Petroleum Coke Market Emerging Opportunities and Future Scope

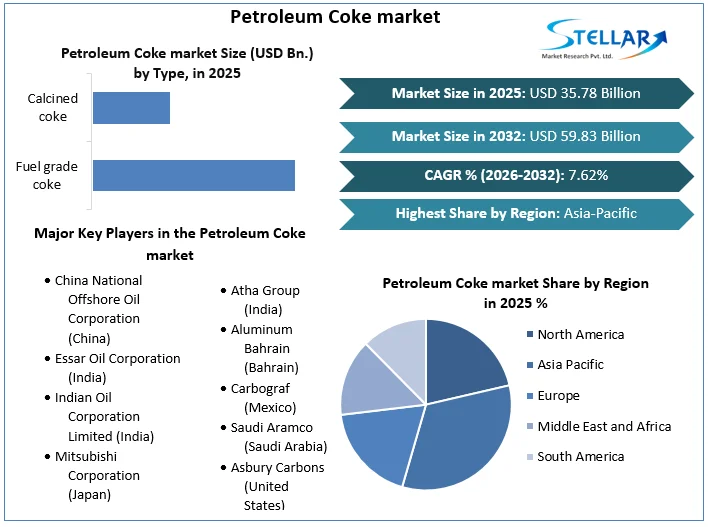

Petroleum Coke market size was valued at US $ 35.78 Billion in 2025 and the Petroleum Coke market revenue is expected to grow at 7.62% through 2026 to 2032, reaching nearly US $ 59.83 Billion. The report analyzes Petroleum Coke market dynamics by region, and end-user industries.

Format : PDF | Report ID : SMR_479

Petroleum Coke Market Overview:

Petroleum coke, often known as coke or petcoke, is a carbon-rich solid substance produced during the refining of crude oil. It is a form of coke produced by a final cracking process in coker units, which is a thermo-based chemical engineering process that splits long-chain petroleum hydrocarbons into shorter chains. In its purest form, petcoke can weigh 98-99 percent carbon, resulting in a carbon-based molecule with hydrogen filling in the gaps. Petcoke contains over 80% carbon and, as a result of its higher energy content, emits 5% to 10% more CO2 (Carbon dioxide) per unit of energy than coal when burned. Petroleum Coke Market report by Stellar Market Research is prepared by considering the segment analysis on the basis of type, application and region.

Residual oils from various distillation processes used in petroleum refining are processed at a high temperature and pressure in petroleum coker units, after driving off fumes and volatiles and separating remaining light and heavy oils, before exiting the petcoke. For the specific process of delayed coking, these activities are referred to as "coking processes," and they almost always involve chemical engineering plant operations.

To get more Insights: Request Free Sample Report

Petroleum Coke Market Dynamics:

The petroleum coke market is likely to grow in response to rising energy demand:

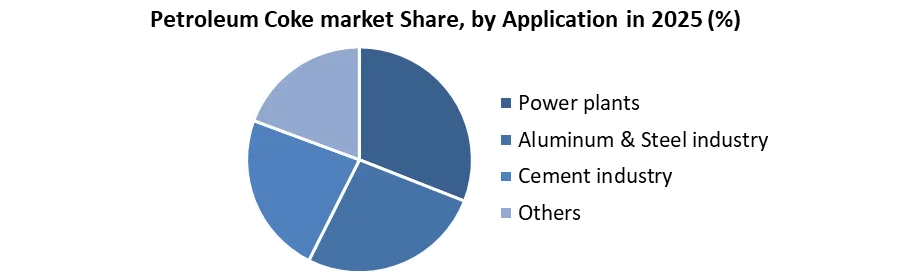

Because of rising global energy demand, the petroleum coke market is growing. Petroleum coke is widely utilised as an energy source in power plants and various sectors, including cement, steel, and others, thanks to its high calorific value. Rising infrastructure spending and urbanisation trends are expected to drive industrial growth by strengthening the cement and steel markets.

Rapid technological advancements and enhanced oil production capacity are also driving the industry forward globally. The growing use of petroleum coke as a cost-effective fuel in the cement and energy industries is also driving the petroleum coke market forward.

Environmental and health risks:

Petroleum coke is typically a source of fine dust that can pass past the human airway filtering system, settle in the lungs, and cause serious health problems such as asthma, pneumonia, and other respiratory illnesses. Vanadium, a hazardous metal, is found in petroleum coke, according to the Environmental Protection Agency. In trace concentrations, it can be dangerous (0.8 micrograms per cubic metre of air). Petcoke storage and combustion are both environmentally hazardous.

The storage and combustion of petcoke raises environmental concerns. As petcoke is processed, by-products collect, posing a waste management problem. The high silt content of petcoke (21.2%) raises the possibility of fugitive dust floating away from petcoke mounds in strong winds. In the United States, an estimated 100 tonnes of petcoke fugitive dust, comprising PM10 and PM2.5, are discharged into the sky each year. In the cities of Chicago, Detroit, and Green Bay, waste management and the emission of fugitive dust are particularly problematic.

By-products accumulate as petcoke is processed, posing a waste management issue. Petcoke causes externalities, which can have an impact on the environment. It is made up of 90% elemental carbon, which is converted to CO2 after combustion. Sulphur emissions and the likelihood of water pollution from nickel and vanadium discharge during refining and storage are further consequences of petcoke use. As a result, these factors are likely to slow the petroleum coke market's growth during the forecast period.

Petroleum Coke market Segmentation:

Based on Type:

The fuel grade coke segment was dominant in 2025, accounting for xx% of the total petroleum coke market. Fuel-grade coke is either sponge coke or shot coke in structure. While oil refineries have been producing coke for over a century, the mechanisms that allow sponge coke or shot coke to form are poorly understood and difficult to forecast.

Lower temperatures and higher pressures promote the development of sponge coke in general. Though its high heat and low ash content make it a good fuel for power generation in coal-fired boilers, petroleum coke has a high Sulphur content and a low volatile composition, causing environmental and technical issues during combustion.

Calcined petroleum coke (CPC) is a byproduct of the calcination of petroleum coke. Calcined petroleum coke is used to produce anodes for the aluminium, steel, and titanium smelting industries. As the application scope of needle calcinated coke in battery electrodes grows, the calcined coke market is likely to rise significantly throughout the forecast period.

Petroleum Coke Market Regional Insights:

In terms of revenue, Asia Pacific was dominating in 2025, with xx% of the global Petroleum Coke Market share. It is expected to be the top regional market in terms of demand during the forecast period. In growing economies like India and China, petroleum coke is widely used in power plants and cement kilns. In China, electricity is generated with the majority of petroleum coke used in power plants.

India uses a large amount of the commodity in the cement sector thanks to the country's growing industrialization. Increased population and rapid development in Asia Pacific are expected to drive the ambitions of petroleum coke producers. Because Asia Pacific now dominates the international petroleum coke business in terms of demand, which is driven by enormous imports, further possibilities are likely to develop.

Europe is likely to have a robust growth rate in the petroleum coke market over the forecast period thanks to the cheap costs associated with energy generation. Petroleum coke is replacing natural gas and coal as a preferred fuel due to its easy and abundant availability. Increasing infrastructure development in the Middle East and Africa is expected to drive petroleum coke demand in the region over the forecast period.

To make petroleum coke, firms that refine crude oil are installing delayed coking plants. The North American market is mature, with a forecasted average growth rate of xx% throughout the forecast period. Petroleum coke has long been a key export from North America.

The objective of the report is to present a comprehensive analysis of the Petroleum Coke Market to the stakeholders in the industry. The report provides trends that are most dominant in the Petroleum Coke Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Petroleum Coke Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Petroleum Coke Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Petroleum Coke Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Petroleum Coke Market is aided by legal factors.

Petroleum Coke Market Scope:

|

Petroleum Coke Market |

|

|

Market Size in 2025 |

USD 35.78 Bn. |

|

Market Size in 2032 |

USD 59.83 Bn. |

|

CAGR (2025-2032) |

7.62% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

By Application

|

|

|

|

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Petroleum Coke Market Key Players

- China National Offshore Oil Corporation (China)

- Essar Oil Corporation (India)

- Indian Oil Corporation Limited (India)

- Mitsubishi Corporation (Japan)

- Sinopec (China)

- British Petroleum (United Kingdom)

- Nippon Coke and Engineering (Japan)

- Shell Petroleum (United Kingdom)

- Atha Group (India)

- Aluminum Bahrain (Bahrain)

- Carbograf (Mexico)

- Saudi Aramco (Saudi Arabia)

- Asbury Carbons (United States)

- ConocoPhillips (United States)

- Minmat Ferro Alloys (India)

- Others

Frequently Asked Questions

The health and environmental hazards about the use of petroleum coke are the key factors expected to hinder the growth of the market during the forecast period.

The Petroleum coke market is expected to grow at a CAGR of 7.62% during the forecast period (2026-2032).

The rising energy demand globally is the key factor expected to drive the growth of the petroleum coke market during the forecast period.

China National Offshore Oil Corporation (China), Essar Oil Corporation (India), Indian Oil Corporation Limited (India), Mitsubishi Corporation (Japan), Sinopec (China), British Petroleum (United Kingdom), Nippon Coke and Engineering (Japan), Shell Petroleum (United Kingdom), Atha Group (India), Aluminum Bahrain (Bahrain), Carbograf (Mexico), Saudi Aramco (Saudi Arabia), Asbury Carbons (United States), ConocoPhillips (United States), Minmat Ferro Alloys (India), and Others are key players covered.

- Chapter 1 Scope of the Report

- Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Petroleum Coke Market: Target Audience

2.3. Global Petroleum Coke Market: Primary Research (As per Client Requirement)

2.4. Global Petroleum Coke Market: Secondary Research

- Chapter 3 Executive Summary

- Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2025-2032(In %)

4.1.1. North America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.2. Europe Market Share Analysis, By Value, 2025-2032 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Value, 2025-2032 (In %)

4.1.4. South America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.5. Middle East and Africa Market Share Analysis, By Value, 2025-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.3.1. Global Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.3.1.1. Power plants

4.3.1.2. Aluminum & Steel industry

4.3.1.3. Cement Industry

4.3.1.4. Others

4.3.2. Global Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.3.2.1. Fuel grade coke

4.3.2.2. Calcined coke

4.4. North America Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.4.1. North America Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.4.1.1. Power plants

4.4.1.2. Aluminum & Steel industry

4.4.1.3. Cement Industry

4.4.1.4. Others

4.4.2. North America Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.4.2.1. Fuel grade coke

4.4.2.2. Calcined coke

4.4.3. North America Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.4.3.1. US

4.4.3.2. Canada

4.4.3.3. Mexico

4.5. Europe Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.5.1. Europe Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.5.2. Europe Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.5.3. Europe Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.5.3.1. UK

4.5.3.2. France

4.5.3.3. Germany

4.5.3.4. Italy

4.5.3.5. Spain

4.5.3.6. Sweden

4.5.3.7. Austria

4.5.3.8. Rest Of Europe

4.6. Asia Pacific Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.6.1. Asia Pacific Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.6.2. Asia Pacific Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.6.3. Asia Pacific Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.6.3.1. China

4.6.3.2. India

4.6.3.3. Japan

4.6.3.4. South Korea

4.6.3.5. Australia

4.6.3.6. ASEAN

4.6.3.7. Rest Of APAC

4.7. South America Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.7.1. South America Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.7.2. South America Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.7.3. South America Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.7.3.1. Brazil

4.7.3.2. Argentina

4.7.3.3. Rest Of South America

4.8. Middle East and Africa Petroleum Coke Market Segmentation Analysis, 2025-2032 (Value US$ BN)

4.8.1. Middle East and Africa Market Share Analysis, By Application, 2025-2032 (Value US$ BN)

4.8.2. Middle East and Africa Market Share Analysis, By Type, 2025-2032 (Value US$ BN)

4.8.3. Middle East and Africa Market Share Analysis, By Country, 2025-2032 (Value US$ BN)

4.8.3.1. South Africa

4.8.3.2. GCC

4.8.3.3. Egypt

4.8.3.4. Nigeria

4.8.3.5. Rest Of ME&A

- Chapter 5 Stellar Competition Matrix

5.1. Global Stellar Competition Matrix

5.2. North America Stellar Competition Matrix

5.3. Europe Stellar Competition Matrix

5.4. Asia Pacific Stellar Competition Matrix

5.5. South America Stellar Competition Matrix

5.6. Middle East and Africa Stellar Competition Matrix

5.7. Key Players Benchmarking

5.7.1. Key Players Benchmarking By Application, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.8. Mergers and Acquisitions in Industry

5.8.1. M&A by Region, Value and Strategic Intent

- Chapter 6 Company Profiles

6.1. Key Players

6.1.1. China National Offshore Oil Corporation (China)

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Essar Oil Corporation (India)

6.1.3. Indian Oil Corporation Limited (India)

6.1.4. Mitsubishi Corporation (Japan)

6.1.5. Sinopec (China)

6.1.6. British Petroleum (United Kingdom)

6.1.7. Nippon Coke and Engineering (Japan)

6.1.8. Shell Petroleum (United Kingdom)

6.1.9. Atha Group (India)

6.1.10. Aluminum Bahrain (Bahrain)

6.1.11. Carbograf (Mexico)

6.1.12. Saudi Aramco (Saudi Arabia)

6.1.13. Asbury Carbons (United States)

6.1.14. ConocoPhillips (United States)

6.1.15. Minmat Ferro Alloys (India)

6.1.16. Others

6.2. Key Findings

6.3. Recommendations