Whisky Market Size, Share, Dynamics, and Segment Analysis and Forecast (2025-2032)

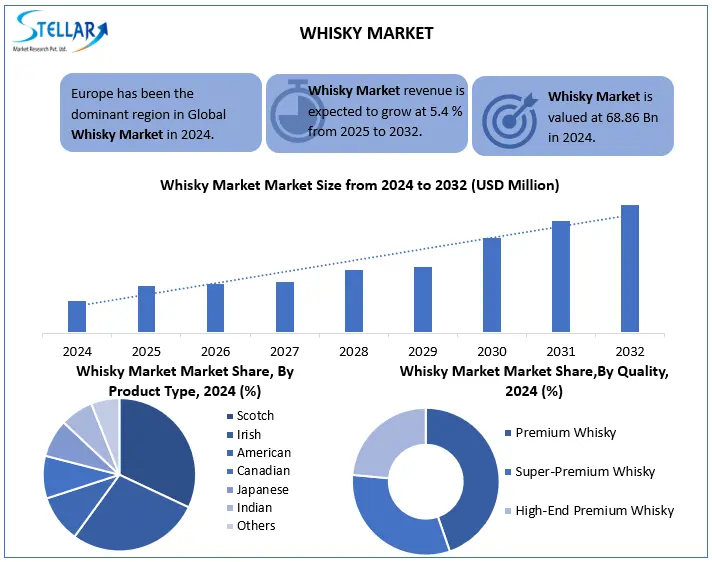

The Whisky Market size was valued at USD 68.86 Bn in 2024, and it is expected to grow USD 104.88 Bn in 2032. The Market CAGR is expected to be around 5.4% during the forecast period (2025-2032).

Format : PDF | Report ID : SMR_2815

Whisky Market Overview

Whisky is a spiritual liquor obtained by distillation of a fermented mash of grain, which is aged for a minimum period (usually 2-3 years based on regional laws), occurs in wooden barrels, resulting in a golden-brown alcoholic beverage, with various taste profiles based on materials and distillation process. Whisky is classified as a hard liquor that usually contains 40% alcohol. The Global Whisky Market experienced an increase in 2024 with the increasing demand for Luxury goods and premium offerings.

Consumers, especially in developing countries, are switched to high quality premium Whisky such as a single malt scotch due to the rich taste, expansion in age, and depth of unique cask finish. For example, the premium Whisky segment now has the largest market share, as consumers are more inclined to spend on better taste and high-quality drinking experiences. However, the market is facing challenges such as restrictive rules and increasing health awareness that affects and limit the consumption. In product types, Scotch Whisky leads globally, with 2024 exports reaching £ 5.4 billion, with India becoming the largest volume market, accounting for 13.7% of global exports. Blended whisky, due to its smoothness and affordability, dominates the developing areas.

In 2024, the European region dominated the global whisky market with its traditional Scotch Whisky heritage and innovations of Diageo and Glenfiddich. While the North America is inspired by the growing consumption of bourbon and craft Whisky, the Asia Pacific region is growing, which is further increasing the possibilities of development and stimulating demand in India, China and Japan. Indian single malt is becoming a global opportunity, offering bold flavors and rapid maturity that rival traditional Whiskies. Despite this, the Whisky market remains highly competitive and innovative, with dominant players such as Diageo, Pernod Ricard and William Grant and Sons shaping their future through premium offerings and global expansion.

To get more Insights: Request Free Sample Report

Whisky Market Dynamics

Demand for Luxury Goods & Premiumization to Fuel Whisky Market Growth

The market for global whisky is experiencing significant growth due to the increasing consumption of luxury and premium spirits. There is premiumization as people continue to look for premium, high-quality products. Premium Scotch whiskies, particularly the single malts, are being appreciated more because of their more substantial flavor, with added maturation years, and character. There is also momentum provided by special packaging, special cask finishing in the shape of special editions, which are experience-based and high-end.

- In 2024, Premium whisky accounts for the largest whisky market share, as consumers are willing to pay high prices for superior taste and a great drinking experience.

The global whisky market is witnessing strong growth because of the rising consumption of high-end and luxury spirits. Premiumization is an ongoing trend as consumers continue to seek premium, high-quality products. While premium Scotch whiskies, especially single malts, are being more appreciated due to their more solid flavor, additional years of maturation, and character. This is enhanced by limited editions, featuring special packaging and special cask finishes that are experience-oriented and sophisticated.

Regulatory and Health-Related Constraints to Hinder Whisky Market Growth

Stringent government regulations and the increasing health consciousness among consumers. High excise duties, complex licensing regulations, and severe advertising limitations in many markets are significant impediments, particularly for smaller, newer brands. Such regulatory hurdles drive up costs and restrict businesses from international expansion. The growing concern for health risks associated with alcohol, like liver disease, addictive tendencies, and lifestyle-related issues, is clearly drawing many consumers to shift towards low-alcohol and alcohol-free beverages.

Growing Popularity of Indian Single Malt Whiskies to Present Opportunity in the Whisky Market

Indian single malt whisky is now competing fiercely in the international market alongside traditional Scotch and Japanese whisky. The sales of Indian single malts have already outpaced Scotch in the domestic market, and expand internationally, driven by Amrut, Paul John, and Rampur. Their bold, flavor-rich profile and rapid aging due to India's tropical climate makes this whisky revered among experts and collectors worldwide. Since premiums continue to shape consumer preferences worldwide, Indian single malt represents a high-development opportunity in the global Whisky market, offering diversity, authenticity, and a compelling value proposition.

Whisky Market Segment Analysis

Based on Product Type, the global whisky market is segmented by product categories as Scotch, Irish, American, Canadian, Japanese, Indian and Others. Scotch whisky dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Canada, America, French and Indian countries greatly support the exportation of Scotch Whisky. Its Premium appeal and variety in scotches like single malt, mixed and blended makes it a popular demand, especially with collectors and connoisseurs alike.

- Scotch Whisky had a global export of £ 5.4 billion in 2024, reflecting demand internationally and solidifying its stance as a premium spirit.

Based on the Grain Type, whiskies are classified into malt whisky, grain whisky, single malt, single grain whisky, and blended whisky. Blended whisky dominated the market in 2024 and is expected to hold the largest Whisky market share over the forecast period, especially in developing countries, because of its lack of solid flavor. Among these, blended Whisky has the most distinctive taste and offers the widest appeal to consumers. Producers include Johnny Walker and Chivas Regal.

Based on Quality, Considering the Quality, Pricing and Brand Positioning Strategy, whisky is classified into three categories of super-premium, high-end premium and premium. Premium whisky is the dominant segment, driven by a large middle-class population, rising disposable incomes, and increasing preference for aspirational lifestyles. While super-premium and high-end whiskies are growing fast, especially in gifting and luxury occasions, premium whisky remains the volume driver across both developed and developing nations.

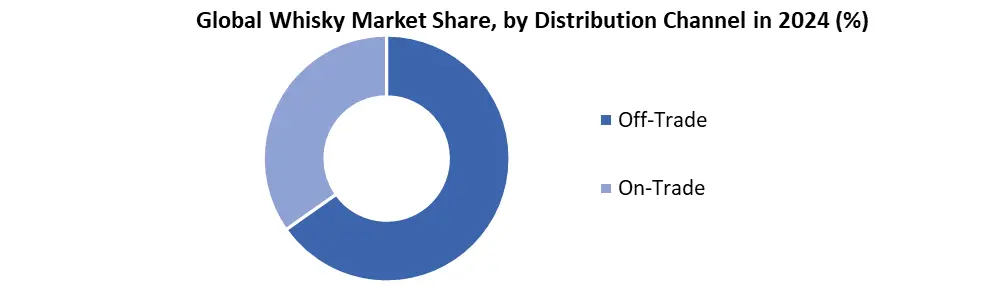

Based Distribution Channel, Whisky distribution channels consist of Off-Trade (retailers, supermarkets) and on-trade (pubs, restaurants). Off-Trade leads the market because it is widely available, affordable, and people prefer bulk buying, especially during festivals and social occasions. However, the on-trade segment is seeing a steady rise with the growth of cocktail culture, nightlife, and premium whisky bars in urban centers.

