Organic Food Market: Global Industry Analysis and Forecast (2025-2032)

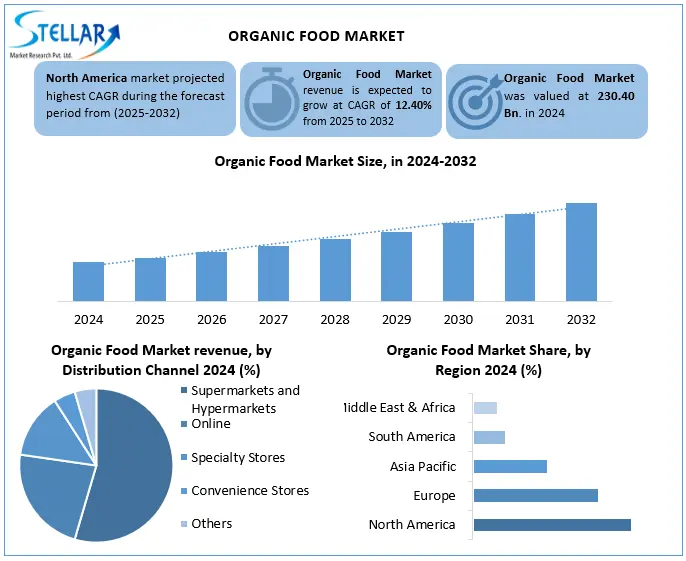

The Organic Food Market size was valued at USD 230.40 Bn. in 2024, and the total Organic Food Market revenue is expected to grow at a CAGR of 12.40% from 2025 to 2032, reaching nearly USD 586.97 Bn.

Format : PDF | Report ID : SMR_2854

Organic Food Market Overview

Organic food refers to food products that are grown and processed without the use of synthetic chemicals, like fertilizers, artificial pesticides, genetically modified organisms (GMOs), antibiotics, or growth hormones. Organic agriculture depends on several natural methods, such as soil health and ecology, to maintain any crop rotation, manure and control organic insects.

The organic food market is fastest fastest-growing market because of rising health awareness, environmental concerns and demand for sustainable products. Major trends in the organic food market are e-commerce expansion, technological development and environmentally friendly packaging. Consumer demand for chemical-free food and safe food to driving the organic food market.

The most dominant region in the organic food market is North America, particularly the United States in 2024. The top two companies in the organic food market are Hain Celestial and Danone SA. The U.S. applied 10% baseline tariffs on most imported goods, including organic products. Additionally, up to 34% mutual tariffs on countries such as China and India have disrupted organic import flow, especially affecting organic corn and soy markets.

To get more Insights: Request Free Sample Report

Organic Food Market Dynamics

Increasing Consumer Demand for Chemical-Free and Safe Food to Drive the Market Growth

Now a days, Consumers are becoming more aware of the probable health risks related to pesticides, synthetic fertilizers and additives used in traditional agriculture. Consumers are concerned that, these all chemicals cause allergies, hormonal disruption and long-term diseases and other major conditions making them seek healthy options. Without synthetic chemicals, Organic foods are grown and they are considered safe, more natural and better for personal health. This increasing preference encourages farmers to adopt organic farming methods and motivates food producers and retailers to offer more organic products. Consumers are choosing organic options because the rising availability and confidence in biological foods, which promotes the expansion of the biological food market globally.

Infant and Maternal Health Prioritization to Drive the Growth of Organic Food Market

Parents and expectant mothers are rapidly alert about the foods they consume and provide to their children. They seek safe, chemical-free options that affect the development and well-being of mother and child both to avoid exposure to harmful pesticides, additives and synthetic ingredients. The organic foods are considered a safe choice during pregnancy and other crucial life phases. Thus, the requirement for organic foods like baby foods, dairy products, fruits and vegetables are growing continuously. Also, the manufacturers and retailers of organic foods expand their organic products to targeted consumers such as, mothers, expectant mothers, infants and newborn babies. The healthcare professionals and public health campaigns often recommend biological options for this group, supporting further market growth.

Shorter Shelf Life to Restrain the Organic Food Market Growth

Organic products are free from synthetic preservatives and chemicals that usually expand freshness. Thus, organic fruits, vegetables, dairy, and other disastrous items deteriorate faster than traditional products. This leads to high damage during transportation, storage and store shelves and increasing costs for producers and retailers. Small shelf life limits the geographical access of biological foods, making it difficult to supply distant markets. These challenges reduce the availability and convenience of organic products, therefore, slowing the market growth.

