US Pea Protein Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

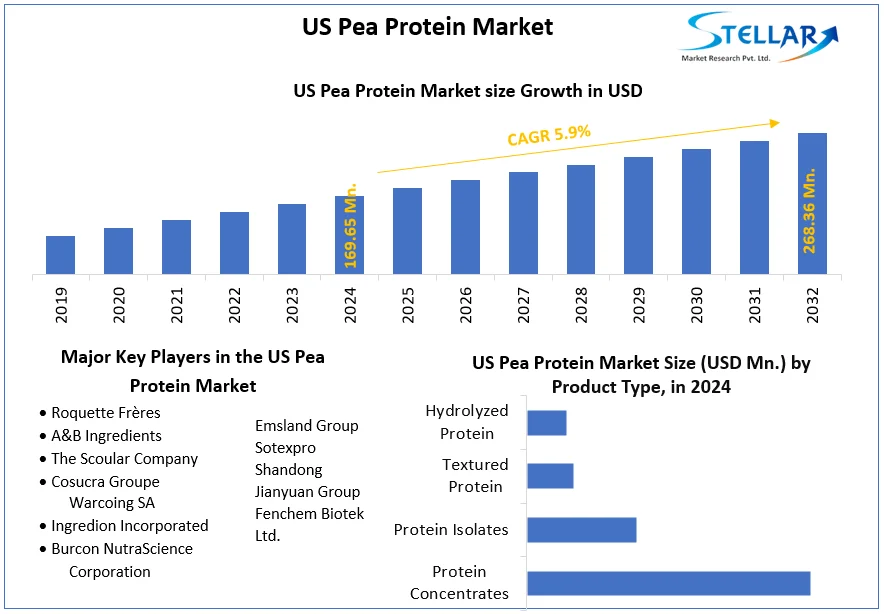

The US Pea Protein Market size was valued at USD 169.65 Mn. in 2024 and the total US Pea Protein revenue is expected to grow at a CAGR of 5.9% from 2025 to 2032, reaching nearly USD 268.36 Mn.

Format : PDF | Report ID : SMR_1596

US Pea Protein Market Overview-

Pea protein extraction involves a process such as a dry phase that removes the outer shell through mechanical action, yielding a mixture. Subsequent wet filtration and centrifugation isolate water-soluble pea proteins from fibers and starch in the resulting flour. Pea protein leads as the fastest-growing source. The US Pea Protein market growth pivots on innovations in plant-based dairy, baked goods, and sports nutrition applications. 80% of U.S. consumers embrace plant-based meat alternatives. The growing demand for pea protein market in the US is driven by health-conscious choices, environmental sustainability, and ethical considerations. Advances in food technology contribute to the rise of innovative, animal-free protein products.

The report analyses the US Pea Protein market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted the analysis and revealed the US Pea Protein industry's resilience challenges.

To get more Insights: Request Free Sample Report

Rapid Surge in Plant Protein Consumption Drives the US Pea Protein Market

The US Pea Protein Market's surging demand for pea protein driven by the rise of plant-based diets, presents significant growth opportunities. Its hypoallergenic nature and complete amino acid profile appeal to health-conscious consumers. Premium pricing, driven by its superior nutritional value, contributes to higher profit margins. Innovation in processing and sustainability benefits further enhance market dynamics, fostering expansion and consumer loyalty.

The US pea protein market grapples with challenges, including potential supply chain constraints due to surging demand, leading to shortages and price fluctuations. Intensifying competition from new entrants and other plant protein sources poses threats to profit margins. Scaling up production and overcoming taste concerns is crucial for sustained growth in the face of processing challenges and consumer perceptions.

Additionally, explore government policies backing plant-based protein, vital for sustainable consumption. Investigate climate change effects on pea production, considering alternative sourcing methods. Assess evolving technologies for enhanced efficiency and sustainability in pea protein production.

US Pea Protein Market Segment Analysis

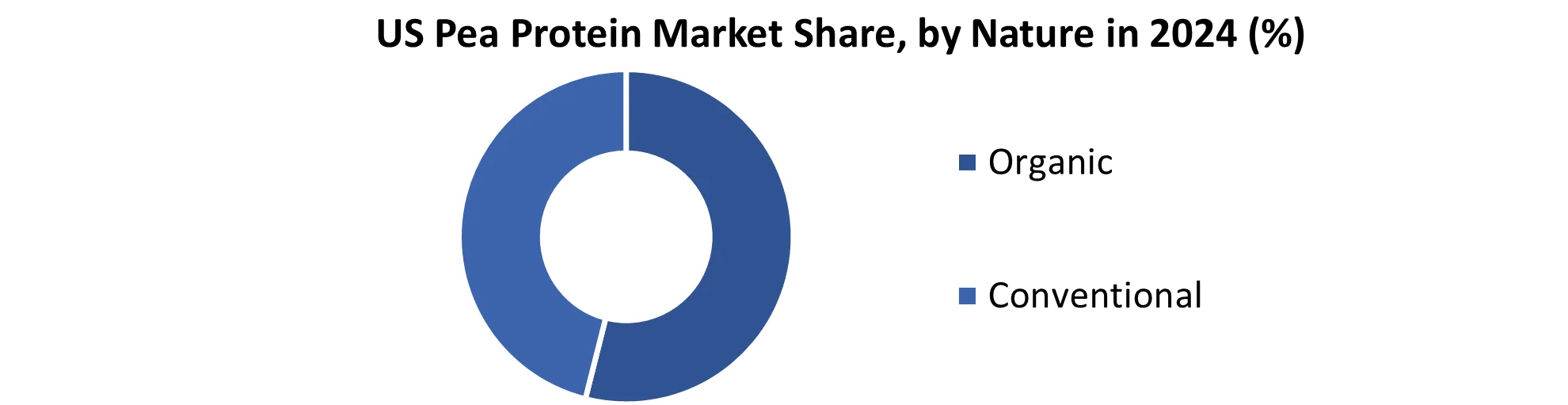

Based on Nature, the Conventional Pea Protein segment held the largest market share of about 80% in the US Pea Protein Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 6.1 % during the forecast period. It stands out as the dominant segment within the US Pea Protein Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Conventional pea protein's affordability and widespread availability boost accessibility for consumers, fostering US Pea Protein Market growth. The affordability encourages initial interest, contributing to the growth of the pea protein market. The increased adoption of plant-based alternatives reflects dietary shifts, positively impacting the industry's trajectory. The trend benefits both conventional and organic producers, marking a pivotal moment in the evolution of the US pea protein market.

The conventional pea protein market faces environmental scrutiny due to non-organic farming practices, raising sustainability concerns. Potential pesticide residues in conventional peas contribute to health apprehensions among consumers, fostering a preference for organic options. Ethical considerations, such as the use of synthetic fertilizers and pesticides, pose challenges, especially for consumers prioritizing animal welfare and responsible land management practices. These factors collectively impact the trajectory of the US pea protein market.

The conventional pea protein pivots on addressing negative aspects through sustainable practices, transparency, and innovation. Adopting eco-friendly agricultural methods, ensuring sourcing transparency, and developing greener processing techniques are crucial. Successfully mitigating environmental concerns while preserving positive attributes determines the sustained growth and acceptance of conventional pea protein in the evolving landscape of the US Pea Protein market.

US Pea Protein Market Scope:

|

US Pea Protein Market |

|

|

Market Size in 2024 |

USD 169.65 Mn. |

|

Market Size in 2032 |

USD 268.36 Mn. |

|

CAGR (2025-2032) |

5.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Nature

|

|

By Product Type

|

|

|

By End Use

|

|

Leading Key Players in the US Pea Protein Market

- Roquette Frères

- A&B Ingredients

- The Scoular Company

- Cosucra Groupe Warcoing SA

- Ingredion Incorporated

- Burcon NutraScience Corporation

- Emsland Group

- Sotexpro

- Shandong Jianyuan Group

- Fenchem Biotek Ltd.

Frequently Asked Questions

Income disparity and Price sensitivity are expected to be the major restraining factors for the US Pea Protein market growth.

The US Pea Protein Market size was valued at USD 160.2 Million in 2023. The total US Pea Protein revenue is expected to grow at a CAGR of 5.9 % from 2024 to 2030, reaching nearly USD 239.3 million By 2030.

1. US Pea Protein Market Introduction

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Executive Summary

1.4 Emerging Technologies

1.5 Market Projections

1.6 Strategic Recommendations

2. US Pea Protein Market: Dynamics

2.1.1 Market Drivers

2.1.2 Market Restraints

2.1.3 Market Opportunities

2.1.4 Market Challenges

2.2 PORTER’s Five Forces Analysis

2.3 PESTLE Analysis

2.4 Regulatory Landscape

2.5 Analysis of Government Schemes and Initiatives for the US Pea Protein Industry

2.6 The Pandemic and Redefining of The US Pea Protein Industry Landscape

3. US Pea Protein Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

3.1 US Pea Protein Market Size and Forecast, by Nature (2024-2032)

3.1.1 Organic

3.1.2 Conventional

3.2 US Pea Protein Market Size and Forecast, by Product Type (2024-2032)

3.2.1 Protein Concentrates

3.2.2 Protein Isolates

3.2.3 Textured Protein

3.2.4 Hydrolyzed Protein

3.3 US Pea Protein Market Size and Forecast, by End Use (2024-2032)

3.3.1 Food Processing

3.3.1.1 Meat Alternatives

3.3.1.2 Bakery Products

3.3.1.3 Confectionery

3.3.1.4 Snacks & Cereals

3.3.1.5 Meat-Based Products

3.3.1.6 Functional Beverages

3.3.2 Animal Feed

3.3.2.1 Livestock

3.3.2.1.1 Cattle

3.3.2.1.2 Swine

3.3.2.1.3 Poultry

3.3.2.2 Pet Food

3.3.2.3 Aquafeed

3.3.3 Nutraceuticals

3.3.4 Sports Nutrition

3.3.5 Infant Nutrition

3.3.6 Cosmetic and Personal Care

4. US Pea Protein Market: Competitive Landscape

4.1 STELLAR Competition Matrix

4.2 Competitive Landscape

4.3 Key Players Benchmarking

4.3.1 Company Name

4.3.2 Service Segment

4.3.3 End-user Segment

4.3.4 Revenue (2024)

4.3.5 Company Locations

4.4 Leading US Pea Protein Companies, by market capitalization

4.5 Market Structure

4.5.1 Market Leaders

4.5.2 Market Followers

4.5.3 Emerging Players

4.6 Mergers and Acquisitions Details

5. Company Profile: Key Players

5.1 Roquette Frères

5.1.1 Company Overview

5.1.2 Business Portfolio

5.1.3 Financial Overview

5.1.4 SWOT Analysis

5.1.5 Strategic Analysis

5.1.6 Scale of Operation (small, medium, and large)

5.1.7 Details on Partnership

5.1.8 Regulatory Accreditations and Certifications Received by Them

5.1.9 Awards Received by the Firm

5.1.10 Recent Developments

5.2 A&B Ingredients

5.3 The Scoular Company

5.4 Cosucra Groupe Warcoing SA

5.5 Ingredion Incorporated

5.6 Burcon NutraScience Corporation

5.7 Emsland Group

5.8 Sotexpro

5.9 Shandong Jianyuan Group

5.10 Fenchem Biotek Ltd.

6. Key Findings

7. Industry Recommendations

8. Terms and Glossary

9. US Pea Protein Market: Research Methodology