Global Whisky Market Regional Analysis

The Europe region dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032)

The global Whisky market is primarily controlled in Europe because of its heritage, particularly in Scotland and Ireland. Europe dominates the market owing to its premium Scotch whisky, which is followed by increasing consumer demand for single malt variants. Cask innovations and limited editions are the recent developments followed by major market key players such as Diageo and Glenfiddich, targeted towards the luxury consumers. North America, led by the U.S has adequate market opportunities due to the rising demand for bourbon and rye whiskies. Unique grain blends and aging processes, together with experimental distillers, contribute to the rapid growth of American Craft whisky segment. The Asia Pacific region is highly associated with the increasing level of disposable income and the growing interest towards premium spirits coming from China, India, and Japan. Japanese whisky has received international acclaim with a global consumer base and continues to fuel interest.

Global Whisky Market Competitive Landscape

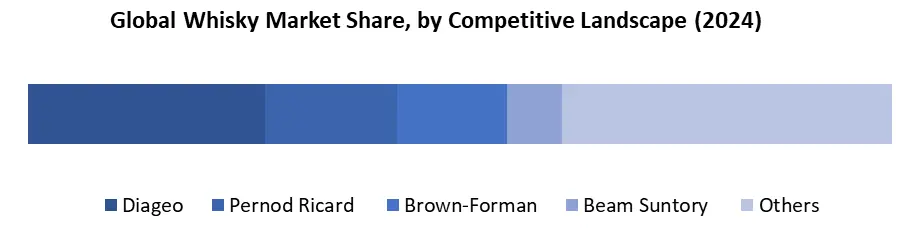

The global whisky market is characterized by competitiveness, with the major key players. Diageo is a British beverage manufacturer company and is the leader in the global Whisky market, producing 40% of total Scotch Whisky. Diageo is a global alcohol manufacturing company that owns brands like J&B, Buchanan's, and Johnnie Walker.

With its well-known brands, Chivas Regal, Glenlivet, and Ballantine's, Pernod Ricard holds a significant portion of the market. About 8% of the global market is held by independent Scottish distiller William Grant and Sons. Bacardi, Brown-Forman, and Beam Suntory are some of the other significant companies in the sector. However, these businesses have expanded internationally through acquisitions and new developments.

Global Whisky Market Recent Developments

|

Date |

Recent Development |

Region |

|

May 29, 2025 |

Old Forester President’s Choice limited bourbon & rye is now released nationwide |

USA |

|

May 24, 2025 |

Midleton Distillery won 20+ Double Gold medals at the San Francisco World Spirits Competition |

Ireland |

|

May 22, 2025 |

Indian single malts surpassed Scotch whisky in domestic sales for the first time |

India |

|

May 15, 2025 |

Tilaknagar Industries in talks to acquire Imperial Blue from Pernod Ricard (deal ~$600M) |

India |

|

April 2025 |

UK considers Geographical Indication (GI) status for English Single Malt Whisky |

UK |

|

Whisky Market Scope |

|

|

Market Size in 2024 |

USD 68.86 Bn |

|

Market Size in 2032 |

USD 104.88 Bn |

|

CAGR (2024-2032) |

5.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Scotch Irish American Canadian Japanese Indian Others |

|

By Grain Type Malt Whisky Grain Whisky Blended Whisky Single Malt Whisky Single Grain Whisky Blended Grain Whisky |

|

|

By Quality Premium Whisky Super-Premium Whisky High-End Premium Whisky |

|

|

By Distribution Channel Off-Trade On-Trade |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Whisky Market

North America

- Brown-Forman Corporation – United States

- Sazerac Company – United States

- Heaven Hill Brands – United States

- Beam Suntory – United States

- MGP Ingredients – United States

Europe

- Diageo plc – United Kingdom

- William Grant & Sons Ltd. – United Kingdom

- Edrington Group – United Kingdom

- Whyte & Mackay Ltd. – United Kingdom

- La Martiniquaise – France

- Pernod Ricard – France

- Bacardi Limited – Bermuda

- Stock Polska – Poland

- The Green Tree Distillery – Czech Republic.

- Altia Plc – Finland

Asia

- Suntory Holdings Ltd. – Japan

- Nikka Whisky Distilling Co. – Japan

- Amrut Distilleries – India

- Radico Khaitan Ltd. – India

- John Distilleries Pvt. Ltd. – India

- Pernod Ricard India Pvt. Ltd. – India

- Tilaknagar Industries Ltd. – India

- Allied Blenders & Distillers Pvt. Ltd. – India

- Diageo China – China

- Pernod Ricard China – China

South America

- Casa Santa Luzia – Brazil

- Destilería La Alazana – Argentina

MEA

- Keroche Breweries Ltd. – Kenya

- African Distillers Ltd. – Zimbabwe

- Distell Group Ltd. – South Africa

Frequently Asked Questions

Demand for luxury goods and premiumization drives momentum in the Whisky Market.

