High Purity Methane Gas Market: Trends, Growth Opportunities and Forecast (2025-2032)

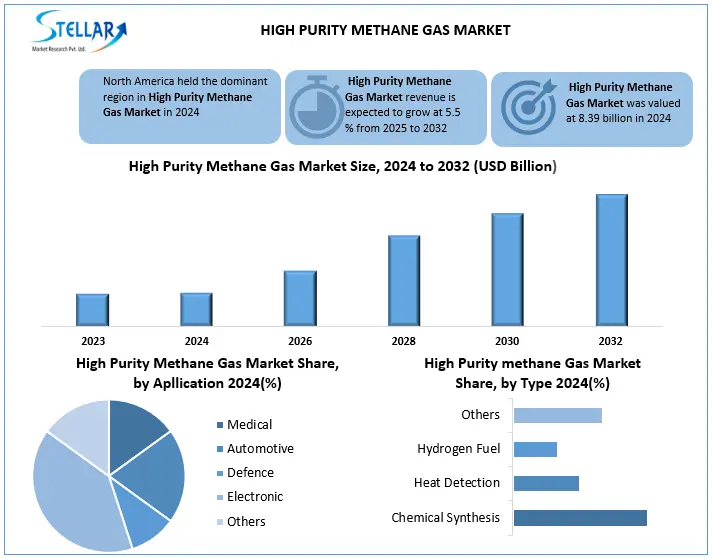

The High Purity Methane Gas Market was valued at USD 8.39 billion in 2024. Its total industry revenue is expected to grow by 5.5% from 2025 to 2032, reaching nearly USD 12.88 billion in 2032.

Format : PDF | Report ID : SMR_2847

High Purity Methane Gas Market Overview

High purity methane gas (typically ≥99.99% purity) is a critical industrial gas used in advanced applications requiring contamination-free performance. It serves as a key feedstock in semiconductor manufacturing (for CVD and etching processes), medical imaging (MRI cooling mixtures), and renewable energy (hydrogen production). Its ultra-clean properties make it indispensable in electronics, healthcare, and precision industries, where even trace impurities can compromise product quality or safety.

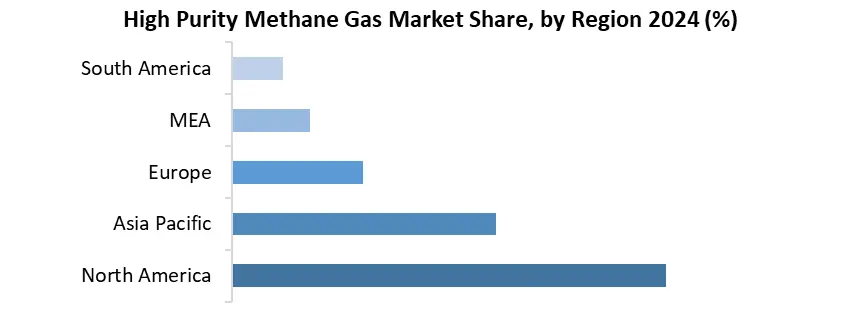

The global high purity methane gas market leads due to a semiconductor expansion and green energy initiative. North America dominates the market due to high-value medical/tech applications. Major players such as Linde, Air Liquide, and Air Products control supply through patent purification takes and strategic partnerships. Emerging trends include biogas-ritual methane and strict purity standards (99.9995%) for the next-gen and healthcare.

Trade policies and tariffs significantly impact the high purity methane gas market, with geopolitical tensions and carbon taxes disrupting supply chains and raising costs. Preferential agreements like USMCA boost trade, while high EU tariffs (6.5%) drive localization efforts. China’s 12% YoY import growth underscores rising demand, but trade barriers risk price volatility and supply shortages, particularly for semiconductors and healthcare.

To get more Insights: Request Free Sample Report

High Purity Methane Gas Market Dynamics

Increasing needs in semiconductor production to Drive the High Purity Methane Gas Market

High purity methane gas market is growing because it is necessary to make semiconductors, which are used in smartphones, computers, and electric vehicles. Methane gas is used in major processes such as chemical vapor deposition (CVD) and is carved to create high quality microchips. As technology advances and equipment becomes smaller, the need for ultra-pure gases like methane increases. The rise of renewable energy and electric vehicles, which depends on the semiconductor, is also promoting demand. To maintain, manufacturers are growing in production and quality, increasing the market.

High expenditure related to gas processing to Restrain the High Purity Methane Gas Market

The expensive nature of gas processing is a significant range in the High Purity Methane Gas Market. Producing high purity methane leads to sophisticated refinery technology and rigid quality control protocol to meet strict requirements of areas such as semiconductors, wherever minus impurities can reduce product efficacy. These procedures require adequate financial investment, special machinery and energy-mang operations, all of which increase production expenses. In addition, ensuring uniform purity standards during storage and transportation increases additional costs. For the end-users, especially in budget-conscious areas, these high costs can obstruct adoption and market expansion. As a result, manufacturers face the difficulty of harmonizing quality and cost-effectiveness, as well as demanding novel approaches for low processing expenses and increase the availability of high purity methane for a wide variety of use.

Advancing intelligent technologies and automation to Boost the High Purity Methane Gas Market

Increasing use of smart technologies and automation provides sufficient possibilities for high purity methane gas market. With increasing integration of smart manufacturing and automatic processes in areas such as semiconductors, electronics, and renewable energy, high purity gases such as methane are estimated to increase. High-purity methane is important in advanced manufacturing procedures such as chemical vapor deposition (CVD) and plasma capacitance, which are required to create high-performance semiconductors and microelectronics used in smart devices, IOT systems, and automation technologies. In addition, the demand for energy-skilled and precise-centered production methods corresponds with the need for ultra-pure gases to guarantee extreme performance and output. This trend creates opportunities for progress in gas refinement, storage, and distribution systems, allowing manufacturers to meet the changing needs of smart technologies and automation. By cashing on these opportunities, participants in the high -purity methane market can wide their influence and encourage development in this vibrant industry.

High Purity Methane Gas Market Regional Analysis

North America It is dominant region in high purity methane gas market. Due to a strong healthcare sector (MRI system), the semiconductor industry is fueled by the Chips Act investment, and strict quality standards leading the high purity methane gas market. The focus of the field on renewable methane for clean energy further strengthens its position. With major players such as Linde and Air Products are leading due to the advanced technology and medical applications.

High Purity Methane Gas Market Segment Analysis

Based on type, the high purity methane gas market is divided into chemical synthesis, heat detection, hydrogen fuel, and others. In high purity methane gas markets, the chemical synthesis segment is currently the major type due to comprehensive use in industrial applications. Methane is an important feedstock in the production of chemicals such as methanol, ammonia and hydrogen, which are essential for fertilizers, plastic and synthetic materials. The increasing demand for these products in industries such as agriculture, petrochemicals and manufacturing increases the dominance of this segment. Additionally, the role of methane in steam improvement for hydrogen production further strengthens its position.

Based on application, the high purity methane gas market is divided into Medical, Automotive, Defence, Electronic, and Others. The medical sector is a major driver of high purity methane gas market, mainly for MRI cooling (helium-methane mix), respiratory diagnosis and gas chromatography in laboratories. With ultra-high purity (>99.999%) requirements and strong demand in North America and Europe due to an increase in chronic diseases and advanced medical technologies further strengthens its dominance over industrial uses. Top suppliers such as Linde and Air Liquide prefer medical-grade production, ensuring stable growth in this high-value section.

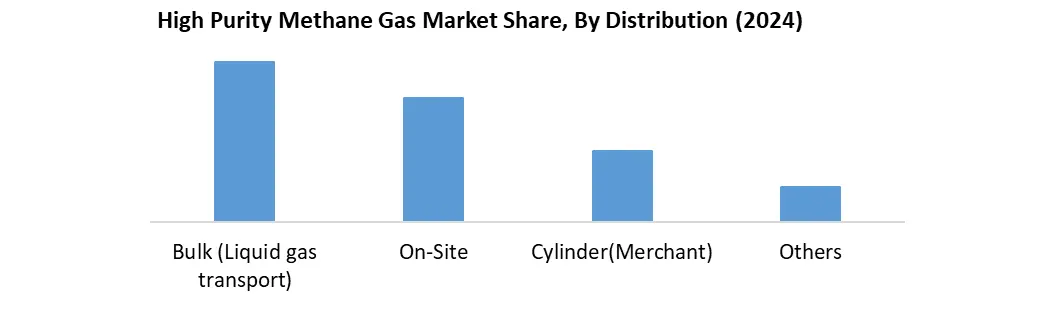

Based on distribution, the high purity methane gas market is divided into On-Site, Bulk (Liquid Gas Transport), Cylinder (Merchant), and others. The bulk (liquid gas transport) segment dominates the high-purity methane gas market because it is the most cost-effective and efficient method for supplying large industrial users, such as chemical plants and power generators, which require high volumes of methane. Cylinder and on-site distribution are smaller-scale solutions, making bulk delivery the preferred choice for major consumers.

High Purity Methane Gas Market Competitive Landscape

High purity methane gas market is dominated by Linde, Air Liquide and Air Products due to advanced refinery technology, global supply chains and major partnerships. In Linde electronics-grade methane, Air Liquide in medical applications and Air Products in industrial bulk supply. Their dominance arises from a contract with veterans like R&D, stability initiative, and TSMC and Intel. Small players focus on niche segments but lack comparative scale.

High Purity Methane Gas Market Recent Development

Air Liquide’s Medical Focus

- On 12 March 2024, partnered with GE Healthcare to supply ultra-pure methane-helium mixes for next-gen MRI systems, targeting 99.9995% purity

|

High Purity Methane Gas Market Scope |

|

|

Market Size in 2024 |

USD 8.39 Bn. |

|

Market Size in 2032 |

USD 12.88 Bn. |

|

CAGR (2024-2032) |

5.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Segments |

By Type Chemical Synthesis Heat Detection Hydrogen Fuel Others |

|

By Distribution On-Site Bulk (Liquid Gas Transport) Cylinder (Merchant) others |

|

|

By Application Medical Automotive Defence Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the High Purity Methane Gas Market

North America

- Air Products & Chemicals, Inc. (USA)

- Praxair, Inc. (Linde plc subsidiary) (USA)

- Matheson Tri-Gas, Inc. (USA)

- Messer Group (US operations) (USA)

- American Gas Products (Florida, USA)

Europe

- Linde plc (Germany)

- Air Liquide S.A. (Paris, France)

- Messer Group GmbH (Germany)

- SOL Group (Italy)

- Nippon Gases (Germany)

Asia-Pacific

- Taiyo Nippon Sanso Corporation (Tokyo, Japan)

- Sumitomo Seika Chemicals (Osaka, Japan)

- Air Water Inc. (Osaka, Japan)

- Korea Gas Corporation (KOGAS) (Seoul, South Korea)

- Gulf Cryo (Dubai, UAE – with strong APAC presence)

- Huate Gas Co., Ltd. (Chengdu, China)

- Hangzhou Hangyang Co., Ltd. (Hangzhou, China)

- Beijing Yanjing Gas Co., Ltd. (Beijing, China)

- Linde India Ltd. (Mumbai, India)

Middle East & Africa

- Gulf Cryo (Dubai, UAE)

- Saudi Industrial Gas Co. (SIGAS) (Riyadh, Saudi Arabia)

- African Oxygen Limited (Afrox) (Johannesburg, South Africa)

South America

- White Martins (Praxair subsidiary) (Rio de Janeiro, Brazil)

- Linde Argentina S.A. (Buenos Aires, Argentina)

- Indura S.A. (Santiago, Chile)

- Oxiquim S.A. (Santiago, Chile)

- Gases del Pacífico (Lima, Peru)

Frequently Asked Questions

Creating high-purity methane requires refined purification, special machinery, and energy-mang methods, resulting in an increase in high cost and price-sensitive areas.

It guarantees cost-effectiveness and a stable supply, allowing it to be perfect for mass applications such as semiconductor production.

It is used to make transistors, sensors and power electronics, and in CVD processes for semiconductors.

1. High Purity Methane Gas Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global High Purity Methane Gas Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. High Purity Methane Gas Market: Dynamics

3.1. High Purity Methane Gas Market Trends by Region

3.1.1. North America High Purity Methane Gas Market Trends

3.1.2. Europe High Purity Methane Gas Market Trends

3.1.3. Asia Pacific High Purity Methane Gas Market Trends

3.1.4. Middle East and Africa High Purity Methane Gas Market Trends

3.1.5. South America High Purity Methane Gas Market Trends

3.2. High Purity Methane Gas Market Dynamics

3.2.1. Global High Purity Methane Gas Market Drivers

3.2.2. Global High Purity Methane Gas Market Restraints

3.2.3. Global High Purity Methane Gas Market Opportunities

3.2.4. Global High Purity Methane Gas Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for High Purity Methane Gas Industry

4. High Purity Methane Gas Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

4.1.1. Chemical Synthesis

4.1.2. Heat Detection

4.1.3. Hydrogen Fuel

4.1.4. Others

4.2. High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

4.2.1. On-Site

4.2.2. Bulk (Liquid Gas Transport)

4.2.3. Cylinder (Merchant)

4.2.4. Others

4.3. High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

4.3.1. Medical

4.3.2. Automotive

4.3.3. Defence

4.3.4. Electronic

4.3.5. Others

4.4. High Purity Methane Gas Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America High Purity Methane Gas Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

5.1.1. Chemical Synthesis

5.1.2. Heat Detection

5.1.3. Hydrogen Fuel

5.1.4. Others

5.2. North America High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

5.2.1. On-Site

5.2.2. Bulk (Liquid Gas Transport)

5.2.3. Cylinder (Merchant)

5.2.4. Others

5.3. North America High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

5.3.1. Medical

5.3.2. Automotive

5.3.3. Defence

5.3.4. Electronic

5.3.5. Others

5.4. North America High Purity Methane Gas Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Chemical Synthesis

5.4.1.1.2. Heat Detection

5.4.1.1.3. Hydrogen Fuel

5.4.1.1.4. Others

5.4.1.2. United States High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

5.4.1.2.1. On-Site

5.4.1.2.2. Bulk (Liquid Gas Transport)

5.4.1.2.3. Cylinder (Merchant)

5.4.1.2.4. Others

5.4.1.3. United States High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Medical

5.4.1.3.2. Automotive

5.4.1.3.3. Defence

5.4.1.3.4. Electronic

5.4.1.3.5. Others

5.4.1.4. Canada High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

5.4.1.4.1. Chemical Synthesis

5.4.1.4.2. Heat Detection

5.4.1.4.3. Hydrogen Fuel

5.4.1.4.4. Others

5.4.1.5. Canada High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

5.4.1.5.1. On-Site

5.4.1.5.2. Bulk (Liquid Gas Transport)

5.4.1.5.3. Cylinder (Merchant)

5.4.1.5.4. Others

5.4.2. Canada High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

5.4.2.1.1. Medical

5.4.2.1.2. Automotive

5.4.2.1.3. Defence

5.4.2.1.4. Electronic

5.4.2.1.5. Others

5.4.3. Mexico

5.4.3.1. Mexico High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

5.4.3.1.1. Chemical Synthesis

5.4.3.1.2. Heat Detection

5.4.3.1.3. Hydrogen Fuel

5.4.3.1.4. Others

5.4.3.2. Mexico High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

5.4.3.2.1. On-Site

5.4.3.2.2. Bulk (Liquid Gas Transport)

5.4.3.2.3. Cylinder (Merchant)

5.4.3.2.4. Others

5.4.3.3. Mexico High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Medical

5.4.3.3.2. Automotive

5.4.3.3.3. Defence

5.4.3.3.4. Electronic

5.4.3.3.5. Others

6. Europe High Purity Methane Gas Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.2. Europe High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.3. Europe High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4. Europe High Purity Methane Gas Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.1.3. United Kingdom High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.2.3. France High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.3.3. Germany High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.4.3. Italy High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.5.3. Spain High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.6.3. Sweden High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.7. Austria

6.4.7.1. Austria High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.7.3. Austria High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

6.4.8.3. Rest of Europe High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific High Purity Methane Gas Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.3. Asia Pacific High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific High Purity Methane Gas Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.1.3. China High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.2.3. S Korea High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.3.3. Japan High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.4.3. India High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.5.3. Australia High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.6.3. Indonesia High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Malaysia High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.7.3. Malaysia High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.8. Vietnam

7.4.8.1. Vietnam High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Vietnam High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.8.3. Vietnam High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Thailand High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.9.3. Thailand High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.10. Philippines

7.4.10.1. Philippines High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Philippines High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.10.3. Philippines High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

7.4.11.3. Rest of Asia Pacific High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa High Purity Methane Gas Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

8.3. Middle East and Africa High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa High Purity Methane Gas Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

8.4.1.3. South Africa High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

8.4.2.3. GCC High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

8.4.3.3. Nigeria High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

8.4.4.3. Rest of ME&A High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

9. South America High Purity Methane Gas Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

9.2. South America High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

9.3. South America High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

9.4. South America High Purity Methane Gas Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

9.4.1.3. Brazil High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

9.4.2.3. Argentina High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America High Purity Methane Gas Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America High Purity Methane Gas Market Size and Forecast, By Distribution (2024-2032)

9.4.3.3. Rest Of South America High Purity Methane Gas Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. Air Products & Chemicals, Inc. (Allentown, Pennsylvania, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Praxair, Inc. (Linde plc subsidiary) (Danbury, Connecticut, USA)

10.3. Matheson Tri-Gas, Inc. (Basking Ridge, New Jersey, USA)

10.4. Messer Group (US operations) (Bridgewater, New Jersey, USA)

10.5. American Gas Products (Florida, USA)

10.6. Linde plc (Guildford, UK / Munich, Germany)

10.7. Air Liquide S.A. (Paris, France)

10.8. Messer Group GmbH (Bad Soden, Germany)

10.9. SOL Group (Monza, Italy)

10.10. Nippon Gases (formerly Eurogases) (Düsseldorf, Germany)

10.11. Taiyo Nippon Sanso Corporation (Tokyo, Japan)

10.12. Sumitomo Seika Chemicals (Osaka, Japan)

10.13. Air Water Inc. (Osaka, Japan)

10.14. Korea Gas Corporation (KOGAS) (Seoul, South Korea)

10.15. Gulf Cryo (Dubai, UAE – with strong APAC presence)

10.16. Huate Gas Co., Ltd. (Chengdu, China)

10.17. Hangzhou Hangyang Co., Ltd. (Hangzhou, China)

10.18. Beijing Yanjing Gas Co., Ltd. (Beijing, China)

10.19. Linde India Ltd. (Mumbai, India)

10.20. Gulf Cryo (Dubai, UAE)

10.21. Saudi Industrial Gas Co. (SIGAS) (Riyadh, Saudi Arabia)

10.22. African Oxygen Limited (Afrox) (Johannesburg, South Africa)

10.23. White Martins (Praxair subsidiary) (Rio de Janeiro, Brazil)

10.24. Linde Argentina S.A. (Buenos Aires, Argentina)

10.25. Indura S.A. (Santiago, Chile)

10.26. Oxiquim S.A. (Santiago, Chile)

10.27. Gases del Pacífico (Lima, Peru)

11. Key Findings

12. Analyst Recommendations

13. High Purity Methane Gas Market: Research Methodology