Europe Ethanolamine Market- Europe Industry Analysis and Forecast (2025-2032)

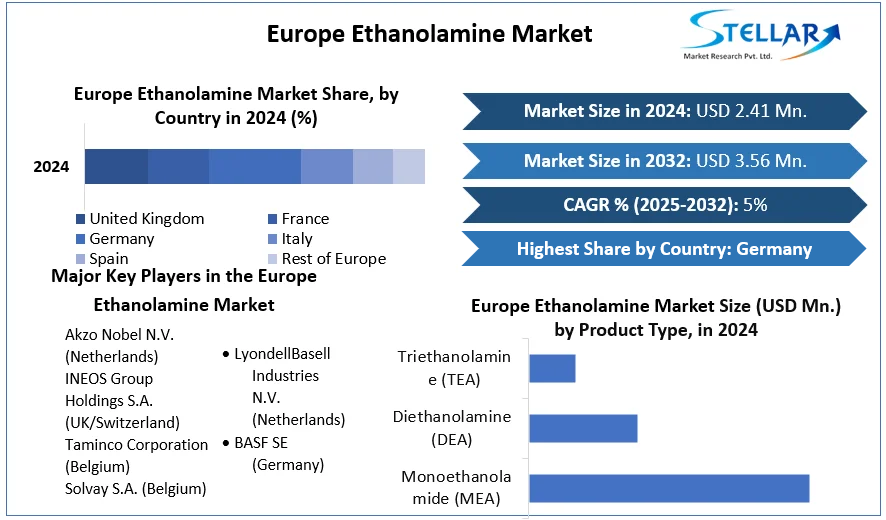

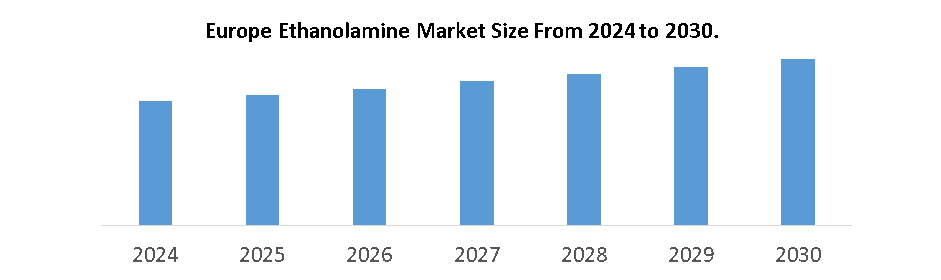

Europe Ethanolamine Market size was valued at USD 2.41 Bn. in 2024 and Europe Ethanolamine Revenue is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 3.56 Bn. in 2032.

Format : PDF | Report ID : SMR_1711

Europe Ethanolamine Market Overview:

Ethanolamines are compounds with both amine and alcohol functionality on ethyl carbon backbones, produced from the application of liquid phase ammonia to ethylene oxide. The reaction has been controlled to produce a combination of three commercially significant products, commonly known as monoethanolamide (MEA), diethanolamine (DEA), and triethanolamine (TEA).

European ethanolamine’s demand is likely to grow moderately through the forecast period, while the actual production is likely to stay relatively stable, although utilization rates are likely to be increased, to keep up with growing demand. It remains unclear whether changes in ethanolamine’s nameplate capacity in Europe.

Report on the Ethanolamine Market which covers Market Overview, Future Economic Impact, Competition by Manufacturers, Supply (Production), and Consumption Analysis.

The market research report on the global Ethanolamine industry provides a comprehensive study of the various materials used in the production of Ethanolamine market products. Starting from industry chain analysis to cost structure analysis, the report analyses multiple aspects, including the production and end-use segments of the Ethanolamine market products. The latest trends in the pharmaceutical industry have been detailed in the report to measure their impact on the production of Ethanolamine market products.

To get more Insights: Request Free Sample Report

Europe Ethanolamine Market Dynamics:

Driving Forces Behind Europe's Ethanolamine Market

The increasing demand of the cleaning products industry and increasing usage of personal care products is driving the Europe Ethanolamine Market. There are three main ethanolamines, mono-ethanolamine (MEA), di-ethanolamine (DEA), and tri-ethanolamine (TEA). MEA’s main use is in the manufacture of ethylene amine, personal care products/detergents, industrial surfactants used in crude oil and shale gas exploration, and wood treatments. Ethanolamine’s supply has been largely sufficient for requirements in most cases, despite output/supply constraints for certain players.

