Epigenetics Market Driving Innovation in Gene Regulation and Precision Medicine

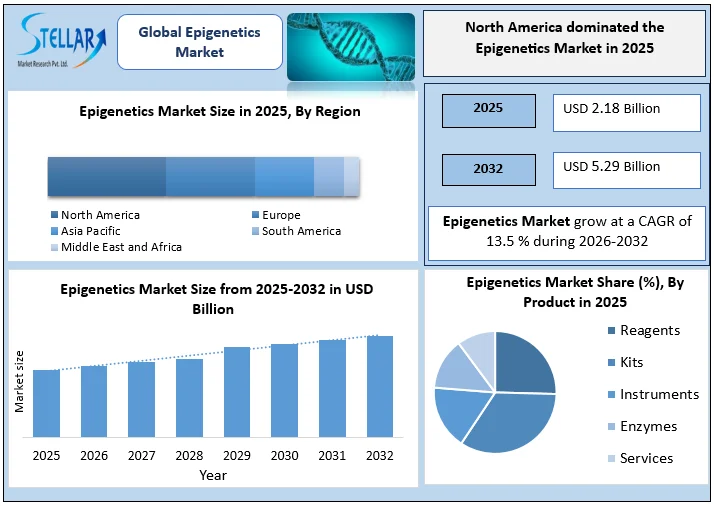

Global Epigenetics Market to reach approximately USD 5.29 Bn by 2032 from USD 2.18 Bn in 2025 at a CAGR of 13.5%.

Format : PDF | Report ID : SMR_2897

Epigenetics Market Overview:

The epigenetics market is gaining traction in oncology and personalised medicine by targeting gene expression regulation mechanisms that influence disease progression without altering DNA sequences. Core mechanisms, including DNA methylation, histone modification, chromatin remodelling, and non-coding RNA regulation, are directly linked to tumour development across solid and hematological cancers. Epigenetic changes are now critical biomarkers for early detection, prognostic evaluation, and therapy optimization.

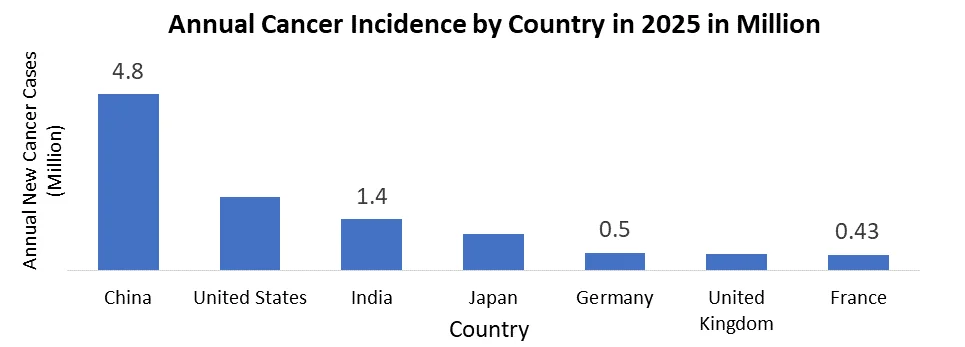

Cancer remains a significant global challenge, with nearly 20?million new cases and 10?million deaths in 2022. Lung, breast, colorectal, and stomach cancers are among the most prevalent and lethal. Epigenetic diagnostics, such as Epi proColon, detect methylated DNA in blood with 97% specificity, while liquid biopsy platforms like Guardant Health Shield achieve sensitivities above 80%, demonstrating the market’s growing clinical relevance.

Country-Level Insights

- United States: Dominated North American epigenetics, accounting for over 60% of activity, driven by NIH funding and pharmaceutical R&D integration.

- China: R&D investment increased approximately 35% in 2024, fueling biomarker discovery and clinical adoption.

- Europe (Germany, UK, France): Strong collaborations support diagnostic and therapeutic development.

- Japan & India: Rising cancer incidence and expanding genomic infrastructure drive adoption of epigenetic profiling in clinical centres.

Key Highlights:

- Global Epigenetics Market projected to reach USD 5.29 Bn by 2032 from USD 2.18 Bn in 2025 at a CAGR of 13.5%.

- DNA methylation remains the largest technology segment, xx% market share, driving early cancer detection and liquid biopsy applications.

- Oncology dominated revenue 60%, while non-oncology applications in cardiovascular, neurological, and metabolic diseases are expanding rapidly.

- Major innovations include QIAGEN QIAseq panels, New England Biolabs EM-seq v2, PacBio sequencing lab in Singapore, and Thermo Fisher’s Olink acquisition.

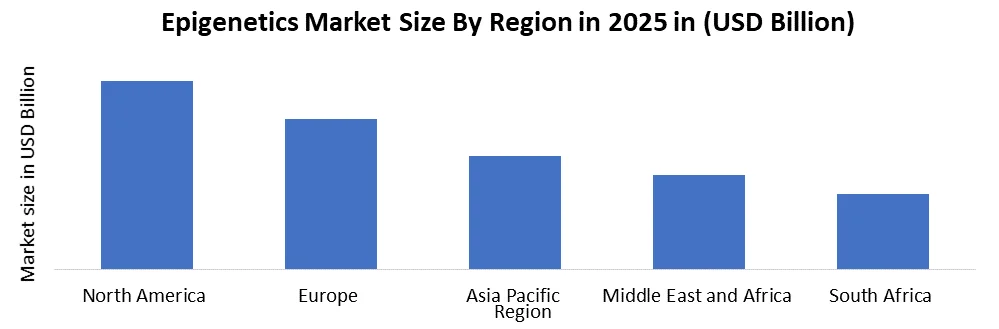

- North America held the market (~38–45% share), while Asia-Pacific is the fastest-growing region due to investment in genomics infrastructure.

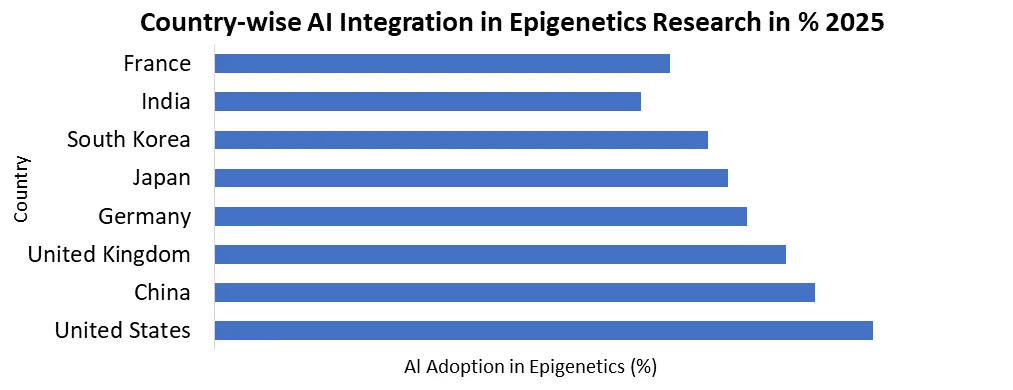

- Clinical adoption is growing, supported by AI-powered bioinformatics and multi-omics integration, despite workforce gaps and regulatory variability.

To get more Insights: Request Free Sample Report

Epigenetics Market Dynamics

Rising Cancer Incidence & Personalized Medicine to Drive the Epigenetics Market Growth

The increasing global prevalence of cancer is the principal growth catalyst. With nearly 20 million new cancer cases and nearly 10 million deaths annually in 2022, clinicians and researchers are increasingly adopting epigenetic markers for early detection, prognostic evaluation, and treatment planning. This is particularly evident in DNA methylation-based diagnostics for colorectal, lung, breast, and prostate cancers.

Epigenetics is integral to precision medicine, where individual methylation and chromatin profiles help tailor therapies beyond traditional genomic sequencing. AI and next-generation sequencing (NGS) platforms further enhance analytical depth, enabling actionable insights in clinical settings.

Technical Complexity & Workforce Gaps Limit the Growth of the Epigenetics Market

Despite high potential, the epigenetics market faces notable challenges:

- Complex epigenomic data demands advanced bioinformatics, which many institutions struggle to interpret at scale.

- Less than 20% of genomic labs globally have dedicated epigenetics expertise and workflows, restricting adoption pace.

Regulatory frameworks for clinical acceptance vary by region, often slowing integration into standard care pathways.

Epigenetics Market – Regulatory Landscape by Country

|

Country |

Primary Regulatory Authority |

Epigenetic Drugs Approval Status |

Epigenetic Diagnostics Regulation |

Clinical Trial Environment |

|

United States |

FDA |

Multiple epigenetic drugs approved for cancer (AML, MDS, CTCL) |

DNA methylation & liquid biopsy assays regulated as IVDs |

Very high trial volume; fast-track & orphan pathways |

|

Germany |

BfArM / PEI |

Epigenetic oncology drugs approved via EU framework |

Companion diagnostics increasingly mandated |

Strong academic–industry trials |

|

United Kingdom |

MHRA |

Approved epigenetic therapies aligned with EMA legacy |

Strong focus on biomarker-driven oncology |

High adoption in precision medicine trials |

|

France |

ANSM |

Epigenetic drugs approved for hematologic cancers |

Centralized reimbursement evaluation |

Moderate–high trial activity |

|

Japan |

PMDA |

Approved epigenetic drugs; strict post-market surveillance |

High regulatory scrutiny for diagnostics |

High-quality but slower approvals |

Non-Oncology Expansion & AI Integration creates lucrative growth opportunities in the Epigenetics Market

Beyond cancer, epigenetic insights are expanding into autoimmune, neurological, metabolic, and cardiovascular disease research, creating new market avenues. Integration of AI and machine learning enhances interpretation of complex epigenetic landscapes, helping identify novel biomarkers and therapeutic targets.

Key Segment Analysis of Epigenetics Market:

Cancer Driven Adoption: The oncology segment dominated the epigenetics market, accounting for approximately XX.X % of total revenue in 2025, underscoring its centrality in cancer diagnostics, therapeutics, and biomarker discovery.

Technology Leadership:

- DNA methylation leads technology preference, capturing approximately 44–47%+ market share, due to its proven utility in early cancer detection and as a liquid biopsy marker.

- Histone acetylation/methylation assays are emerging rapidly, with adoption aided by innovation in chromatin profiling techniques.

Product Demand Patterns:

- Reagents & kits constitute the largest product group (nearly 33–40%), driven by research and clinical testing demand.

- Bioinformatics and services show accelerated growth as laboratories outsource complex data interpretation.

Regional Analysis

North America: Market Dominator

North America, led by the United States, held the largest global share (~38–45%), driven by research funding, precision medicine adoption, and strong pharmaceutical R&D. The region’s leadership in high throughput sequencing for cancer studies and liquid biopsy integration reinforces its dominance.

Asia Pacific: Fastest Emerging Region

Asia Pacific is the fastest growing market segment, propelled by increased epigenetic research investment, expanding genomic infrastructure, and rising cancer incidence rates in China, India, and Japan. Import growth of profiling kits and data analytics services has increased by ~35%, reflecting accelerating regional demand.

Europe: Maturing Market with Research Collaborations

Europe remains a significant contributor, especially in Germany, UK, and France, where national precision medicine initiatives are expanding clinical use of epigenetic diagnostics and advanced cancer profiling programs.

Recent Country Developments

- China: R&D funding on epigenetics up nearly 35% in 2025, boosting cancer biomarker discovery and collaboration with global biotech firms.

- United States: Continued dominance in clinical epigenetic testing adoption, with increasing integration of AI for data analytics.

- Europe: Expansion of national precision medicine frameworks supporting histone and methylation profiling.

Competitive Landscape: Top 5 Key Players & Strategies

The competitive environment features global life science firms with diversified portfolios in epigenetic tools, diagnostics, and analytics. Key players are investing in technology innovation, partnerships, and AI enhanced solutions to capture oncology demand.

- Illumina, Inc. (US): Leading in NGS and methylation arrays, Illumina drives cancer epigenetics research and biomarker discovery through clinical lab partnerships.

- Thermo Fisher Scientific, Inc. (US): Offers Ion Torrent and MagMAX systems for high-throughput methylation and histone analysis, focusing on integrated clinical workflows.

- QIAGEN N.V. (Netherlands): Provides methylation kits and the GeneGlobe platform for streamlined epigenetic analysis, with strong oncology collaborations.

- Roche Diagnostics (Switzerland): Develops advanced methylation assays and companion diagnostics for cancer screening with validated clinical workflows.

- Agilent Technologies (US): Supplies high-performance instruments and reagents for DNA methylation and histone profiling, supporting academic and pharma research.

Recent Developments

- April 2025 – QIAGEN: Launched QIAseq Multimodal Cancer Genomics Panels at AACR, enabling DNA and RNA biomarker analysis for oncology research and translational medicine.

- January 2025 – New England Biolabs: Released EM-seq v2 kit, an enzyme-based alternative to bisulfite sequencing, enhancing 5mC and 5hmC detection with improved accuracy.

- October 2024 – PacBio: Opened a high-throughput sequencing lab in Singapore with Revio systems, advancing genomics research in human health, biodiversity, and precision medicine.

- July 2024 – Thermo Fisher Scientific: Acquired Olink Proteomics, integrating proteomics with genomic and epigenomic workflows for multi-omics precision medicine research.

Strategic Outlook: Over the past five years, these players have focused on expanding precision medicine capabilities, integrating AI and machine learning in analysis workflows, launching liquid biopsy panels, and forming academic–industry partnerships to translate research into clinical solutions.

Demand & Supply Oncology: Research & Diagnostics

Demand Drivers:

- Integration of epigenetic biomarkers in early cancer detection tests.

- Liquid biopsy techniques utilizing methylation signatures for non?invasive screening.

- Rising oncology R&D and personalized medicine programs.

Supply Insights:

- North America and Europe dominate supply of advanced assay kits and sequencing tools.

- Asia Pacific emerging as a significant importer of profiling kits and analytical services.

- CROs and bioinformatics service providers contribute to outsourced data interpretation, reducing barriers for biotech innovators.

Organized vs. Unorganized Sector: Pain Points

Organized Sector: Characterized by established global players with high quality standards, validated protocols, and compliance structures.

Challenges: High cost of tools, complex data workflows, and regulatory variability.

Unorganized Sector: Includes smaller regional manufacturers and service labs with lower entry costs but limited quality control, validation, and scalability.

Epigenetics Market Scope

|

Global Epigenetics Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 2.18 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

13.5 % |

Market Size in 2032: |

USD 5.29 Billion |

|

Epigenetics Market Segment Analysis |

By Product |

Reagents Kits ChIP sequencing kit Whole Genomic Amplification kit Bisulfite Conversion kit RNA sequencing kit Others Instruments Enzymes Services |

|

|

By Technology |

DNA Methylation Histone Methylation Histone Acetylation Large non-coding RNA MicroRNA modification Chromatin structures |

||

|

By Application |

Oncology Solid tumors Liquid tumors Non-oncology oncology Inflammatory diseases Metabolic diseases Infectious diseases Cardiovascular diseases Others |

||

|

By End-use |

Academic Research Clinical Research Hospitals & Clinics Pharmaceutical & Biotechnology Companies Other Users |

||

Epigenetics Market Key Players

- Thermo Fisher Scientific

- Illumina

- Merck KGaA

- Pacific Biosciences (PacBio)

- Danaher Corporation

- Bio-Rad Laboratories

- QIAGEN

- Promega Corporation

- Revvity (PerkinElmer Life Sciences)

- New England Biolabs

- Zymo Research

- Active Motif

- Diagenode (Hologic)

- Roche

- Agilent Technologies

- 10x Genomics

- Element Biosciences

- Dovetail Genomics

- Abcam

- Epigentek Group

- Cantata Bio

- EpiCypher

- GeneTex

- GenScript Biotech

- Creative Biolabs

- Takara Bio

- Abbott Laboratories

- Eisai

- Novartis

- Domainex

Frequently Asked Questions

Main Segments of the Epigenetics Market are Products, Technologies, Applications, and End Use

Illumina, Thermo Fisher, Merck, Agilent, Bio-Rad, Qiagen, New England Biolabs, Active Motif, Zymo Research, and PerkinElmer drive innovation globally.

Rising disease prevalence, epigenetic biomarkers adoption, growing R&D, and AI integration accelerate research and market growth.

North America Dominated the Epigenetics Market in 2025

1. Epigenetics Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Epigenetics Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Epigenetics Market: Dynamics

3.1. Epigenetics Market Trends

3.2. Epigenetics Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Regulatory and Ethical Landscape

4.1. Global Regulatory Framework

4.2. Ethical Considerations

4.3. Data Privacy and Security

4.4. Compliance Requirements

4.5. Regional Regulatory Differences

4.6. Future Policy Trends

5. Pricing and Cost Structure Analysis

5.1. Cost Breakdown by Product Type

5.2. Pricing Models

5.3. Reimbursement Scenario

5.4. Cost Comparison by Region

5.5. Impact of Scale and Automation

5.6. Price Trend Analysis

6. Intellectual Property Landscape

6.1. Patent Filing Trends

6.2. Key Patent Holders

6.3. Licensing Agreements

6.4. Technology Transfer

6.5. IP Challenges

6.6. Future Patent Outlook

7. Research Funding and Investment Analysis

7.1. Public Research Funding

7.2. Private Investments and Venture Capital

7.3. Government Grants

7.4. Strategic Collaborations

7.5. Mergers and Acquisitions

7.6. Investment Outlook

8. Supply Chain and Manufacturing Analysis

8.1. Raw Material Sourcing

8.2. Manufacturing Processes

8.3. Quality Standards

8.4. Distribution Channels

8.5. Supply Chain Risks

8.6. Sustainability Initiatives

9. Epigenetics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. Epigenetics Market Size and Forecast, By Product (2025-2032)

9.1.1. Reagents

9.1.2. Kits

9.1.2.1. ChIP sequencing kit

9.1.2.2. Whole Genomic Amplification kit

9.1.2.3. Bisulfite Conversion kit

9.1.2.4. RNA sequencing kit

9.1.2.5. Others

9.1.3. Instruments

9.1.4. Enzymes

9.1.5. Services

9.2. Epigenetics Market Size and Forecast, By Technology (2025-2032)

9.2.1. DNA Methylation

9.2.2. Histone Methylation

9.2.3. Histone Acetylation

9.2.4. Large non-coding RNA

9.2.5. MicroRNA modification

9.2.6. Chromatin structures

9.3. Epigenetics Market Size and Forecast, By Application (2025-2032)

9.3.1. Oncology

9.3.1.1. Solid tumors

9.3.1.2. Liquid tumors

9.3.2. Non-oncology oncology

9.3.2.1. Inflammatory diseases

9.3.2.2. Metabolic diseases

9.3.2.3. Infectious diseases

9.3.2.4. Cardiovascular diseases

9.3.2.5. Others

9.4. Epigenetics Market Size and Forecast, By End-use (2025-2032)

9.4.1. Academic Research

9.4.2. Clinical Research

9.4.3. Hospitals & Clinics

9.4.4. Pharmaceutical & Biotechnology Companies

9.4.5. Other Users

9.5. Epigenetics Market Size and Forecast, By Region (2025-2032)

9.5.1. North America

9.5.2. Europe

9.5.3. Asia Pacific

9.5.4. Middle East and Africa

9.5.5. South America

10. North America Epigenetics Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

10.1. North America Epigenetics Market Size and Forecast, By Product (2025-2032)

10.2. North America Epigenetics Market Size and Forecast, By Technology (2025-2032)

10.3. North America Epigenetics Market Size and Forecast, By Application (2025-2032)

10.4. North America Epigenetics Market Size and Forecast, By End-use (2025-2032)

10.5. North America Epigenetics Market Size and Forecast, by Country (2025-2032)

10.5.1. United States

10.5.2. Canada

10.5.3. Mexico

11. Europe Epigenetics Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

11.1. Europe Epigenetics Market Size and Forecast, By Product (2025-2032)

11.2. Europe Epigenetics Market Size and Forecast, By Technology (2025-2032)

11.3. Europe Epigenetics Market Size and Forecast, By Application (2025-2032)

11.4. Europe Epigenetics Market Size and Forecast, By End-use (2025-2032)

11.5. Europe Epigenetics Market Size and Forecast, by Country (2025-2032)

11.5.1. United Kingdom

11.5.2. France

11.5.3. Germany

11.5.4. Italy

11.5.5. Spain

11.5.6. Sweden

11.5.7. Russia

11.5.8. Rest of Europe

12. Asia Pacific Epigenetics Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

12.1. Asia Pacific Epigenetics Market Size and Forecast, By Product (2025-2032)

12.2. Asia Pacific Epigenetics Market Size and Forecast, By Technology (2025-2032)

12.3. Asia Pacific Epigenetics Market Size and Forecast, By Application (2025-2032)

12.4. Asia Pacific Epigenetics Market Size and Forecast, By End-use (2025-2032)

12.5. Asia Pacific Epigenetics Market Size and Forecast, by Country (2025-2032)

12.5.1. China

12.5.2. S Korea

12.5.3. Japan

12.5.4. India

12.5.5. Australia

12.5.6. Indonesia

12.5.7. Malaysia

12.5.8. Philippines

12.5.9. Thailand

12.5.10. Vietnam

12.5.11. Rest of Asia Pacific

13. Middle East and Africa Epigenetics Market Size and Forecast (by Value in USD Billion) (2025-2032)

13.1. Middle East and Africa Epigenetics Market Size and Forecast, By Product (2025-2032)

13.2. Middle East and Africa Epigenetics Market Size and Forecast, By Technology (2025-2032)

13.3. Middle East and Africa Epigenetics Market Size and Forecast, By Application (2025-2032)

13.4. Middle East and Africa Epigenetics Market Size and Forecast, By End-use (2025-2032)

13.5. Middle East and Africa Epigenetics Market Size and Forecast, by Country (2025-2032)

13.5.1. South Africa

13.5.2. GCC

13.5.3. Egypt

13.5.4. Nigeria

13.5.5. Rest of ME&A

14. South America Epigenetics Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

14.1. South America Epigenetics Market Size and Forecast, By Product (2025-2032)

14.2. South America Epigenetics Market Size and Forecast, By Technology (2025-2032)

14.3. South America Epigenetics Market Size and Forecast, By Application (2025-2032)

14.4. South America Epigenetics Market Size and Forecast, By End-use (2025-2032)

14.5. South America Epigenetics Market Size and Forecast, by Country (2025-2032)

14.5.1. Brazil

14.5.2. Argentina

14.5.3. Colombia

14.5.4. Chile

14.5.5. Rest Of South America

15. Company Profile: Key Players

15.1. Thermo Fisher Scientific

15.1.1. Company Overview

15.1.2. Business Portfolio

15.1.3. Financial Overview

15.1.4. SWOT Analysis

15.1.5. Strategic Analysis

15.1.6. Recent Developments

15.2. Illumina

15.3. Merck KGaA

15.4. Pacific Biosciences (PacBio)

15.5. Danaher Corporation

15.6. Bio-Rad Laboratories

15.7. QIAGEN

15.8. Promega Corporation

15.9. Revvity (PerkinElmer Life Sciences)

15.10. New England Biolabs

15.11. Zymo Research

15.12. Active Motif

15.13. Diagenode (Hologic)

15.14. Roche

15.15. Agilent Technologies

15.16. 10x Genomics

15.17. Element Biosciences

15.18. Dovetail Genomics

15.19. Abcam

15.20. Epigentek Group

15.21. Cantata Bio

15.22. EpiCypher

15.23. GeneTex

15.24. GenScript Biotech

15.25. Creative Biolabs

15.26. Takara Bio

15.27. Abbott Laboratories

15.28. Eisai

15.29. Novartis

15.30. Domainex

15.31. Others

16. Key Findings

17. Analyst Recommendations

18. Epigenetics Market: Research Methodology