Organic Food Market Segment Analysis

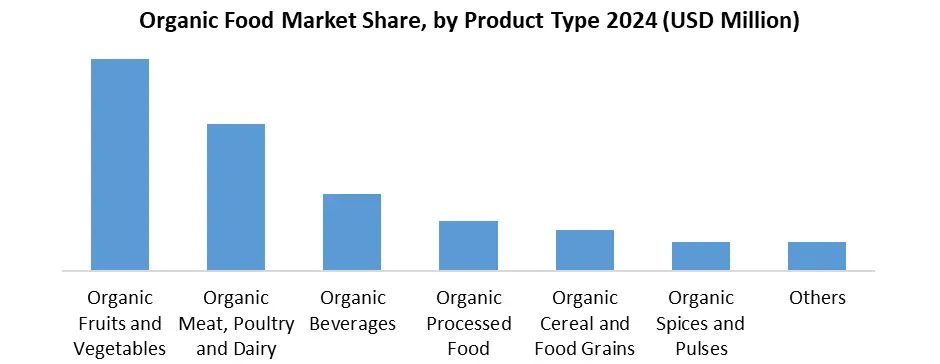

By Product Type, the organic foods market is segmented into organic drinks, organic cereal and grains, Organic Meat, Poultry and Dairy products, Organic Spices and Pulses, Organic Processed Food, Organic Fruits and Vegetables and Others. The most dominant product types in the organic foods market are biological fruits and vegetables. Since they consume them every day and conventional farming has a large potential for pesticides, which results in consumers choosing for organic foods. This product are viewed as healthy, fresh and safe because they are grown naturally without the use of synthetic chemicals. Biological fruits and vegetables are also simpler for farmers to cultivate methodically than more complicated processed foods or meat items, adding to higher availability and variety.

Based on Distribution Channel, the organic food market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online and Others. Supermarkets and Hypermarket segments are dominating the distribution channels type in the organic food market because of their widespread access, diversity and more consumer trust. These stores provide a comprehensive classification of certified organic products at the same location, making the organic food purchase convenient for busy consumers. Their supply chain ensures the availability of the product continuously, and their ability to offer competitive prices and promotion attracts a large number of customers. Moreover, dedicated organic corridors, in-store branding, and private-labelled organic lines promote reliability, strengthening supermarkets and hypermarkets leadership in the market. As the consumers demand for health and stability increases, supermarkets continue to expand their organic offerings, further strengthening their major conditions.

Organic Food Market Regional analysis:

The most dominant region in the organic food market is North America, mainly the United States (U.S.) in 2024. Higher consumer awareness about health, food security and environmental issues and the strong preference for chemical-free and organic foods. In the U.S., the USDA provides a trusted standard for organic products to organic certifications in which has a well-established regulatory system. Organic foods are widely accessible in major supermarket chains and online platforms, making them convenient for daily purchases. Also, the government's support through subsidies, certification programs and research funding supports to farmers to adopt organic practices. High disposable income in the area also allows consumers to absorb price premiums associated with organic products.

Organic Food Market Competitive Landscape

The top companies in the organic food market are Hain Celestial Group and Danone S.A. Hain Celestial is focused on stimulating the growth of the market by concentrating on its core brands and categories, particularly in natural snacks and individual care. Danone S.A. has shown stronger financial health driven by strong demand in North America and strategic portfolio adjustments. Danone’s global reach, diversified organic dairy, plant-based products and focus on value creation position it well for sustainable growth. While Hain Celestial is working for overcome short-term tasks through portfolio optimization. Danone leverages its scale and strategic agility to maintain a competitive edge in the organic food market worldwide.

Organic Food Market Recent Development

In May 2025, Danone acquired a majority stake in Kate Farms for extend its presence in the United States (U.S.) organic medical nutrition. The move is part of Danone's strategy to expand in plant-based organic products and specialized nutrition, especially for consumers with medical feeding needs.

In June 2022, an Australian organic infant nutrition startup, Sprout Organic Inc., contract a partnership deal with the country's largest online shopping platforms, Amazon, to sell its plant-based organic baby products to customers nationwide.

|

The Organic Food Market Scope |

|

|

Market Size in 2024 |

USD 230.40 Bn. |

|

Market Size in 2032 |

USD 586.97 Bn. |

|

CAGR (2025-2032) |

12.40% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Organic Beverages Organic Cereal and Food Grains Organic Meat, Poultry and Dairy Organic Spices and Pulses Organic Processed Food Organic Fruits and Vegetables Others |

|

By Distribution Channel Supermarkets and Hypermarkets Specialty Stores Convenience Stores Online Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Organic Food Market Key Players:

North America

- Organic Valley (U.S.)

