Pea Protein Market: Global Industry Analysis and Forecast (2025-2032) by Product, Form, Source and Application

The Pea Protein Market size was valued at USD 664.22 Mn. in 2024 and the total Global Pea Protein Market revenue is expected to grow at a CAGR of 12.02% from 2025 to 2032, reaching nearly USD 1646.94 Mn. by 2032.

Format : PDF | Report ID : SMR_1656

Pea Protein Market Overview

Pea protein is a great plant-based protein derived from split peas, known for its dietary benefits and functional properties. It is rich in fundamental amino acids, especially lysine and threonine, and is viewed as an excellent protein and a utilitarian fixing in the global business because of its low high protein content, accessibility, reasonableness, and sustainability as a crop. Pea protein has magnificent utilitarian properties, for example, dissolvability, water and oil holding limit, emulsion capacity, gelation, and consistency, making it a promising fix in the food business.

The Pea Protein market is influenced by various factors that contributed to its tremendous growth in the last few years, such as its sustainability, versatility, and many more. The Primary driving factors of the Pea Protein Market, however, include the growing demand for Plant-Based proteins, rich Nutritional values, and its allergen-free nature. However, the Pea Protein Market faces some major restraints that hinder its growth such as Disruptions in the supply chain, Shortage of Pea, and limited availability of raw materials. The Pea Protein Market is segmented by Product, Form, Source, and Application.

The Pea Protein Market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East. North America holds the largest market share globally with accounting for 33% for the year 2024. The dominance is majorly attributed to the high consumer demand for plant-based items and the robust beverage and food industry. Europe on the other hand accounts for the second largest market share in the Pea Protein Market globally due to the significant presence of key players and a growing interest in plant-based diets.

APAC region led by China, holds a 26% of the market share in 2024 in the region with growing plant-based market and allergen concerns regarding traditional ingredients. Some of the major key players dominating the Pea Protein Market globally include- Roquette Frères (France), Cargill, Incorporated (US), Glanbia PLC (Ireland), Kerry (Ireland), Ingredion Incorporated (US), Emsland Group (Germany), Yantai Shuangta Foods Co, Ltd (China), The Scoular Company (US), Burcon Nutrascience Corp (Canada), Shandong Jianyuan Group (China), DuPont, Puris Protein Llc, Fenchem Inc., Dupont, Axiom Foods Inc, Burcon Nutrascience Corp, ET-Chem (China), AGT Foods and Ingredients (Canada), The Green Labs LLC (US), Martin & Pleasance.

To get more Insights: Request Free Sample Report

Pea Protein Market Dynamics

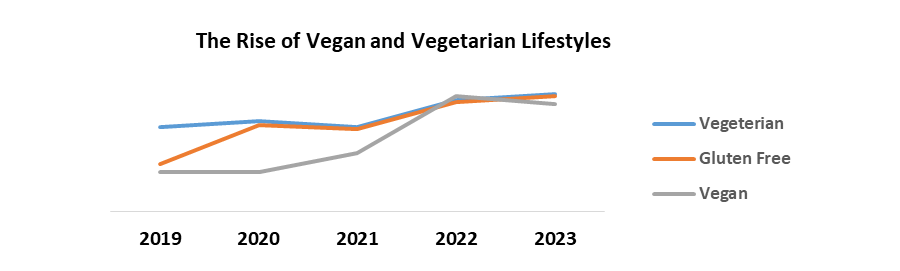

Rising Demand for Plant-based Proteins- The rise in demand is primarily attributed to the growing health awareness among the masses and the health benefits associated with plant-based diets. Also, Plant-based alternatives offer lower saturated fats and cholesterol, appealing to those seeking healthier options. The rising fame of vegan lovers and vegetarian ways of life has moved the interest in plant-based protein sources, with pea protein being a prime decision. According to a survey conducted by MMR, about 5% of Americans consider themselves vegetarians, and 3% consider themselves vegans. Only 2% of Americans identified as vegan in 2012, implying the vegan population growth. The vegan lifestyle is gaining popularity, with projections indicating that by 2040, only 40% of the world's population is going to consume meat.

In the UK, the number of vegans was 4X between 2014 and 2019, indicating a substantial increase in veganism within The region The is clear in the market as additional people take on plant-based dietary patterns. Concerns about meat prices and environmental impact have led consumers to reduce meat consumption, creating a demand for alternative protein sources like pea protein.

Nutritional Value- The critical driving element for the Pea Protein Market is its Nutritional benefit, especially its high protein content, which requests health-conscious consumers looking for supplement-rich other options. Pea protein is plentiful in fundamental amino acids, and B-group nutrients, and has medical advantages like diminishing the risk of cardiovascular illnesses and diabetes. The healthful profile makes pea protein an important fix in the food business, adding to its prevalence and market development. Pea protein's capacity to give useful properties like emulsification, texture, and foaming has extended its market potential, making it a favoured option as plant-based diets gain traction globally.

The area is encountering a flood in development to fulfil developing shoppers' needs for different choices and healthier alternatives. In general, the dietary benefit of pea protein assumes a crucial part in driving its market development by taking special care of the rising interest in plant-based protein sources among health-conscious consumers looking for supportable and supplement-rich alternatives.

Restraints faced by the Pea Protein Market

Supply Chain Disruptions- The major restraining factor for the Pea Protein Market is supply chain disruptions, particularly during events like the Coronavirus pandemic. These disturbances lead to difficulties in obtaining unrefined components and raising costs, affecting the market's presentation. The unsteadiness in supply chains hampers the smooth progression of raw materials required for pea protein creation, creating setbacks and vulnerabilities on the lookout. The Coronavirus pandemic adversely affects across all areas, influencing the development of the market.

Supply chain disturbances have been a huge test, ruining the market's capacity to fulfil needs proficiently and prompting variances in costs and accessibility of pea protein items. Despite the rising interest in plant-based proteins like pea protein, these disturbances have presented limitations on market extension because of the unstable supply of raw materials. The difficulties in keeping a consistent supply chain have restricted the market's development potential, influencing creation limits and generally market execution. Subsequently, organizations in the pea protein industry are confronting obstacles in guaranteeing a consistent stockpile of natural substances and overseeing costs successfully amid these disturbances.

Price Volatility- Fluctuations in pea costs add to showcase unsteadiness. Cost unpredictability presents difficulties for makers in maintaining competitive pricing and stable net revenues. The component fills in as a significant restraining force for the Pea Protein market. Pea protein manufacturers face vulnerability to underway expenses because of fluctuating pea costs. Abrupt expansions in pea costs raise creation costs, affecting overall revenues and preventing makers' capacity to keep up with cutthroat evaluations. For instance, In 2019, the prices of peas in the United States exhibited fluctuations. The price dropped to 0.69 US$/kg before increasing to 0.72 US$/kg in 2021. Also, The volatility makes it challenging for manufacturers to set and maintain competitive prices in the market. Rapid changes in input costs affect the final product's pricing strategy, potentially leading to reduced competitiveness. The inconsistency in pea costs influences the security of net revenues for pea protein manufacturers. Trouble in foreseeing and overseeing costs influences the general financial strength of organizations on the lookout.

Segmentation of Pea Protein Market

By Product, The by-product section of the pea protein market incorporates isolates, concentrates, textured pea protein, hydrolyzed protein, and others. Among these, pea protein isolates rule the market, representing around half of the market share in 2024. Pea protein concentrates come next, trailed by textured pea protein, as considered to encounter the most noteworthy CAGR of 9.7% between 2025 and 2032. The interest in pea protein isolates is especially high since they are reasonable for dietary enhancements in the sports nutrition area, given their high protein focus and essential amino acids. Textured pea protein is acquiring consideration because of its reasonableness for use in meat items, offering a high protein focus and vital amino acids, further developed emulsification, great water-restricting qualities, and high dissolvability.

By Form, in the pea protein market, the "Form" segment categorizes pea protein into dry and wet forms. Dry pea protein ruled the market in 2022, representing around three-fourths of the market share. Dry pea protein is gotten from yellow field peas and is an urgent elective protein hotspot for the two veggie lovers and lactose-bigoted people. It offers a high protein focus, fundamental amino acids, and various health benefits like upgraded dissemination, muscle preservation, expanded digestion, and glucose level administration. Dry pea protein is ordinarily utilized instead of other protein sources like soy, almonds, and peanuts because of its allergen properties and nourishing benefits. Then again, wet pea protein is more uncommon in the market compared with its dry partner.

By Source, The by-source segment of the pea protein market comprises three primary classifications: yellow split peas, chickpeas, and lentils. Yellow split peas rule the market, adding to the majority of pea protein creation around the world. The is to a great extent because of their high protein content and flexibility for use in different food designs, making them ideal for fusing into numerous food and refreshment things. Another significant source, chickpeas, provide a distinct flavour profile and contributes to the overall variation in pea protein products. Lastly, Lentils are a legume variety that adds nutritional value and influence the texture and taste of pea protein products. Chickpeas and lentils are also part of the pea protein market but contribute smaller portions compared to yellow split pea.

By Application, Food, meat alternatives, performance nutrition, functional foods, snacks, bakery goods, confections, other food applications, drinks, and other applications are all included in the pea protein market's "By Application" division. Because of its high protein content and nutritional advantages, pea protein is widely used in food preparation. It is frequently used as a plant-based source of protein in meat alternatives to satisfy the needs of vegetarians and vegans. Due to its ability to rebuild muscle and balance energy, pea protein is also commonly found in performance nutrition products for athletes and fitness enthusiasts. Pea protein is a useful component in functional meals that improves the nutritional profile of the goods. In addition, it's added to drinks, baked goods, confections, and snacks to increase their protein level and draw in plant-based consumers who are health-conscious. Pea protein's adaptability makes it suitable for use in a broad variety of food items and supplements in several food industry sectors.

Competitive Landscape for the Pea Protein Market

The Global Pea Protein market is experiencing significant growth driven by the rising demand for plant-based protein and health consciousness. It has attracted a diverse range of players, creating a dynamic and competitive landscape. The Global Pea Protein Market is dynamic, with several key players vying for market share and innovation. Leading players in the Global Pea Protein Market that has been dominates the industry consist of Rouquette Freres, Cargill, Glanbia, Kerry, and Ingredion. Some of the emerging players who are constantly in the process of establishing a major foothold in the Pea Protein Market are Emsland Group, Burcan Nutrascience, AGT Foods, and The Green Labs. These companies are constantly in the run on developing new pea protein variations with enhanced taste, sustainability, and functionality. As well as expanding their manufacturing ability, and collaborative initiatives with food and beverage manufacturers to introduce innovative products. For instance-

Rouquette Freres- In the year 2024, Roquette Frères partnered to distribute plant proteins in the United States and Canada. The partnership aimed to enhance the distribution of ingredients like pea, hemp, and pumpkin proteins in the region, reflecting a strategic move to grow market reach and product offerings. Roquette Frères made a strategic investment in Beren Therapeutics, a biopharma start-up. The investment aims to strengthen Roquette's presence in the biopharmaceutical sector and potentially diversify its product portfolio.

The Company also acquired Qualicaps, a leading capsule manufacturer. The acquisition is significant as it grows Roquette's global footprint in the pharmaceutical business, allowing the company to offer a broader range of products and services to its customers. Also, Roquette Frères invested in DAIZ, a Japanese food tech startup known for its proprietary technology in plant seed germination. The investment is aimed at leveraging DAIZ's innovative technology to develop new plant-based food products, enhancing Roquette's offerings in the plant-based food sector.

Cargill- Cargill, in a joint venture with Continental Grain Company, acquired Sanderson Farms for $203.00 per share of common stock on July 22, 2022. The acquisition involved combining Sanderson Farms with Wayne Farms, forming a new privately held poultry business named Wayne-Sanderson Farms. Clint Rivers was appointed as the CEO of the combined company. On January 20, 2023, Cargill acquired Owensboro Grain Company, a fifth-generation family-owned soybean processing facility and refinery located in Owensboro, Kentucky. The acquisition enhances Cargill's North American oilseeds network capacity to meet the growing demand for oilseeds driven by food, feed, and renewable fuel markets.

Kerry- On February 27, 2020, Kerry acquired Pevesa Biotech, a Spanish company specializing in non-allergenic and organic plant protein ingredients for infant, general, and clinical nutrition. The acquisition aimed to increase Kerry's presence in the hydrolyzed plant protein space and enhance its ability to provide sustainable, non-GMO plant-based proteins. Pevesa's product range includes organic and conventional rice protein hydrolysates, pea protein isolate, partially hydrolyzed pea and rice proteins, as well as residue- and chemical-free biofertilizers containing plant protein hydrolysates.

|

Pea Protein Market Scope |

|

|

Market Size in 2024 |

USD 664.22 Mn. |

|

Market Size in 2032 |

USD 1646.94 Mn. |

|

CAGR (2025-2032) |

12.02% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Form

|

|

|

By Source

|

|

|

|

By Application

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Pea Protein Market Key Players

- Roquette Frères (France)

- Cargill, Incorporated (US)

- Glanbia PLC (Ireland)

- Kerry (Ireland)

- Ingredion Incorporated (US)

- Emsland Group (Germany)

- Yantai Shuangta Foods Co, Ltd (China)

- The Scoular Company (US)

- Burcon Nutrascience Corp (Canada)

- Shandong Jianyuan Group (China)

- DuPont

- Puris Protein Llc

- Fenchem Inc.

- Dupont

- Axiom Foods Inc

- Burcon Nutrascience Corp

- ET-Chem (China)

- AGT Foods and Ingredients (Canada)

- The Green Labs LLC (US)

- Martin & Pleasance

Regional Breakdown:

Asia Pacific Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Europe Pea Protein Market: Industry Analysis and Forecast (2024-2030)

Frequently Asked Questions

Supply Chain disruptions and Pea Shortage is expected to be the major restraining factor for the market growth.

North America is expected to lead the global Pea Protein market during the forecast period.

The Market size was valued at USD 664.22 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 12.02% from 2024 to 2032, reaching nearly USD 1646.94 Million.

The segments covered in the market report are By Product, Form, Source and Application.

1. Pea Protein Market: Research Methodology

2. Pea Protein Market: Executive Summary

3. Pea Protein Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Pea Protein Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Pea Protein Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Pea Protein Market Size and Forecast, by Product (2024-2032)

5.1.1. Includes isolates

5.1.2. concentrates

5.1.3. textured

5.1.4. hydrolysates

5.2. Pea Protein Market Size and Forecast, by Form (2024-2032)

5.2.1. Dry

5.2.2. wet

5.3. Pea Protein Market Size and Forecast, by Source (2024-2032)

5.3.1. Yellow split peas

5.3.2. chickpeas

5.3.3. lentils

5.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

5.4.1. Food

5.4.2. meat substitutes

5.4.3. performance nutrition

5.4.4. functional foods

5.4.5. snacks

5.4.6. bakery products

5.4.7. confections

5.4.8. other food applications

5.4.9. beverages

5.4.10. other applications

5.5. Pea Protein Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Pea Protein Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Pea Protein Market Size and Forecast, by Product (2024-2032)

6.1.1. Includes isolates

6.1.2. concentrates

6.1.3. textured

6.1.4. hydrolysates

6.2. North America Pea Protein Market Size and Forecast, by Form (2024-2032)

6.2.1. Dry

6.2.2. wet

6.3. North America Pea Protein Market Size and Forecast, by Source (2024-2032)

6.3.1. Yellow split peas

6.3.2. chickpeas

6.3.3. lentils

6.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

6.4.1. Food

6.4.2. meat substitutes

6.4.3. performance nutrition

6.4.4. functional foods

6.4.5. snacks

6.4.6. bakery products

6.4.7. confections

6.4.8. other food applications

6.4.9. beverages

6.4.10. other applications

6.5. North America Pea Protein Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Pea Protein Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Pea Protein Market Size and Forecast, by Product (2024-2032)

7.1.1. Includes isolates

7.1.2. concentrates

7.1.3. textured

7.1.4. hydrolysates

7.2. Europe Pea Protein Market Size and Forecast, by Form (2024-2032)

7.2.1. Dry

7.2.2. wet

7.3. Europe Pea Protein Market Size and Forecast, by Source (2024-2032)

7.3.1. Yellow split peas

7.3.2. chickpeas

7.3.3. lentils

7.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

7.4.1. Food

7.4.2. meat substitutes

7.4.3. performance nutrition

7.4.4. functional foods

7.4.5. snacks

7.4.6. bakery products

7.4.7. confections

7.4.8. other food applications

7.4.9. beverages

7.4.10. other applications

7.5. Europe Pea Protein Market Size and Forecast, by Country (2024-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Pea Protein Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Pea Protein Market Size and Forecast, by Product (2024-2032)

8.1.1. Includes isolates

8.1.2. concentrates

8.1.3. textured

8.1.4. hydrolysates

8.2. Asia Pacific Pea Protein Market Size and Forecast, by Form (2024-2032)

8.2.1. Dry

8.2.2. wet

8.3. Asia Pacific Pea Protein Market Size and Forecast, by Source (2024-2032)

8.3.1. Yellow split peas

8.3.2. chickpeas

8.3.3. lentils

8.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

8.4.1. Food

8.4.2. meat substitutes

8.4.3. performance nutrition

8.4.4. functional foods

8.4.5. snacks

8.4.6. bakery products

8.4.7. confections

8.4.8. other food applications

8.4.9. beverages

8.4.10. other applications

8.5. Asia Pacific Pea Protein Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Pea Protein Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Pea Protein Market Size and Forecast, by Product (2024-2032)

9.1.1. Includes isolates

9.1.2. concentrates

9.1.3. textured

9.1.4. hydrolysates

9.2. Middle East and Africa Pea Protein Market Size and Forecast, by Form (2024-2032)

9.2.1. Dry

9.2.2. wet

9.3. Middle East and Africa Pea Protein Market Size and Forecast, by Source (2024-2032)

9.3.1. Yellow split peas

9.3.2. chickpeas

9.3.3. lentils

9.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

9.4.1. Food

9.4.2. meat substitutes

9.4.3. performance nutrition

9.4.4. functional foods

9.4.5. snacks

9.4.6. bakery products

9.4.7. confections

9.4.8. other food applications

9.4.9. beverages

9.4.10. other applications

9.5. Middle East and Africa Pea Protein Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Pea Protein Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Pea Protein Market Size and Forecast, by Product (2024-2032)

10.1.1. Includes isolates

10.1.2. concentrates

10.1.3. textured

10.1.4. hydrolysates

10.2. South America Pea Protein Market Size and Forecast, by Form (2024-2032)

10.2.1. Dry

10.2.2. wet

10.3. South America Pea Protein Market Size and Forecast, by Source (2024-2032)

10.3.1. Yellow split peas

10.3.2. chickpeas

10.3.3. lentils

10.4. Pea Protein Market Size and Forecast, by Application (2024-2032)

10.4.1. Food

10.4.2. meat substitutes

10.4.3. performance nutrition

10.4.4. functional foods

10.4.5. snacks

10.4.6. bakery products

10.4.7. confections

10.4.8. other food applications

10.4.9. beverages

10.4.10. other applications

10.5. South America Pea Protein Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1.1. Roquette Frères

11.1.2. Company Overview

11.1.3. Financial Overview

11.1.4. Business Portfolio

11.1.5. SWOT Analysis

11.1.6. Business Strategy

11.1.7. Recent Developments

11.2. Cargill, Incorporated (US)

11.3. Glanbia PLC (Ireland)

11.4. Kerry (Ireland)

11.5. Ingredion Incorporated (US)

11.6. Emsland Group (Germany)

11.7. Yantai Shuangta Foods Co, Ltd (China)

11.8. The Scoular Company (US)

11.9. Burcon Nutrascience Corp (Canada)

11.10. Shandong Jianyuan Group (China)

11.11. DuPont

11.12. Puris Protein Llc

11.13. Fenchem Inc.

11.14. Dupont

11.15. Axiom Foods Inc

11.16. Burcon Nutrascience Corp

11.17. ET-Chem (China)

11.18. AGT Foods and Ingredients (Canada)

11.19. The Green Labs LLC (US)

11.20. Martin & Pleasance

12. Key Findings

13. Industry Recommendation