Stringent government regulations and the?increasing health consciousness among consumers are the main restraints to the market.

Europe dominates the Whisky market is the dominant industry driving Whisky implementation.

Diageo, Pernod Ricard, Bacardi Limited, Whyte & Mackay Ltd, J&B, Buchanan's, and Johnnie Walker. These are the major key players in the global whisky Market.

1. Whisky Market: Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Whisky Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Whisky Market: Dynamics

3.1. Whisky Market Trends by Region

3.1.1. North America Whisky Market Trends

3.1.2. Europe Whisky Market Trends

3.1.3. Asia Pacific Whisky Market Trends

3.1.4. Middle East and Africa Whisky Market Trends

3.1.5. South America Whisky Market Trends

3.2. Whisky Market Dynamics

3.2.1. Whisky Market Drivers

3.2.2. Whisky Market Restraints

3.2.3. Whisky Market Opportunities

3.2.4. Whisky Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Whisky Industry

4. Whisky Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Whisky Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Scotch

4.1.2. Irish

4.1.3. American

4.1.4. Canadian

4.1.5. Japanese

4.1.6. Indian

4.1.7. Others

4.2. Whisky Market Size and Forecast, By Grain Type (2024-2032)

4.2.1. Malt Whisky

4.2.2. Grain Whisky

4.2.3. Blended Whisky

4.2.4. Single Malt Whisky

4.2.5. Single Grain Whisky

4.2.6. Blended Grain Whisky

4.3. Whisky Market Size and Forecast, By Quality (2024-2032)

4.3.1. Premium Whisky

4.3.2. Super-Premium Whisky

4.3.3. High-End Premium Whisky

4.4. Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

4.4.1. Off-Trade

4.4.2. On-Trade

4.5. Whisky Market Size and Forecast, by region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Whisky Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Whisky Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Scotch

5.1.2. Irish

5.1.3. American

5.1.4. Canadian

5.1.5. Japanese

5.1.6. Indian

5.1.7. Others

5.2. North America Whisky Market Size and Forecast, By Grain Type (2024-2032)

5.2.1. Malt Whisky

5.2.2. Grain Whisky

5.2.3. Blended Whisky

5.2.4. Single Malt Whisky

5.2.5. Single Grain Whisky

5.2.6. Blended Grain Whisky

5.3. North America Whisky Market Size and Forecast, By Quality (2024-2032)

5.3.1. Premium Whisky

5.3.2. Super-Premium Whisky

5.3.3. High-End Premium Whisky

5.4. North America Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1. Off-Trade

5.4.2. On-Trade

5.5. North America Whisky Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Whisky Market Size and Forecast, By Product Type (2024-2032)

5.5.1.1.1. Scotch

5.5.1.1.2. Irish

5.5.1.1.3. American

5.5.1.1.4. Canadian

5.5.1.1.5. Japanese

5.5.1.1.6. Indian

5.5.1.1.7. Others

5.5.1.2. United States Whisky Market Size and Forecast, By Grain Type (2024-2032)

5.5.1.2.1. Malt Whisky

5.5.1.2.2. Grain Whisky

5.5.1.2.3. Blended Whisky

5.5.1.2.4. Single Malt Whisky

5.5.1.2.5. Single Grain Whisky

5.5.1.2.6. Blended Grain Whisky

5.5.1.3. United States Whisky Market Size and Forecast, By Quality (2024-2032)

5.5.1.3.1. Premium Whisky

5.5.1.3.2. Super-Premium Whisky

5.5.1.3.3. High-End Premium Whisky

5.5.1.4. United States Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.1.4.1. Off-Trade

5.5.1.4.2. On-Trade

5.5.2. Canada

5.5.2.1. Canada Whisky Market Size and Forecast, By Product Type (2024-2032)

5.5.2.1.1. Scotch

5.5.2.1.2. Irish

5.5.2.1.3. American

5.5.2.1.4. Canadian

5.5.2.1.5. Japanese

5.5.2.1.6. Indian

5.5.2.1.7. Others

5.5.2.2. Canada Whisky Market Size and Forecast, By Grain Type (2024-2032)

5.5.2.2.1. Malt Whisky

5.5.2.2.2. Grain Whisky

5.5.2.2.3. Blended Whisky

5.5.2.2.4. Single Malt Whisky

5.5.2.2.5. Single Grain Whisky

5.5.2.2.6. Blended Grain Whisky

5.5.2.3. Canada Whisky Market Size and Forecast, By Quality (2024-2032)

5.5.2.3.1. Premium Whisky

5.5.2.3.2. Super-Premium Whisky

5.5.2.3.3. High-End Premium Whisky

5.5.2.4. Canada Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.2.4.1. Off-Trade

5.5.2.4.2. On-Trade

5.5.3. Mexico

5.5.3.1. Mexico Whisky Market Size and Forecast, By Product Type (2024-2032)

5.5.3.1.1. Scotch

5.5.3.1.2. Irish

5.5.3.1.3. American

5.5.3.1.4. Canadian

5.5.3.1.5. Japanese

5.5.3.1.6. Indian

5.5.3.1.7. Others

5.5.3.2. Mexico Whisky Market Size and Forecast, By Grain Type (2024-2032)

5.5.3.2.1. Malt Whisky

5.5.3.2.2. Grain Whisky

5.5.3.2.3. Blended Whisky

5.5.3.2.4. Single Malt Whisky

5.5.3.2.5. Single Grain Whisky

5.5.3.2.6. Blended Grain Whisky

5.5.3.3. Mexico Whisky Market Size and Forecast, By Quality (2024-2032)

5.5.3.3.1. Premium Whisky

5.5.3.3.2. Super-Premium Whisky

5.5.3.3.3. High-End Premium Whisky

5.5.3.4. Mexico Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.3.4.1. Off-Trade

5.5.3.4.2. On-Trade

6. Europe Whisky Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Whisky Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.3. Europe Whisky Market Size and Forecast, By Quality (2024-2032)

6.4. Europe Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5. Europe Whisky Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.1.2. United Kingdom Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.1.3. United Kingdom Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.1.4. United Kingdom Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.2. France

6.5.2.1. France Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.2.2. France Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.2.3. France Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.2.4. France Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.3.2. Germany Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.3.3. Germany Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.3.4. Germany Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.4.2. Italy Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.4.3. Italy Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.4.4. Italy Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.5.2. Spain Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.5.3. Spain Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.5.4. Spain Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.6.2. Sweden Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.6.3. Sweden Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.6.4. Sweden Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.7. Austria

6.5.7.1. Austria Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.7.2. Austria Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.7.3. Austria Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.7.4. Austria Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Whisky Market Size and Forecast, By Product Type (2024-2032)

6.5.8.2. Rest of Europe Whisky Market Size and Forecast, By Grain Type (2024-2032)

6.5.8.3. Rest of Europe Whisky Market Size and Forecast, By Quality (2024-2032)

6.5.8.4. Rest of Europe Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Whisky Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Whisky Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.3. Asia Pacific Whisky Market Size and Forecast, By Quality (2024-2032)

7.4. Asia Pacific Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5. Asia Pacific Whisky Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.1.2. China Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.1.3. China Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.1.4. China Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.2.2. S Korea Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.2.3. S Korea Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.2.4. S Korea Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.3.2. Japan Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.3.3. Japan Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.3.4. Japan Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.4. India

7.5.4.1. India Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.4.2. India Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.4.3. India Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.4.4. India Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.5.2. Australia Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.5.3. Australia Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.5.4. Australia Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.6.2. Indonesia Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.6.3. Indonesia Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.6.4. Indonesia Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.7. Philippines

7.5.7.1. Philippines Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.7.2. Philippines Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.7.3. Philippines Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.7.4. Philippines Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.8. Malaysia

7.5.8.1. Malaysia Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.8.2. Malaysia Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.8.3. Malaysia Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.8.4. Malaysia Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.9. Vietnam

7.5.9.1. Vietnam Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.9.2. Vietnam Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.9.3. Vietnam Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.9.4. Vietnam Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.10. Thailand

7.5.10.1. Thailand Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.10.2. Thailand Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.10.3. Thailand Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.10.4. Thailand Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Whisky Market Size and Forecast, By Product Type (2024-2032)

7.5.11.2. Rest of Asia Pacific Whisky Market Size and Forecast, By Grain Type (2024-2032)

7.5.11.3. Rest of Asia Pacific Whisky Market Size and Forecast, By Quality (2024-2032)

7.5.11.4. Rest of Asia Pacific Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Whisky Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

8.1. Middle East and Africa Whisky Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Whisky Market Size and Forecast, By Grain Type (2024-2032)

8.3. Middle East and Africa Whisky Market Size and Forecast, By Quality (2024-2032)

8.4. Middle East and Africa Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

8.5. Middle East and Africa Whisky Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Whisky Market Size and Forecast, By Product Type (2024-2032)

8.5.1.2. South Africa Whisky Market Size and Forecast, By Grain Type (2024-2032)

8.5.1.3. South Africa Whisky Market Size and Forecast, By Quality (2024-2032)

8.5.1.4. South Africa Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Whisky Market Size and Forecast, By Product Type (2024-2032)

8.5.2.2. GCC Whisky Market Size and Forecast, By Grain Type (2024-2032)

8.5.2.3. GCC Whisky Market Size and Forecast, By Quality (2024-2032)

8.5.2.4. GCC Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.3. Nigeria

8.5.3.1. Nigeria Whisky Market Size and Forecast, By Product Type (2024-2032)

8.5.3.2. Nigeria Whisky Market Size and Forecast, By Grain Type (2024-2032)

8.5.3.3. Nigeria Whisky Market Size and Forecast, By Quality (2024-2032)

8.5.3.4. Nigeria Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.4. Rest of ME&A

8.5.4.1. Rest of ME&A Whisky Market Size and Forecast, By Product Type (2024-2032)

8.5.4.2. Rest of ME&A Whisky Market Size and Forecast, By Grain Type (2024-2032)

8.5.4.3. Rest of ME&A Whisky Market Size and Forecast, By Quality (2024-2032)

8.5.4.4. Rest of ME&A Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Whisky Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

9.1. South America Whisky Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Whisky Market Size and Forecast, By Grain Type (2024-2032)

9.3. South America Whisky Market Size and Forecast, By Quality (2024-2032)

9.4. South America Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

9.5. South America Whisky Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Whisky Market Size and Forecast, By Product Type (2024-2032)

9.5.1.2. Brazil Whisky Market Size and Forecast, By Grain Type (2024-2032)

9.5.1.3. Brazil Whisky Market Size and Forecast, By Quality (2024-2032)

9.5.1.4. Brazil Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Whisky Market Size and Forecast, By Product Type (2024-2032)

9.5.2.2. Argentina Whisky Market Size and Forecast, By Grain Type (2024-2032)

9.5.2.3. Argentina Whisky Market Size and Forecast, By Quality (2024-2032)

9.5.2.4. Argentina Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.3. Rest Of South America

9.5.3.1. Rest Of South America Whisky Market Size and Forecast, By Product Type (2024-2032)

9.5.3.2. Rest Of South America Whisky Market Size and Forecast, By Grain Type (2024-2032)

9.5.3.3. Rest Of South America Whisky Market Size and Forecast, By Quality (2024-2032)

9.5.3.4. Rest Of South America Whisky Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1. Diageo

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Brown-Forman Corporation

10.3. Sazerac Company

10.4. Heaven Hill Brands

10.5. Beam Suntory

10.6. MGP Ingredients

10.7. William Grant & Sons Ltd.

10.8. Edrington Group

10.9. Whyte & Mackay Ltd.

10.10. La Martiniquaise

10.11. Pernod Ricard

10.12. Bacardi Limited

10.13. Stock Polska

10.14. The Green Tree Distillery

10.15. Altia Plc

10.16. Suntory Holdings Ltd.

10.17. Nikka Whisky Distilling Co.

10.18. Amrut Distilleries

10.19. Radico Khaitan Ltd.

10.20. John Distilleries Pvt. Ltd.

10.21. Pernod Ricard India Pvt. Ltd.

10.22. Tilaknagar Industries Ltd.

10.23. Allied Blenders & Distillers Pvt. Ltd.

10.24. Diageo China

10.25. Pernod Ricard China

10.26. Casa Santa Luzia

10.27. Destilería La Alazana

10.28. Keroche Breweries Ltd.

10.29. African Distillers Ltd.

10.30. Distell Group Ltd.

11. Key Findings

12. Analyst Recommendations

13. Whisky Market: Research Methodology