Cheese Market- Global Industry Analysis and Forecast (2025-2032)

Cheese Market size was valued at USD 118.77 Bn. in 2024 and the total Cheese market size is expected to grow at a CAGR of 4.61% from 2025 to 2032, reaching nearly USD 170.33 Bn. by 2032.

Format : PDF | Report ID : SMR_1806

Cheese Market Overview:

Cheese is a dairy product produced in a range of flavors, textures, and forms by coagulation of the milk protein casein. It comprises proteins and fat from milk (usually the milk of cows, buffalo, goats, or sheep). During production, milk is usually acidified and either the enzymes of rennet or bacterial enzymes with similar activity are added to cause the casein to coagulate. Cheese is valued for its portability, long shelf life, and high content of fat, protein, calcium, and phosphorus.

The report has covered several aspects of growth to analysis the current market trends and opportunities in the cheese market. The report contains a thorough analysis of the many strategies used by the major companies, including alliances, joint ventures, acquisitions, and mergers. The SWOT analysis was used in the report to examine the company’s entire market position and find opportunities, threats, strengths, and weaknesses. Report has also covered regions such as Europe, North America, and parts of Asia-Pacific exhibit high consumption rates for the cheese market globally. While Cheese remains a staple in many cuisines globally, market trends indicate a growing interest in premium, artisanal, and specialty varieties.

The rise in small dairy farmers transitioning to Natural practices has prolonged the availability of cheese varieties, offering unique flavors and textures that resonate with consumers seeking diverse culinary experiences. From traditional varieties like cheddar and mozzarella to innovative specialty flavors and artisanal creations, Cheese Market producers continuously diversify their product lines to meet consumer demands. The factor is further supporting the Natural cheese market growth.

- World cheese exports are pegged at 3.5 million tonnes in 2023, up by a modest rate of 0.4 percent, underpinned by higher imports by China, the United Kingdom, Australia, the Russian Federation, Saudi Arabia, Mexico, and the United States.

To get more Insights: Request Free Sample Report

Cheese Market Dynamics

Cheese Market Evolution in New Flavors, Convenience, and Innovation

The cheese market is experiencing significant growth globally owing to evolving customer interests and preferences driving trends in the cheese market. The global cheese market is transforming owing to a growing appetite for new flavors and varieties as cheese has been an essential part of daily lives, manufacturers see the benefits of exploring new products and technology to ensure no compromise on the overall quality of the end product. The increasing demand for convenience and fast food is a primary driver for cheese market growth.

Cheese consumption has increased thanks to the significant diversity of varieties, versatility of product presentation, and changes in consumers’ lifestyles has accelerated the market growth. Cheese powder has witnessed strong demand, fuelled by the preference for easy-to-use ingredients in various food applications. In the dairy industry, cheese production ranks second after cow milk in terms of production volume as a result it has boosted the market growth.

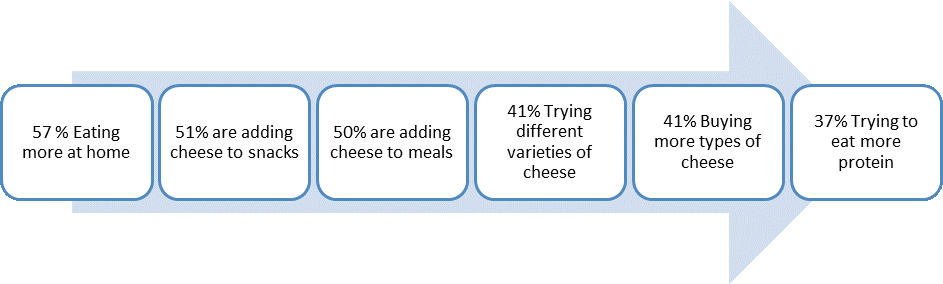

Fig. 1. Customers Preferences

Navigating Challenges of the Cheese Market

The fluctuation in the prices of milk has hindered market growth by an increase in the cost of the cheese as a result it has affected the profitability of manufacturers. The growing popularity of veganism and non-dairy substitutes has caused a shift in consumer preferences as a result traditional cheese manufacturers are facing competition and keeping their products relevant and appealing to new generations is a constant challenge. Government regulations in different countries are significantly impacting the dairy industry trends. For instance, strict food safety and labeling regulations in the United States have increased production costs for cheese manufacturers, potentially limiting the market growth.

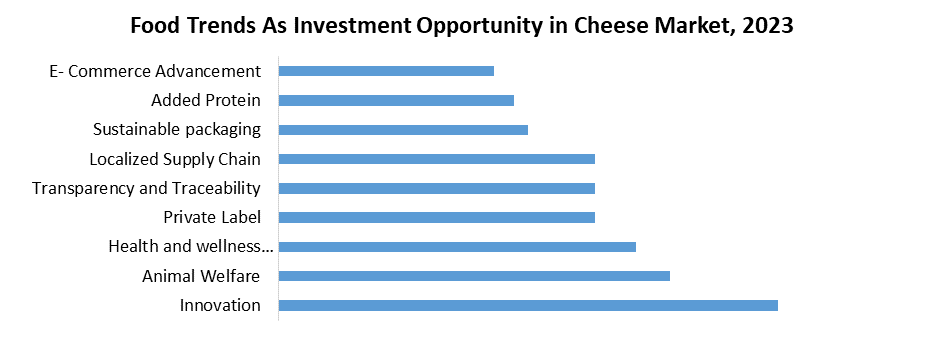

Intensifying the Cheese Market through Flavor Exploration and E-Commerce

The cheese market offers numerous opportunities to the manufacturers to produce and develop new techniques in cheese such as innovation in the cheese, enhancing flavors, and growing their products via E-Commerce has opened up doors globally. The surge in the younger generation and escalation in the adoption rate of fast foods such as burgers, pizza, etc., has propelled the Cheese market. Manufacturers start to innovate as customers look for new options and flavors in the cheese market to enhance the taste buds of the younger population resulting in the higher demand for the cheese.

Cheese Market Segment Analysis:

Based on type, Natural Cheese Segment dominates the market with an increasing CAGR through the forecast period. The growing consumer demand for healthy and natural foods is expected to be the major factor driving the Natural cheese market. As Consumers are increasingly prioritizing food products that are minimally processed, and free from artificial ingredients, there’s a notable shift towards Natural cheese and perceived as being more wholesome and nutritious. The trend is evident in the rising popularity of organic cheese, and raw cheese made with traditional methods.

Several factors are contributing to the growing demand for healthy and natural cheese, consumers are becoming more aware of the health benefits of cheese, such as its high protein content, calcium, and essential vitamins. In many countries, where Natural food consumption has increased rapidly, the demand for Natural cheese has surged significantly. Thanks to consumer's preference for products free from synthetic additives and produced using environmentally friendly practices.

Cheese Market Regional Analysis

Europe dominated the cheese market and is expected to maintain its dominance through the forecast period 2025- 2032 with an increasing CAGR. The high production costs of milk in most of the EU rule out a competitive role in supplying the world’s net importing markets with low-priced dairy commodities. Cheese has provided better export opportunities than any other dairy product, as the willingness to pay for quality European cheese has always been high, and the impact of higher raw-material costs is less problematic.

The most popular types of cheese in Europe vary from country to country. In France, for example, the most popular types include Camembert, Brie, and Roquefort, while in Italy, Parmesan, Mozzarella, and Gorgonzola are among the most consumed varieties. The EU cheese export market to the League of Arab States is significant, with the Arab League importing Europe cheese worth EUR 643.7 million, indicating potential for increased market participation. Every year, approximately nine million tons of cheese are consumed in the European Union. According to STELLAR Analysis, of cheese consumption per capita in the EU, in 2022 Europeans ate some 20 kilos of cheese. There are marked differences in consumption between countries. In 2022, Swedes and Norwegians each ate roughly 19 kilos of cheese per year, most of its white cheese.

Germany was the largest exporter of cheese globally with exports amounting to a value of 6.2 billion U.S. dollars, followed by the Netherlands with 5.4 billion dollars in cheese exports. Cheese imports are also expected to drop by 6 percent in the European Union, owing to higher domestic production.

North America is expected to be the fastest-growing region with an increasing CAGR in forecast period 2025- 2032. The surge in demand for cheese has propelled the region owing to the high preference for protein-based cheese, rising trend toward fast food has accelerated the market growth in the region.

Cheese Market Competitive Landscape

- In April 2023, SAVENCIA Fromage & Dairy announces the acquisition of Sucesores de Alfredo Williner (Williner), one of the major players in dairy products in Argentina. Savencia has thus enriched its portfolio with Ilolay a major local brand of dairy and family tradition that has been present in most Argentinean households for decades. It offers a wide range of dairy products through a network distribution well established throughout the country.

- In December 2023, The Savencia Fromage & Dairy Group's sales increased by +3.7%, an increase of Eur 240 million compared to 2022. This results from organic growth of +11.6% and a structural effect of +2.1% linked mainly to the consolidation of Williner's activities from April 2023

|

Cheese Market Scope |

|

|

Market Size in 2024 |

USD 118.77 Bn. |

|

Market Size in 2032 |

USD 170.33 Bn. |

|

CAGR (2025-2032) |

4.61 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Processed Natural |

|

By Source Animal Plant |

|

|

By Product Type Cheddar Mozzarella Parmesan Others |

|

|

By Distribution Channel Offline Online |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Cheese Market Key Players

- Arla Foods amba

- Fonterra Co-operative Group Limited

- Almarai Company

- GCMMF (Amul)

- Hook's Cheese Company

- Amul

- Bega Cheese

- Lactalis Group.

- Bel Group

- Bletsoe Cheese

- Brunkow Cheese Factory

- Mother Dairy

- Parag Milk Foods

- Fonterra Co-Operative Group Ltd.

- Mondelez International Group

- SAVENCIA SA

- Dairy Farmers of America

- Meiji Holdings

- FrieslandCampina

- Saputo

- Glanbia

- Cady Cheese Factory

- XX

Frequently Asked Questions

Ecommerce is trend for the Cheese growth.

The Market size was valued at USD 118.77 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 4.61% from 2025 to 2032, reaching nearly USD 170.33 Billion.

The segments covered in the market report are by type, product type, source and Distribution Channel.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Cheese Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Cheese Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Cheese Market: Dynamics

4.1. Cheese Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Cheese Market Drivers

4.3. Cheese Market Restraints

4.4. Cheese Market Opportunities

4.5. Cheese Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis and Supply Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Consumer Behavior Analysis

4.12. Regulatory Landscape

4.12.1. Market Regulation by Region

4.12.1.1. North America

4.12.1.2. Europe

4.12.1.3. Asia Pacific

4.12.1.4. Middle East and Africa

4.12.1.5. South America

4.12.2. Impact of Regulations on Market Dynamics

4.12.3. Government Schemes and Initiatives

5. Cheese Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

5.1. Cheese Market Size and Forecast, by Type (2024-2032)

5.1.1. Processed

5.1.2. Natural

5.2. Cheese Market Size and Forecast, by Source (2024-2032)

5.2.1. Animal

5.2.2. Plant

5.3. Cheese Market Size and Forecast, by Product Type (2024-2032)

5.3.1. Cheddar

5.3.2. Mozzarella

5.3.3. Parmesan

5.3.4. Others

5.4. Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

5.4.1. Offline

5.4.2. Online

5.5. Cheese Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Cheese Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

6.1. North America Cheese Market Size and Forecast, by Type (2024-2032)

6.1.1. Processed

6.1.2. Natural

6.2. North America Cheese Market Size and Forecast, by Source (2024-2032)

6.2.1. Animal

6.2.2. Plant

6.3. North America Cheese Market Size and Forecast, by Product Type (2024-2032)

6.3.1. Cheddar

6.3.2. Mozzarella

6.3.3. Parmesan

6.3.4. Others

6.4. North America Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

6.4.1. Offline

6.4.2. Online

6.5. North America Cheese Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Cheese Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

7.1. Europe Cheese Market Size and Forecast, by Type (2024-2032)

7.2. Europe Cheese Market Size and Forecast, by Source (2024-2032)

7.3. Europe Cheese Market Size and Forecast, by Product Type (2024-2032)

7.4. Europe Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

7.5. Europe Cheese Market Size and Forecast, by Country (2024-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Cheese Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

8.1. Asia Pacific Cheese Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Cheese Market Size and Forecast, by Source (2024-2032)

8.3. Asia Pacific Cheese Market Size and Forecast, by Product Type (2024-2032)

8.4. Asia Pacific Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

8.5. Asia Pacific Cheese Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Rest of Asia Pacific

9. Middle East and Africa Cheese Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

9.1. Middle East and Africa Cheese Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Cheese Market Size and Forecast, by Source (2024-2032)

9.3. Middle East and Africa Cheese Market Size and Forecast, by Product Type (2024-2032)

9.4. Middle East and Africa Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

9.5. Middle East and Africa Cheese Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Nigeria

9.5.4. Rest of ME&A

10. South America Cheese Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tons) (2024-2032)

10.1. South America Cheese Market Size and Forecast, by Type (2024-2032)

10.2. South America Cheese Market Size and Forecast, by Source (2024-2032)

10.3. South America Cheese Market Size and Forecast, by Product Type (2024-2032)

10.4. South America Cheese Market Size and Forecast, by Distribution Channel (2024-2032)

10.5. South America Cheese Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Arla Foods amba

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Fonterra Co-operative Group Limited

11.3. Almarai Company

11.4. GCMMF (Amul)

11.5. Hook's Cheese Company

11.6. Amul

11.7. Bega Cheese

11.8. Lactalis Group.

11.9. Bel Group

11.10. Bletsoe Cheese

11.11. Brunkow Cheese Factory

11.12. Mother Dairy

11.13. Parag Milk Foods

11.14. Fonterra Co-Operative Group Ltd.

11.15. Mondelez International Group

11.16. SAVENCIA SA

11.17. Dairy Farmers of America

11.18. Meiji Holdings

11.19. FrieslandCampina

11.20. Saputo

11.21. Glanbia

11.22. Cady Cheese Factory

11.23. XX

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook