Blockchain Healthcare Market Blockchain Moves from Pilot to Platform in Global Healthcare Systems

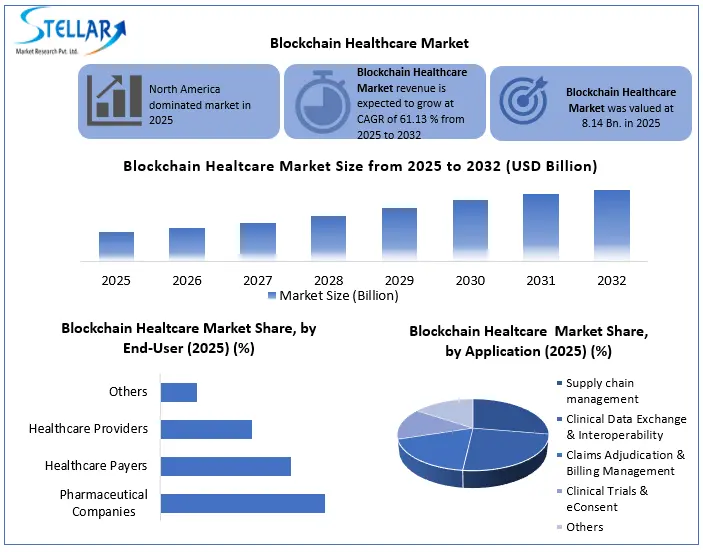

Blockchain Healthcare Market was valued at USD 8.14 Billion in 2025, and the total revenue is expected to grow at a CAGR of 61.13 % from 2025 to 2032, reaching USD 229.54 Billion by 2032.

Format : PDF | Report ID : SMR_2451

Blockchain Healthcare Market Overview

Blockchain technology in the healthcare market enables decentralized, immutable, and permission-based data exchange across healthcare providers, payers, pharmaceutical companies, and research institutions. Traditional healthcare IT systems rely heavily on centralized databases, which account for over 60% of reported healthcare data breaches globally. Blockchain addresses these vulnerabilities by distributing data verification while maintaining strict access control.

Between 2019 and 2021, more than 70% of blockchain healthcare initiatives remained at proof-of-concept or pilot stages. By 2024, industry assessments indicate that over 55% of these pilots progressed into multi-institution or production-level deployments, reflecting improvements in interoperability standards, cloud integration, and regulatory alignment. Today, blockchain healthcare solutions are increasingly embedded into electronic health records (EHRs), health information exchanges (HIEs), and payer systems.

Key Market Highlights (2025)

- Healthcare generates 30% of the world’s data volume, growing at a CAGR of 36%, significantly faster than financial services.

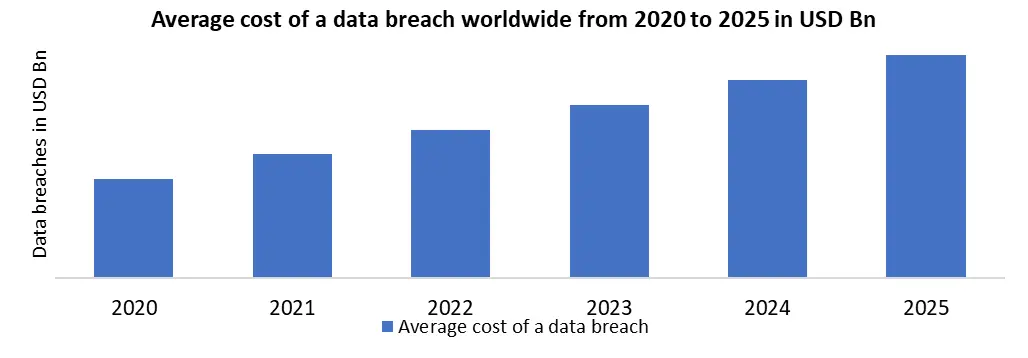

- The average cost of a healthcare data breach reached USD 10.9 million in 2024, the highest among all industries.

- Blockchain-enabled claims automation reduces administrative overhead by 30–45%

- Pharmaceutical blockchain systems have reduced counterfeit drug incidence by up to 50% in controlled pilots.

- More than 200+ active blockchain healthcare projects are currently operational worldwide.

