Craft Beer Market Global Industry Analysis and Forecast (2026-2032)

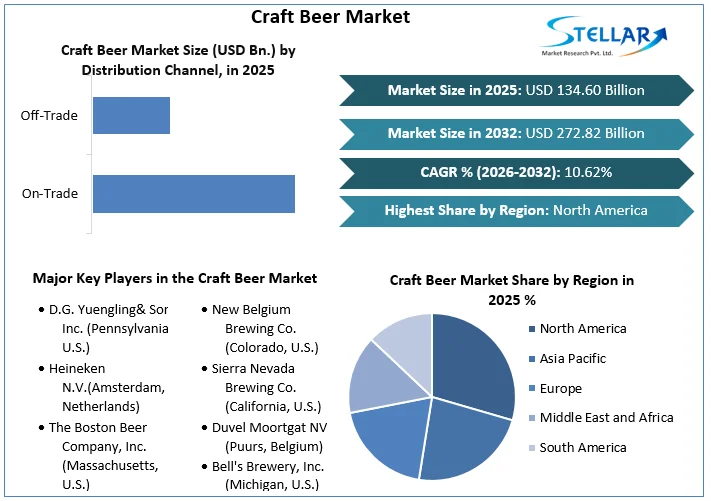

The Craft Beer Market size was valued at USD 134.60 Bn. in 2025 and the total Global Craft Beer revenue is expected to grow at a CAGR of 10.62% from 2026 to 2032, reaching nearly USD 272.82 Bn. by 2032.

Format : PDF | Report ID : SMR_2409

Craft Beer Market Overview:

Craft beer has been made by craft breweries, which typically produce smaller amounts of beer than larger "macro" breweries and are often independently owned. Such breweries are generally perceived and marketed as emphasizing enthusiasm, new flavors, and varied brewing techniques.

The craft beer market is witnessing notable trends and dynamics driven by evolving consumer preferences and technological advancements. Health-conscious trends are influencing demand, with increasing interest in low-alcohol, non-alcoholic, and gluten-free beers as consumers seek healthier lifestyle choices. This shift has prompted breweries to innovate, resulting in a broader market segment and attracting new customers. Innovation in brewing technologies enhances product quality and variety, with advancements in fermentation processes and novel ingredients enriching flavor profiles. Breweries are also capitalizing on unique customer experiences, such as brewery tours and tasting events, to foster brand loyalty and stand out in a competitive landscape.

However, the market faces regulatory and compliance challenges, including complex labeling rules, varying alcohol content regulations, and taxation issues, which impact operational costs and market entry. Regional insights reveal that North America remains a stronghold for craft beer market, driven by the U.S. market's diversity and innovation. Meanwhile, the Asia-Pacific region is poised for rapid growth due to shifting consumer preferences and increasing health awareness. The Asia Pacific region, including countries like China, Japan, India, South Korea, Australia, and Indonesia, is quickly becoming the largest geographic segment in the market. This growth is fueled by rapid economic development, increasing urbanization, and the rise of a middle class with greater disposable income.

The region is also distinguished by a young, dynamic population eager to explore new and diverse flavors, challenging traditional beer consumption patterns. Market expansion is particularly strong in China, Japan, and Australia, where the number of microbreweries is rising, and interest in craft beer culture is spreading across the region.

To get more Insights: Request Free Sample Report

Craft Beer Market Trend:

Demand for health-conscious beers reflects healthier lifestyle trends

On the other hand, lagers make up another significant market category because of their wide appeal and easy availability. A diverse range of customers favor lagers. Ales have a more intense and harsher taste compared to lagers because of the higher temperature fermentation process. Pilsners and helles, two sub-types within this category, offer a diverse range of flavors to cater to a broad spectrum of consumer preferences.

The growing demand for health-conscious options in the craft beer market reflects a broader consumer shift towards healthier lifestyles. Low-alcohol, non-alcoholic, and gluten-free beers are increasingly sought after as consumers become more health-aware and seek alternatives that align with their dietary preferences and wellness goals. This trend is driven by a desire to reduce alcohol consumption, manage calorie intake, and accommodate dietary restrictions.

The impact on the market is significant. Breweries are investing in research and development to create high-quality, flavorful low-alcohol and non-alcoholic beers that meet consumer expectations. This has expanded the craft beer market segment and attracted new customers who might have previously avoided craft beer. Additionally, the introduction of gluten-free options caters to individuals with gluten sensitivities or celiac disease, further broadening the consumer base.

- Heineken has embraced this trend with its Heineken 0.0, a non-alcoholic beer that maintains the brand's signature taste while providing a healthier option for consumers.

- MillerCoors offers Miller Lite, a low-alcohol beer that appeals to health-conscious drinkers looking for lower calorie and alcohol content without sacrificing flavor.

