Water as a Fuel Market Size, Share & Trends Analysis Report by Fuel Type, Technology, End-use and Region

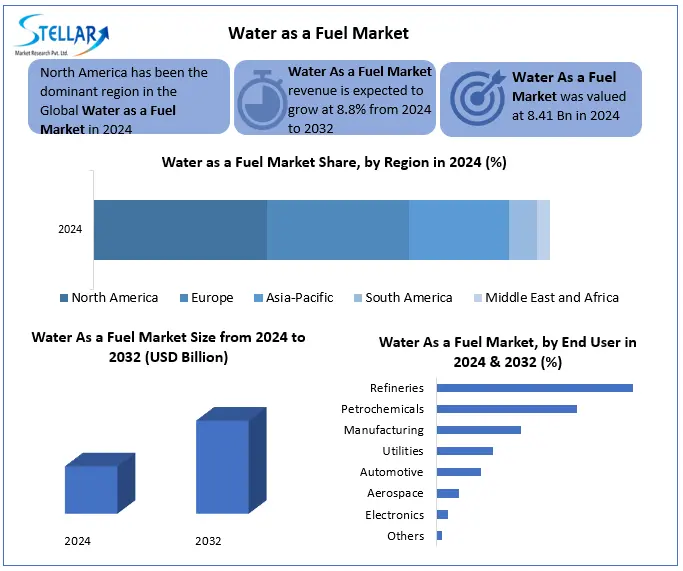

The Water as a Fuel Market was valued at USD 8.41 bn in 2024 and is expected to reach USD 16.51 bn by 2032, at a CAGR of 8.8% during the forecast period.

Format : PDF | Report ID : SMR_2859

Water as a Fuel Market Overview

The Water as a Fuel Market represents a transformative change in clean energy technology, focusing on using hydrogen extracted from water through electrolysis and other advanced processes to create permanent fuel solutions. This innovative approach is being applied to the service of areas such as hydrogen fuel cells, modified combustion engines and hybrid energy systems, transportation, industrial power and renewable energy storage. The technology takes advantage of successes in high-efficiency electrolysers, catalytic Water Splitting, and water-based nanofluids to maximise energy production, reducing environmental impact.

The market is experiencing rapid expansion, expected to dominate future energy systems with hydrogen fuel technologies. Recent years have seen major corporations and startups growing innovation to improve the efficiency and scalability of water-derived fuel.

Major technological progresses include the next generation of ion exchange membrane (AEM) electrolysers that significantly reduce hydrogen production costs, and photochemical hydroelectric water-division systems that use sunlight to generate hydrogen without external power. Additionally, solid-state hydrogen storage solutions are increasing the viability of water-based fuel for mobile applications. Integration of AI-operated energy management systems is optimising hydrogen production and use, while advanced thermal conversion technologies are unlocking new methods to extract energy from water with unprecedented efficiency.

The Water as a Fuel Market report offers a deep analysis of the Market Research Industry. It demonstrates a rapid summary of industry data and a key catalogue of the market.

To get more Insights: Request Free Sample Report

Water as a Fuel Market Dynamics

Environmental sustainability to Drive Water as a Fuel Market

As the world struggles with the need for pressure to reduce greenhouse gas emissions and climate change, the implementation of water as a source for clean hydrogen production has expanded enough speed. Hydrogen produced by water using renewable energy sources, such as air and solar energy, is considered a green and low-carbon option for traditional fossil fuels. It promises to decarbonise various sectors, including transportation, industry and energy production.

The use of water as a fuel source aligns with global efforts for infection in durable and environmentally friendly energy solutions. It reduces carbon emissions and air pollutants significantly, as the only sub-product of hydrogen combustion is water vapour. As nations and industries have determined ambitious decarbonization goals, the role of hydrogen produced from water as a clean energy carrier is rapidly increasing.

This demand is reinforced by the recognition of hydrogen's ability to shape the energy landscape and to contribute more environmentally. Environmental imperative for reducing carbon emissions is a motivational power behind the expansion of Water as a Fuel Market, as it provides a cleaner and more durable energy for the future.

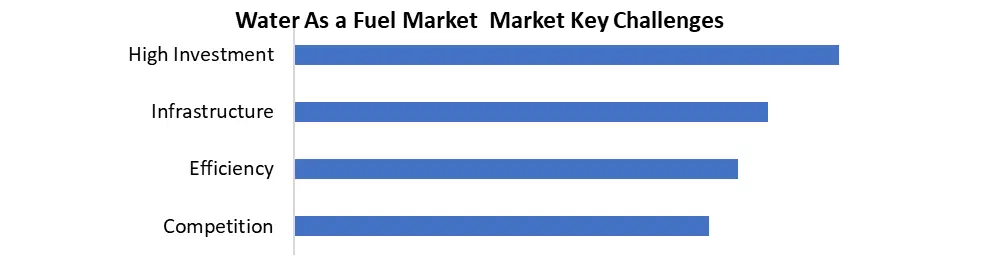

Technological Challenges & Competition from Alternatives to Restrain the Water as a Fuel Market

Despite the progress, electrolyser technology still encounters issues of efficiency and durability, affecting market development by limiting scalability and reliability. Competition from other clean energy sources, such as batteries and carbon capture technology, away from fuel solutions, affects market share and revenue capacity.

Water as a Fuel Market Segment Analysis

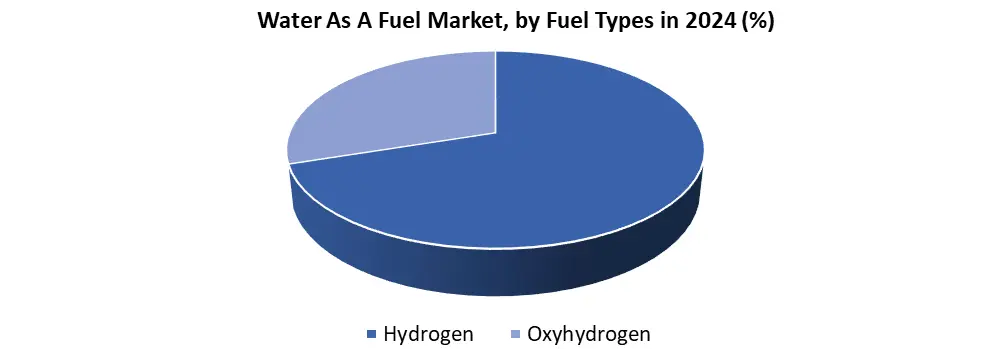

Based on Fuel Type, Water as a Fuel Market is segmented into Hydrogen and oxyhydrogen. Hydrogen is the major fuel type in the global water-based fuel market, which is due to widespread adoption in industries such as well-established infrastructure, scalability and transport, energy storage and power generation. Major investments in green hydrogen (produced through electrolysis using renewable energy) are accelerating its growth, supported by government policies and corporate decarbonization efforts.

The second major fuel type is oxyhydrogen, which is a mixture of hydrogen and oxygen gases, and holds a small but notable part in the market. It is mainly used in welding, improving motor vehicle efficiency and small-scale energy applications. While it lacks a large-scale infrastructure of pure hydrogen, its ability to produce on demand through electrolysis makes it useful for special uses. However, challenges such as storage boundaries and low energy density prohibit its widespread adoption than hydrogen.

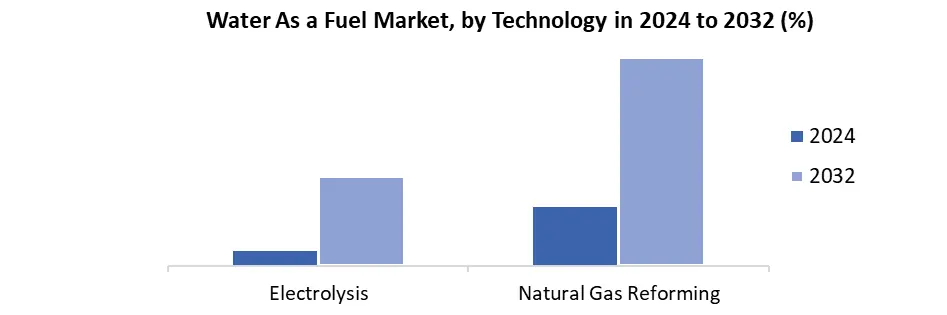

By Technology, the Water as a Fuel Market is segmented into electrolysis and natural gas reforming. Natural gas improvement (especially steam methane correction, or SMR) is currently the major technique for hydrogen production due to its cost-effectiveness and well-established industrial infrastructure. This is for the majority of global hydrogen supply, especially for purification, ammonia production and use in chemical industries. However, this method produces grey hydrogen, which is associated with carbon emissions until the carbon capture (blue hydrogen) is combined. Despite environmental concerns, its economic efficiency keeps it a leading production method for now.

Electrolysis is the fastest-growing hydrogen production method, which is inspired by the increasing demand for green hydrogen (produced using renewable energy). While it currently holds a small market share compared to natural gas improvement, its importance is increasing due to global decarbonization efforts, government encouragement and declining renewable energy costs. Electrolysis is particularly favoured in areas with strong policy support for abundant renewable resources and clean energy. However, high power requirements and capital costs remain important challenges to widespread adoption.

Water as a Fuel Market Regional Analysis

In North America, the Water as a Fuel Market displays significant growth, which occupies a sufficient market share, driven by the United States and Canada. The area's commitment to reducing carbon emissions demands hydrogen-based solutions. Strong investment in research and development promotes technological progress, electroscopy efficiency. Initiatives such as tax encouragement and partnership between government agencies and the private sector increase revenue growth. Transport and power generation fields offer attractive opportunities, in which potential revenue growth is powered by hydrogen fuel cells and green energy strategies.

Europe has emerged as a prominent player in global waters as a fuel market, leading to the increasing traction of solutions in countries such as Germany, France and the Netherlands. The high emphasis on attaining carbon neutrality creates a strong demand for hydrogen technologies in the area. Stringent regulations and subsidies for renewable energy promote electrolyser installations and support market revenue growth.

Water as a Fuel Market Competitive Landscape

According to the latest Water as a Fuel Market analysis, the global industry is moderately consolidated, with a few large-scale vendors controlling the majority of the market share. The majority of organisations are heavily investing in R&D activities. Manufacturers are focusing on Water as a Fuel Market trend and implementing strategies such as new product development, mergers, and acquisitions to gain more revenue.

Panasonic Corporation, Plug Power Inc., Ballard Power Systems, Bloom Energy, AFC Energy Plc, Hydrogenics Corporation, Sinopec, Enapter, ITM Power, and SFC Energy AG are some of the key entities operating in the global market.

In March 2023, Ballard Power Systems and First Mode announced a purchase order for Ballard to supply First Mode with 30 hydrogen fuel cell modules (3 megawatts) for diesel-free mining trucks. This is equivalent to approximately 4,000 horsepower.

|

Water as a Fuel Market Scope |

|

|

Market Size in 2024 |

USD 8.41 Bn. |

|

Market Size in 2032 |

USD 16.51 Bn. |

|

CAGR (2025-2032) |

8.8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Fuel Type Hydrogen Oxyhydrogen |

|

By Technology Electrolysis Natural Gas Reforming |

|

|

By End-User Refineries Manufacturing Petrochemicals Utilities Automotive Aerospace Electronics Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Thailand, Malaysia, Philippines, Vietnam, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Water as a Fuel Market

North America

- Plug Power Inc. (Latham, New York, USA)

- FuelCell Energy Inc. (Danbury, Connecticut, USA)

- Bloom Energy (San Jose, California, USA)

- Giner ELX Inc. (Newton, Massachusetts, USA)

- Ballard Power Systems Inc. (Burnaby, British Columbia, Canada)

- Hydrogenics Corporation (Cummins Inc.) (Mississauga, Ontario, Canada)

Europe

- ITM Power PLC (Sheffield, United Kingdom)

- AFC Energy Plc. (Cranleigh, Surrey, United Kingdom)

- Ceres Power Holdings plc (Horsham, United Kingdom)

- McPhy Energy S.A. (La Motte-Fanjas, France)

- Sunfire GmbH (Dresden, Germany)

- Enapter AG (Berlin, Germany)

- Nel ASA (Oslo, Norway)

- Linde plc (Guildford, United Kingdom)

- Air Liquide (Paris, France)

- Thyssenkrupp Nucera (Dortmund, Germany)

- VARO Energy (Zug, Switzerland)

Asia Pacific

- Panasonic Corporation (Osaka, Japan)

- Mitsubishi Power (Yokohama, Japan)

- Sinopec (Beijing, China)

- ZTT Group (Jiangsu, China)

- Korea Electric Power Corporation (Naju, South Korea)

Middle East and Africa

- Siemens AG (Munich, Germany) (active in MEA projects)

- Green Hydrogen Systems (Kolding, Denmark) (active in MEA projects)

South America

- Petrobras (Rio de Janeiro, Brazil)

- H2U Green Hydrogen (Montevideo, Uruguay)

- YPF Luz (Buenos Aires, Argentina)

Frequently Asked Questions

The Natural Gas Reforming dominated the market due to its cost-effectiveness and well-established industrial infrastructure.

The global Water as a Fuel Market was USD 8.41 billion in 2024.

The top players in the Water as a Fuel Market are Lug Power Inc., Nel ASA, Bloom Energy, Air Liquide, Thyssenkrupp Nucera, ITM Power PLC, and Panasonic Corporation.

1. Water as a Fuel Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Water as a Fuel Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Water as a Fuel Market: Dynamics

3.1. Water as a Fuel Market Trends

3.2. Water as a Fuel Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Water as a Fuel Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

4.1. Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

4.1.1. Hydrogen

4.1.2. Oxyhydrogen

4.2. Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

4.2.1. Electrolysis

4.2.2. Natural Gas Reforming

4.3. Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

4.3.1. Refineries

4.3.2. Manufacturing

4.3.3. Petrochemicals

4.3.4. Utilities

4.3.5. Automotive

4.3.6. Aerospace

4.3.7. Electronics

4.3.8. Others

4.4. Water as a Fuel Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Water as a Fuel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

5.1. North America Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

5.1.1. Hydrogen

5.1.2. Oxyhydrogen

5.2. North America Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

5.2.1. Electrolysis

5.2.2. Natural Gas Reforming

5.3. North America Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

5.3.1. Refineries

5.3.2. Manufacturing

5.3.3. Petrochemicals

5.3.4. Utilities

5.3.5. Automotive

5.3.6. Aerospace

5.3.7. Electronics

5.3.8. Others

5.4. North America Water as a Fuel Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

5.4.1.1.1. Hydrogen

5.4.1.1.2. Oxyhydrogen

5.4.1.2. United States Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

5.4.1.2.1. Electrolysis

5.4.1.2.2. Natural Gas Reforming

5.4.1.3. United States Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

5.4.1.3.1. Refineries

5.4.1.3.2. Manufacturing

5.4.1.3.3. Petrochemicals

5.4.1.3.4. Utilities

5.4.1.3.5. Automotive

5.4.1.3.6. Aerospace

5.4.1.3.7. Electronics

5.4.1.3.8. Others

5.4.2. Canada

5.4.2.1. Canada Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

5.4.2.1.1. Hydrogen

5.4.2.1.2. Oxyhydrogen

5.4.2.2. Canada Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

5.4.2.2.1. Electrolysis

5.4.2.2.2. Natural Gas Reforming

5.4.2.3. Canada Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

5.4.2.3.1. Refineries

5.4.2.3.2. Manufacturing

5.4.2.3.3. Petrochemicals

5.4.2.3.4. Utilities

5.4.2.3.5. Automotive

5.4.2.3.6. Aerospace

5.4.2.3.7. Electronics

5.4.2.3.8. Others

5.4.3. Mexico

5.4.3.1. Mexico Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

5.4.3.1.1. Hydrogen

5.4.3.1.2. Oxyhydrogen

5.4.3.2. Mexico Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

5.4.3.2.1. Electrolysis

5.4.3.2.2. Natural Gas Reforming

5.4.3.3. Mexico Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

5.4.3.3.1. Refineries

5.4.3.3.2. Manufacturing

5.4.3.3.3. Petrochemicals

5.4.3.3.4. Utilities

5.4.3.3.5. Automotive

5.4.3.3.6. Aerospace

5.4.3.3.7. Electronics

5.4.3.3.8. Others

6. Europe Water as a Fuel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

6.1. Europe Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.2. Europe Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.3. Europe Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4. Europe Water as a Fuel Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.1.2. United Kingdom Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.1.3. United Kingdom Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.2. France

6.4.2.1. France Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.2.2. France Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.2.3. France Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.3.2. Germany Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.3.3. Germany Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.4.2. Italy Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.4.3. Italy Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.5.2. Spain Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.5.3. Spain Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.6.2. Sweden Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.6.3. Sweden Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.7. Russia

6.4.7.1. Russia Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.7.2. Russia Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.7.3. Russia Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

6.4.8.2. Rest of Europe Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

6.4.8.3. Rest of Europe Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7. Asia Pacific Water as a Fuel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Asia Pacific Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.2. Asia Pacific Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.3. Asia Pacific Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4. Asia Pacific Water as a Fuel Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.1.2. China Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.1.3. China Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.2.2. S Korea Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.2.3. S Korea Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.3.2. Japan Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.3.3. Japan Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.4. India

7.4.4.1. India Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.4.2. India Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.4.3. India Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.5.2. Australia Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.5.3. Australia Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.6.2. Indonesia Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.6.3. Indonesia Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.7.2. Malaysia Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.7.3. Malaysia Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.8. Philippines

7.4.8.1. Philippines Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.8.2. Philippines Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.8.3. Philippines Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.9. Thailand

7.4.9.1. Thailand Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.9.2. Thailand Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.9.3. Thailand Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.10.2. Vietnam Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.10.3. Vietnam Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

7.4.11.2. Rest of Asia Pacific Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

7.4.11.3. Rest of Asia Pacific Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8. Middle East and Africa Water as a Fuel Market Size and Forecast (by Value in USD Billion) (2025-2032)

8.1. Middle East and Africa Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.2. Middle East and Africa Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.3. Middle East and Africa Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8.4. Middle East and Africa Water as a Fuel Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.4.1.2. South Africa Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.4.1.3. South Africa Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.4.2.2. GCC Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.4.2.3. GCC Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8.4.3. Egypt

8.4.3.1. Egypt Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.4.3.2. Egypt Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.4.3.3. Egypt Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.4.4.2. Nigeria Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.4.4.3. Nigeria Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

8.4.5.2. Rest of ME&A Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

8.4.5.3. Rest of ME&A Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9. South America Water as a Fuel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. South America Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.2. South America Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.3. South America Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9.4. South America Water as a Fuel Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.4.1.2. Brazil Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.4.1.3. Brazil Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.4.2.2. Argentina Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.4.2.3. Argentina Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9.4.3. Colombia

9.4.3.1. Colombia Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.4.3.2. Colombia Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.4.3.3. Colombia Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9.4.4. Chile

9.4.4.1. Chile Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.4.4.2. Chile Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.4.4.3. Chile Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Water as a Fuel Market Size and Forecast, By Fuel Type (2025-2032)

9.4.5.2. Rest Of South America Water as a Fuel Market Size and Forecast, By Technology (2025-2032)

9.4.5.3. Rest Of South America Water as a Fuel Market Size and Forecast, By End-User (2025-2032)

10. Company Profile: Key Players

10.1. Plug Power Inc. (Latham, New York, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Plug Power Inc. (Latham, New York, USA)

10.3. FuelCell Energy Inc. (Danbury, Connecticut, USA)

10.4. Bloom Energy (San Jose, California, USA)

10.5. Giner ELX Inc. (Newton, Massachusetts, USA)

10.6. Ballard Power Systems Inc. (Burnaby, British Columbia, Canada)

10.7. Hydrogenics Corporation (Cummins Inc.) (Mississauga, Ontario, Canada)

10.8. ITM Power PLC (Sheffield, United Kingdom)

10.9. AFC Energy Plc. (Cranleigh, Surrey, United Kingdom)

10.10. Ceres Power Holdings plc (Horsham, United Kingdom)

10.11. McPhy Energy S.A. (La Motte-Fanjas, France)

10.12. Sunfire GmbH (Dresden, Germany)

10.13. Enapter AG (Berlin, Germany)

10.14. Nel ASA (Oslo, Norway)

10.15. Linde plc (Guildford, United Kingdom)

10.16. Air Liquide (Paris, France)

10.17. Thyssenkrupp Nucera (Dortmund, Germany)

10.18. VARO Energy (Zug, Switzerland)

10.19. Panasonic Corporation (Osaka, Japan)

10.20. Mitsubishi Power (Yokohama, Japan)

10.21. Sinopec (Beijing, China)

10.22. ZTT Group (Jiangsu, China)

10.23. Korea Electric Power Corporation (Naju, South Korea)

10.24. Siemens AG (Munich, Germany) (active in MEA projects)

10.25. Green Hydrogen Systems (Kolding, Denmark) (active in MEA projects)

10.26. Petrobras (Rio de Janeiro, Brazil)

10.27. H2U Green Hydrogen (Montevideo, Uruguay)

10.28. YPF Luz (Buenos Aires, Argentina)

11. Key Findings

12. Industry Recommendations

13. Water as a Fuel Market: Research Methodology