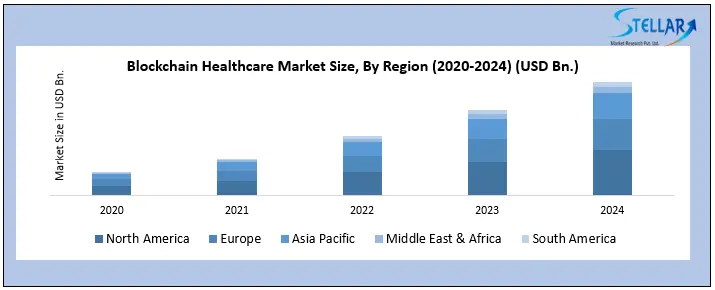

Blockchain Healthcare Market Size, By Region from 2020 to 2024 (USD Bn)

To get more Insights: Request Free Sample Report

Trend: Blockchain-Driven Interoperability Redefining Healthcare Data Sharing

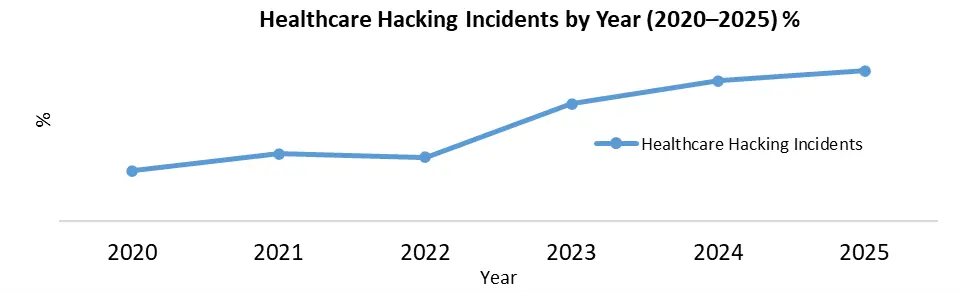

Blockchain is rapidly evolving from standalone proofs of concept to an enterprise-grade interoperability backbone for healthcare data systems. Traditional electronic health records (EHRs) contribute to fragmented data silos that have stoked a rising tide of breaches — for example, the U.S. recorded 663 healthcare data breaches in 2020, peaking at 746 in 2023 and remaining high at 628 in 2025.

By enabling secure cross-institution data exchange, blockchain reduces redundant records, minimizes manual reconciliation errors, and creates a verifiable audit trail that enhances data portability and reduces risk exposure across providers and payers.

- In 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day.

Blockchain Healthcare Market Dynamics:

Growth of Decentralized Patient Identity (DID) Adoption to Strengthen Healthcare Data Ownership and Security

The accelerating frequency, scale, and financial impact of healthcare data breaches have emerged as a critical driver for Decentralized Patient Identity (DID) adoption. Centralized identity systems—built on usernames, passwords, and fragmented credentials—represent a single point of failure across healthcare ecosystems. Blockchain-enabled DID replaces these vulnerable identifiers with cryptographically verifiable, patient-controlled identities, enabling secure authentication, consent management, and access control across providers, payers, and life sciences stakeholders. As breach-related costs exceed USD 10 million per incident on average and regulatory scrutiny intensifies, healthcare organizations are increasingly prioritizing DID architectures to reduce attack surfaces, strengthen trust, and enable secure collaboration across digital health networks.

- Healthcare remains the most expensive industry for data breaches, with average breach costs exceeding USD 10–11 million per incident

- Centralized identity systems contribute to over 60% of unauthorized access incidents, driven by credential compromise and poor access governance

- Decentralized Identity (DID) frameworks reduce reliance on centralized identifiers, cutting identity-related attack surfaces by an estimated 30–40% in early deployments

- According to the World Health Organization (WHO), over 100,000 deaths occur annually in Africa due to improper dosing from counterfeit or substandard drugs sourced from untrusted vendors

- Pharmaceutical counterfeiting represents 10% of the global drug supply in low- and middle-income countries, driving demand for blockchain-based identity and traceability systems.

High Implementation Costs and Integration Complexity

Deploying blockchain in healthcare requires significant capital investment, specialized talent, and integration with legacy EHR systems. Small and mid-sized providers often face implementation costs exceeding USD 1–2 million for enterprise-grade solutions. Additionally, aligning blockchain with existing IT infrastructure, workflows, and compliance processes is technically challenging, slowing adoption and limiting scalability across healthcare networks despite clear long-term benefits.

Integration of Blockchain with Emerging Technologies (AI and IoT) in Healthcare

The convergence of blockchain with AI and IoT presents a high-impact growth opportunity in healthcare by enabling trusted, high-quality data pipelines. Over 70% of healthcare organizations are investing in AI-driven analytics, yet data integrity and provenance remain key bottlenecks. IoT-enabled medical devices are expected to exceed 30 billion connected units globally by 2026, generating massive real-time health data volumes. Blockchain can act as a verification layer, ensuring data authenticity for AI models, reducing data tampering risks by 30–40%, and enabling secure, auditable data lakes that accelerate clinical decision-making, remote monitoring, and predictive healthcare outcomes.

