US Fish Oil Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The US Fish Oil Market size was valued at USD 788.4 Mn. in 2024 and the total US Fish Oil revenue is expected to grow at a CAGR of 9.5% from 2025 to 2032, reaching nearly USD 1629.52 Mn.

Format : PDF | Report ID : SMR_1637

US Fish Oil Market Overview

Fish oil, extracted from oily fish tissues, is crucial for a healthy diet due to its omega-3 fatty acids—EPA and DHA—known for reducing inflammation. Adding small amounts optimizes health, cellular metabolism, and physiological functions. Recent focus on seafood highlights its omega-3 richness, backed by research showing benefits in preventing diseases such as cardiovascular issues, cancers, skin conditions, and inflammation. Omega-3s are vital for fetal growth. Health authorities recommend daily fish oil intake, emphasizing the need for societal awareness amidst the rise of lifestyle diseases in the modern world.

The comprehensive report serves as a detailed US Fish Oil Market analysis. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the US Fish Oil Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

US Fish Oil Market Dynamics:

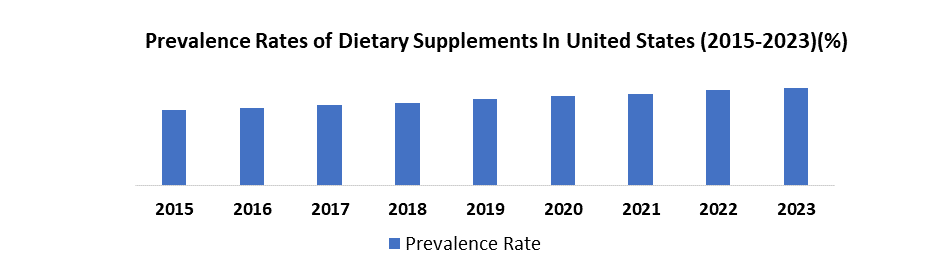

Rising Demand for Dietary Supplements to Drive the US Fish Oil Market

Increasing health consciousness drives the popularity of fish oil supplements and drives the US Fish Oil market growth. The surge encourages product diversification, with various formulations catering to diverse preferences. Also, limited sustainable fish sources lead to price fluctuations. As the US Fish Oil market increases and grows regulatory scrutiny is expected, influencing product formulation and marketing practices. Additionally, the demand for dietary supplements fuels the dynamic landscape of the fish oil market and shapes growth, innovation, and regulatory considerations.

Growing awareness of omega-3 health benefits, including heart health and reduced inflammation, drives interest in fish oil. As people prioritize preventive healthcare, fish oil supplements are favored for convenient nutrient intake. With an aging population seeking age-related health support, fish oil's potential benefits have gained prominence. The ease and availability of supplements contribute to their popularity.

Additionally, sustainability is a concern as overfishing for fish oil strains fish populations and ecosystems, emphasizing the need for sustainable sourcing. Despite being generally safe, fish oil supplements cause side effects like heartburn. Misinformation about their benefits fosters unrealistic expectations and misuse. Quality variations highlight the importance of cautious product selection.

US Fish Oil Market Segment Analysis

Based on Species Type, the Anchoveta segment held the largest market share of about 30% in the US Fish Oil Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 9.6% during the forecast period. It stands out as the dominant segment within the US Fish Oil Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

US Fish Oil Market Anchoveta's affordability broadens consumer access to fish oil. Its high omega-3 content, rich in EPA and DHA, improves its value in supplements, pet food, and aquaculture. Responsibly managed anchoveta fisheries showcase sustainable potential, leveraging high abundance and rapid reproduction to maintain a long-term fish oil supply with minimal environmental impact.

Overfishing poses concerns for anchoveta populations, susceptible to a decline in rising fish oil demand. This activity disrupts marine ecosystems. Processing anchoveta into fish oil raises environmental issues like water pollution. Dependence on anchoveta as a primary source creates vulnerability; a significant population decline disrupts the US fish oil market and causes price fluctuations.

In the US fish oil market, anchoveta plays a complex role. It provides advantages such as affordability and high omega-3 content. Also, ensuring sustainable management practices is crucial to prevent overfishing and minimize environmental impact. Additionally, diversifying fish oil sources reduces dependence on a single species, fostering a more resilient market.

|

US Fish Oil Market Scope |

|

|

Market Size in 2024 |

USD 788.4 Million |

|

Market Size in 2032 |

USD 1629.52 Million |

|

CAGR (2025-2032) |

9.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Species Type

|

|

By End User

|

|

Leading Key Players in the US Fish Oil Market

- DSM Nutritional Products

- Croda International plc

- Omega Protein Corporation (now part of Cooke Inc.)

- GC Rieber Oils

- Colpex International

- TripleNine Group

- Corbion N.V.

- Archer Daniels Midland Company (ADM)

- Copeinca ASA

- Epax Norway AS (A Subsidiary of FMC Corporation)

Frequently Asked Questions

Stringent regulation and Rising manufacturing costs are expected to be the major restraining factors for the US Fish Oil market growth.

The US Fish Oil Market size was valued at USD 788.4 Million in 2024 and the total US Fish Oil revenue is expected to grow at a CAGR of 9.5% from 2025 to 2032, reaching nearly USD 1629.52 Million By 2032.

1. US Fish Oil Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. US Fish Oil Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. US Fish Oil Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquarter

3.3.3. Product Segment

3.3.4. Total Production (2024)

3.3.5. End-User Segment

3.3.6. Y-O-Y%

3.3.7. Revenue (2024)

3.3.8. Profit Margin

3.3.9. Market Share

3.3.10. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.5.1. Strategic Initiatives and Developments

3.5.2. Mergers and Acquisitions

3.5.3. Collaboration and Partnerships

3.5.4. Product Launches and Innovations

4. US Fish Oil Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. US Fish Oil Market Size and Forecast by Segments (by Value USD Million and Volume in Tonnes)

5.1. US Fish Oil Market Size and Forecast, By Species Type (2024-2032)

5.1.1. Blue Whiting

5.1.2. Anchoveta

5.1.3. Sardine

5.1.4. Capelin

5.2. US Fish Oil Market Size and Forecast, By End User (2024-2032)

5.2.1. Pharmaceuticals

5.2.2. Animal Nutrition and Pet Food

5.2.3. Aquaculture

5.2.4. Dietary Supplements

6. Company Profile: Key players

6.1. DSM Nutritional Products

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.2.1. Total Revenue

6.1.2.2. Segment Revenue

6.1.3. Product Portfolio

6.1.3.1. Product Name

6.1.3.2. Product Details

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Croda International plc

6.3. Omega Protein Corporation (now part of Cooke Inc.)

6.4. GC Rieber Oils

6.5. Colpex International

6.6. TripleNine Group

6.7. Corbion N.V.

6.8. Archer Daniels Midland Company (ADM)

6.9. Copeinca ASA

6.10. Epax Norway AS (A Subsidiary of FMC Corporation)

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook