Global Lime Market Outlook by Size Share Revenue Analysis and Industry Forecast (2025-2032)

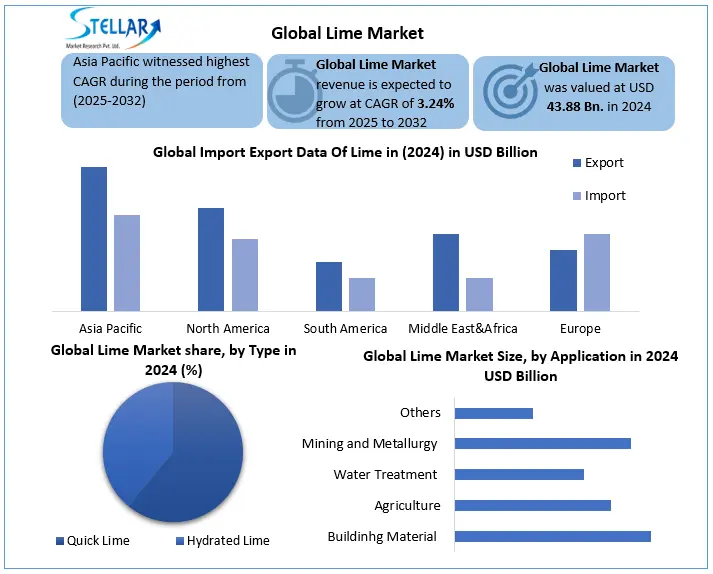

Global Lime Market was valued at USD 43.88 Bn. in 2024 and total Global Lime Market revenue is expected to grow at 3.24% reaching nearly USD 56.19 Bn. from 2025 to 2032.

Format : PDF | Report ID : SMR_2855

Lime Market Overview:

Lime is a type of hard white sedimentary rock that is used for building or for making cement. Emerging markets dominate this growth, with investors are investing USD 58 billion in Lime Market New Administrative Capital allocating USD 1.2 trillion for infrastructure, including new smart cities. These projects reflect a global shift toward sustainable urban development, with the smart city market expected to reach USD 2.5 trillion by 2025.Technological adoption is accelerating, with 30% production of lime. Global Lime Market which holds 85% of the country's limestone reserves implementing AI-driven kilns. These upgrades have boosted energy efficiency by 15-20% while reducing emissions by 12%.

Globally, 45% of lime manufacturers now use digital supply chain tools, improving logistics costs by 8-10%. Lime industry faces sustainability challenges, as lime production contributes 1.5% of global industrial CO? emissions. In response, 25% of European producers have adopted biomass fuels, cutting carbon footprints by 30%, while pilot carbon capture projects show potential to reduce emissions by up to 90% though at a 40% higher operational cost. The Asia-Pacific region, growing at 5.1% CAGR, leads demand, with Africa's urban population set to double by 2032 emerging as the next growth frontier. To compete, new entrants must navigate 15-20% higher capital costs for sustainable technologies, even as 65% of construction firms now prioritize low-carbon materials.

In 2024, the global lime market is significantly influenced by evolving trade policies and tariffs which impact pricing, supply chains, and international competitiveness. The United States heavily reliant on imports for its limestone needs, has implemented a 25% tariff on Mexican goods including limestone leading to increased costs for U.S. importers and consumers.

To get more Insights: Request Free Sample Report

Lime Industry Dynamics

Rapid Growth of the Construction to drive the Global Lime Market

The global lime market is experiencing robust growth, driven primarily by the construction sector which accounts for 70% of total demand. With urbanization rates in developing nations reaching 3.5% annually, massive infrastructure projects are fuelling consumption - evidenced by Egypt's 58 billion New Administrative Capital and India's plan for 8 smart cities as part of its 1.2 trillion infrastructure push. The industry has seen 91 new cities announced worldwide in the past decade, including 15 in just the last year. Technological advancements are transforming production, with 30% of adopting AI-driven kilns that boost efficiency by 15-20%. However, the sector faces sustainability challenges, as traditional methods contribute 1.5% of global industrial CO? emissions. While solutions like biomass fuels reduce emissions by 30%, widespread implementation of carbon capture technology remains costly, increasing operational expenses by 40%. The Asia-Pacific region leads growth at a 2.7% CAGR, while Africa emerges as the next frontier with its urban population projected to double by 2032. As global construction output approaches 15.2 trillion by 2030, the lime industry must balance rising demand with environmental responsibility to maintain its projected 4.2% annual growth through the decade.

