of Asia Pacific Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

8. Middle East and Africa Manuka Honey Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Manuka Honey Market Size and Forecast, By Grade (2025-2032)

8.2. Middle East and Africa Manuka Honey Market Size and Forecast, By Application (2025-2032)

8.3. Middle East and Africa Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

8.4. Middle East and Africa Manuka Honey Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Manuka Honey Market Size and Forecast, By Grade (2025-2032)

8.4.1.2. South Africa Manuka Honey Market Size and Forecast, By Application (2025-2032)

8.4.1.3. South Africa Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Manuka Honey Market Size and Forecast, By Grade (2025-2032)

8.4.2.2. GCC Manuka Honey Market Size and Forecast, By Application (2025-2032)

8.4.2.3. GCC Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Manuka Honey Market Size and Forecast, By Grade (2025-2032)

8.4.3.2. Nigeria Manuka Honey Market Size and Forecast, By Application (2025-2032)

8.4.3.3. Nigeria Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Manuka Honey Market Size and Forecast, By Grade (2025-2032)

8.4.4.2. Rest of ME&A Manuka Honey Market Size and Forecast, By Application (2025-2032)

8.4.4.3. Rest of ME&A Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

9. South America Manuka Honey Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. South America Manuka Honey Market Size and Forecast, By Grade (2025-2032)

9.2. South America Manuka Honey Market Size and Forecast, By Application (2025-2032)

9.3. South America Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

9.4. South America Manuka Honey Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Manuka Honey Market Size and Forecast, By Grade (2025-2032)

9.4.1.2. Brazil Manuka Honey Market Size and Forecast, By Application (2025-2032)

9.4.1.3. Brazil Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Manuka Honey Market Size and Forecast, By Grade (2025-2032)

9.4.2.2. Argentina Manuka Honey Market Size and Forecast, By Application (2025-2032)

9.4.2.3. Argentina Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Manuka Honey Market Size and Forecast, By Grade (2025-2032)

9.4.3.2. Rest Of South America Manuka Honey Market Size and Forecast, By Application (2025-2032)

9.4.3.3. Rest Of South America Manuka Honey Market Size and Forecast, By Distribution Channel (2025-2032)

10. Company Profile: Key Players

10.1. Comvita (New Zealand)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Manuka Health (New Zealand)

10.3. Watson & Son (New Zealand)

10.4. Capilano Honey (Australia)

10.5. Wedderspoon (USA)

10.6. Steens Honey (New Zealand)

10.7. Nature's Way (Australia)

10.8. Kiva (USA)

10.9. Manuka Doctor (UK)

10.10. Happy Valley (New Zealand)

10.11. Arataki Honey (New Zealand)

10.12. WildCape Manuka (New Zealand)

10.13. Australian Manuka Honey (Australia)

10.14. Pure Honey (UK)

10.15. Manuka Pharm (Germany)

10.16. Nature's Greatest (UK)

10.17. Manuka Bio (Germany)

10.18. Three Peaks (New Zealand)

10.19. Airborne Honey (New Zealand)

10.20. First Light Honey (New Zealand)

10.21. Manuka South (New Zealand)

10.22. Kora Organics (Australia)

10.23. ManukaGuard (New Zealand)

10.24. Manuka Biotic (New Zealand)

10.25. Manuka Honey USA (USA)

10.26. Manuka Honey Singapore (Singapore)

10.27. Manuka Honey Dubai (UAE)

10.28. Manuka Honey Japan (Japan)

10.29. Manuka Honey Hong Kong (China)

10.30. Manuka Honey Canada (Canada)

11. Key Findings

12. Analyst Recommendations

13. Manuka Honey Market: Research Methodology