HoReCa Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

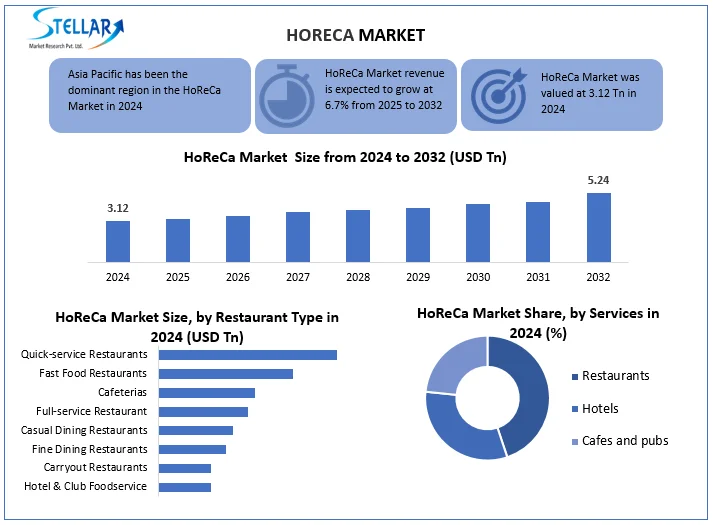

HoReCa Market, valued at USD 3.12 Tn in 2024 and projected to reach USD 5.24 Tn by 2032 at a CAGR of 6.7%, is driven by tourism growth and smart tech adoption

Format : PDF | Report ID : SMR_2772

HoReCa Market Overview

HoReCa (Hotels, Restaurants and Cafe/Catering) is a term used to describe the hospitality industry. It is most commonly used in Europe, but it is also used in other parts of the world, such as India and Australia. In United States, most common term for hospitality market is "hospitality sector".

HoReCa market has been experiencing robust growth by their evolving consumer preferences and global economic recovery. Post-pandemic revenge travel has revitalized hotel bookings, while rising disposable incomes are fuelling demand for premium dining experiences. Rapid adoption of food delivery apps and cloud kitchens is expanding restaurant reach beyond physical locations. Sustainability trends, like zero waste kitchens and plant based menus, are reshaping operations across segments. Technological innovations from AI-powered inventory systems to robotic kitchens are boosting efficiency and customer engagement.

Trade policies and tariffs significantly impact the HoReCa market by influencing supply costs and consumer prices. Import tariffs on ingredients (e.g., seafood, coffee beans,or dairy) raise operational expenses, forcing restaurants and hotels to adjust menus or absorb higher costs.

To get more Insights: Request Free Sample Report

HoReCa Market Dynamics

Growth of Tourism & Hospitality Industry to boost the HoReCa Market Growth

Rising middle class in Asia Pacific is transforming HoReCa landscape, with a expanding disposable incomes driving demand for diverse dining and hospitality experiences. Consumers are increasingly prioritising convenience, quality and premium offerings, from quick service restaurants to luxury hotel stays. This shift is particularly evident in China and India, where urbanisation and digital payment adoption further accelerate HoReCa market growth. Cafes, gourmet dining and boutique hotels are thriving as a aspirational lifestyles gain traction. Also, inflation and economic fluctuations could temper growth in price sensitive markets.

Regulatory & Compliance Burdens to hamper the HoReCa Market Growth

Strict hygiene standards (like HACCP, FDA, or EU Food Safety Regulations) require costly audits and staff training. Complex licensing for alcohol, outdoor seating, or operating hours varies by region, delaying expansions. Labour laws on wages, benefits, and working hours add administrative pressure. Non-compliance risks fines or shutdowns, especially with rising sustainability mandates (plastic bans, waste disposal rules). Smaller operators often struggle more than chains with these costs.

Recently In 2024, California's fast food wage hike to $20/hour forced many restaurants to raise prices or reduce staff hours. Meanwhile, Dubai's removal of alcohol license fees in 2023 boosted hotel bar revenues but created new compliance challenges for venue operators.

AI Robotics and Smart Payments to Boost the HoReCa Industry

The sector is rapidly adopting AI-powered demand forecasting (like Zenput or 7shifts) to optimise inventory and staffing, reducing waste by up to 30%. Kitchen robotics (e.g., Flippy 2 for frying or Miso Robotics’ drink dispensers) automates repetitive tasks, improving speed and consistency. Contactless payments (via QR codes or NFC) now dominate, with 60% of diners preferring digital menus. IoT sensors monitor fridge temps and equipment health, cutting downtime. However, high upfront costs and staff training remain barriers for small businesses.

HoReCa Market Regional Analysis

Asia-Pacific Dominated the Global HoReCa Market by Growing Tourism and Urban Demand

Asia-Pacific led the global HoReCa market in 2024, capturing over 48% share, driven by its massive population, urbanisation, and rising incomes. The region’s 4.7 billion consumers fueled booming demand for dining and hospitality services. Tourism played a key role, with Thailand, Japan, and China seeing surges in visitors. Thailand alone recorded a 39.9% jump in international arrivals. A growing middle class, especially in China and India, further boosted the sector as more people dined out and sought premium stays. This combination of factors solidified APAC’s dominance in the HoReCa market.

HoReCa Market Segment Analysis

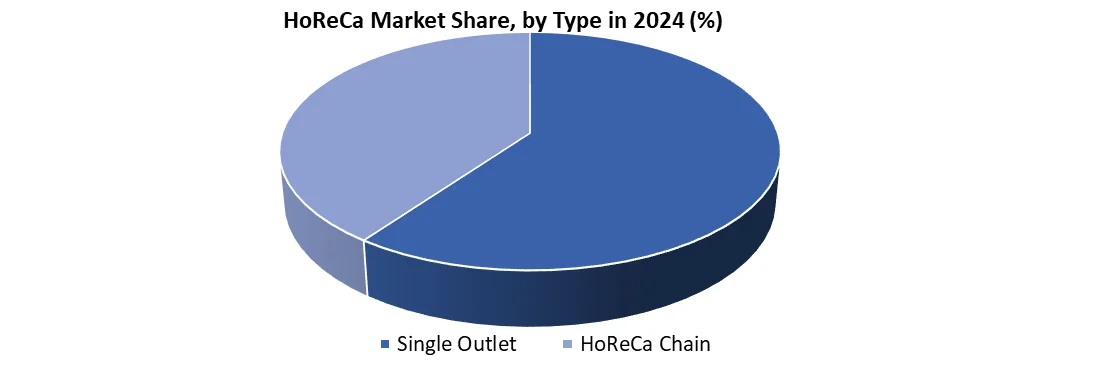

Based on Type, the HoReCa market is segmented into single outlet and HoReCa chain. Single outlet segment held the largest HoReCa Market share of about 60.78% in the global HoReCa market in 2024. According to the SMR analysis, the segment is further expected to grow at a CAGR of 4.12% during the forecast period. Single outlets excel in fostering a sense of community and personalised customer relationships, a stark contrast to the often-perceived impersonal nature of larger chains. By providing tailored recommendations, engaging with customers on a personal level, and also creating unique atmosphere, single outlets establish themselves as welcoming havens for discerning diners seeking more than just a meal. Dominance of single outlets in HoReCA market is a testament to their agility, personalised service, niche expertise, community engagement, and ability to adapt to evolving consumer preferences. These factors enable them to thrive in a dynamic and competitive market, offering unique experiences and culinary delights to diverse customers worldwide, solidifying their position as cornerstone of the HoReCA market.

HoReCa Market Competitive Landscape

HoReCa market is highly competitive and dominated by global giants across foodservice, beverage and hospitality segments. Key players such as McDonald's, Starbucks, PepsiCo, Coca-Cola, and Yum! Brands lead the fast-food and beverage categories with extensive global networks. In contract catering space, Compass Group and Sodexo are prominent, offering large-scale food and facilities management services. Hotel chains like Marriott International add to the competitive mix, with continuous innovation, menu diversification, and digital transformation driving market competition.

Key Industry Developments in the HoReCa Market

- McDonald's Corporation announced the return of its popular Snack Wrap to U.S. menus starting July 10, 2025, after a nearly decade-long hiatus.

- Starbucks Corporation will modify its Rewards program on June 24, 2025, replacing the 25-star bonus for reusable cup users with double stars on their entire purchase.

|

ket Size in 2032 |

USD 5.24 Tn. |

|

CAGR (2024-2032) |

6.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Type Single outlet HoReCa chain |

|

by Services Restaurants Hotels Cafes and pubs |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the HoReCa Market

North America

- McDonald's Corporation (USA)

- Starbucks Corporation (USA)

- PepsiCo Inc. (USA)

- The Coca-Cola Company (USA)

- Yum! Brands Inc. (USA)

- Marriott International Inc. (USA)

- Hilton Worldwide Holdings Inc. (USA)

- Domino's Pizza Inc. (USA)

- Wendy's Company (USA)

- Jack in the Box Inc. (USA)

- Papa John's International Inc. (USA)

- Performance Food Group Co. (USA)

- Reyes Holdings LLC (USA)

Europe

- Compass Group PLC (UK)

- Sodexo S.A. (France)

- InterContinental Hotels Group PLC (UK)

- Costa Limited (UK)

- Heineken N.V. (Netherlands)

Asia Pacific

- ITC Limited (India)

- Tata Consumer Products Limited (India)

- Jubilant FoodWorks Limited (India)

- Jollibee Foods Corporation (Philippines)

- MOS Food Services (Japan)

Middle East & Africa

- Americana Group (UAE)

- Bidcorp (South Africa)

Frequently Asked Questions

Labor shortages, inflation, regulatory burdens, and trade tariffs affecting costs and operations.

