North America Protein Bars Market Outlook by Size, Share Analysis and Market Growth Forecast (2025-2032)

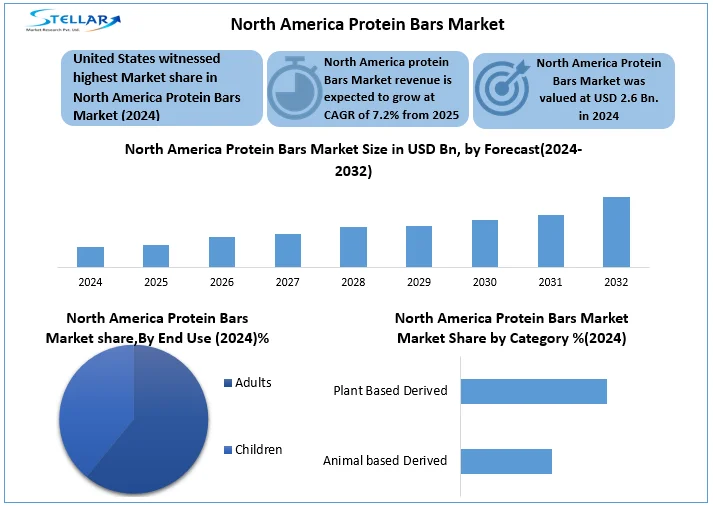

North America Protein Bars Market was valued at USD 2.6 Bn. in 2024 and total North America Protein Bars Market revenue is expected to grow at CAGR 7.2% reaching nearly USD 4.53 Bn. from 2025 to 2032.

Format : PDF | Report ID : SMR_2869

North America Protein Bars Market Overview:

The North American protein bars market is undergoing significant transformation, with recent developments highlighting three key trends. First, product innovation has accelerated with 60% of new launches now featuring 5g or less of sugar and nearly one-third incorporating plant-based proteins according to 2024 industry reports. Brands like Quest Nutrition and No Cow are leading this shift with their latest low-carb high-protein offerings. Second, distribution channels have diversified dramatically e-commerce sales through platforms like Amazon and Thrive North America Protein Bars industry grew 40% year-over-year while convenience store placements increased by 25% as major brands target on-the-go consumers. Third, sustainability has become a market imperative with 85% of top manufacturers adopting recyclable packaging and several, including Clif Bar achieving carbon-neutral production.

The North America Protein Bar market competitive landscape continues to intensify, with legacy brands facing pressure from emerging players specializing in functional ingredients like collagen and probiotics, as well as those catering to specific dietary needs like keto and low-FODMAP diets. Regulatory changes, particularly around protein content claims and clean labelling, are prompting widespread product reformulations across the industry. Looking ahead, the Protein Bar industry is poised for further evolution with the expected entry of novel protein sources and personalized nutrition solutions in 2025.

Imported bars from countries outside the agreement may face higher duties, and non-tariff barriers such as strict labelling requirements, allergen disclosures, and nutritional claim regulations imposed by the U.S. FDA and Canadian CFIA (Canadian Food Inspection Agency) can add compliance costs. These measures ensure safety and transparency but can be a barrier for smaller foreign brands.

To get more Insights: Request Free Sample Report

North America Protein Bars Markets Dynamics

Convenient Nutrition drive the North America Protein Bar Market

The fast and moving lifestyle in North America, especially in urban centres, significantly influences food consumption patterns. 45% of U.S. millennials use protein bars as meal replacements. Today consumers often busy working hours, long trips and multiple responsibilities, leaving little time for traditional meals. In this context 88% of consumers choose protein bars for easy no-prep nutrition. Protein bars offer a quick portable and nutritionally balanced solution. This makes them ideal for professionals who work to jump meals or need a quick boost between meetings athletes who need immediate post-workout recovery and students looking for a quick source of energy between classes. Many bars are designed to provide a specific combination of macronutrients, proteins, fibre and healthy fats, making it suitable for replacement or meal snacks. The availability of specific diet options, like friendly, vegan, gluten-free or low-carbohydrate bars, increases their appeal among health -worried consumers. The rise of remote work has not reduced demand people now look for easy home snacks that do not disturb productivity. This trend ensures that convenient, nutrient-dense protein bars remain a basic item in the modern North American diet.

Taste and Texture is Impact on North America Protein Bars Market

The North American protein bar market faces a significant adoption barrier due to persistent sensory challenges, with taste and texture emerging as key determinants of consumer acceptance. 40% of consumer’s reject protein bars due to poor taste or texture, while 35% of plant-based bars face criticism for bitter or beany off-notes Many consumers report that protein bars usually have a limestone, sandy or excessively dense texture, which make them less pleasant to eat compared to conventional snacks. This is mainly due to the high concentration of protein fibre and other functional ingredients that can compromise sensory appeal. In terms of flavour some protein bars are perceived as artificial or excessively sweet especially when using sugar substitutes like Stevia or Erythritol. Others may not have variety or richness of taste, making them unpleasant for long-term regular consumption. Brands that do not innovate in taste profiles or texture improvements run the risk of losing in a competitive and flavour oriented market. According to IBIS World Industry losses USD 120 Mn. In Annual from the sensory issues like rejection rate due to taste and texture.

Increased focus on clean label and natural ingredients is significant opportunity in North Protein Bar Market

The North America Protein Bars Market is being influenced by the tendency of consumers towards natural ingredients and clean label products for more loud bars on clean labels and natural ingredients. A 2023-24 survey Shows the 18% YOY growth of clean label protein bars market. Also 72% of consumers actively seek clean label bars. As a result, research found that more than 50% of respondents worldwide preferred less sugar in snacks and made from natural non-GMO components. In response, the market created formulas that have plant-based gluten-free and organic elements to meet consumer preferences. Plant-based nutritional bars in the United States are experiencing a growing trend of vegetarian diets among 10 million vegetarian Americans, according to the sales of bars for bars. Similarly, most consumers are looking at the artificial additives to reduce their intake, and choose natural sweetness like honey, and stevia, over artificial sugars in nutrition bars.

North America Protein Bars Market Segmentation

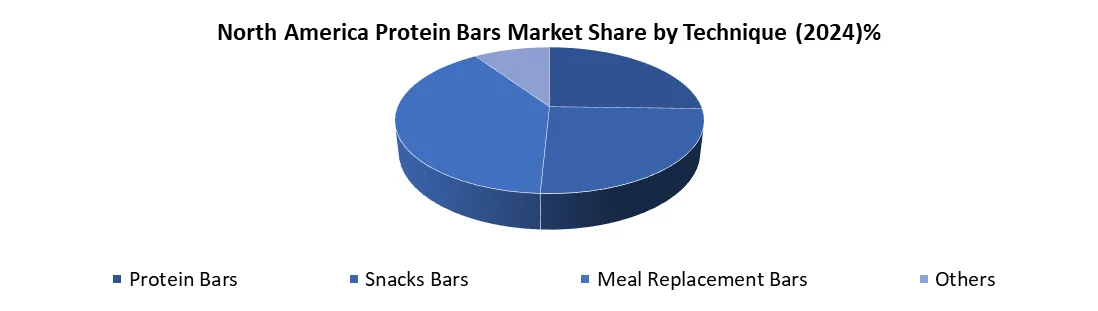

Based on Product type The Protein Bar Market is segmented into Protein Bars, Snacks Bar, Energy Bars, Meal Replacement bars and Others. Meal Replacement bars dominated the market in 2024 and is expected to hold largest share during the forecast period. Meal replacement bars dominate the protein bars market due to their convenience nutritional value and modern lifestyle alignment. These bars offer a quick and on the go solution to busy consumers like professionals, students and athletes who don't have time for traditional meals. They are formulated with a balanced mixture of protein, fiber healthy fats and essential vitamins and minerals making them suitable as complete meal alternatives. Its role in supporting weight control and popular diet trends ceto low carbohydrate and intermittent fasting further fuelled demand. Consumers looking for clean, plant-based or low sugar -based label options also find these bars attractive due to continuous innovation in ingredients and flavours. long-term expiration and easy storage make them attractive to retailers and buyers, increasing their presence in supermarkets, convenience stores and e-commerce platforms.