Adoption and Continuous Technological Advancements to Boost the Lime industry

Technological advances Automation IoT-qualified ovens AI-based monitoring systems and real-time data analysis, are transforming lime production, improving energy efficiency by 15 to 25% and increasing production by up to 20%. In Asia Pacific represents more than 60% of global lime production, companies are rapidly investing in vertical axis and regenerative ovens, which reduce fuel consumption by 30 to 40% compared to traditional methods. The sector is also aligning with global sustainability goals, and carbon capture technologies are showing potential to reduce emissions by up to 60%. In addition, the rise of sustainable lime products, such as lime carbon and hydraulic lime, should grow to more than 6% CAGR, driven by the demand for ecological construction practices. These advances not only improve operational efficiency but also position the lime Market to meet environmental and regulatory standards around the world.

Environmental Regulations and Carbon Emissions to Impact the Global Lime Industry

One of the most pressing challenges in the global lime Market is its significant carbon impression, mainly due to the intensive calcination process. Production also involves limestone heating (calcium carbonate) at temperatures above 900°C which not only consumes substantial energy but also releases carbon dioxide (CO?) both from fossil fuel combustion and chemical decomposition of limestone. This double source of emissions places lime production among the most intensive carbon industrial processes. Environmental regulations are increasingly directing these emissions, attracting lime producers to seek sustainable alternatives. Some companies are exploring the use of substitute fuels like garbage and biomass fuels to replace traditional fossil fuels in ovens. the adoption of these alternatives is still in their early stages in the lime industry and the challenges remain in relation to the quality and constancy of fuel.

Global Lime Market Segment Analysis

Based on Type, the Global Lime Market is segmented into Quick lime and Hydrated Lime. Quick lime segment dominates the market in 2024 and is expected to hold largest share during the forecast period. Quick lime also known as calcium oxide which plays a significant role in boost the lime Industry. It is a highly flexible and widely used chemical compound in construction materials cement concrete and where it acts as a binding agent. It is also used in the steel industry for the production of high quality steel and steel related products and as a fluxing agent to remove contaminations silica phosphorus and sulphur from iron ore during the steel making process. The alkaline properties of quicklime make it valuable for waste water treatment soil stabilization and pH regulation in industrial processes. The growing construction and steel industries along with the increasing demand for water treatment solutions are accelerating its adoption rate through the global Lime Market.

Based on Application, the global Lime market is segmented into Building Material, Agriculture, Water Treatment, Mining and Metallurgy and Others. Building Material and construction segment dominated the market in 2024 and is expected to hold largest market share over the forecast period. Lime is a critical raw material in cement production with global cement output reaching 41 Bn. metric tons in 2021 according to the International Energy Agency. Its use in concrete mortar and road construction further solidifies its authority Rapid urbanization particularly in Asia-Pacific and infrastructure investments like the U.S.12 trillion Infrastructure Investment and Jobs drive the demand in global lime market. This segment is adaptable and cost-effectiveness make it indispensable for meeting global housing and infrastructure needs ensuring its continued leadership in the limestone market.

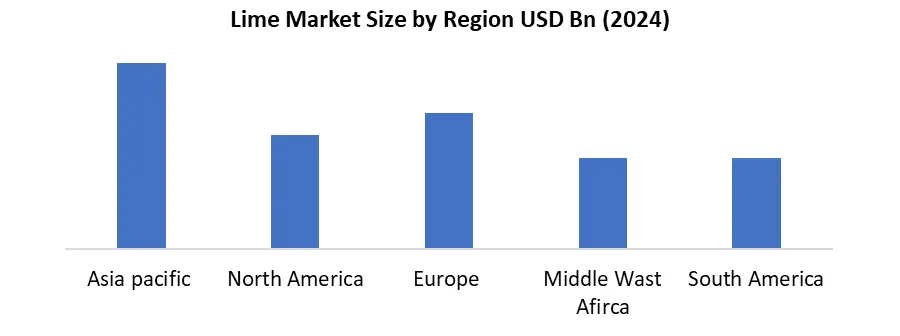

Lime Market Regional Analysis:

Asia-Pacific dominated the Lime market in 2024 and is expected to hold largest share during the forecast period. Asia Pacific Dominated with 40.2% of the global market share in 2024. The domination of Asia-Pacific in the global market is majorly boost from rapid industrialization, urbanization, and infrastructure development. Particularly in China and India. China alone produced over 2.1 Bn. metric tons of limestone in 2021, primarily for cement and steel production according to the International Energy Agency. Government investments in mega-infrastructure projects, in several countries like India's USD 1.4 trillion National Infrastructure Pipeline, further boost demand. With increasing applications in construction and environmental sectors Asia-Pacific remains pivotal to the global limestone market.

Lime Market Competitive Landscape

The global lime Industry is Highly Competitive with multinational companies and regional players seeking market share. Leading companies like Lhoist Group, Carmeuse, Graymont Lime Company and Nord kalk dominate the industry, collectively representing approximately 35% to 40% of global market share. These main participants focus on strategic initiatives mergers and acquisitions, technological advances and sustainability practices to strengthen Lime Market positions. e.g the adoption of energy efficiency production processes and carbon capture technologies has become increasingly important due to strict environmental regulations. Asia Pacific region leads the market boost by rapid industrialisation and infrastructure development in countries like China and India. The competitive scenario is shaped by a combination of global strategies and regional dynamics, with companies continually adapting to the evolution of market demands and regulatory environments.

Recent Key Development Lime Market:

- In November 2024, Carmeuse announced a 150 million investments in Lime to build a new lime production plant in Texas strengthening its supply for the U.S. steel as well as construction sectors.

- Lhoist partnered with a European clean energy company in October 2024 to pilot hydrogen fuelled lime kilns, aiming for carbon-neutral Lime production.

- Graymont expanded its North American operations in September 2024 by acquiring a Canadian lime producer to boost regional supply capacity of Lime.

|

Global Lime Market Scope |

|

|

Market Size in 2024 |

USD 43.88 Bn. |

|

Market Size in 2032 |

USD 56.19 Bn. |

|

CAGR (2025-2032) |

3.24% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Quick Lime Hydrated Lime |

|

By Application Building Material Agriculture Water Treatment Mining and Metallurgy Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Lime industry

North America

- Carmeuse Lime & Stone (Pittsburgh, USA)

- Mississippi Lime Company (St. Louis, USA)

- United States Lime & Minerals, Inc. (Dallas, USA)

- Graymont (Richmond, Canada)

- Lhoist North America (Fort Worth, USA)

- Pete Lien & Sons, Inc. (Rapid City, USA)]

Asia Pacific

- Adelaide Brighton Ltd (Adbri) (Adelaide, Australia)

- Boral Ltd. (North Sydney, Australia)

- Sibelco Australia (Brisbane, Australia)

- Omya Australia Pty Ltd (Sydney, Australia)

- Wagners (Toowoomba, Australia)

- Shandong Haoyuan Group (Shandong, China)

South America

- Loma Negra C.I.A.S.A. (Buenos Aires, Argentina)

- Votorantim Cimentos (Sao Paulo, Brazil)

- Cementos Pacasmayo S.A.A. (Lima, Peru)

- Cementos Argos S.A. (Medellín, Colombia)

- InterCement Brasil S.A. (São Paulo, Brazil)

- Cementos Bio Bio S.A. (Santiago, Chile)

Middle East & Africa

- Arabian Cement Co. (Khoms, Libya)

- PPC Ltd. (Sandton, South Africa)

- Gulf Lime Company (Abu Dhabi, United Arab Emirates)

- Al Rashed Cement (Dammam, Saudi Arabia)

- Abu Qir Fertilizers and Chemicals Industries Co. (Alexandria, Egypt)

- Oman Cement Company (Muscat, Oman)

Europe

- Carmeuse (Louvain-la-Neuve, Belgium)

- Omya AG (Oftringen, Switzerland)

- Nordkalk Corporation (Pargas, Finland)

- Schaefer Kalk GmbH & Co. KG (Wulfrath, Germany)

- Mineralmühle Leun GmbH (Leun, Germany)

- Lhoist Group (Louvain-la-Neuve, Belgium)

Frequently Asked Questions

1. Lime Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Lime Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Lime Market: Dynamics

3.1. Lime Market Trends by Region

3.1.1. North America Lime Market Trends

3.1.2. Europe Lime Market Trends

3.1.3. Asia Pacific Lime Market Trends

3.1.4. Middle East and Africa Lime Market Trends

3.1.5. South America Lime Market Trends

3.2. Lime Market Dynamics

3.2.1. Global Lime Market Drivers

3.2.2. Global Lime Market Opportunities

3.2.3. Global Lime Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Lime Industry

4. Lime Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Lime Market Size and Forecast, Type (2024-2032)

4.1.1. Quick Lime

4.1.2. Hydrated Lime

4.2. Lime Market Size and Forecast, By Application (2024-2032)

4.2.1. Building Material

4.2.2. Agriculture

4.2.3. Water Treatment

4.2.4. Mining and Metallurgy

4.3. Lime Market Size and Forecast, by Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Lime Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1.1. North America Lime Market Size and Forecast, Type (2024-2032)

5.1.2. Quick Lime

5.1.3. Hydrated Lime

5.2. North America Lime Market Size and Forecast, By Application (2024-2032)

5.2.1. Building Material

5.2.2. Agriculture

5.2.3. Water Treatment

5.2.4. Mining and Metallurgy

5.2.5. Others

5.3. North America Lime Market Size and Forecast, By Country (2024-2032)

5.3.1. United States

5.3.2. Canada

5.3.3. Mexico

5.4. North America Lime Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Lime Market Size and Forecast, Type (2024-2032)

5.4.1.1.1. Quick Lime

5.4.1.1.2. Hydrated Lime

5.4.1.2. United States Lime Market Size and Forecast, By Application (2024-2032)

5.4.1.2.1. Building Material

5.4.1.2.2. Agriculture

5.4.1.2.3. Water Treatment

5.4.1.2.4. Mining and Metallurgy

5.4.1.2.5. Others

5.4.2. Canada

5.4.2.1. Canada Lime Market Size and Forecast, Type (2024-2032)

5.4.2.1.1. Hydrated Lime

5.4.2.1.2. Quick Lime

5.4.2.2. Canada Lime Market Size and Forecast, By Application (2024-2032)

5.4.2.2.1. Building Material

5.4.2.2.2. Agriculture

5.4.2.2.3. Water Treatment

5.4.2.2.4. Mining and Metallurgy

5.4.2.2.5. Others

5.4.3. Mexico

5.4.3.1. Mexico Lime Market Size and Forecast, Type (2024-2032)

5.4.3.1.1. Quick Lime

5.4.3.1.2. Hydrated Lime

5.4.3.2. Mexico Lime Market Size and Forecast, By Application (2024-2032)

5.4.3.2.1. Building Material

5.4.3.2.2. Agriculture

5.4.3.2.3. Water Treatment

5.4.3.2.4. Mining and Metallurgy

5.4.3.2.5. Others

6. Europe Lime Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Lime Market Size and Forecast, Type (2024-2032)

6.2. Europe Lime Market Size and Forecast, By Application (2024-2032)

6.3. Europe Lime Market Size and Forecast, By region (2024-2032)

6.4. Europe Lime Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Lime Market Size and Forecast, Type (2024-2032)

6.4.1.2. United Kingdom Lime Market Size and Forecast, By Application (2024-2032)

6.4.1.3. United Kingdom Lime Market Size and Forecast, By region (2024-2032)

6.4.2. France

6.4.2.1. France Lime Market Size and Forecast, Type (2024-2032)

6.4.2.2. France Lime Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Lime Market Size and Forecast, Type (2024-2032)

6.4.3.2. Germany Lime Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Lime Market Size and Forecast, Type (2024-2032)

6.4.4.2. Italy Lime Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Lime Market Size and Forecast, Type (2024-2032)

6.4.5.2. Spain Lime Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Lime Market Size and Forecast, Type (2024-2032)

6.4.6.2. Sweden Lime Market Size and Forecast, By Application (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Lime Market Size and Forecast, Type (2024-2032)

6.4.7.2. Austria Lime Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Lime Market Size and Forecast, Type (2024-2032)

6.4.8.2. Rest of Europe Lime Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Lime Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Lime Market Size and Forecast, Type (2024-2032)

7.2. Asia Pacific Lime Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Lime Market Size and Forecast, By region (2024-2032)

7.4. Asia Pacific Lime Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Lime Market Size and Forecast, Type (2024-2032)

7.4.1.2. China Lime Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Lime Market Size and Forecast, Type (2024-2032)

7.4.2.2. S Korea Lime Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Lime Market Size and Forecast, Type (2024-2032)

7.4.3.2. Japan Lime Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Lime Market Size and Forecast, Type (2024-2032)

7.4.4.2. India Lime Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Lime Market Size and Forecast, Type (2024-2032)

7.4.5.2. Australia Lime Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Lime Market Size and Forecast, Type (2024-2032)

7.4.6.2. Indonesia Lime Market Size and Forecast, By Application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Lime Market Size and Forecast, Type (2024-2032)

7.4.7.2. Malaysia Lime Market Size and Forecast, By Application (2024-2032)

7.4.8. Vietnam

7.4.8.1. Vietnam Lime Market Size and Forecast, Type (2024-2032)

7.4.8.2. Vietnam Lime Market Size and Forecast, By Application (2024-2032)

7.4.9. Taiwan

7.4.9.1. Taiwan Lime Market Size and Forecast, Type (2024-2032)

7.4.9.2. Taiwan Lime Market Size and Forecast, By Application (2024-2032)

7.4.10. Rest of Asia Pacific

7.4.10.1. Rest of Asia Pacific Lime Market Size and Forecast, Type (2024-2032)

7.4.10.2. Rest of Asia Pacific Lime Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Lime Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Lime Market Size and Forecast, Type (2024-2032)

8.2. Middle East and Africa Lime Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Lime Market Size and Forecast, By region (2024-2032)

8.4. Middle East and Africa Lime Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Lime Market Size and Forecast, Type (2024-2032)

8.4.1.2. South Africa Lime Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Lime Market Size and Forecast, Type (2024-2032)

8.4.2.2. GCC Lime Market Size and Forecast, By Application (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Lime Market Size and Forecast, Type (2024-2032)

8.4.3.2. Nigeria Lime Market Size and Forecast, By Application (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Lime Market Size and Forecast, Type (2024-2032)

8.4.4.2. Rest of ME&A Lime Market Size and Forecast, By Application (2024-2032)

9. South America Lime Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Lime Market Size and Forecast, Type (2024-2032)

9.2. South America Lime Market Size and Forecast, By Application (2024-2032)

9.3. South America Lime Market Size and Forecast, By region (2024-2032)

9.4. South America Lime Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Lime Market Size and Forecast, Type (2024-2032)

9.4.1.2. Brazil Lime Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Lime Market Size and Forecast, Type (2024-2032)

9.4.2.2. Argentina Lime Market Size and Forecast, By Application (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Lime Market Size and Forecast, Type (2024-2032)

9.4.3.2. Rest of South America Lime Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. Carmeuse Lime & Stone (Pittsburgh, Pennsylvania, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Mississippi Lime Company (St. Louis, Missouri, USA)

10.3. United States Lime & Minerals, Inc. (Dallas, Texas, USA)

10.4. Graymont (Richmond, British Columbia, Canada)

10.5. Lhoist North America (Fort Worth, Texas, USA)

10.6. Pete Lien & Sons, Inc. (Rapid City, South Dakota, USA)]

10.7. Adelaide Brighton Ltd (Adbri) (Adelaide, Australia)

10.8. Boral Ltd. (North Sydney, Australia)

10.9. Sibelco Australia (Brisbane, Australia)

10.10. Omya Australia Pty Ltd (Sydney, Australia)

10.11. Wagners (Toowoomba, Australia)

10.12. Shandong Haoyuan Group (Shandong, China)

10.13. Loma Negra C.I.A.S.A. (Buenos Aires, Argentina)

10.14. Votorantim Cimentos (Sao Paulo, Brazil)

10.15. Cementos Pacasmayo S.A.A. (Lima, Peru)

10.16. Cementos Argos S.A. (Medellín, Colombia)

10.17. InterCement Brasil S.A. (São Paulo, Brazil)

10.18. Cementos Bio Bio S.A. (Santiago, Chile)

10.19. Arabian Cement Co. (Khoms, Libya)

10.20. PPC Ltd. (Sandton, South Africa)

10.21. Gulf Lime Company (Abu Dhabi, United Arab Emirates)

10.22. Al Rashed Cement (Dammam, Saudi Arabia)

10.23. Abu Qir Fertilizers and Chemicals Industries Co. (Alexandria, Egypt)

10.24. Oman Cement Company (Muscat, Oman

10.25. Carmeuse (Louvain-la-Neuve, Belgium)

10.26. Omya AG (Oftringen, Switzerland)

10.27. Nordkalk Corporation (Pargas, Finland)

10.28. Schaefer Kalk GmbH & Co. KG (Wulfrath, Germany)

10.29. Mineralmühle Leun GmbH (Leun, Germany)

10.30. Lhoist Group (Louvain-la-Neuve, Belgium)

11. Key Findings

12. Analyst Recommendations

13. Lime Market: Research Methodology