Craft Beer Market Dynamics:

Craft Beer Market Drivers:

Innovation in brewing technologies

Advancements in brewing technology and techniques have significantly impacted the craft beer market by enhancing the quality, flavor, and variety of products available. Modern improvements in fermentation processes, such as the use of advanced yeast strains and precise temperature control, allow brewers to produce more consistent and complex flavors. These innovations help create unique beer profiles that stand out in a crowded market, attracting both enthusiasts and new consumers seeking distinct experiences.

The use of novel ingredients, such as exotic hops, rare grains, and innovative adjuncts like fruits or spices, further differentiates craft beers from mainstream options. This experimentation drives consumer interest and fosters a culture of discovery within the craft beer community.

- New England IPA (NEIPA): Advances in hop utilization and dry hopping techniques have led to the popularity of NEIPAs. These beers feature hazy appearances and intense, juicy hop flavors that were previously challenging to achieve consistently.

- Milk Stouts: The incorporation of lactose (milk sugar) in brewing creates milk stouts with a rich, creamy mouthfeel and sweetness. This technique showcases how ingredient innovation can produce unique flavor profiles and appeal to diverse palates.

Craft Beer Market Opportunity:

Unique brewery experiences build loyalty and attract customers

Enhanced brewery experiences are becoming a key strategy for craft breweries to attract and retain customers. By offering unique experiences such as brewery tours, tasting events, and on-site restaurants, breweries create a deeper connection with their customers. These experiences provide visitors with an insight into the brewing process, the opportunity to sample a variety of beers, and a space to socialize and enjoy the ambiance of the brewery.

This approach not only fosters brand loyalty but also helps differentiate breweries in a competitive market. Visitors who have positive and memorable experiences are more likely to become repeat customers and advocate for the brand, driving word-of-mouth promotion and social media buzz.

In the European craft beer market, this trend is particularly impactful. With a rich brewing heritage and a growing interest in craft beer across the continent, European breweries are leveraging enhanced experiences to stand out. Countries like Belgium, Germany, and the UK are seeing increased tourism and local engagement through brewery events and specialized tours. This not only boosts sales but also strengthens the overall craft beer community, contributing to the market's growth and vibrancy.

Craft Beer Market Challenge:

Regulatory and Compliance Challenge

Navigating regulatory and compliance challenges in the craft beer market involves managing a complex landscape of local and national regulations, as well as dealing with taxation issues. Craft breweries must adhere to stringent rules related to labeling, which include accurate product information and compliance with health warnings. Regulations on alcohol content also vary by region, requiring breweries to ensure that their products meet local standards. This regulatory complexity can increase operational costs and complicate market entry.

Taxation further impacts craft breweries, with federal, state, and provincial taxes affecting profitability. In the U.S., the federal excise tax rates on beer are set by the Alcohol and Tobacco Tax and Trade Bureau (TTB), which can significantly impact costs. For instance, the Craft Beverage Modernization and Tax Reform Act has provided temporary tax relief but faces periodic changes. In Canada, the Federal excise duty and provincial taxes add layers of complexity, varying significantly between provinces.

Craft Beer Market Segment:

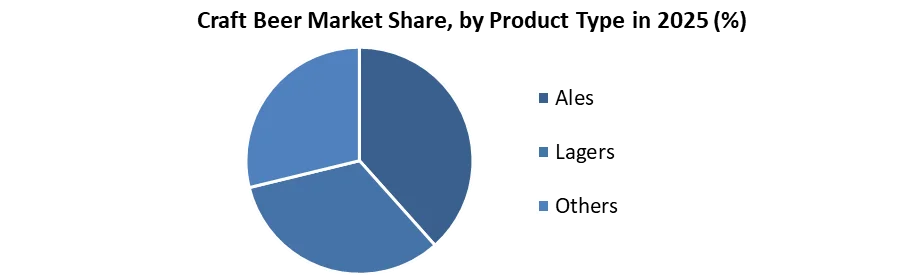

According to the Product Type, The Craft Beer Market is categorized into ales, lagers, and others. Ales held the large portion of the market in 2025. They are famous for their intricate and profound flavors. This group includes IPAs, stouts, porters, and additional varieties. Each one of them has a distinct taste and scent. Ales' flavors are enriched by their fermentation process conducted at elevated temperatures, enhancing their complexity and variety. The craft beer market is particularly popular among beer enthusiasts who appreciate the craft and unique beer experiences and seek a variety of flavors and complexity. The increase in popularity of barrel-aged and experimental ales is appealing to a larger portion of consumers who enjoy distinctive and handcrafted beer experiences.