Blockchain Healthcare Market: Segment Analysis

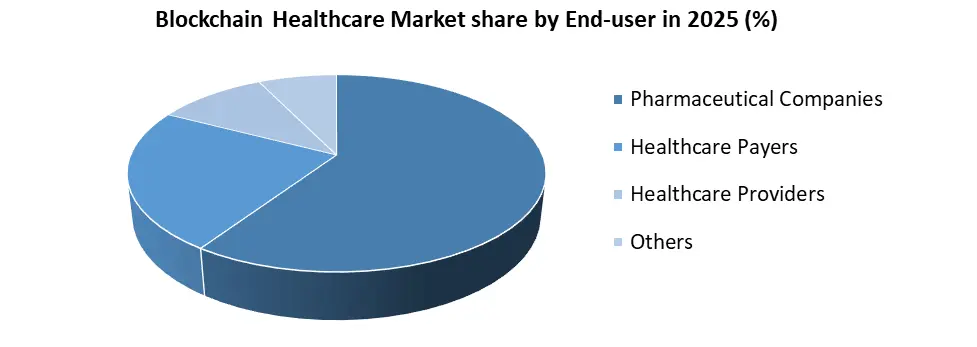

Based on End-user, the Blockchain Healthcare Market is categorized into Pharmaceutical Companies, Healthcare Payers, Healthcare Providers, and Others. Pharmaceutical companies are expected to dominate the market over the forecast period (2026–2032), driven by the growing need for drug traceability, counterfeit prevention, and clinical trial data integrity. Healthcare payers leverage blockchain for automated claims processing, fraud detection, and smart contract-based reimbursements, reducing administrative costs by 30–40%. Healthcare providers, including hospitals and labs, adopt blockchain to enhance EHR interoperability, implement decentralized patient identity (DID), and improve secure data sharing, cutting reconciliation errors by 25–35%. Other users, such as research institutions, telehealth platforms, and government bodies, use blockchain for consent management and secure clinical trial data, with over 70% of blockchain-enabled trials expected to adopt smart contracts by 2027.

Regional Analysis: Blockchain Healthcare Market

In 2025, North America dominated the Blockchain Healthcare Market, accounting for approximately 40% of the global market, driven by favorable regulations, adoption of the FDA’s Drug Supply Chain Security Act, rising healthcare fraud, and escalating healthcare costs projected to reach USD 6.2 trillion by 2028 (Centers for Medicare & Medicaid Services). Europe follows with an estimated 28% market share, supported by GDPR compliance, AI-integrated blockchain solutions, and innovations like Epillo Health Systems’ INTRx and Guardtime’s MyPCR platform serving 30 million patients in the UK. The Asia-Pacific region held ~ 25% share, led by China, Japan, and India, while Latin America, the Middle East, and Africa collectively contribute the remaining 7%, reflecting early-stage but growing blockchain adoption.

Blockchain Healthcare Market Competitive Landscape:

The Blockchain Healthcare Market is highly competitive, with both established IT/consulting giants and emerging startups driving innovation across data security, EHR interoperability, and supply chain traceability. Major players include IBM, Accenture, Guardtime, Wipro, Kaleido, and ConsenSys, who focus on blockchain-enabled solutions for hospitals, pharmaceutical companies, and insurers. Companies are differentiating through AI and IoT integration, smart contract automation, and decentralized patient identity frameworks, while investments such as Avaneer Health’s USD 50 million seed funding highlight significant growth potential. Market consolidation and partnerships continue to intensify competition and accelerate adoption globally.

Blockchain Healthcare Market Scope

|

Blockchain Healthcare Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 8.14 Bn. |

|

Forecast Period 2026 to 2032 CAGR: |

61.13 % |

Market Size in 2032: |

USD 229.54 Bn. |

|

Blockchain Healthcare Market Segments Covered: |

By Network Type |

Private Public Others |

|

|

By Application |

Supply chain management Clinical Data Exchange & Interoperability Claims Adjudication & Billing Management Clinical Trials & eConsent Others |

||

|

By End-User |

Pharmaceutical Companies Healthcare Payers Healthcare Providers Others |

||

Blockchain Healthcare Market, by region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, and Rest of APAC)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

Blockchain Healthcare industry key Players

- IBM (US)

- Microsoft (US)

- Gem (US)

- Chronicled (US)

- iSolve, LLC (US)

- Hashed Health (US)

- Patientory (US)

- Factom (US)

- SimplyVital Health (US)

- Solve. Care (US)

- Oracle Corporation (US)

- Change Healthcare (US)

- BurstIQ (US)

- Akiri, Inc. (US)

- Avaneer Health, Inc. (US)

- Crystal chain (US)

- Equideum Health (US)

- Embleema (US)

- Guardtime (Estonia)

- FarmaTrust (UK)

- Blockpharma (France)

- Medicalchain SA (UK)

- Farma Trust (UK)

- Medical Chain SA (UK)

- Kaleido, Inc. (US)

- ConsenSys (US)

- Guardtime (Switzerland)

Frequently Asked Questions

High implementation costs, regulatory uncertainty, scalability limitations, and limited blockchain expertise restrict widespread adoption in healthcare.

North America is expected to lead due to advanced healthcare IT infrastructure, early blockchain adoption, strong funding, and supportive digital health initiatives.

The Blockchain Healthcare Market was valued at USD 8.14 Billion in 2025 and is expected to grow at a 61.13 % CAGR, reaching USD 229.54 Billion by 2032.

1. Blockchain Healthcare Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Blockchain Healthcare Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Profit Margin (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Blockchain Healthcare Market: Dynamics

3.1. Blockchain Healthcare Market Trends

3.2. Blockchain Healthcare Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Blockchain Healthcare Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

4.1. Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

4.1.1. Private

4.1.2. Public

4.1.3. Others

4.2. Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

4.2.1. Supply chain management

4.2.2. Clinical Data Exchange & Interoperability

4.2.3. Claims Adjudication & Billing Management

4.2.4. Clinical Trials & eConsent

4.2.5. Others

4.3. Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

4.3.1. Pharmaceutical Companies

4.3.2. Healthcare Payers

4.3.3. Healthcare Providers

4.3.4. Others

4.4. Blockchain Healthcare Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Blockchain Healthcare Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

5.1. North America Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

5.2. North America Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

5.3. North America Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

5.4. North America Blockchain Healthcare Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Blockchain Healthcare Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

6.1. Europe Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

6.2. Europe Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

6.3. Europe Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

6.4. Europe Blockchain Healthcare Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

6.4.1.2. United Kingdom Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

6.4.1.3. United Kingdom Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Russia

6.4.8. Rest of Europe

7. Asia Pacific Blockchain Healthcare Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Asia Pacific Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

7.2. Asia Pacific Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

7.3. Asia Pacific Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

7.4. Asia Pacific Blockchain Healthcare Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Philippines

7.4.9. Thailand

7.4.10. Vietnam

7.4.11. Rest of Asia Pacific

8. Middle East and Africa Blockchain Healthcare Market Size and Forecast (by Value in USD Billion) (2025-2032)

8.1. Middle East and Africa Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

8.2. Middle East and Africa Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

8.3. Middle East and Africa Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

8.4. Middle East and Africa Blockchain Healthcare Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Egypt

8.4.4. Nigeria

8.4.5. Rest of ME&A

9. South America Blockchain Healthcare Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. South America Blockchain Healthcare Market Size and Forecast, By Network Type (2025-2032)

9.2. South America Blockchain Healthcare Market Size and Forecast, By Application (2025-2032)

9.3. South America Blockchain Healthcare Market Size and Forecast, By End-User (2025-2032)

9.4. South America Blockchain Healthcare Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Colombia

9.4.4. Chile

9.4.5. Rest Of South America

10. Company Profile: Key Players

10.1. IBM (US)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.1.7. BYD Auto

10.2. Microsoft (US)

10.3. Gem (US)

10.4. Chronicled (US)

10.5. iSolve, LLC (US)

10.6. Hashed Health (US)

10.7. Patientory (US)

10.8. Factom (US)

10.9. SimplyVital Health (US)

10.10. Solve. Care (US)

10.11. Oracle Corporation (US)

10.12. Change Healthcare (US)

10.13. BurstIQ (US)

10.14. Akiri, Inc. (US)

10.15. Avaneer Health, Inc. (US)

10.16. Crystal chain (US)

10.17. Equideum Health (US)

10.18. Embleema (US)

10.19. Guardtime (Estonia)

10.20. FarmaTrust (UK)

10.21. Blockpharma (France)

10.22. Medicalchain SA (UK)

10.23. Farma Trust (UK)

10.24. Medical Chain SA (UK)

10.25. Kaleido, Inc. (US)

10.26. ConsenSys (US)

10.27. Guardtime (Switzerland)

10.28. Others

11. Key Findings

12. Analyst Recommendations

13. Blockchain Healthcare Market: Research Methodology