Ethanolamine's amphiphilic nature, which has both hydrophilic and hydrophobic properties, makes it an ideal ingredient for surfactants. Surfactants are used in various cleaning products, cosmetics, and agrochemicals, contributing to the rising demand for Ethanolamine Market.

Challenges and shifts in Europe's Ethanolamine Market

There have also been findings linking liver tumors to DEA use in cosmetics, and as such its use in cosmetics has already been banned in the European Union. Cocomide MEA has been stigmatized as a cause of skin irritation, although most tests have found it to be non-irritating in the required formulations of both rinse-off and leave-on personal care products.

After ethylene oxide (EO) prices exploded in Western Europe thanks to lower imports, reduced domestic supply, higher energy prices, and higher raw material prices the early months of 2022 to April were relatively high. Thanks to continuous production restrictions in countries exporting to the region. As the economic climate in Western Europe began to weaken, domestic demand in key sectors such as construction, automotive, textiles, oil and gas, cleaning, and personal care manufacturing began to decline in the second half of 2022 and continued to decline through 2023.

Europe Ethanolamine Market Segment Analysis:

By End Users, the Cleaning industry held the largest share of Ethanolamine Market. Ethanolamines such as MEA are common ingredients in cleaning products like floor and tile cleaners, as well as laundry detergents. As a surfactant in the products, ethanolamine helps remove dirt, grease, and stains. DEA is a common ingredient in industrial cleaning products, such as engine degreasers and industrial strength detergents, thanks to its ability to break down oil and grease. MEA acts as a plasticizing agent, and chemical manufacturing plants use MEA to remove carbon dioxide from ammonia gas in the production of synthetic ammonia. To protect workers in industrial settings, OSHA has established a permissible exposure limit (PEL) for ethanolamine at 3 ppm in the air and requires employers to control workplace exposure below that PEL.

The construction segment experienced marginal growth in 2024, with civil engineering projects outpacing both residential and non-residential buildings. The textile sector, meanwhile, grappled with significant challenges, and the demand for EO derivatives in this space dwindled. High inventory levels among apparel retailers suppressed the need for additional EO derivatives.

Europe Ethanolamine Market Regional Insight:

Ethanolamine is a crucial commodity in the France market, being used by various industries such as agriculture and agricultural chemicals, household products, cleaning agents, and preservatives.

In April 2024, Ineos announced the force majeure (FM) of ethanolamines at the Lavera plant in France. The announcement continued through the summer and fall as the EO unit at the same location shut down, severely limiting ethanolamine production. The annual capacity of the plant is 55 kt of ethanolamine production. Western European markets reacted quickly to FM's announcement, which led to a short-term price increase. At the end of May, prices began to fall again. Sophisticated demand has been so strong that even though one major player left the game in Europe, the downward trend in prices remained undeniable.

MEA is used here to produce the acid scavenger triazine. Some non-durable consumer goods sectors, such as textiles and related applications, are unlikely to recover in the near term. The demand for personal care products and cleaning applications is expected to stabilize. A modest increase in the total agricultural output is predicted for the eurozone in 2024, which slightly boosts ethanolamine market demand in the agricultural field.

- The European Union has adopted a series of regulations aimed at reducing the environmental impact of chemicals used in consumer products, such as ethanolamines. Include the Regulation on Registration, Evaluation, Authorization, and Restriction of Chemical Substances (REACH)

- The European Chemicals Agency has also established restrictions and labeling requirements for certain hazardous substances in consumer products containing ethanolamine.

Europe Ethanolamine Market Competitive Landscape:

- On August 31, 2023, BASF completed the sale of its production site in De Meern, Netherlands, to IQatalyst B.V., Luxembourg, a subsidiary of ASC Investment Sarl, Luxembourg. The transaction mainly covered facilities for the production of nickel-based catalysts, including the associated infrastructure and inventories. The production site was part of the Catalysts division. The purchase price was €13 Million, and the after-tax disposal loss was €4 Million.

- In December 2023, INEOS announced an agreement with LyondellBasell to buy its Ethylene Oxide and Derivatives business including the Bayport Underwood site, in Texas. The deal includes the 420 kt Ethylene Oxide plant, the 375 kt Ethylene Glycols plant and the 165kt Glycol Ethers plant together with all associated third-party business on the site, for $700 Million.

Europe Ethanolamine Market Scope:

|

Europe Ethanolamine Market |

|

|

Market Size in 2024 |

USD 2.41 Mn. |

|

Market Size in 2032 |

USD 3.56 Mn. |

|

CAGR (2025-2032) |

5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product Type

|

|

By End Users

|

|

|

|

By Country Scope • Germany • United Kingdom • Spain • France • Italy • Belgium • Sweden • Poland • Russia |

Europe Ethanolamine Market Key Players

- Akzo Nobel N.V. (Netherlands)

- INEOS Group Holdings S.A. (UK/Switzerland)

- Taminco Corporation (Belgium)

- Solvay S.A. (Belgium)

- LyondellBasell Industries N.V. (Netherlands)

- BASF SE (Germany)

Frequently Asked Questions

DEA used in Cosmetics is expected to be the major restraining factor for the market growth.

The Market size was valued at USD 2.41 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 3.56 Billion.

The segments covered in the market report are By Product Type, End Users.

1. Europe Ethanolamine Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Europe Ethanolamine Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Europe Ethanolamine Market Import Export Landscape

3.1. Import Trends

3.2. Export Trends

3.3. Regulatory Compliance

3.4. Major Export Destinations

3.5. Import-Export Disparities

4. Europe Ethanolamine Market: Dynamics

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.1.4. Market Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Regulatory Landscape

4.5. Analysis of Government Schemes and Initiatives for the European Ethanolamine Industry

5. Europe Ethanolamine Market Size and Forecast by Segments (by Value USD)

5.1. Europe Ethanolamine Market Size and Forecast, by Product Type (2024-2032)

5.1.1. Monoethanolamide (MEA)

5.1.2. Diethanolamine (DEA)

5.1.3. Triethanolamine (TEA)

5.2. Europe Ethanolamine Market Size and Forecast, by End Users (2024-2032)

5.2.1. Agriculture

5.2.2. Construction

5.2.3. Personal Care

5.2.4. Cleaning Industry

5.2.5. Oil and Gas

5.2.6. Metallurgy and Metalworking

5.2.7. Textile

5.2.8. Others

5.3. Europe Ethanolamine Market Size and Forecast, by Country (2024-2032)

5.3.1. Germany

5.3.2. United Kingdom

5.3.3. Spain

5.3.4. France

5.3.5. Italy

5.3.6. Belgium

5.3.7. Sweden

5.3.8. Poland

5.3.9. Russia

6. Europe Ethanolamine Market: Competitive Landscape

6.1. STELLAR Competition Matrix

6.2. Competitive Landscape

6.3. Key Players Benchmarking

6.3.1. Company Name

6.3.2. Service Segment

6.3.3. End-user Segment

6.3.4. Revenue (2023)

6.3.5. Company Locations

6.4. Leading Europe Ethanolamine Companies, by market capitalization

6.5. Market Structure

6.5.1. Market Leaders

6.5.2. Market Followers

6.5.3. Emerging Players

6.6. Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1. INEOS Group Holdings S.A. (UK/Switzerland)

7.1.1. Company Overview

7.1.2. Business Portfolio

7.1.3. Financial Overview

7.1.4. SWOT Analysis

7.1.5. Strategic Analysis

7.1.6. Scale of Operation (small, medium, and large)

7.1.7. Details on Partnership

7.1.8. Regulatory Accreditations and Certifications Received by Them

7.1.9. Awards Received by the Firm

7.1.10. Recent Developments

7.2. Akzo Nobel N.V. (Netherlands)

7.3. Taminco Corporation (Belgium)

7.4. Solvay S.A. (Belgium)

7.5. LyondellBasell Industries N.V. (Netherlands)

7.6. BASF SE (Germany)

8. Key Findings

9. Industry Recommendations