Europe Polyhydroxyalkanoates Market & Sustainable Plastics Future 2032

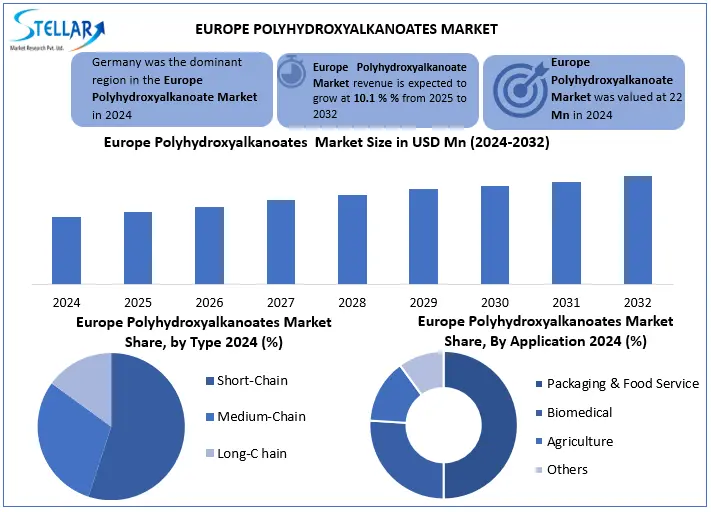

Europe Polyhydroxyalkanoates Market size was valued at USD 22 million in 2024, and the total Europe Polyhydroxyalkanoates Market size is expected to grow at a CAGR of 10.1% from 2025 to 2032, reaching nearly USD 47.50 million by 2032.

Format : PDF | Report ID : SMR_2890

Europe Polyhydroxyalkanoates Market Overview

Polyhydroxyalkanoate is biodegradable, bio-based polyester produced by microorganisms, used as sustainable alternative to conventional plastics in packagings, medical devices and agricultural films by its natural compostability and marine degradation properties.

Europe Polyhydroxyalkanoates market has been expanding globally by bans on single use plastics and demand for biodegradable alternatives. Produced from renewable feedstocks via microbial fermentation, unpackaging, agriculture and medical implants. Key drivers include corporate sustainability commitments and innovations like waste derive Polyhydroxyalkanoate production, reducing costs. Europe is growing rapidly under strict regulations like Europe Single Use Plastics Directive and Major players like Bio-on S.P.A., Biome Bioplastics Ltd., BASF SE, focusing on high value applications like marine-degradable packaging and absorbable medical devices.

Trade policies, like EU carbon taxes, further incentivize adoption, markets future hinges on cost reduction and niche applications, particularly in flexible packaging and biomedical sectors, aligning with circular economy goals.

Europe Polyhydroxyalkanoates Market Recent Developments

|

Date |

Company |

Development |

|

May 4, 2023 |

BASF SE (Germany) |

Launched Ecovio 70 PS14H6, a biodegradable polymer suitable for extrusion coating in food-contact packaging. |

|

April 9, 2025 |

Bioextrax AB (Sweden) |

Announced involvement in the EU COM4PHA project to develop cost-efficient PHBV-based materials for packaging and agriculture. |

To get more Insights: Request Free Sample Report

Europe Polyhydroxyalkanoates Market Dynamics

Increasing concerns for human health and safety to drive the Europe Polyhydroxyalkanoates Market Growth

Manufacturers in Europe Polyhydroxyalkanoates market blend PHAs with other polymers to provide valuable human-use options. Moreover, thermal decomposition methods such as pyrolysis are being used for chemically decomposing PHA into other substances which can recover 85% of monomer content from PHA, by the presence of heat and leaving no harm to the environment. biopolymers has improved mechanical performance by 30–40%, expanding their use in medical devices, packaging, and agricultural films.

Growing investments in R&D activities to drive the Europe Polyhydroxyalkanoates Market

Polyhydroxyalkanoates are diverse group of biodegradable polyesters which can be synthesized through biological and non-biological routes. Polyhydroxyalkanoates are compounds belong to class of polyesters made from renewable resources like corn starch or sugar cane bagasse. The growing acceptance of PHA in various industries and segments, companies are investing heavily around USD 250 million, to explore new applications for PHA including biomedical products, paints & coatings and textile which is expected to offer lucrative opportunities for growth of the Europe Polyhydroxyalkanoates market.

Slow advancement in manufacturing technologies to Restrain the Europe Polyhydroxyalkanoates Production

Economic threats hamper the broad market penetration of Europe Polyhydroxyalkanoates production of these materials is still significantly more expensive 3-5 times higher as compared to the well-established, large-scale manufacturing of petrol-based plastics. In particular, the allocation of feedstocks needed for PHA production drastically contributes to these polyesters still high production price. The major limitations in producing PHAs are special growth conditions required, substrate composition, cultures condition, fermentation processes (batch, fed-batch, repeated batch, or fed-batch, and continuous modes), and high recovery cost. In addition, the production of PHA generates a large amount of biomass waste upto 3-4 kg of wet biomass waste, increasing the disposable and treatment cost

Europe Polyhydroxyalkanoates Market Segment Analysis

Based on type, Europe Polyhydroxyalkanoates market is categorized into short chain, medium chain and long chain. In 2024 short chain segment held largest market share, primarily attributed to its lower production costs, ease of availability and favourable mechanical properties. Short chain Polyhydroxyalkanoate are widely utilized in commercial applications due to their excellent biodegradability and material stability. Rapid expansion of global packaging industry is expected to continue driving demand for short-chain-length Polyhydroxyalkanoate in coming years.

Based on application, Europe Polyhydroxyalkanoates market is segmented into packaging & food, biomedical, agriculture, others. Packaging and food services emerged as the dominated application area in 2024, accounting for approximately 62% of total Europe Polyhydroxyalkanoates market share. Current manufacturing process rely heavily on microbial fermentation, which requires significant capital investment and complex infrastructure for large scale implementation. Performance characteristics of Europe Polyhydroxyalkanoates present limitations in specific end use applications. PHAs are leading in biodegradability and environmental compatibility however, their mechanical properties, including tensile strength, elasticity and thermal resistance, may fall short when compared to traditional plastics. These material constraints restrict their applicability in industries that demand high performance polymers, such as automotive, electronics and certain types of rigid packaging.

Europe Polyhydroxyalkanoates Market Country Analysis

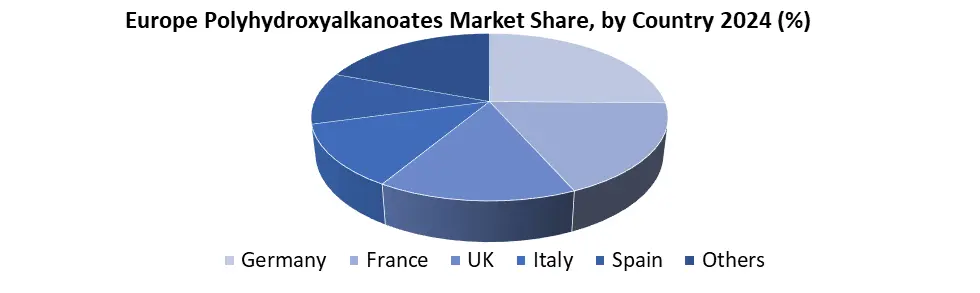

Germany dominated the Europe Polyhydroxyalkanoates market by 25.7% of the total market share in 2024. Countries like France, UK, Italy and Spain have established a strong manufacturing base with advanced biopolymer production capabilities. Key companies are headquartered in this country like Bio-on S.P.A., Biome Bioplastics Ltd., BASF SE, contributing to Europe Polyhydroxyalkanoates output through large scale, cost efficient production. Regional growth is further growing by supportive government policies aimed at reducing plastic pollution like China strict bans on single use plastics and also Indian regulations promoting biodegradable alternatives. Benefits from abundant availability of lowcost feedstock, including agricultural and industrial waste, which enhances sustainability and economic feasibility of Europe Polyhydroxyalkanoates production. Rapid industrialization, along with expanding packaging, agriculture, biomedical and a consumer goods sectors, is increasing demand for eco-friendly and biodegradable materials. Continuous investments in research and development for genetically engineered microorganisms and advanced fermentation techniques are helping reduce production costs and improve product performance.

Europe Polyhydroxyalkanoates Market Competitive Landscape

Europe Polyhydroxyalkanoates (PHA) market is evolving, with innovation and sustainability driving growth. The market is projected to grow from 2025-2032, driven by the EU’s focus on biodegradable plastics and single-use plastic bans. Novamont S.P.A. leads the region in biopolymer integration, leveraging its MATER-BI technology and acquisition of Bio-on assets, although it does not produce PHA directly. BASF SE, while not focused on PHA, holds a strong position in compostable bioplastics through its Ecovio line, contributing to Europe leadership in sustainable packaging. Among innovators, Bioextrax AB (Sweden) stands out with its patented solvent-free extraction process that can reduce PHA production costs by up to 50%, offering a key competitive advantage and attracting licensing interest.

Biome Bioplastics and Biomer occupy smaller but specialized niches in packaging and technical PHA applications, while Polyhydroxyalkanoate Solutions Ltd. shows little recent public activity. Overall, the European PHA landscape is dominated by a mix of R&D-focused startups and large chemical firms preparing to scale as demand for natural, compostable plastics accelerates across the Europe.

|

Europe Polyhydroxyalkanoates Market |

|

|

Market Size in 2024 |

USD 22 Million |

|

Market Size in 2032 |

USD 47.50 Million |

|

CAGR (2024-2032) |

10.1 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Short-chain Medium-chain Long-chain |

|

By Application Packaging & Food Service Biomedical Agriculture Others |

|

|

Country Covered |

UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe |

Europe Polyhydroxyalkanoates Market Key Players

Germany

- BASF SE (Germany)

- Biomer (Germany)

Italy

- Novamont S.P.A. (Italy)

- Bio-on S.P.A. (Italy)

UK

- Biome Bioplastics Ltd. (UK)

- Polyhydroxyalkonate Solutions Ltd. (UK)

Sweden

- Bioextrax AB (Sweden)

Frequently Asked Questions

The Europe PHA market is expected to grow at a CAGR of over 10.1% from 2025 to 2032.

Major challenge is that Polyhydroxyalkanoates is expensive to produce compared to regular plastic.

Germany is the leading country in Europe, with the largest market share for Europe Polyhydroxyalkanoates.

1. Europe Polyhydroxyalkanoates Market: Research Methodology

2. Europe Polyhydroxyalkanoates Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Europe Polyhydroxyalkanoates Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquater

3.3.3. Product Segment

3.3.4. End-user Segment

3.3.5. Revenue (2023)

3.3.6. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Europe Polyhydroxyalkanoates Market: Dynamics

4.1. Europe Polyhydroxyalkanoates Market Trends

4.2. Europe Polyhydroxyalkanoates Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

4.7. Advancements in Renewable Energy Cables

5. Europe Polyhydroxyalkanoates Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

5.1. Europe Polyhydroxyalkanoates Market Size and Forecast, By Type (2024-2032)

5.1.1. Short-chain

5.1.2. Medium-chain

5.1.3. Long-chain

5.2. Europe Polyhydroxyalkanoates Market Size and Forecast, By Application (2024-2032)

5.2.1. Packaging & Food Service

5.2.2. Biomedical

5.2.3. Agriculture

5.2.4. Others

5.3. Europe Polyhydroxyalkanoates Market Size and Forecast, By Country (2024-2032)

5.3.1. United Kingdom

5.3.1.1. United Kingdom Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Short-chain

5.3.1.1.2. Medium-chain

5.3.1.1.3. Long-chain

5.3.1.2. United Kingdom Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.1.2.1. Packaging & Food Service

5.3.1.2.2. Biomedical

5.3.1.2.3. Agriculture

5.3.1.2.4. Others

5.3.2. France

5.3.2.1. France Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.2.2. France Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.3. Germany

5.3.3.1. Germany Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.3.2. Germany Polyhydroxyalkanoate Market Size and Forecast, By Application 2025-2032)

5.3.4. Italy

5.3.4.1. Italy Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.4.2. Italy Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.5. Spain

5.3.5.1. Spain Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.5.2. Spain Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.6. Sweden

5.3.6.1. Sweden Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.6.2. Sweden Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.7. Russia

5.3.7.1. Russia Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.7.2. Russia Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

5.3.8. Rest of Europe

5.3.8.1. Rest of Europe Polyhydroxyalkanoate Market Size and Forecast, By Type (2024-2032)

5.3.8.2. Rest of Europe Polyhydroxyalkanoate Market Size and Forecast, By Application (2024-2032)

6. Company Profile: Key Players

6.1. Biomer (Germany)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bio-on S.P.A. (Italy)

6.3. Biome Bioplastics Ltd. (UK)

6.4. BASF SE (Germany)

6.5. Novamont S.P.A. (Italy)

6.6. Polyhydroxyalkonate Solutions Ltd. (UK)

6.7. Bioextrax AB (Sweden)

7. Key Findings

8. Industry Recommendations