Private Label Food and Beverage Market Industry Analysis and Forecast (2026-2032)

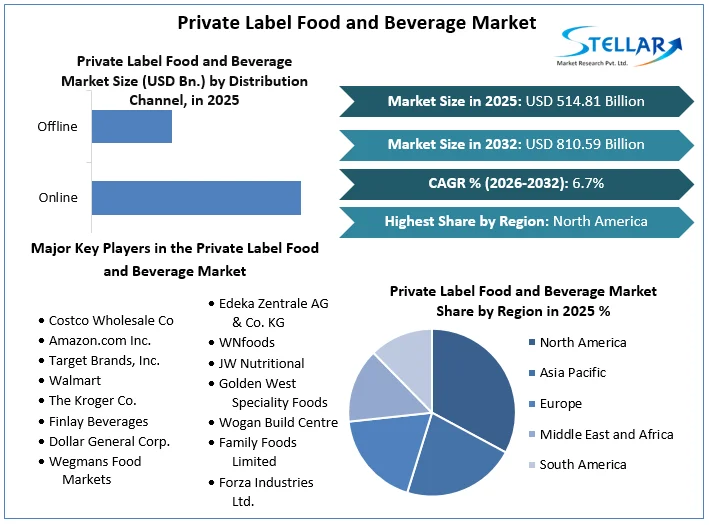

Private Label Food and Beverage Market size was valued at USD 514.81 Bn. in 2025 and the total Private Label Food and Beverage revenue is expected to grow at a CAGR of 6.7 % from 2026 to 2032, reaching nearly USD 810.59 Bn. by 2032.

Format : PDF | Report ID : SMR_1781

Private Label Food and Beverage Market Overview:

Private labelling is a business where retailers contract third-party manufacturers to produce products exclusively for them. These items are then sold under the retailer’s brand, rather than the manufacturer’s name. It allows businesses to sell private-label food products that align with their market and brand strategy without having to invest in production facilities or raw materials. Material Requirements Planning (MRP) is a valuable tool that private label manufacturers use to assist in their efforts to best serve their customers. The process involves partnering with a private label manufacturer who supplies customizable products tailored to meet specific needs and preferences. Retailers provide specifications regarding ingredients, taste, packaging, and pricing structures.

The report focuses on the Private Label Food market size, segment size, competitor landscape, recent status, and development trends. Additionally, the report provides detailed Consumer behaviour analysis, supply chain, and market dynamics (drivers, restraints, opportunities) providing crucial information for knowing the Private Label Food market. The Private Label Food And Beverages market provide competitive landscape analysis which incorporates the market ranking of the major players, along with new service/product launches, business growths, acquisitions, and performance. That allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

To get more Insights: Request Free Sample Report

Private Label Food and Beverage Market Dynamics:

E-Commerce and Premiumization Drive the Private Label Food and Beverage Market Growth

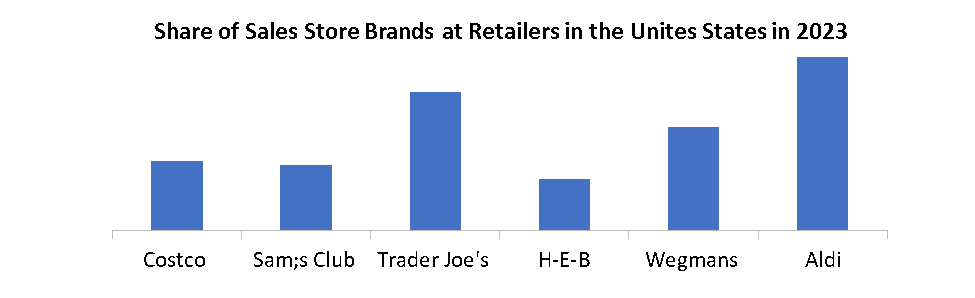

Growing E-Commerce is driving the Private Label Food and Beverage Market. Retailers have a platform to display and sell their private label products directly to customers thanks to the growth of e-commerce. Customers conveniently obtain a variety of private-label solutions through online channels. Also, Premiumization is driving growth in the Private Label Food and Beverage Market. Premium private label products now represent more than 19 per cent of store brand sales. The rise of higher-end store brand products has come hand-in-hand with consumers' inclination to spend more on store brands. Discount products still represent the majority of store brand sales in America. The right store-branded product, 26 per cent of person feel that name brands are worth the extra price.