Based on Category the North America Protein Bars Market segmented into Animal derived and Plant derived. Plant derived Based segment dominated the market in 2024 and is expected to hold the largest share during forecast period. The Protein Bars Industry Continues the growth with 68% of market share of this segment Because of the ever growing shift by consumers toward healthier, sustainable and ethical food choices. There is a marked rise in demand driven by awareness and concern regarding health and environment among consumers of vegan and vegetarian diets. Being natural free from allergens, and nutritionally dense plant based bars align with the clean-label trends, made with nuts, seeds, and plant proteins. They also appeal to a wider audience, including flexitarians looking to reduce meat and dairy consumption. Also improvements in plant-based protein formulations have improved taste and texture making these products very appealing to health-conscious consumers and driving the nutritional bars market growth.

Based on End User the Protein Bars Market segmented into Adults and Children. Adult segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Based on the protein bar market forecast the adult segment dominates the sugar substitutes market due to the rising prevalence of lifestyle related conditions like obesity diabetes and cardiovascular diseases. Adults are increasingly adopting sugar substitutes as a healthier alternative to traditional sugar to manage calorie intake and maintain overall health. This demographic boost demand for low calorie and natural substitutes, like stevia, erythritol and monk fruit, as part of fitness and weight management regimens.

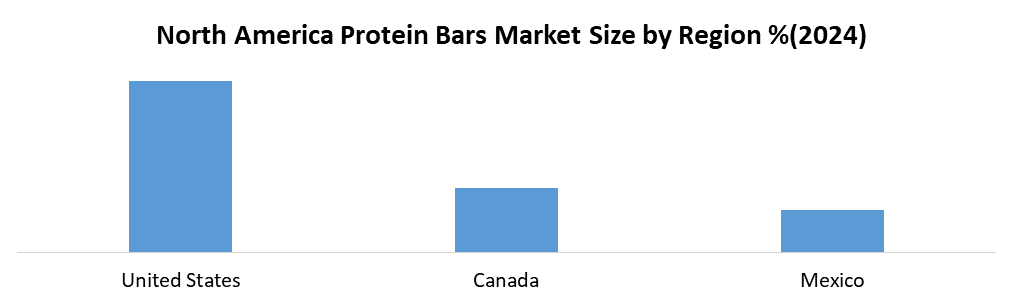

Based on Country the United States dominated the North American Protein Bars market in 2024 and is expected to hold the highest share during the forecast period. And the United States Protein Bars Market acquired 87% of overall North America Protein Bars Industry with 1.58 Bn market size. The robust market performance is driven mainly by the strong fitness culture of the country and the growing health awareness among consumers. The evolving fitness trend has led to a significant increase in academy associations, with approximately 64.19 Mn. The protein bar market benefited from the growing demand for convenient on-the-go nutrients, especially as breakfast alternatives. Supermarkets and hypermarkets serve as the main distribution channels and also Retail Infrastructure 45% of sales through supermarkets, offering a wide variety of protein bar products to meet various consumer preferences. Main retail networks such as Walmart Safeway and Sobeys have established extensive national networks making US protein bars easily accessible to consumers. The market has also witnessed significant product innovations with US protein bar manufacturers by introducing clean tag products and various flavours to meet consumer preferences.

Competitive Landscape in North America Protein Bar Market

Clif Bar & Company and Quest Nutrition are two competitors in the protein bar market, each with different consumer segments. Barra Clif, founded in 1992 and now owned by Mondelez International, focuses on organic natural ingredients and markets for outdoor enthusiasts and health-conscious consumers. Its product line, including Clif Builder bars, emphasises sustainability and plant based nutrition. On the other hand, Quest Nutrition, founded in 2010 and owned by Simply Good Foods Co., serves consumers focused on high -high protein carbohydrate bars using milk and whey isolates. The mission is positioned as a performance brand, appealing to Ketus and demographic gymnastics, with a wide range of product protein chips and cookies. While the cliff leads the natural and organic space, Quest dominates the functional nutrition of aptitude. Both companies have a strong presence in retail and e -e-commerce, although they are different in terms of brand. Cliff promotes an image of adventure and lifestyle, while the mission uses influence based marketing and performance oriented.

Key Developments:

30 Jan 2024: Hershey’s (USA) acquires ONE Brands’ remaining stake for USD 250M, expanding premium protein bar portfolio.

14 Sep 2024: Post Holdings (USA) buys D’s Naturals (USA), a low-FODMAP protein bar brand, for USD 120M.

15 Jan 2025: Beyond Meat (USA) enters protein bars with "Beyond Protein Bar", pea protein-based, exclusive at Whole Foods.

|

North America Protein Bar Market Scope Table |

|

|

Market Size in 2024 |

USD 2.6 Bn. |

|

Market Size in 2032 |

USD 4.53 Bn. |

|

CAGR (2025-2032) |

7.2% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Protein Bars Snacks Bars Meal Replacement Bars Others |

|

By Category Animal Based Derived Plant Based Derived |

|

|

By End User Adults Children |

|

|

Regional Scope |

North America- United States, Canada, and Mexico |

Key players in North America Protein Bars Market

1. Quest Nutrition (El Segundo, California, USA)

2. Clif Bar & Company (Emeryville, California, USA)

3. KIND Snacks (New York City, New York, USA)

4. RXBAR (Kellogg’s) (Chicago, Illinois, USA)

5. ONE Brands (Hershey’s) (Denver, Colorado, USA)

6. No Cow (Boston, Massachusetts, USA)

7. Atkins (Simply Good Foods) (Denver, Colorado, USA)

8. Power Crunch (GeniSys Brands) (Irvine, California, USA)

9. Misfits Health (Austin, Texas, USA)

10. GoMacro (Viola, Wisconsin, USA)

11. Bulletproof (Seattle, Washington, USA)

12. Legendary Foods (Las Vegas, Nevada, USA)

13. Gatorade (PepsiCo) (Chicago, Illinois, USA)

Frequently Asked Questions

Clif focuses on organic, plant-based ingredients, while Quest targets high-protein, performance-oriented consumers.

The United States dominates the market, accounting for around 87% of the regional share in 2024.

Many consumers find the taste and texture of protein bars unappealing, affecting repeat purchases.

1. North America Protein Bars Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America Protein Bars Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. North America Protein Bars Market: Dynamics

3.1. Protein Bars Market Trends by Region

3.1.1. North America Protein Bars Market Trends

3.2. Protein Bars Market Dynamics

3.2.1. North America Protein Bars Market Drivers

3.2.2. North America Bars Market Restraints

3.2.3. North America Bars Market Opportunities

3.2.4. North America Bars Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. Europe

3.5.2. Asia Pacific

3.5.3. Middle East and Africa

3.5.4. South America

3.6. Key Opinion Leader Analysis for Protein Bars Industry

4. North America Protein Bars Market: Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Protein Bars Market Size and Forecast, By Product (2024-2032)

4.1.1. Protein Bars

4.1.2. Snacks Bars

4.1.3. Meal Replacement Bars

4.1.4. Others

4.2. Protein Bars Market Size and Forecast, By Category (2024-2032)

4.2.1. Animal Based Derived

4.2.2. Plant Based Derived

4.3. Protein Bars Market Size and Forecast, By End Use (2024-2032)

4.3.1. Clinical Laboratories

4.3.2. Hospital

4.3.3. Physicians

4.3.4. Others

4.4. Protein Bars Market Size and Forecast, by Region (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. North America Company Profile: Key Players

5.1. Clif Bar & Company (California)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Quest Nutrition (California)

5.3. RXBAR (Kellogg’s) (Illinois)

5.4. ONE Brands (Hershey’s) (North corolina)

5.5. Optimum Nutrition (Glanbia Performance Nutrition) (USA)

6. Key Findings

7. Analyst Recommendations

8. North America Protein Bars Market: Research Methodology