United Kingdom Automotive Engine Oil Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

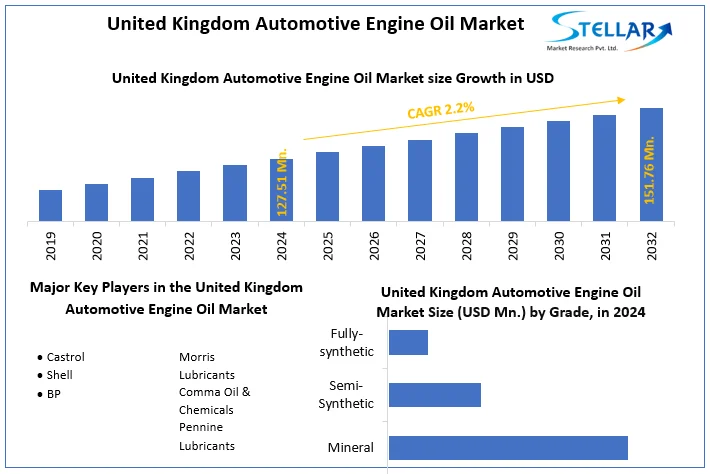

The United Kingdom Automotive Engine Oil Market size was valued at USD 127.51 Mn. Litres in 2024 and the total United Kingdom Automotive Engine Oil Market size is expected to grow at a CAGR of 2.2 % from 2025 to 2032, reaching nearly USD 151.76 Mn. Litres.

Format : PDF | Report ID : SMR_1731

United Kingdom Automotive Engine Oil Market Overview

Automotive Engine oil is a lubricant used in internal combustion engines, which power cars, motorcycles, lawnmowers, engine-generators, and many other machines. In engines, some parts move against each other, and the friction between the parts wastes otherwise useful power by converting kinetic energy into heat.

The Report has covered various aspects related to market strategies, competition landscape, dynamics, segment analysis, and key players present in the United Kingdom Automotive Engine Oil Market. The United Kingdom Automotive Engine Oil Market revenue is expected to grow from xx to xx during the forecast year with an increase in sales of the product. The commercial sector has boosted economic growth by xx%. The in-depth analysis of leading Market leaders and their product strategies which is implemented for United Kingdom Automotive Engine Oil Manufacturing is provided to get insights about the United Kingdom Market. Intrinsic factors such as drivers and restraints are examined, along with extrinsic factors like opportunities and challenges in the market.

- The UK hosts some of the world’s most renowned small volume manufacturers including quintessentially British brands producing luxury vehicles and sports cars.

To get more Insights: Request Free Sample Report

United Kingdom Automotive Engine Oil Market Dynamics

Driving Forces behind the Growth of the Automotive Engine Oil Market in the United Kingdom

The UK has a growing oil collection and re-refining sector producing light feedstock for power stations and industry fuel or other oil-based products for manufacturing as a result there is an increase in demand for the automotive engine oil market in the United Kingdom. The UK remains a global leader in automotive production and exports, with an increasing number of cars, vans, buses, trucks, taxis, specialists, and even off-highway vehicles transitioning towards zero emissions which has propelled the market growth of engine oil in the country. The Rising growth of commercial and Logistics sectors in the United Kingdom has accelerated the demand for engine oils owing to a surge in vehicle fleets in the UK.

Navigating Challenges in the United Kingdom's Automotive Engine Oil Market

In a United Kingdom competitive market environment, price sensitivity remains an important factor influencing consumer purchase decisions. While good quality motor oils offer undeniable benefits in terms of performance and protection, some consumers opt for cheaper options at the expense of quality as a result it has hindered the demand for automotive engine oil in the United Kingdom. The supply chain shortages in engine oil in the United Kingdom were impacted because of Russia and Ukraine ware which led to a shortage of engine oil in the country.

The shift towards the Electrification of consumers has created barriers in the automotive engine oil market. For instance, the rising adoption of electric vehicles presents both challenges and opportunities for the automotive lubricants industry. While EVs eliminate the need for traditional engine oils, there's a growing demand for specialized lubricants for electric drivetrains, gearboxes, and auxiliary systems.

United Kingdom Automotive Engine Oil Market Segment Analysis

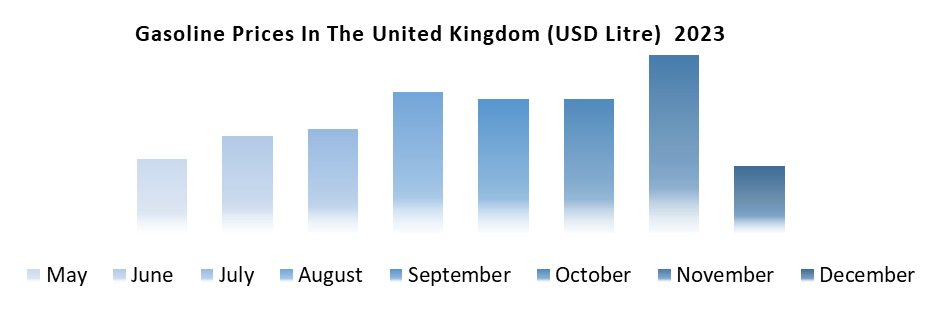

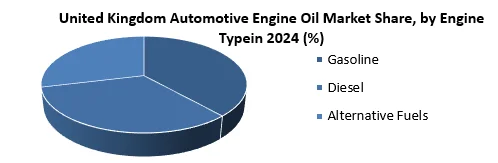

Based on Engine Type, the Gasoline Segment held the largest number share with a growing CAGR during the forecast period. Gasoline is a fuel made from crude oil and other petroleum liquids. Gasoline is mainly used in vehicle engines. Petroleum refineries and blending facilities produce finished motor gasoline for retail sale at gasoline fuelling stations. In the UK, road transport accounts for more than half of the oil demand and relies on petrol and diesel to meet around 98 percent of its energy needs. Demand is met through a combination of production and imports; the UK is a net importer of diesel but a net exporter of petrol.

According to Stellar Analysis, The four biggest UK supermarkets have doubled their profit margins on fuel since Russia invaded Ukraine in February 2022.

According to the Regulation of the United Kingdom, Under the Petroleum Act of 1998, the Crown has all ownership rights to hydrocarbon resources in the UK. Responsibility for administration on behalf of the Crown falls to the Secretary of State for the Department for Business, Energy and Industrial Strategy (BEIS).

- The UK government has announced that sales of new petrol and diesel cars and vans are estimated to be banned from 2030, and sales of new hybrids from 2035.

|

|

United Kingdom Automotive Engine Oil Market Scope |

|

Market Size in 2024 |

USD 127.51 Mn. |

|

Market Size in 2032 |

USD 151.76 Mn. |

|

CAGR (2025-2032) |

2.2 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Grade

|

|

By Engine Type

|

|

|

By Vehicle Type

|

United Kingdom Automotive Engine Oil Market Key Players

- Castrol

- Shell

- BP

- Morris Lubricants

- Comma Oil & Chemicals

- Pennine Lubricants

Frequently Asked Questions

Shift towards Electric Vehicles are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 127.51 Million in 2024 and the total Market revenue is expected to grow at a CAGR of 2.2 % from 2025 to 2032, reaching nearly USD 151.76 Billion.

The segments covered in the market report are By Grade, Engine Type, and Vehicle Type.

1. United Kingdom Automotive Engine Oil Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. United Kingdom Automotive Engine Oil Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. United Kingdom Automotive Engine Oil Market Import Export Landscape

3.1. Import Trends

3.2. Export Trends

3.3. Regulatory Compliance

3.4. Major Export Destinations

3.5. Import-Export Disparities

4. United Kingdom Automotive Engine Oil Market: Dynamics

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.1.4. Market Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Regulatory Landscape

4.5. Analysis of Government Schemes and Initiatives for the United Kingdom Automotive Engine Oil Industry

5. United Kingdom Automotive Engine Oil Market Size and Forecast by Segments (by Value USD)

5.1. United Kingdom Automotive Engine Oil Market Size and Forecast, by Grade (2024-2032)

5.1.1. Mineral

5.1.2. Semi-Synthetic

5.1.3. Fully-synthetic

5.2. United Kingdom Automotive Engine Oil Market Size and Forecast, by Engine Type (2024-2032)

5.2.1. Gasoline

5.2.2. Diesel

5.2.3. Alternative Fuels

5.3. United Kingdom Automotive Engine Oil Market Size and Forecast, by Vehicle Type (2024-2032)

5.3.1. Passenger Cars

5.3.2. Light Commercial Vehicles

5.3.3. Heavy-Duty Vehicles

5.3.4. Motorcycle

6. United Kingdom Automotive Engine Oil Market: Competitive Landscape

6.1. STELLAR Competition Matrix

6.2. Competitive Landscape

6.3. Key Players Benchmarking

6.3.1. Company Name

6.3.2. Service Segment

6.3.3. End-user Segment

6.3.4. Revenue (2024)

6.3.5. Company Locations

6.4. Leading United Kingdom Automotive Engine Oil Market Companies, by market capitalization

6.5. Market Structure

6.5.1. Market Leaders

6.5.2. Market Followers

6.5.3. Emerging Players

6.6. Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1. Castrol

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Scale of Operation (small, medium, and large)

7.1.7. Details on Partnership

7.1.8. Regulatory Accreditations and Certifications Received by Them

7.1.9. Awards Received by the Firm

7.1.10. Recent Developments

7.2. Shell

7.3. BP

7.4. Morris Lubricants

7.5. Comma Oil & Chemicals

7.6. Pennine Lubricants

8. Key Findings

9. Industry Recommendations

10. Terms and Glossary