On the other hand, lagers make up another significant craft beer market category because of their wide appeal and easy availability. A diverse range of customers favor lagers. Ales have a more intense and harsher taste compared to lagers because of the higher temperature fermentation process. Pilsners and helles, two sub-types within this category, offer a diverse range of flavors to cater to a broad spectrum of consumer preferences.

Craft Beer Market Regional Insights:

In North America, the craft beer market is predominantly driven by the U.S., where the craft beer movement originated. The U.S. boasts a vibrant craft beer industry with thousands of independent breweries, fostering innovation and variety. The market's growth is supported by a strong consumer preference for unique, high-quality beers and a growing number of craft beer enthusiasts. Canada's craft beer market is also expanding, albeit at a slower pace. Canadian craft breweries are gaining traction with a focus on local ingredients and regional flavors. Both countries face regulatory and taxation challenges, but these are being addressed through evolving policies and industry advocacy. The U.S. and Canadian craft beer markets are characterized by a strong emphasis on quality and diversity, contributing to their continued growth.

The craft beer market in the Asia-Pacific region is projected to experience rapid growth in the upcoming years due to changing consumer preferences, globalization, an expanding middle class, local breweries, food combinations, popularity among young people, tourism, health awareness, and government backing.

Craft Beer Market Competitive Landscape:

D.G. Yuengling & Son, Inc., founded in 1829, is one of the oldest breweries in the U.S., headquartered in Pottsville, Pennsylvania. Known for traditional American beers like Yuengling Lager and Yuengling Light Lager, Yuengling is one of the largest U.S. breweries by volume. Its strategy involves maintaining traditional brewing methods while expanding regionally and leveraging heritage, with recent initiatives including market expansion, a partnership with Molson Coors, and product innovations.

Heineken N.V., established in 1864 and headquartered in Amsterdam, Netherlands, is a global leader in the beer industry with a vast portfolio including Heineken, Amstel, and Lagunitas. As a publicly traded company, Heineken reports substantial financial figures, with 2023 revenue of around €34 billion and a net income of €2.6 billion. Heineken’s strategy emphasizes global expansion, innovation, sustainability, and strategic acquisitions. Recent developments include significant sustainability initiatives and the acquisition of craft beer brands like Lagunitas.

Recent Developments:

In 2023, New Belgium Brewing Co. (Colorado, U.S.) recently introduced a new range of IPAs and seasonal beers, focusing on innovative brewing techniques.

In 2023, Bell's Brewery, Inc. (Michigan, U.S.)

- Sustainability Initiatives: Implemented new environmental sustainability practices, focusing on reducing waste and energy consumption.

- Product Innovations: Released several new seasonal and specialty beers, including a new line of barrel-aged brews.

In 2023, the Boston Beer Company, Inc. (Massachusetts, U.S.)

- Innovative Products: Expanded its lineup with a new hard seltzer line and a series of limited-edition IPAs.

- Collaborations: Partnered with various craft breweries for limited-release collaborations, enhancing its portfolio diversity.

Craft Beer Market Scope Table

|

Craft Beer Market |

|

|

Market Size in 2025 |

USD 134.60 billion. |

|

Market Size in 2032 |

USD 272.82 billion. |

|

CAGR (2026-2032) |

10.62% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Type:

|

|

By Distribution Channel:

|

|

|

By Ingredients:

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Craft Beer Market Key Players:

- D.G. Yuengling& Son, Inc. (Pennsylvania, U.S.)

- Heineken N.V.(Amsterdam, Netherlands)

- The Boston Beer Company, Inc. (Massachusetts, U.S.)

- Constellation Brands, Inc. (New York, U.S.)

- Anheuser-Busch InBev (Leuven, Belgium)

- New Belgium Brewing Co. (Colorado, U.S.)

- Sierra Nevada Brewing Co. (California, U.S.)

- Duvel Moortgat NV (Puurs, Belgium)

- Bell's Brewery, Inc. (Michigan, U.S.)

- Dogfish Head Craft Brewery Inc. (Delaware, U.S.)

Frequently Asked Questions

Innovation in brewing technologies is driving the growth of the Craft Beer Market.

.G. Yuengling& Son, Inc. (Pennsylvania, U.S.) Heineken N.V. (Amsterdam, Netherlands) the Boston Beer Company, Inc. (Massachusetts, U.S.) Constellation Brands, Inc. (New York, U.S.) Anheuser-Busch InBev (Leuven, Belgium) New Belgium Brewing Co. (Colorado, U.S.) Sierra Nevada Brewing Co. (California, U.S.) Duvel Moortgat NV (Puurs, Belgium) Bell's Brewery, Inc. (Michigan, U.S.) Dogfish Head Craft Brewery Inc. (Delaware, U.S.) Craft Beer Market.