Navigating Challenges in the Private Label Food and Beverage Market

Well-established branded products in the market are likely to hamper the growth of private-label food and beverage products. Private label retailers face the challenge of differentiating their products from national brands and offering unique value propositions to consumers. Developing innovative and distinctive offerings that stand out in the market is crucial to attracting customers and creating a loyal customer base. Additionally, Managing the supply chain is a complex task for private-label retailers. They need to guarantee a reliable supply of high-quality products, maintain relationships with manufacturers, and effectively manage inventory levels.

Private Label Food and Beverage Market Segment Analysis:

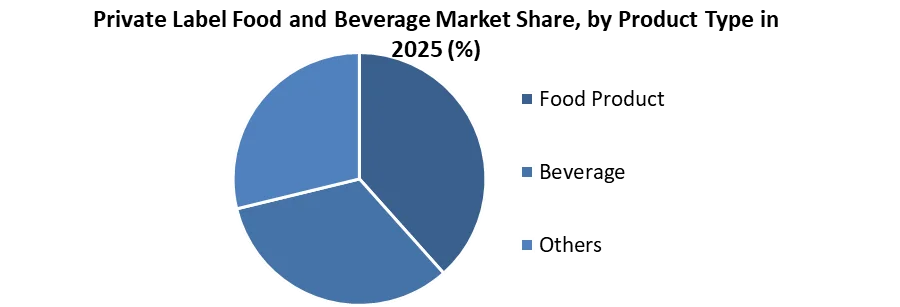

By Product, Food products held the highest market share in 2025 for the Private Label Food and Beverage Market. The segment includes private-label food products such as whole foods, processed foods, frozen foods, chilled foods, sweets and snacks, bakery products, ready-to-eat meals, ice creams, dried processed foods, confectioneries, snack bars, and other speciality foods (gluten-free foods, non-genetically modified organism (non-GMO) foods, and organic foods).

Private-label acceptance is significantly higher in some food categories than in others. Private-label cheese held 45% of the market, canned vegetable sales held 38.3%, and coffee held 14.9%. 30% of shoppers aged 18-34 purchase more store-brand products that feature sustainable sourcing. Private-label products are becoming an increasingly important platform for retailers looking to enhance sustainability profiles. 60% of private-label food products retailers are already available on eCommerce platforms.

Private Label Food and Beverage Market Regional Insight:

North America held XXX % market share in 2025 for the Private Label Food and Beverage Market. Consumer demand for niche private-label products has risen in recent years in the US. As a result, vendors of private-label food and beverages are coming up with speciality items that are well-positioned to attract new consumers and acquire private-label food and beverage market in US shares to capitalize on the potential. Some of the major players operating in the U.S. private label food and beverages market are Loblaws Inc., Sobey Inc., Metro Richelieu Inc., Walmart, Costco Wholesale Corporation, Amazon.com, Inc. and others.

- Walmart and Target, two of the largest retailers in the US, have significantly contributed to the growth of private-label retail for the F&B segment. Both companies heavily invested in developing and promoting their brand offerings, leveraging their extensive retail networks and consumer trust

Asia Pacific held XXX % market share in 2025 for the Private Label Food and Beverage Market. The Asia-Pacific region is witnessing major retailers in Australia, Japan, and China increasing their private label portfolios. For example, Woolworths, one of Australia's leading supermarket chains, introduced private label products, including Macro Wholefoods and Woolworths Select, catering to health-conscious consumers. The younger generation has embraced the on-the-go food trend to a large degree. As a result, the private-label food and beverage industry has significant development as a result of the factor. A few major retailer brands in the Japanese private label market, such as Seven and i Premium (Seven & i Holdings), Topvalu (Aeon Group), Co-op (Japanese Consumers’ Co-operative Union) and CGC (CGC Group). Japanese retailers haven't traditionally focused on private labels, some are beginning to follow the model of stores in Europe and the United States, which have devoted much effort to store brands.

Private Label Food and Beverage Market Competitive Landscape:

- In June 2023, DealShare, an India-based e-commerce startup announced that the company investing INr 1,000 Cr over the next five years to strengthen its private labels and local businesses. The company already owns eight private label brands in 16 categories and plans to add two to three additional brands to its portfolio.

- In August 2023, SpartanNash, a food distributor and grocery store in the United States announced that the company launched new products to its premium private label brands, and the first product to be announced was the collection of wine. The company has also announced that it will be launching more than 1,000 new private-label brands by 2025.

Private Label Food and Beverage Market Scope:

|

Private Label Food and Beverage Market |

|

|

Market Size in 2025 |

USD 514.81 Bn. |

|

Market Size in 2032 |

USD 810.59 Bn. |

|

CAGR (2026-2032) |

6.7 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Type

|

|

Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Private Label Food and Beverage Market Key Players:

- Costco Wholesale Co.

- Amazon.com Inc.

- Target Brands, Inc.

- Walmart

- The Kroger Co.

- Finlay Beverages

- Dollar General Corp.

- Wegmans Food Markets

- Edeka Zentrale AG & Co. KG

- WNfoods

- JW Nutritional

- Golden West Speciality Foods

- Wogan Build Centre

- Family Foods Limited

- Forza Industries Ltd.

- Italian Beverage Company Ltd.

Frequently Asked Questions

Well-established branded products in the market are a challenge for the Private Label Food and Beverage Market growth.

The Market size was valued at USD 514.81 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 6.7% from 2026 to 2032, reaching nearly USD 810.59 Billion.

The segments covered in the market report are by Product Type and Distribution channel.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Private Label Food and Beverage Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Private Label Food and Beverage Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Private Label Food and Beverage Market: Dynamics

4.1. Private Label Food and Beverage Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Private Label Food and Beverage Market Drivers

4.3. Private Label Food and Beverage Market Restraints

4.4. Private Label Food and Beverage Market Opportunities

4.5. Private Label Food and Beverage Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Private Label Food and Beverage Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Food Product

5.1.2. Beverage

5.1.3. Others

5.2. Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

5.2.1. Online

5.2.2. Offline

5.3. Private Label Food and Beverage Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Private Label Food and Beverage Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Food Product

6.1.2. Beverage

6.1.3. Others

6.2. North America Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

6.2.1. Online

6.2.2. Offline

6.3. North America Private Label Food and Beverage Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Private Label Food and Beverage Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

7.2. Europe Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

7.3. Europe Private Label Food and Beverage Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Private Label Food and Beverage Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

8.2. Asia Pacific Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

8.3. Asia Pacific Private Label Food and Beverage Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Private Label Food and Beverage Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

9.2. Middle East and Africa Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

9.3. Middle East and Africa Private Label Food and Beverage Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Private Label Food and Beverage Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Private Label Food and Beverage Market Size and Forecast, by Product Type (2025-2032)

10.2. South America Private Label Food and Beverage Market Size and Forecast, by Distribution Channel (2025-2032)

10.3. South America Private Label Food and Beverage Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Costco Wholesale Co.

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Amazon.com Inc.

11.3. Target Brands, Inc.

11.4. Walmart

11.5. The Kroger Co.

11.6. Finlay Beverages

11.7. Dollar General Corp.

11.8. Wegmans Food Markets

11.9. Edeka Zentrale AG & Co. KG

11.10. WNfoods

11.11. JW Nutritional

11.12. Golden West Speciality Foods

11.13. Wogan Build Centre

11.14. Family Foods Limited

11.15. Forza Industries Ltd.

11.16. Italian Beverage Company Ltd.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook