Lobster Market: Size, Share, Trends, By Type, Species, Distribution Channel, Dynamics, Key Players and Forecast 2025-2032

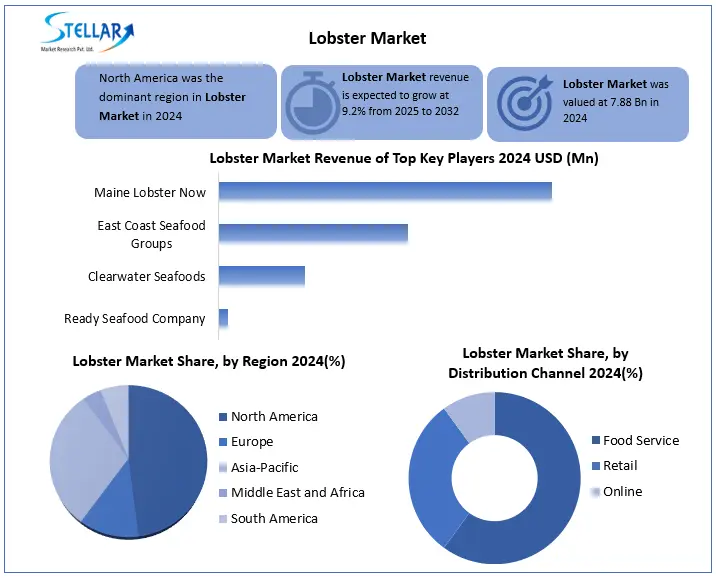

The Lobster Market was valued at USD 7.88 Bn. in 2024 and is expected to grow at a CAGR of 9.2% from 2025 to 2032, reaching nearly USD 15.93 Bn. by 2032.

Format : PDF | Report ID : SMR_2814

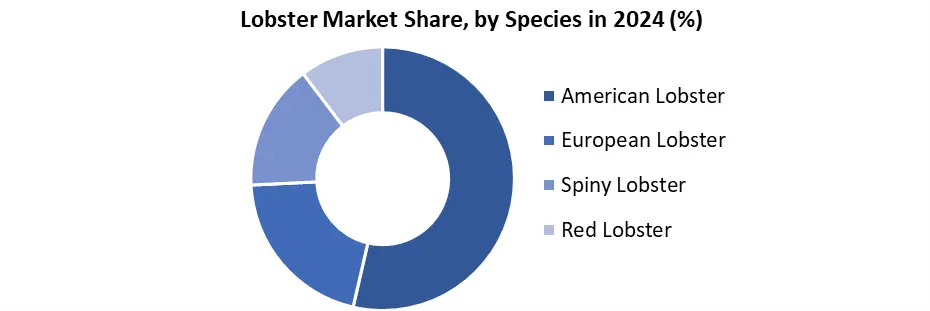

The Global Lobster Market growth is driven by increasing consumer demand for premium seafood, mainly in North America, Europe, and Asia. Lobster is widely considered a luxury seafood, making it a high-value item in the seafood industry. The market includes various lobster species, such as American Lobster, Spiny Lobster, and Red Lobster, with different price points and regional popularity.

Globally major lobster supply comes from countries such as the United States, Canada, Australia, and parts of Caribbean. Lobster consumption is increasing, especially in developing economies such as China, where middle-class income and dietary preferences are increasing demand for luxury foods. In the Western markets, the lobster is popular in fine dining and seafood restaurant chains, as well as the trend of convenience in Ready-to-Eat and also in frozen sections. In 2024, North America led the Global Lobster Market, contributing about 47% of the total revenue. Maine's lobster industry alone accounts for 90% of US lobster, producing USD 1 billion annually. Lobster prices are highly susceptible to the supply due to geopolitical factors weather conditions and trade. For example, tariffs and trade restrictions, especially between the US and China, have affected the lobster export mobility. Prices during the holiday season and major festivals are at its peak when demand increased globally.

To get more Insights: Request Free Sample Report

Lobster Market Dynamics

Rising Global Demand for Luxury Seafood to Boost the Lobster Market

The global demand for lobster is strong. This demand is mainly driven by the increased consumer interest in premium seafood, mainly in United States, Europe and China. The growing middle class groups in developing economies, mainly in Asia pacific, where lobster is a sign of luxury seafood and a festive delicacy. The Foodservice Industry was responsible for the wholesale (about 60%) of demand, but retail sales increased due to the popularity of prepared to lobster products, especially in urban and e-commerce-operated markets.

The Market Faces Restraints Related to Climate Change and Ocean Warming

Lobsters travel to colder northern waters due to rising sea temperature, especially in the Gulf of Maine. This disrupted traditional fishing zones, increased operational costs for fishermen, and reduced harvest volumes in long-standing regions like Maine, where lobster catch dropped to 85.1 million pounds, a 15-year low. Climate change threatens environmental stability and may permanently shift key supply sources. Lobsters are sensitive to temperature changes. Warmer waters affect their molting cycles, growth, and reproduction rates, threatening long-term sustainability.

Expansion of Lobster Consumption in Emerging Markets is an opportunity for lobster market

Since economic growth continued to increase millions in the middle class, the demand for premium seafood, especially lobster - in urban centers was dated. In China, anticipation of lifting import restrictions on the Australian lobster ruled over business relations and restored a major export route, as the Chinese consumers returned to see the lobster as a symbol of the status and celebration. Also, the improved cold chain logistics and increasing growth of e-commerce made it easier for consumers to access both live and frozen lobster through online platforms. Moreover, the post-pandemic recovery of tourism and upscale hospitality in the Asia-Pacific region further boosted demand in resorts and fine-dining establishments.

Lobster Market Segment Analysis

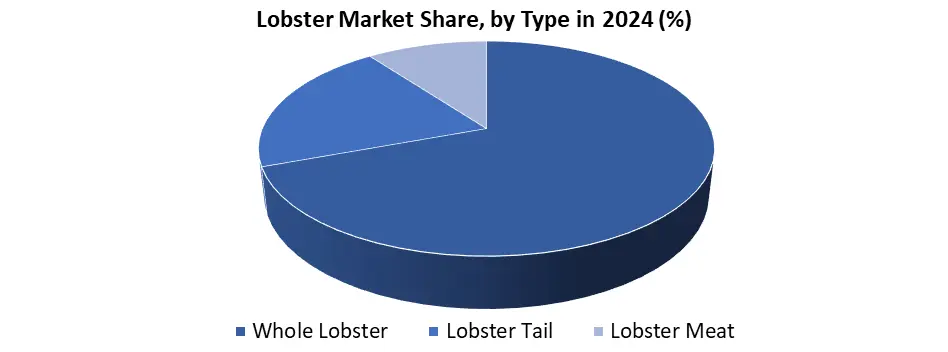

Based on Type, the lobster market is segmented into Whole lobster, lobster tail, and lobster meat. The whole lobster segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). The lobster is also known as a live lobster. The dominance is due to continuous demand in its high unit value and premium seafood segments. Despite its complications involved in its storage and transport, the live lobster maintained a leading position due to its freshness, luxury and quality. In 2024, the whole lobster segment accounted for 68% of the global lobster market. The market share is expected to increase to 40% by 2032. Countries like Canada, the United States (Maine), and Australia depends heavily on live lobster exports to fuel their seafood economies.

Based on species, the lobster market is segmented into American lobster, European Lobster, spiny lobster, and red lobster. The American lobster segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). American lobster fisheries in Canada and America produced most of the world's supply. Canada alone exported more than 60,000 tonnes of live and processed lobster in 2024, mainly Asia, U.S. and in Europe. Despite the slight decline in main landing due to warming water, the species remained the most European harvested lobster worldwide. Decades of industry development, strict stability practices, and traceability standards further enhanced global confidence in the American lobster species.

Lobster Market Regional Analysis:

The North America region dominated the Market in 2024 and is expected to hold the largest Market share over the forecast period (2024-2032)

North America remained the backbone of global lobster production and exports in 2024. In that Canada was the world's largest lobster exporter, with annual exports more than USD 3.2 billion due to increased demand from China, United States, and the European Union. Canada and the U.S. accounted for over 75% of global live lobster exports, with most shipments directed toward the rapidly growing Asia-Pacific market. With strong government support, established trade routes and frequent product quality, North America remained the keystone of the global lobster supply chain in 2024.

Lobster Market Competitive Landscape

North America was a strategic stronghold, in which the industry dominated through integrated operations in crop, processing and international distribution with companies such as Clearwater Seafoods, East Coast Seafood Group, and Ready Seafood Company. Clearwater Seafoods, one of Canada's largest combined seafood companies, played a leading role in exports to Europe and Asia, taking advantage of its strong stability, credibility and fleet operations. In the U.S., Ready Seafood Co. and Maine Lobster Now serve both business-to-business and direct-to-consumer markets, benefit from on online sales and overnight live shipping.

|

Lobster Market Scope |

|

|

Market Size in 2024 |

USD 7.88 Bn |

|

Market Size in 2032 |

USD 15.93 Bn |

|

CAGR (2024-2032) |

9.2% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Whole Lobster Lobster Tail Lobster Meat |

|

By Species American Lobster European Lobster Spiny Lobster Red Lobster |

|

|

By Distribution Channel Food Service Retail Online |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Lobster Market

North America

- Clearwater Seafoods (Canada)

- East Coast Seafood Group (United States)

- Ready Seafood Co. (United States)

- Maine Lobster Now (United States)

- Boston Lobster Company (United States)

- Paturel International Company (Canada)

- Premium Seafoods (Canada)

- Lobster Trap Company (United States)

- Tangier Lobster Company (Canada)

- Ocean Choice International (Canada)

Europe

- Blue Lobster Company (United Kingdom)

- Royal Greenland (Denmark)

- Clearwater Europe Ltd. (United Kingdom)

- Fylkir Seafood (Iceland)

- Northbay Seafood (United Kingdom)

Asia-Pacific

- Geraldton Fishermen’s Co-operative (Australia)

- Kailis Bros. (Australia)

- Austral Fisheries (Australia)

- Exportadora de Mariscos (New Zealand)

- Lobster West (Australia)

Latin America

- Pescanova Nicaragua (Nicaragua)

- Mariscos del Pacifico (Honduras)

- Caribbean Lobsters S.A. (Panama)

- Brasmar Group (Brazil)

- Lobster House (Mexico)

Middle East & Africa

- West Coast Lobster (South Africa)

- Indian Ocean Lobster (Kenya)

- Lobster Fisheries of Oman (Oman)

- Arabian Seafoods (United Arab Emirates)

- Cape Fish Co. (South Africa)

Frequently Asked Questions

Rising Global Demand for Luxury Seafood to Boost the Lobster Market.

Clearwater Seafoods, East Coast Seafood Group, and Ready Seafood Company are the key competitors in the Lobster Market.

Expansion of Lobster Consumption in Emerging Markets is an opportunity for the lobster market.

The whole lobster (live lobster) segment dominated the Lobster Market.

1. Lobster Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Lobster Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. Distribution Channel Segment

2.3.4. Revenue (2024)

2.4. Leading Lobster Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Lobster Market: Dynamics

3.1. Lobster Market Trends by Region

3.1.1. North America Lobster Market Trends

3.1.2. Europe Lobster Market Trends

3.1.3. Asia Pacific Lobster Market Trends

3.1.4. Middle East & Africa Lobster Market Trends

3.1.5. South America Lobster Market Trends

3.2. Lobster Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Lobster Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Lobster Market Size and Forecast, By Type (2024-2032)

4.1.1. Whole Lobster

4.1.2. Lobster Tail

4.1.3. Lobster Meat

4.2. Lobster Market Size and Forecast, By Species (2024-2032)

4.2.1. American Lobster

4.2.2. European Lobster

4.2.3. Spiny Lobster

4.2.4. Red Lobster

4.3. Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Food Service

4.3.2. Retail

4.3.3. Online

4.4. Lobster Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Lobster Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Lobster Market Size and Forecast, By Type (2024-2032)

5.1.1. Whole Lobster

5.1.2. Lobster Tail

5.1.3. Lobster Meat

5.2. North America Lobster Market Size and Forecast, By Species (2024-2032)

5.2.1. American Lobster

5.2.2. European Lobster

5.2.3. Spiny Lobster

5.2.4. Red Lobster

5.3. North America Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Food Service

5.3.2. Retail

5.3.3. Online

5.4. North America Lobster Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Lobster Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Whole Lobster

5.4.1.1.2. Lobster Tail

5.4.1.1.3. Lobster Meat

5.4.1.2. United States Lobster Market Size and Forecast, By Species (2024-2032)

5.4.1.2.1. American Lobster

5.4.1.2.2. European Lobster

5.4.1.2.3. Spiny Lobster

5.4.1.2.4. Red Lobster

5.4.1.3. United States Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Food Service

5.4.1.3.2. Retail

5.4.1.3.3. Online

5.4.2. Canada

5.4.2.1. Canada Lobster Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Whole Lobster

5.4.2.1.2. Lobster Tail

5.4.2.1.3. Lobster Meat

5.4.2.2. Canada Lobster Market Size and Forecast, By Species (2024-2032)

5.4.2.2.1. American Lobster

5.4.2.2.2. European Lobster

5.4.2.2.3. Spiny Lobster

5.4.2.2.4. Red Lobster

5.4.2.3. Canada Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.3.1. Food Service

5.4.2.3.2. Retail

5.4.2.3.3. Online

5.4.3. Mexico

5.4.3.1. Mexico Lobster Market Size and Forecast, By Type (2024-2032)

5.4.3.1.1. Whole Lobster

5.4.3.1.2. Lobster Tail

5.4.3.1.3. Lobster Meat

5.4.3.2. Mexico Lobster Market Size and Forecast, By Species (2024-2032)

5.4.3.2.1. American Lobster

5.4.3.2.2. European Lobster

5.4.3.2.3. Spiny Lobster

5.4.3.2.4. Red Lobster

5.4.3.3. Mexico Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.3.3.1. Food Service

5.4.3.3.2. Retail

5.4.3.3.3. Online

6. Europe Lobster Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Lobster Market Size and Forecast, By Type (2024-2032)

6.2. Europe Lobster Market Size and Forecast, By Species (2024-2032)

6.3. Europe Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Lobster Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Lobster Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Lobster Market Size and Forecast, By Species (2024-2032)

6.4.1.3. United Kingdom Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.2. France

6.4.2.1. France Lobster Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Lobster Market Size and Forecast, By Species (2024-2032)

6.4.2.3. France Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Lobster Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Lobster Market Size and Forecast, By Species (2024-2032)

6.4.3.3. Germany Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Lobster Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Lobster Market Size and Forecast, By Species (2024-2032)

6.4.4.3. Italy Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Lobster Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Lobster Market Size and Forecast, By Species (2024-2032)

6.4.5.3. Spain Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Lobster Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Lobster Market Size and Forecast, By Species (2024-2032)

6.4.6.3. Sweden Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Lobster Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Lobster Market Size and Forecast, By Species (2024-2032)

6.4.7.3. Austria Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Lobster Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Lobster Market Size and Forecast, By Species (2024-2032)

6.4.8.3. Rest of Europe Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Lobster Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Lobster Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Lobster Market Size and Forecast, By Species (2024-2032)

7.3. Asia Pacific Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Lobster Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Lobster Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Lobster Market Size and Forecast, By Species (2024-2032)

7.4.1.3. China Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Lobster Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Lobster Market Size and Forecast, By Species (2024-2032)

7.4.2.3. S Korea Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Lobster Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Lobster Market Size and Forecast, By Species (2024-2032)

7.4.3.3. Japan Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Lobster Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Lobster Market Size and Forecast, By Species (2024-2032)

7.4.4.3. India Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Lobster Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Lobster Market Size and Forecast, By Species (2024-2032)

7.4.5.3. Australia Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Lobster Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Lobster Market Size and Forecast, By Species (2024-2032)

7.4.6.3. Indonesia Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Lobster Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Lobster Market Size and Forecast, By Species (2024-2032)

7.4.7.3. Philippines Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Lobster Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Lobster Market Size and Forecast, By Species (2024-2032)

7.4.8.3. Malaysia Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Lobster Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Lobster Market Size and Forecast, By Species (2024-2032)

7.4.9.3. Vietnam Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Lobster Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Lobster Market Size and Forecast, By Species (2024-2032)

7.4.10.3. Thailand Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Lobster Market Size and Forecast, By Type (2024-2032)

7.4.11.2. ASEAN Lobster Market Size and Forecast, By Species (2024-2032)

7.4.11.3. ASEAN Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Lobster Market Size and Forecast, By Type (2024-2032)

7.4.12.2. Rest of Asia Pacific Lobster Market Size and Forecast, By Species (2024-2032)

7.4.12.3. Rest of Asia Pacific Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Lobster Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Lobster Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Lobster Market Size and Forecast, By Species Model (2024-2032)

8.3. Middle East and Africa Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Lobster Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Lobster Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Lobster Market Size and Forecast, By Species Model (2024-2032)

8.4.1.3. South Africa Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Lobster Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Lobster Market Size and Forecast, By Species Model (2024-2032)

8.4.2.3. GCC Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Lobster Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Lobster Market Size and Forecast, By Species Model (2024-2032)

8.4.3.3. Nigeria Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Lobster Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Lobster Market Size and Forecast, By Species Model (2024-2032)

8.4.4.3. Rest of ME&A Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Lobster Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

9.1. South America Lobster Market Size and Forecast, By Type (2024-2032)

9.2. South America Lobster Market Size and Forecast, By Species (2024-2032)

9.3. South America Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Lobster Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Lobster Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Lobster Market Size and Forecast, By Species (2024-2032)

9.4.1.3. Brazil Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Lobster Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Lobster Market Size and Forecast, By Species (2024-2032)

9.4.2.3. Argentina Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Lobster Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America Lobster Market Size and Forecast, By Species (2024-2032)

9.4.3.3. Rest Of South America Lobster Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1 Clearwater Seafoods (Canada)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2 East Coast Seafood Group (United States)

10.3 Ready Seafood Co. (United States)

10.4 Maine Lobster Now (United States)

10.5 Boston Lobster Company (United States)

10.6 Paturel International Company (Canada)

10.7 Premium Seafoods (Canada)

10.8 Lobster Trap Company (United States)

10.9 Tangier Lobster Company (Canada)

10.10 Ocean Choice International (Canada)

10.11 Blue Lobster Company (United Kingdom)

10.12 Royal Greenland (Denmark)

10.13 Clearwater Europe Ltd. (United Kingdom)

10.14 Fylkir Seafood (Iceland)

10.15 Northbay Seafood (United Kingdom)

10.16 Geraldton Fishermen’s Co-operative (Australia)

10.17 Kailis Bros. (Australia)

10.18 Austral Fisheries (Australia)

10.19 Exportadora de Mariscos (New Zealand)

10.20 Lobster West (Australia)

10.21 Pescanova Nicaragua (Nicaragua)

10.22 Mariscos del Pacifico (Honduras)

10.23 Caribbean Lobsters S.A. (Panama)

10.24 Brasmar Group (Brazil)

10.25 Lobster House (Mexico)

10.26 West Coast Lobster (South Africa)

10.27 Indian Ocean Lobster (Kenya)

10.28 Lobster Fisheries of Oman (Oman)

10.29 Arabian Seafoods (United Arab Emirates)

10.30 Cape Fish Co. (South Africa)

11. Key Findings & Analyst Recommendations

12. Lobster Markets: Research Methodology