Tourism boosts demand for hotels, restaurants, and cafes, especially through events and government initiatives.

Post-pandemic travel, rising incomes, food delivery apps, sustainability trends, and tech innovations like AI and robotics.

The top global key players in the HoReCa market in 2024 include McDonald's Corporation, Starbucks Corporation, PepsiCo Inc., The Coca-Cola Company, Yum! Brands Inc., Compass Group PLC, Sodexo S.A., Marriott International Inc.

1. HoReCa Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global HoReCa Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. HoReCa Market: Dynamics

3.1. HoReCa Market Trends

3.2. HoReCa Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. HoReCa Market: Global Market Size and Forecast by Segmentation (by Value in USD Trillion) (2024-2032)

4.1. HoReCa Market Size and Forecast, By Type (2024-2032)

4.1.1. Single outlet

4.1.2. HoReCa chain

4.2. HoReCa Market Size and Forecast, By Services (2024-2032)

4.2.1. Restaurants

4.2.2. Hotels

4.2.3. Cafes and pubs

4.3. HoReCa Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America HoReCa Market Size and Forecast by Segmentation (by Value in USD Trillion) (2024-2032)

5.1. North America HoReCa Market Size and Forecast, By Type (2024-2032)

5.1.1. Single outlet

5.1.2. HoReCa chain

5.2. North America HoReCa Market Size and Forecast, By Services (2024-2032)

5.2.1. Restaurants

5.2.2. Hotels

5.2.3. Cafes and pubs

5.3. North America HoReCa Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States HoReCa Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Single outlet

5.3.1.1.2. HoReCa chain

5.3.1.2. United States HoReCa Market Size and Forecast, By Services (2024-2032)

5.3.1.2.1. Restaurants

5.3.1.2.2. Hotels

5.3.1.2.3. Cafes and pubs

5.3.2. Canada

5.3.2.1. HoReCa Market Size and Forecast, By Type (2024-2032)

5.3.2.1.1. Single outlet

5.3.2.1.2. HoReCa chain

5.3.2.2. Canada HoReCa Market Size and Forecast, By Services (2024-2032)

5.3.2.2.1. Restaurants

5.3.2.2.2. Hotels

5.3.2.2.3. Cafes and pubs

5.3.3. Mexico

5.3.3.1. Mexico HoReCa Market Size and Forecast, By Type (2024-2032)

5.3.3.1.1. Single outlet

5.3.3.1.2. HoReCa chain

5.3.3.2. Mexico HoReCa Market Size and Forecast, By Services (2024-2032)

5.3.3.2.1. Restaurants

5.3.3.2.2. Hotels

5.3.3.2.3. Cafes and pubs

6. Europe HoReCa Market Size and Forecast by Segmentation (by Value in USD Trillion) (2024-2032)

6.1. Europe HoReCa Market Size and Forecast, By Type (2024-2032)

6.2. Europe HoReCa Market Size and Forecast, By Services (2024-2032)

6.3. Europe HoReCa Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.1.2. United Kingdom HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.2. France

6.3.2.1. France HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.2.2. France HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.3. Germany

6.3.3.1. Germany HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.3.2. Germany HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.4. Italy

6.3.4.1. Italy HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.4.2. Italy HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.5. Spain

6.3.5.1. Spain HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.5.2. Spain HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.6.2. Sweden HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.7. Russia

6.3.7.1. Russia HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.7.2. Russia HoReCa Market Size and Forecast, By Services (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe HoReCa Market Size and Forecast, By Type (2024-2032)

6.3.8.2. Rest of Europe HoReCa Market Size and Forecast, By Services (2024-2032)

7. Asia Pacific HoReCa Market Size and Forecast by Segmentation (by Value in USD Trillion) (2024-2032)

7.1. Asia Pacific HoReCa Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific HoReCa Market Size and Forecast, By Services (2024-2032)

7.3. Asia Pacific HoReCa Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.1.2. China HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.2.2. S Korea HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.3. Japan

7.3.3.1. Japan HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.3.2. Japan HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.4. India

7.3.4.1. India HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.4.2. India HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.5. Australia

7.3.5.1. Australia HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.5.2. Australia HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.6. Indonesia