The Craft Beer Market size was valued at USD 134.60 billion in 2025 and the total Global Craft Beer revenue is expected to grow at a CAGR of 10.62% from 2026 to 2032, reaching nearly USD 272.82 billion by 2032.

The segments covered in the Craft Beer Market report are by product type, distribution channel, ingredients, and region.

1. Craft Beer Market: Research Methodology

2. Craft Beer Market: Executive Summary

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Craft Beer Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape Key Players Benchmarking

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Craft Beer Market: Dynamics

4.1. Craft Beer Market Trends

4.2. Craft Beer Market Dynamics

4.2.1. Market Driver

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Value Chain Analysis

4.6. Regulatory Landscape by Region

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Middle East and Africa

4.6.5. South America

4.7. Global Import-Export Analysis

5. Craft Beer Market Size and Forecast by Segments (by Value in USD Billion)

5.1. Craft Beer Market Size and Forecast, By Product Type (2025-2032)

5.1.1. Ales

5.1.2. Lagers

5.1.3. Others

5.2. Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

5.2.1. On-Trade

5.2.2. Off-Trade

5.3. Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

5.3.1. Malt

5.3.2. Yeast

5.3.3. Enzymes

5.3.4. Hops

5.4. Craft Beer Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Craft Beer Market Size and Forecast (by Value in USD Billion)

6.1. North America Craft Beer Market Size and Forecast, By Product Type (2025-2032)

6.1.1. Ales

6.1.2. Lagers

6.1.3. Others

6.2. North America Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

6.2.1. On-Trade

6.2.2. Off-Trade

6.3. North America Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

6.3.1. Malt

6.3.2. Yeast

6.3.3. Enzymes

6.3.4. Hops

6.4. North America Craft Beer Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Craft Beer Market Size and Forecast (by Value in USD Billion)

7.1. Europe Craft Beer Market Size and Forecast, By Product Type (2025-2032)

7.1.1. Ales

7.1.2. Lagers

7.1.3. Others

7.2. Europe Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

7.2.1. On-Trade

7.2.2. Off-Trade

7.3. Europe Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

7.3.1. Malt

7.3.2. Yeast

7.3.3. Enzymes

7.3.4. Hops

7.4. Europe Craft Beer Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Craft Beer Market Size and Forecast (by Value in USD Billion)

8.1. Asia Pacific Craft Beer Market Size and Forecast, By Product Type (2025-2032)

8.1.1. Ales

8.1.2. Lagers

8.1.3. Others

8.2. Asia Pacific Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

8.2.1. On-Trade

8.2.2. Off-Trade

8.3. Asia Pacific Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

8.3.1. Malt

8.3.2. Yeast

8.3.3. Enzymes

8.3.4. Hops

8.4. Asia Pacific Craft Beer Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. ASIAN

8.4.8. Rest of Asia Pacific

9. Middle East and Africa Craft Beer Market Size and Forecast (by Value in USD Billion)

9.1. Middle East and Africa Craft Beer Market Size and Forecast, By Product Type (2025-2032)

9.1.1. Ales

9.1.2. Lagers

9.1.3. Others

9.2. Middle East and Africa Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

9.2.1. On-Trade

9.2.2. Off-Trade

9.3. Middle East and Africa Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

9.3.1. Malt

9.3.2. Yeast

9.3.3. Enzymes

9.3.4. Hops

9.4. Middle East and Africa Craft Beer Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Craft Beer Market Size and Forecast (by Value in USD Billion)

10.1. South America Craft Beer Market Size and Forecast, by Product Type (2025-2032)

10.1.1. Ales

10.1.2. Lagers

10.1.3. Others

10.2. South America Craft Beer Market Size and Forecast, By Distribution Channel (2025-2032)

10.2.1. On-Trade

10.2.2. Off-Trade

10.3. South America Craft Beer Market Size and Forecast, By Ingredients (2025-2032)

10.3.1. Malt

10.3.2. Yeast

10.3.3. Enzymes

10.3.4. Hops

10.4. South America Craft Beer Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. D.G. Yuengling& Son, Inc. (Pennsylvania, U.S.)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Heineken N.V.(Amsterdam, Netherlands)

11.3. The Boston Beer Company, Inc. (Massachusetts, U.S.)

11.4. Constellation Brands, Inc. (New York, U.S.)

11.5. Anheuser-Busch InBev (Leuven, Belgium)

11.6. New Belgium Brewing Co. (Colorado, U.S.)

11.7. Sierra Nevada Brewing Co. (California, U.S.)

11.8. Duvel Moortgat NV (Puurs, Belgium)

11.9. Bell's Brewery, Inc. (Michigan, U.S.)

11.10. Dogfish Head Craft Brewery Inc. (Delaware, U.S.)

12. Key Findings

13. Industry Recommendations