- General Mills Inc. (U.S.)

- Amy’s Kitchen (U.S.)

- Hain Celestial Group (U.S.)

- Nature’s Path Foods (Canada)

- Aurora Organic Dairy (U.S.)

- Sprout Organics Inc. (U.S)

Europe

- Danone (France)

- Lactalis (France)

- Auga Group (Lithuania)

- Alnatura (Germany)

- Eosta (Netherlands)

Asia-Pacific

- Suminter India Organics (India)

- Sresta Natural Bioproducts (India)

- Organic India (India)

- Ichitan Group (Thailand)

- Wen Ken Group (Singapore)

Middle East & Africa

- Alaffia (Togo)

- Biofarm (South Africa)

- Faithful to Nature (South Africa)

- SEKEM (Egypt)

- El Rashidi El Mizan (Egypt)

South America

- Native Organic Products (Brazil)

- Organica Brasil (Brazil)

- Campo Vivo (Brazil)

- Korin Agropecuária (Brazil)

- Jasmine Alimentos (Brazil)

Frequently Asked Questions

Hain Celestial Group and Danone S.A. are the major players in the organic food market.

The North America region is the most dominant Organic Food Market.

In May 2025, Danone acquired a majority stake in Kate Farms to expand its footprint in the U.S. organic medical nutrition market.

Rising Consumer Demand for Chemical-Free and Safe Food is the key driver in the Organic Food Market.

1. Organic Food Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Organic Food Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Organic Food Market: Dynamics

3.1. Organic Food Market Trends

3.2. Organic Food Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Organic Food Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Organic Food Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Organic Beverages

4.1.2. Organic Cereal and Food Grains

4.1.3. Organic Meat, Poultry and Dairy

4.1.4. Organic Spices and Pulses

4.1.5. Organic Processed Food

4.1.6. Organic Fruits and Vegetables

4.1.7. Others

4.2. Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Specialty Stores

4.2.3. Convenience Stores

4.2.4. Online

4.2.5. Others

4.3. Organic Food Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Organic Food Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Organic Food Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Organic Beverages

5.1.2. Organic Cereal and Food Grains

5.1.3. Organic Meat, Poultry and Dairy

5.1.4. Organic Spices and Pulses

5.1.5. Organic Processed Food

5.1.6. Organic Fruits and Vegetables

5.1.7. Others

5.2. North America Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Supermarkets and Hypermarkets

5.2.2. Specialty Stores

5.2.3. Convenience Stores

5.2.4. Online

5.2.5. Others

5.3. North America Organic Food Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States Organic Food Market Size and Forecast, By Product Type (2024-2032)

5.3.1.1.1. Organic Beverages

5.3.1.1.2. Organic Cereal and Food Grains

5.3.1.1.3. Organic Meat, Poultry and Dairy

5.3.1.1.4. Organic Spices and Pulses

5.3.1.1.5. Organic Processed Food

5.3.1.1.6. Organic Fruits and Vegetables

5.3.1.1.7. Others

5.3.1.2. United States Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1.2.1. Supermarkets and Hypermarkets

5.3.1.2.2. Specialty Stores

5.3.1.2.3. Convenience Stores

5.3.1.2.4. Online

5.3.1.2.5. Others

5.3.2. Canada

5.3.2.1. Canada Organic Food Market Size and Forecast, By Product Type (2024-2032)

5.3.2.1.1. Organic Beverages

5.3.2.1.2. Organic Cereal and Food Grains

5.3.2.1.3. Organic Meat, Poultry and Dairy

5.3.2.1.4. Organic Spices and Pulses

5.3.2.1.5. Organic Processed Food

5.3.2.1.6. Organic Fruits and Vegetables

5.3.2.1.7. Others

5.3.2.2. Canada Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.2.2.1. Supermarkets and Hypermarkets

5.3.2.2.2. Specialty Stores

5.3.2.2.3. Convenience Stores

5.3.2.2.4. Online

5.3.2.2.5. Others

5.3.3. Mexico

5.3.3.1. Mexico Organic Food Market Size and Forecast, By Product Type (2024-2032)

5.3.3.1.1. Organic Beverages

5.3.3.1.2. Organic Cereal and Food Grains

5.3.3.1.3. Organic Meat, Poultry and Dairy

5.3.3.1.4. Organic Spices and Pulses

5.3.3.1.5. Organic Processed Food

5.3.3.1.6. Organic Fruits and Vegetables

5.3.3.1.7. Others

5.3.3.2. Mexico Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.3.2.1. Supermarkets and Hypermarkets

5.3.3.2.2. Specialty Stores

5.3.3.2.3. Convenience Stores

5.3.3.2.4. Online

5.3.3.2.5. Others

6. Europe Organic Food Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3. Europe Organic Food Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.1.2. United Kingdom Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.2. France

6.3.2.1. France Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.2.2. France Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.3. Germany

6.3.3.1. Germany Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.3.2. Germany Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.4. Italy

6.3.4.1. Italy Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.4.2. Italy Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.5. Spain

6.3.5.1. Spain Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.5.2. Spain Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.6.2. Sweden Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.7. Russia

6.3.7.1. Russia Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.7.2. Russia Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Organic Food Market Size and Forecast, By Product Type (2024-2032)

6.3.8.2. Rest of Europe Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Organic Food Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Asia Pacific Organic Food Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.1.2. China Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.2.2. S Korea Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.2.3. S Japan

7.3.2.4. Japan Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.2.5. Japan Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.3. India

7.3.3.1. India Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.3.2. India Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.4. Australia

7.3.4.1. Australia Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.4.2. Australia Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.5. Indonesia

7.3.5.1. Indonesia Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.5.2. Indonesia Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.6. Malaysia

7.3.6.1. Malaysia Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.6.2. Malaysia Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.7. Philippines

7.3.7.1. Philippines Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.7.2. Philippines Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.8. Thailand

7.3.8.1. Thailand Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.8.2. Thailand Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.9. Vietnam

7.3.9.1. Vietnam Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.9.2. Vietnam Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Organic Food Market Size and Forecast, By Product Type (2024-2032)

7.3.10.2. Rest of Asia Pacific Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Organic Food Market Size and Forecast (by Value in USD Bn.) (2024-2032

8.1. Middle East and Africa Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Middle East and Africa Organic Food Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.3.1.2. South Africa Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3.2. GCC

8.3.2.1. GCC Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.3.2.2. GCC Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3.3. Egypt

8.3.3.1. Egypt Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.3.3.2. Egypt Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3.4. Nigeria

8.3.4.1. Nigeria Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.3.4.2. Nigeria Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

8.3.5. Rest of ME&A

8.3.5.1. Rest of ME&A Organic Food Market Size and Forecast, By Product Type (2024-2032)

8.3.5.2. Rest of ME&A Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Organic Food Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032

9.1. South America Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. South America Organic Food Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.3.1.2. Brazil Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.3.2.2. Argentina Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.3. Colombia

9.3.3.1. Colombia Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.3.3.2. Colombia Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.4. Chile

9.3.4.1. Chile Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.3.4.2. Chile Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.5. Rest Of South America

9.3.5.1. Rest Of South America Organic Food Market Size and Forecast, By Product Type (2024-2032)

9.3.5.2. Rest Of South America Organic Food Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1. Danone (France)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Organic Valley (U.S.)

10.3. General Mills Inc. (U.S.)

10.4. Amy’s Kitchen (U.S.)

10.5. Hain Celestial Group (U.S.)

10.6. Nature’s Path Foods (Canada)

10.7. Aurora Organic Dairy (U.S.)

10.8. Sprout Organics Inc. (U.S)

10.9. Lactalis (France)

10.10. Auga Group (Lithuania)

10.11. Alnatura (Germany)

10.12. Eosta (Netherlands)

10.13. Suminter India Organics (India)

10.14. Sresta Natural Bioproducts (India)

10.15. Organic India (India)

10.16. Ichitan Group (Thailand)

10.17. Wen Ken Group (Singapore)

10.18. Native Organic Products (Brazil)

10.19. Organica Brasil (Brazil)

10.20. Campo Vivo (Brazil)

10.21. Korin Agrocuária (Brazil)

10.22. Jasmine Alimentos (Brazil)

10.23. Alaffia (Togo)

10.24. Biofarm (South Africa)

10.25. Faithful to Nature (South Africa)

10.26. SEKEM (Egypt)

10.27. El Rashidi El Mizan (Egypt) Vivo (Brazil)

11. Key Findings

12. Industry Recommendations

13. Organic Food Market: Research Methodology