7.3.6.1. Indonesia HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.6.2. Indonesia HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.7. Malaysia

7.3.7.1. Malaysia HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.7.2. Malaysia HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.8. Philippines

7.3.8.1. Philippines HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.8.2. Philippines HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.9. Thailand

7.3.9.1. Thailand HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.9.2. Thailand HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.10. Vietnam

7.3.10.1. Vietnam HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.10.2. Vietnam HoReCa Market Size and Forecast, By Services (2024-2032)

7.3.11. Rest of Asia Pacific

7.3.11.1. Rest of Asia Pacific HoReCa Market Size and Forecast, By Type (2024-2032)

7.3.11.2. Rest of Asia Pacific HoReCa Market Size and Forecast, By Services (2024-2032)

8. Middle East and Africa HoReCa Market Size and Forecast (by Value in USD Trillion) (2024-2032

8.1. Middle East and Africa HoReCa Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa HoReCa Market Size and Forecast, By Services (2024-2032)

8.3. Middle East and Africa HoReCa Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa HoReCa Market Size and Forecast, By Type (2024-2032)

8.3.1.2. South Africa HoReCa Market Size and Forecast, By Services (2024-2032)

8.3.2. GCC

8.3.2.1. GCC HoReCa Market Size and Forecast, By Type (2024-2032)

8.3.2.2. GCC HoReCa Market Size and Forecast, By Services (2024-2032)

8.3.3. Egypt

8.3.3.1. Egypt HoReCa Market Size and Forecast, By Type (2024-2032)

8.3.3.2. Egypt HoReCa Market Size and Forecast, By Services (2024-2032)

8.3.4. Nigeria

8.3.4.1. Nigeria HoReCa Market Size and Forecast, By Type (2024-2032)

8.3.4.2. Nigeria HoReCa Market Size and Forecast, By Services (2024-2032)

8.3.5. Rest of ME&A

8.3.5.1. Rest of ME&A HoReCa Market Size and Forecast, By Type (2024-2032)

8.3.5.2. Rest of ME&A HoReCa Market Size and Forecast, By Services (2024-2032)

9. South America HoReCa Market Size and Forecast by Segmentation (by Value in USD Trillion) (2024-2032

9.1. South America HoReCa Market Size and Forecast, By Type (2024-2032)

9.2. South America HoReCa Market Size and Forecast, By Services (2024-2032)

9.3. South America HoReCa Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil HoReCa Market Size and Forecast, By Type (2024-2032)

9.3.1.2. Brazil HoReCa Market Size and Forecast, By Services (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina HoReCa Market Size and Forecast, By Type (2024-2032)

9.3.2.2. Argentina HoReCa Market Size and Forecast, By Services (2024-2032)

9.3.3. Colombia

9.3.3.1. Colombia HoReCa Market Size and Forecast, By Type (2024-2032)

9.3.3.2. Colombia HoReCa Market Size and Forecast, By Services (2024-2032)

9.3.4. Chile

9.3.4.1. Chile HoReCa Market Size and Forecast, By Type (2024-2032)

9.3.4.2. Chile HoReCa Market Size and Forecast, By Services (2024-2032)

9.3.5. Rest Of South America

9.3.5.1. Rest Of South America HoReCa Market Size and Forecast, By Type (2024-2032)

9.3.5.2. Rest Of South America HoReCa Market Size and Forecast, By Services (2024-2032)

10. Company Profile: Key Players

10.1. McDonald's Corporation (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Starbucks Corporation (USA)

10.3. PepsiCo Inc. (USA)

10.4. The Coca-Cola Company (USA)

10.5. Yum! Brands Inc. (USA)

10.6. Marriott International Inc. (USA)

10.7. Hilton Worldwide Holdings Inc. (USA)

10.8. Domino's Pizza Inc. (USA)

10.9. Wendy's Company (USA)

10.10. Jack in the Box Inc. (USA)

10.11. Papa John's International Inc. (USA)

10.12. Performance Food Group Co. (USA)

10.13. Reyes Holdings LLC (USA)

10.14. Compass Group PLC (UK)

10.15. Sodexo S.A. (France)

10.16. InterContinental Hotels Group PLC (UK)

10.17. Costa Limited (UK)

10.18. Heineken N.V. (Netherlands)

10.19. ITC Limited (India)

10.20. Tata Consumer Products Limited (India)

10.21. Jubilant FoodWorks Limited (India)

10.22. Jollibee Foods Corporation (Philippines)

10.23. MOS Food Services (Japan)

10.24. Americana Group (UAE)

10.25. Bidcorp (South Africa)

10.26. Telepizza España (Brazil)

11. Key Findings

12. Industry Recommendations

13. HoReCa Market: Research Methodology