Cannabis Seed Market Industry Analysis and Forecast (2026-2032)

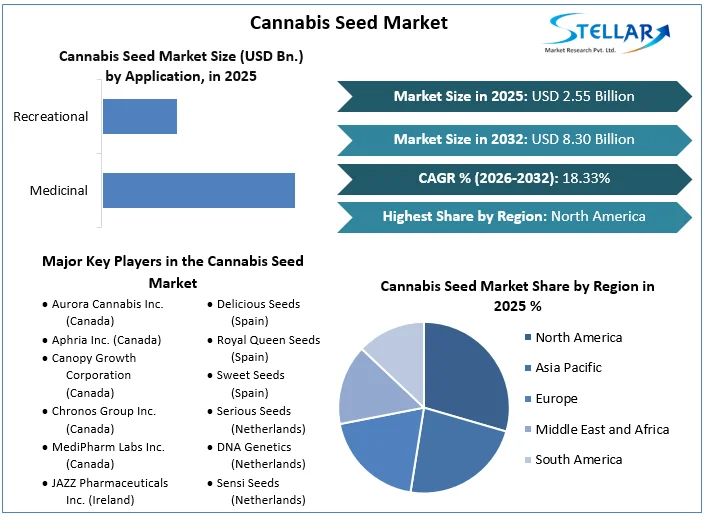

The Cannabis Seed Market size was valued at USD 2.55 Bn. in 2025 and the total Global Cannabis Seed revenue is expected to grow at a CAGR of 18.33 % from 2026 to 2032, reaching nearly USD 8.30 Bn. by 2032.

Format : PDF | Report ID : SMR_1809

Cannabis Seed Market Overview

Cannabis is a genus of flowering plants in the Cannabaceem family. Cannabis seeds are rich in protein; fiber; and healthful fatty acids, such as omega-3s and omega-6s. The seeds are high in arginine (amino acid) and gamma-linolenic acid (fatty acid) content. These substances help reduce the risk of heart disease, cure chronic pain, and improve neurological and other conditions.

The report from Stellar Market Research presents a thorough analysis of the Cannabis Seed Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The analysis of the Cannabis Seed Market scope provides a detailed comprehension of the complex network of processes and stakeholders involved in the production and distribution of these seeds. The surge in cannabis cultivation is owed to the change in legal contexts and societal norms. The report vividly captures the growing interest in this field, detailing the extensive implications and the significant economic benefits that cultivation has brought to industries and local economies.

Key players play a crucial role in driving innovation and improving product efficacy, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the Cannabis Seed Market, ensuring continuous transactions between suppliers and end-users. Additionally, the analysis evaluates the cost-profit ratio, assessing companies' financial capabilities for investing in research and development to introduce new products or enhance existing ones.

The market scope includes opportunities in new product development and advancements in formulation technologies, which propel market growth and innovation. Through quantitative research methods, the report offers statistical data on the effectiveness of Cannabis Seeds in various applications and their impact on market trends. Competitive intelligence analysis aids in comprehending market dynamics, competitor strategies, and customer perceptions, empowering market players to gain a competitive advantage in the global Cannabis Seed Market.

To get more Insights: Request Free Sample Report

Cannabis Seed Market Dynamics

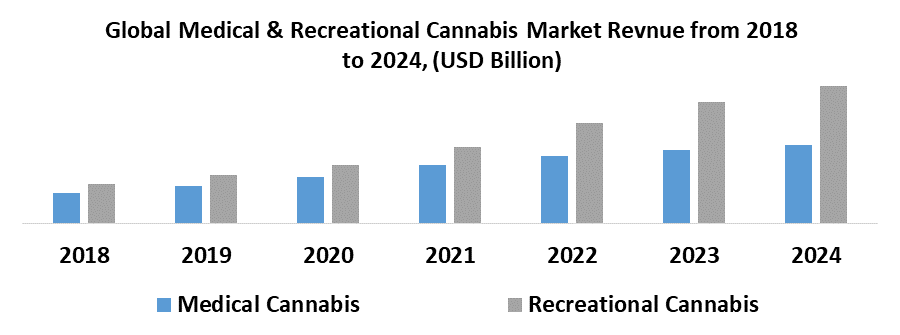

Medical Applications and Technological Innovations Drive Growth

The recognition of cannabis as a treatment for conditions such as chronic pain, anxiety, and epilepsy has led to a higher demand for specific strains and genetics. This increased need has boosted revenue and fueled the growth of the cannabis seed market. Precision agriculture, genetic modification, and better breeding techniques have become essential in meeting the unique requirements of the medical cannabis market, leading to innovative developments within the industry. Import and export operations play a crucial role in driving cannabis seeds market growth, especially with the increasing demand for medical cannabis on a global scale.

This trend opens up avenues for cross-border trade, fostering innovation and motivating producers to maintain superior product quality standards. Additionally, pharmaceutical companies are continually exploring new ways to knock into the therapeutic potential of cannabis, which affects the number of units produced and the cost of production. Technology innovation trends such as data analytics play a role in enhancing the traceability and transparency of the supply chain which helps maintain product quality and safety and is crucial for medical applications. The global cannabis seed market is influenced by personalized medicine trends.

Medical professionals prescribe cannabis-based treatments tailored to individual patients, driving demand for diverse cannabis seed varieties that produce strains with specific effects. The growing demand for cannabis seeds in medical applications, fueled by technological innovations, presents numerous opportunities for market consolidation, market leaders, and key companies to establish a strong presence in the industry.

High-Dose Consumption Issues

Barriers to entry into the market arise owing to strict regulations imposed by regulatory bodies on cannabis seeds intended for high-dose products, which have an impact on the cost-profit ratio for producers and create challenges for new entrants. Stricter trade policies, which govern the cultivation and distribution of high-dose cannabis seeds, introduce complexities in trade finance, potentially discouraging investment and hindering growth in certain regions. The volatility in demand for high-dose cannabis seeds creates uncertainty in production and inventory management, which further impacts the company's financial matrix and pricing strategies.

The global cannabis seed market is also subject to market concentration, as larger, more established companies with resources to manage high-dose consumption risks dominate the market, potentially squeezing out smaller players. This concentration leads to a narrower range of products, limiting diversity and consumer choice. Market dynamics in the global cannabis seed market are thus shaped by high-dose consumption issues, creating an intricate balance between meeting consumer needs and adhering to safety and regulatory standards.

Cannabis Seed Market Segment Analysis

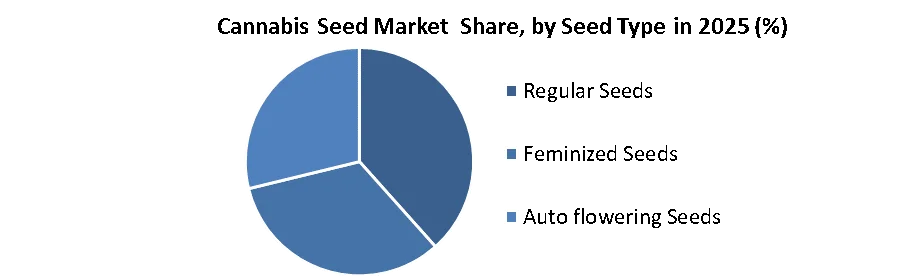

By Seed Type, According to SMR research, the Feminized Seeds segment was the dominant segment in the global cannabis seeds market in 2025. Producers have been focusing on targeting cultivators and consumers who prefer female plants as they are of higher quality and provide a potent yield. This strategic product positioning aligns with the customer's preference for efficient growing and guaranteed outcomes, as the use of feminized seeds eliminates the uncertainty of male plants that negatively impact crop quality. Focusing on market penetration strategies that emphasize feminized seeds enables companies to capitalize on the segment's reliability and predictability.

Businesses target growers by producing feminized seeds that yield exclusively female plants, which dominate the cannabis seed market. Brand loyalty plays a significant role in the dominance of the feminized seed segment. Companies that consistently deliver reliable and high-performing feminized seeds foster trust and loyalty among growers which boosts repeat purchases and enhances the segment's market share driving the growth of the cannabis seed market.

Additionally, the distribution channels for feminized seeds have been optimized to effectively reach both commercial and private growers, satisfying their requirements for reliable harvests. The global cannabis seed market is dominated by feminized seeds owing to their effective product positioning, strong brand loyalty, and alignment with market intelligence which has resulted in feminized seeds playing a major role in shaping the industry's landscape and driving its growth trajectory.

Cannabis Seed Market Regional Analysis

The North American cannabis seed market is a major player in the global market, with the United States and Canada being the top-selling countries. These regions have become leaders in the cannabis industry thanks to their progressive laws that support both medical and recreational use. This legal framework has created opportunities for increased production, distribution, and trade of cannabis seeds, making it a favorable environment for international commerce. The U.S. is home to major cannabis companies that invest significantly in market research to stay ahead of industry trends and maintain their competitive advantage which enables them to optimize their product offerings for both domestic and international markets.

Canada, a significant player in North America, has seen a rise in seed production and sales, becoming a leader in online retail for cannabis seeds. Canadian companies are leading in distribution, supplying both domestic and international markets, strengthening North America's position in the global cannabis seed market. Additionally, by understanding consumer preferences, market demands, and emerging trends, North American companies effectively tailor their products to suit the needs of both local and international customers. This strategic approach has resulted in top-quality cannabis seeds that are sought after across the globe.

The ability to seamlessly supply cannabis seeds and related products to various markets around the world ensures sustained growth and profitability for North American companies. This robust distribution network has cemented North America's position as a global leader in the cannabis seed market. The region's strong international trade presence, strategic global trade relations, and emphasis on market research statistics provide North American companies with a competitive edge in the global cannabis seed market.

Cannabis Seed Market Competitive Landscape

Analysis within this comprehensive study emphasizes the transformative nature of the industry, spotlighting major players such as Aurora Cannabis Inc. (Canada), Aphria Inc. (Canada), Canopy Growth Corporation (Canada), Chronos Group Inc. (Canada), MediPharm Labs Inc. (Canada), JAZZ Pharmaceuticals Inc. (Ireland) among others. The importance of specialized strains and the burgeoning popularity of diverse cannabis products drive the competitive landscape, giving consumers an array of options. End-user preferences, from medicinal utility to recreational diversity, are shaping market trends and driving innovation.

- In January 2023, Royal Queen Seeds, a preeminent seed bank for the cannabis plant in Europe, emerged as the pioneering company to offer authentic F1 cannabis hybrids with the uniformity, stability, and yield quality that is critically essential for the burgeoning legal cannabis market.

- In September 2022, Two of the genotypes developed by the BULGARIAN company CBD Seed Europe, which claims to yield record levels of cannabidiol, were registered on the European Seed Register. Most registered CBD seeds on the European Common Catalogue have 5% to 6% CBD concentrations. However, recently registered cultivars have a field CBD content of up to 12%.

|

Cannabis Seed Market Scope |

|

|

Market Size in 2025 |

USD 2.55 Bn. |

|

Market Size in 2032 |

USD 8.30 Bn. |

|

CAGR (2026-2032) |

18.33% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Nature Organic Conventional |

|

By Seed Type Regular Seeds Feminized Seeds Auto flowering Seeds |

|

|

By Application Medicinal Recreational |

|

|

By Distribution Channel Specialty stores Dispensaries Retail Online |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Cannabis Seed Market

- Aurora Cannabis Inc. (Canada)

- Aphria Inc. (Canada)

- Canopy Growth Corporation (Canada)

- Chronos Group Inc. (Canada)

- MediPharm Labs Inc. (Canada)

- JAZZ Pharmaceuticals Inc. (Ireland)

- T.H.Seeds (Netherlands)

- Delicious Seeds (Spain)

- Royal Queen Seeds (Spain)

- Sweet Seeds (Spain)

- Serious Seeds (Netherlands)

- DNA Genetics (Netherlands)

- Sensi Seeds (Netherlands)

- Green House Seed Company (Netherlands)

- Crop King Seeds (U.S.)

- Paradise Seeds (Netherlands)

- Mountain Top Seed Bank (India)

- Kannabia (Spain)

- Barney's Farm (Netherlands)

- Dutch Passion Seed Company (Netherlands)

- Fast Buds (Spain)

- Dinafem Seeds (Spain)

- Seed Supreme (U.S)

- Seed Cellar (U.S.)

- Humboldt Seed Company (U.S.)

- Tropical Seeds Co. (India)

- Christiania Seeds (Denmark)

Frequently Asked Questions

The growth of the Cannabis Seed Market is driven by the increasing legalization of cannabis for medical and recreational use across various regions, expanding the consumer base.

Investors can capitalize on opportunities in the Cannabis Seed Market by investing in innovative seed companies that offer high-quality, genetically diverse seeds and strong brand reputations.

The Market size was valued at USD 2.55 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 18.33% from 2026 to 2032, reaching nearly USD 8.30 billion.

The segments covered in the market report are Nature, Seed Type, Application, Distribution Channel, and region.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Cannabis Seed Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Cannabis Seed Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Cannabis Seed Market: Dynamics

4.1. Cannabis Seed Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Cannabis Seed Market Drivers

4.3. Cannabis Seed Market Restraints

4.4. Cannabis Seed Market Opportunities

4.5. Cannabis Seed Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis and Supply Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Cannabis Seed Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

5.1. Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

5.1.1. Organic

5.1.2. Conventional

5.2. Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

5.2.1. Regular Seeds

5.2.2. Feminized Seeds

5.2.3. Auto flowering Seeds

5.3. Cannabis Seed Market Size and Forecast, by Application (2025-2032)

5.3.1. Medicinal

5.3.2. Recreational

5.4. Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

5.4.1. Specialty stores

5.4.2. Dispensaries

5.4.3. Retail

5.4.4. Online

5.5. Cannabis Seed Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Cannabis Seed Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

6.1. North America Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

6.1.1. Organic

6.1.2. Conventional

6.2. North America Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

6.2.1. Regular Seeds

6.2.2. Feminized Seeds

6.2.3. Auto flowering Seeds

6.3. North America Cannabis Seed Market Size and Forecast, by Application (2025-2032)

6.3.1. Medicinal

6.3.2. Recreational

6.4. North America Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

6.4.1. Specialty stores

6.4.2. Dispensaries

6.4.3. Retail

6.4.4. Online

6.5. North America Cannabis Seed Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Cannabis Seed Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Europe Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

7.2. Europe Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

7.3. Europe Cannabis Seed Market Size and Forecast, by Application (2025-2032)

7.4. Europe Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

7.5. Europe Cannabis Seed Market Size and Forecast, by Country (2025-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Cannabis Seed Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

8.1. Asia Pacific Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

8.2. Asia Pacific Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

8.3. Asia Pacific Cannabis Seed Market Size and Forecast, by Application (2025-2032)

8.4. Asia Pacific Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

8.5. Asia Pacific Cannabis Seed Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Rest of Asia Pacific

9. Middle East and Africa Cannabis Seed Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. Middle East and Africa Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

9.2. Middle East and Africa Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

9.3. Middle East and Africa Cannabis Seed Market Size and Forecast, by Application (2025-2032)

9.4. Middle East and Africa Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

9.5. Middle East and Africa Cannabis Seed Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Nigeria

9.5.4. Rest of ME&A

10. South America Cannabis Seed Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

10.1. South America Cannabis Seed Market Size and Forecast, by Nature (2025-2032)

10.2. South America Cannabis Seed Market Size and Forecast, by Seed Type (2025-2032)

10.3. South America Cannabis Seed Market Size and Forecast, by Application (2025-2032)

10.4. South America Cannabis Seed Market Size and Forecast, by Distribution Channel (2025-2032)

10.5. South America Cannabis Seed Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Aurora Cannabis Inc. (Canada)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Aphria Inc. (Canada)

11.3. Canopy Growth Corporation (Canada)

11.4. Chronos Group Inc. (Canada)

11.5. MediPharm Labs Inc. (Canada)

11.6. JAZZ Pharmaceuticals Inc. (Ireland)

11.7. T.H.Seeds (Netherlands)

11.8. Delicious Seeds (Spain)

11.9. Royal Queen Seeds (Spain)

11.10. Sweet Seeds (Spain)

11.11. Serious Seeds (Netherlands)

11.12. DNA Genetics (Netherlands)

11.13. Sensi Seeds (Netherlands)

11.14. Green House Seed Company (Netherlands)

11.15. Crop King Seeds (U.S.)

11.16. Paradise Seeds (Netherlands)

11.17. Mountain Top Seed Bank (India)

11.18. Kannabia (Spain)

11.19. Barney's Farm (Netherlands)

11.20. Dutch Passion Seed Company (Netherlands)

11.21. Fast Buds (Spain)

11.22. Dinafem Seeds (Spain)

11.23. Seed Supreme (U.S)

11.24. Seed Cellar (U.S.)

11.25. Humboldt Seed Company (U.S.)

11.26. Tropical Seeds Co. (India)

11.27. Christiania Seeds (Denmark)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook