Global Carbon Steel Tubes Market 2026–2032 Infrastructure Expansion, Energy Demand, and Advances in Seamless & Welded Tube Manufacturing

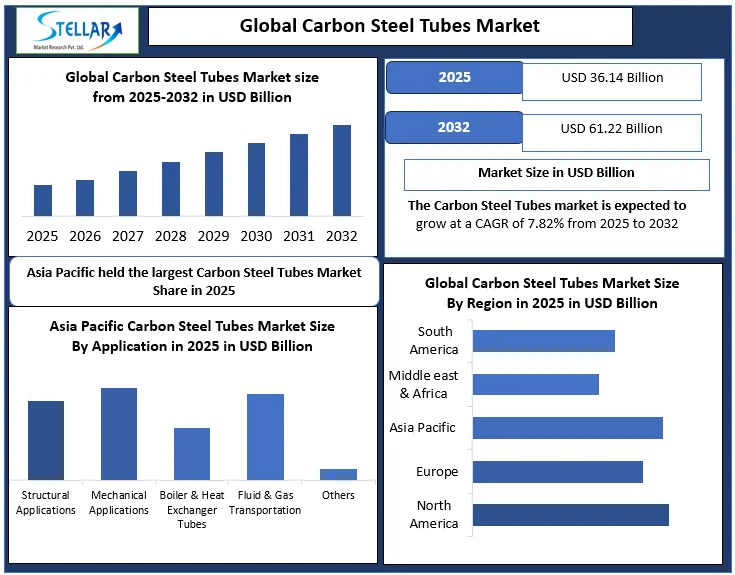

The Global Carbon Steel Tubes Market size was valued at USD 36.14 billion in 2025 to USD 61.22 billion by 2032, with a CAGR of 7.82%.

Format : PDF | Report ID : SMR_2892

Carbon Steel Tubes Market Overview

The global carbon steel tubes market is driven by sustained demand from construction, oil & gas, power generation, automotive, and industrial manufacturing sectors. Carbon steel tubes are widely preferred due to their high mechanical strength, pressure resistance, thermal stability, and cost advantage over alloy and stainless steel alternatives.

Market growth is supported by large-scale infrastructure development, expanding pipeline networks, and rising industrialization across emerging economies. Technological advancements in seamless and welded tube manufacturing, including cold-drawn precision tubing and improved corrosion-resistant coatings, have enhanced product performance and expanded application suitability.

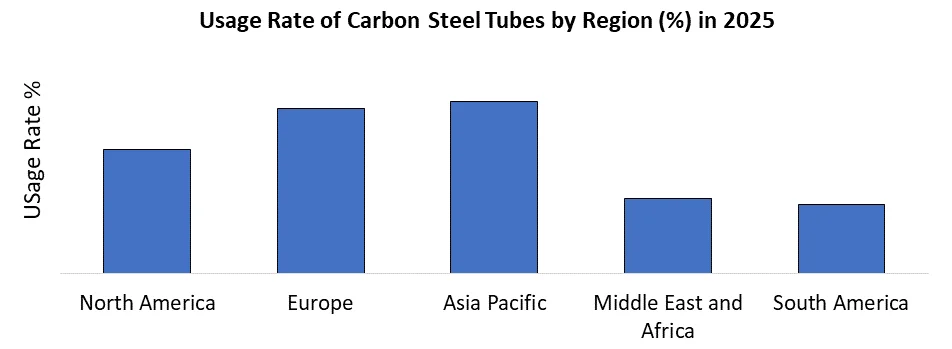

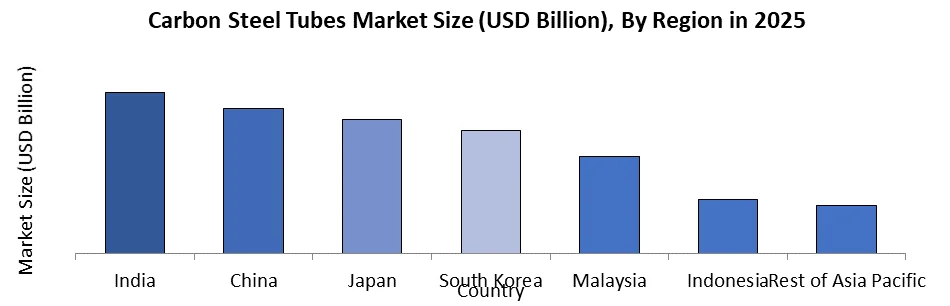

Asia Pacific dominates the global carbon steel tubes market, supported by strong infrastructure spending, industrial expansion, and energy investments, while North America and Europe continue to register steady demand from energy, engineering, and replacement-driven applications.

Key highlights

• Strong demand for seamless and welded carbon steel tubes continues across construction, energy, and industrial fluid-transport projects.

• Precision cold-drawn tubing adoption is increasing, with dimensional tolerances of ±0.10 mm supporting applications in heat exchangers, hydraulic systems, and boilers.

• Expansion of pipeline and district-heating networks, where carbon steel tube systems typically operate above 60 bar, is driving sustained replacement and maintenance demand.

• Corrosion susceptibility remains a key restraint, with coating, lining, and cathodic protection accounting for approximately 6–9% of installed system costs in coastal, chemical, and high-humidity environments.

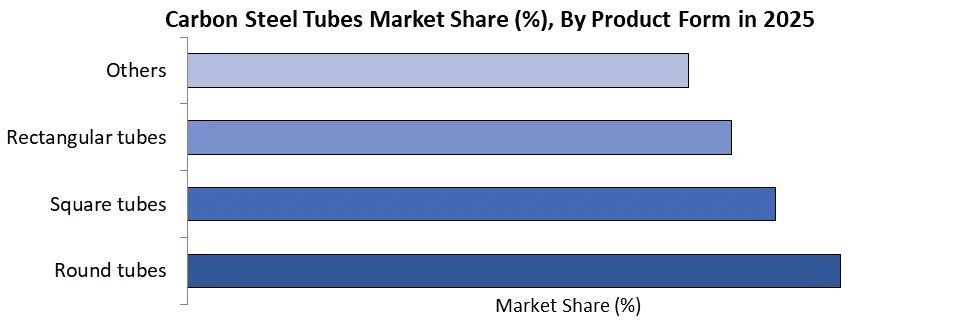

• Round tubes dominate product form due to superior stress distribution and ease of fabrication, supporting diameters ranging from 25 mm to 500 mm across infrastructure and industrial applications.

To get more Insights: Request Free Sample Report

Carbon Steel Tubes Market Dynamics

Trend: Rising Use of Carbon Steel Tubes in Energy & Infrastructure Projects

Expansion of Energy and Infrastructure Projects

The increasing deployment of seamless and welded carbon steel tubes across energy infrastructure, pipeline networks, and urban construction projects remains a primary growth driver. Governments across Asia Pacific, the Middle East, and North America approved infrastructure investments exceeding USD 1.5 trillion between 2023 and 2025, significantly increasing demand for structural and fluid-transport tubing.

Carbon steel tubes are widely used in power plants, refineries, and district heating systems due to their ability to operate at temperatures above 400°C and pressures exceeding 100 bar. Advances in precision cold-drawn tubing and protective coating technologies continue to support long-term adoption.

Expansion of Oil, Gas, and Industrial Pipeline Networks to Boost Carbon Steel Tubes Market

More than 200,000 km of new pipelines were planned or under development between 2024 and 2026, with carbon steel tubes remaining the material of choice due to high tensile strength (up to 485 MPa) and durability. Carbon steel tubes are widely used in onshore and offshore pipelines, refineries, and petrochemical plants where operational reliability is critical. The carbon steel tubing supports hydrogen blending up to 20% in several pilot pipeline projects, strengthening long-term demand. The combination of mechanical strength, weldability, and cost efficiency continues to drive large-scale adoption.

Corrosion Susceptibility and Maintenance Requirements to Restraint Carbon Steel Tubes Market

The material’s susceptibility to corrosion, particularly in high-moisture, acidic, or saline environments. Without protective coatings or cathodic protection systems, carbon steel tubes can experience corrosion rates of 0.1–0.3 mm per year, increasing maintenance frequency and lifecycle costs. Industries such as chemical processing and offshore energy increasingly require coated, alloyed, or lined tubes, which raises overall project expenses.

The stricter environmental regulations mandate regular inspection cycles, pressure testing, and corrosion monitoring, increasing operational complexity. These factors limit adoption in applications where stainless steel or composite tubing offers longer service life with reduced maintenance, especially in highly corrosive environments.

Carbon Steel Tubes Market Segment Analysis

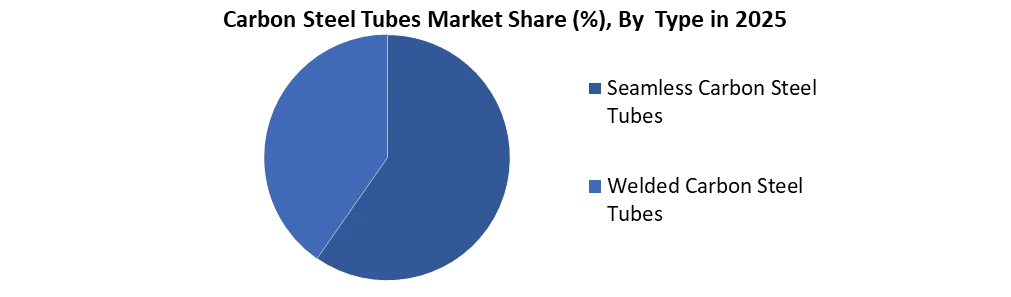

By Type: Segmented into Seamless Carbon Steel Tubes and Welded Carbon Steel Tubes. Seamless carbon steel tubes dominate high-performance applications due to superior strength, pressure resistance, and uniform wall thickness. In Asia-Pacific and global industrial use, over 65% of high-pressure systems (above 100 bar) rely on seamless tubes for oil & gas, boilers, and hydraulic systems. These tubes are commonly used in temperature ranges exceeding 400°C and in critical fluid transport lines. Their dominance is reinforced by compliance with ASTM A106, A179, and A210 standards, making them essential in energy and power infrastructure.

By Product Form, segmented into the round tubes, square tubes, rectangular tubes and Others. Round carbon steel tubes held the largest Carbon Steel Tubes product form in 2025, accounting for nearly 70–75% of tubular applications due to their uniform stress distribution and ease of installation. They are widely used in pipeline networks, heat exchangers, structural columns, and fluid transmission systems, typically ranging from 10 mm to over 600 mm in diameter. Round tubes offer better flow efficiency and pressure handling compared to square or rectangular forms, making them the preferred choice across construction, energy, and industrial engineering projects.

Carbon Steel Tubes Market Regional Analysis

Asia Pacific dominated the Carbon Steel Tubes Market with the largest share in 2025. The seamless carbon steel tubes and welded carbon steel tubes remain the largest regional segment globally. The rapid industrialization, urban infrastructure development, and the expansion of oil & gas pipelines drive the Carbon Steel Tubes Market growth. In the Asia Pacific Carbon Steel Tubes Market, carbon steel heat exchangers and hydraulic tubes are widely used across power plants, refineries, and industrial processing units.

ASTM A179M seamless cold-drawn low-carbon steel tubes are commonly adopted for heat exchange and condenser applications, covering outer diameters from 3.18 mm to 76.2 mm. The same specification is extensively used for hydraulic and pneumatic tubing, manufactured with controlled wall thickness. The welded carbon steel tubes meeting ASTM A178 and ASTM A214 standards are increasingly used for cost-efficient heat transfer applications.

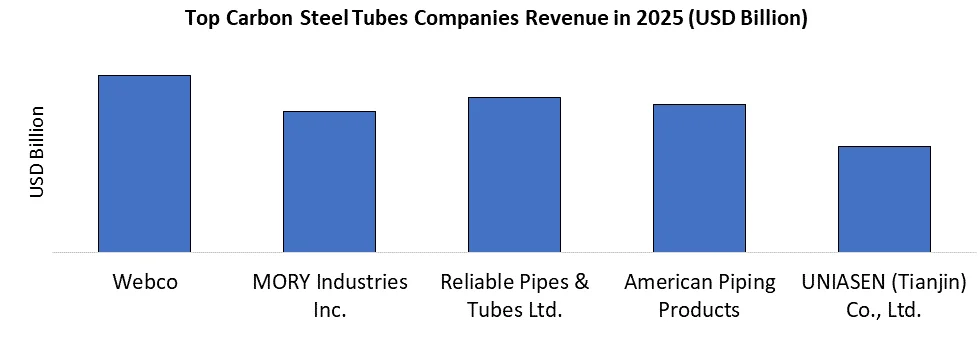

Carbon Steel Tubes Market Competitive Landscape

The Carbon Steel Tubes Market's competitive landscape is fragmented, with key players competing on pricing, capacity expansion, and product quality. Major manufacturers focus on seamless carbon steel tubes, welded carbon steel pipes, and ASTM-grade carbon steel tubing, leveraging long-term contracts, regional expansion, and technology upgrades to strengthen market share.

Recent Developments

- On July 22, 2025, Tenaris won major tube supply contracts from TotalEnergies and Saipem for Suriname’s GranMorgu offshore oil project. The company will supply over 84,000 tons of carbon steel casing, tubing, and seamless line pipes, featuring premium connections and Dopeless technology. This development strengthens Tenaris’s position in offshore carbon steel tubes, seamless pipes, and OCTG solutions for deepwater energy projects.

- Nov. 01, 2024, Welspun Tubular LLC announced a $100 million investment to expand and upgrade its carbon steel pipe and tube production facility in Little Rock, Arkansas. The expansion will enhance its welded and large-diameter pipe portfolio, create 175 new jobs, and strengthen U.S. manufacturing capacity. This strategic move supports increased demand for structural, energy, and pipeline carbon steel tubes in North America.

Carbon Steel Tubes Market Scope

|

Global Carbon Steel Tubes Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 36.14 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

7.82% |

Market Size in 2032: |

USD 61.22 Billion |

|

Carbon Steel Tubes Segment Analysis |

By Type |

Seamless Carbon Steel Tubes Welded Carbon Steel Tubes |

|

|

By Product Form |

Round tubes Square tubes Rectangular tubes Others |

||

|

By Manufacturing Process |

Hot Rolled Tubes Cold Drawn / Cold Rolled Tubes |

||

|

By Size |

Small-diameter tubes Medium-diameter tubes Large-diameter tubes |

||

|

By Application |

Structural Applications Mechanical Applications Boiler & Heat Exchanger Tubes Fluid & Gas Transportation Others |

||

|

By End-Use Industry |

Construction Oil & Gas Automotive Power Generation Mechanical & Engineering Chemical & Petrochemical Others |

||

Carbon Steel Tubes Market Key Players

- Webco

- MORY Industries Inc.

- Reliable Pipes & Tubes Ltd.

- American Piping Products

- UNIASEN (Tianjin) Co., Ltd.

- Kelly Pipe

- Permanent Steel Manufacturing Co. Ltd.

- Hayward Pipe & Supply Co.

- Octal Steel

- Nansteel Manufacturing Co. Ltd.

- DNOW

- Geldbach UK Ltd.

- Eastern Steel

- Neo Impex Stainless Pvt. Ltd.

- Hebei Sanvo Pipes & Fittings Co. Ltd.

- Federal Steel Supply

- FerroPipe

- Dinesh Metal Industries

- Baling Steel

- Hengyang Steel Tube Co. Ltd.

- Baosteel Group Corporation

- Turner Industries Group, LLC

- Tenaris

- Allied Tube & Conduit Corp.

- ArcelorMittal Tubular Products

- JSW Steel (USA)

- Metal-Matic, LLC

- Welspun Tubular, LLC

- Others

Frequently Asked Questions

The major types include seamless carbon steel tubes and welded carbon steel tubes. Seamless tubes are used in high-pressure and high-temperature applications, while welded tubes are preferred for structural and low-pressure uses.

Carbon steel tubes offer high tensile strength, excellent weldability, cost efficiency, durability under high pressure and temperature, and wide availability across construction, energy, and industrial sectors.

The rapid infrastructure development, rising oil & gas exploration activities, expansion of automotive and manufacturing industries, increasing demand for cost-effective piping solutions, and advancements in carbon steel tube manufacturing processes.

1. Carbon Steel Tubes Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Carbon Steel Tubes Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-Use Industry Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Price Trend Analysis, by Region

3.1. Historical Price Trends (2020-2025)

3.1.1. Price Trends Across Seamless and Welded Carbon Steel Tubes

3.2. Regional Price Variations (2025)

3.2.1. Key Factors Influencing Price Trends

3.2.2. Raw Material Prices (Iron Ore, Scrap, HRC)

3.2.3. Energy, Labor, and Manufacturing Cost Volatility

3.2.4. Logistics, Freight, and Trade Duty Impact

3.2.5. Capacity Utilization and Global Demand–Supply Balance_

4. Consumption Analysis

4.1. Global Consumption Trends by Product Type (2020–2025)

4.1.1. Seamless vs Welded Tube Consumption Share

4.2. Product Type and Application-Based Demand

4.2.1. Consumption by Construction, Oil & Gas, Power, and Automotive

4.3. Consumption Cycles and Replacement Demand

4.3.1. Project-Based Consumption and Maintenance Demand

4.4. Impact of Infrastructure Spending & Industrial Activity

4.4.1. Role of Government and Private Sector Capex

5. Production Analysis

5.1. Top Carbon Steel Tube Producing Countries in 2025

5.2. Manufacturing Capacity and Utilization Trends

5.2.1. Installed Production Capacity (2025)

5.2.2. Capacity Utilization by Region

5.3. Impact of Energy Costs and Environmental Regulations

6. Key Production Inputs and Manufacturing Practices

6.1. Raw Materials, Energy, and Labor Requirements

6.2. ERW, Seamless, and SAW Manufacturing Technologies

6.3. Automation and Digitalization in Tube Mills

6.4. Sustainability Initiatives and Emission Reduction

7. Global Trade and Export Landscape

7.1. Major Exporting Countries: China, Japan, India, South Korea, Germany

7.2. Major Importing Countries: USA, UAE, Saudi Arabia, Germany, Indonesia

7.3. Global Export–Import Volume and Value (2020–2025)

7.4. Tariff Structures, Anti-Dumping Duties, and Trade Barriers

7.5. Impact of Supply Chain Disruptions and Geopolitical Risks

8. Comparative Analysis: Carbon Steel Tubes vs Alternative Materials

8.1. Performance and Cost Comparison: Carbon Steel vs Stainless Steel, Aluminum, PVC

8.2. Substitution Risk in Construction and Fluid Transport

8.3. Strength, Lifecycle Cost, and Sustainability Comparison

8.4. Future Outlook of Carbon Steel Tubes in Industrial Applications

9. Investment Landscape & Industry Ecosystem

9.1. Capital Investments and Capacity Expansion Trends (2020–2025)

9.2. Mergers, Acquisitions, and Strategic Alliances

9.3. Manufacturing Clusters and Tube Mill Hubs

9.4. Technology Upgrades and Innovation Roadmap

10. Supply Chain Analysis

10.1. Upstream: Raw Material Suppliers and Steel Mills

10.2. Manufacturing and Tube Processing Stage

10.3. Distribution, Stockists, and Logistics Network

10.4. Downstream End-Users and Project Contractors

10.5. Scrap Recycling and Circular Economy Integration

11. ESG Lens on the Carbon Steel Tubes Industry

11.1. Environmental Impact and Carbon Emission Management

11.2. Worker Safety, Labor Practices, and Skill Development

11.3. Corporate Governance and Compliance Standards

11.4. Recycling, Energy Efficiency, and Waste Reduction

11.5. Ethical Sourcing and Responsible Manufacturing

12. Regulatory Landscape & Trade Policies

12.1. Global Regulatory Framework for Carbon Steel Tubes

12.2. Country-Wise Standards and Compliance Requirements

12.3. Product Certification, Testing, and Labeling Norms

13. Carbon Steel Tubes Market: Dynamics

13.1. Carbon Steel Tubes Market Trends

13.2. Carbon Steel Tubes Market Dynamics

13.2.1. Drivers

13.2.2. Restraints

13.2.3. Opportunities

13.2.4. Challenges

13.3. PORTER’s Five Forces Analysis

13.4. PESTLE Analysis

13.5. Regulatory Landscape by Region

13.6. Key Opinion Leader Analysis for the Global Industry

13.7. Analysis of Government Schemes and Initiatives for Industry

14. Carbon Steel Tubes Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

14.1. Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

14.1.1. Seamless Carbon Steel Tubes

14.1.2. Welded Carbon Steel Tubes

14.2. Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

14.2.1. Round tubes

14.2.2. Square tubes

14.2.3. Rectangular tubes

14.2.4. Others

14.3. Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

14.3.1. Hot Rolled Tubes

14.3.2. Cold Drawn / Cold Rolled Tubes

14.4. Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

14.4.1. Small-diameter tubes

14.4.2. Medium-diameter tubes

14.4.3. Large-diameter tubes

14.5. Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

14.5.1. Structural Applications

14.5.2. Mechanical Applications

14.5.3. Boiler & Heat Exchanger Tubes

14.5.4. Fluid & Gas Transportation

14.5.5. Others

14.6. Carbon Steel Tubes Market Size and Forecast, By End User (2025-2032)

14.6.1. Structural Applications

14.6.2. Mechanical Applications

14.6.3. Boiler & Heat Exchanger Tubes

14.6.4. Fluid & Gas Transportation

14.6.5. Others

14.7. Carbon Steel Tubes Market Size and Forecast, By Region (2025-2032)

14.7.1. North America

14.7.2. Europe

14.7.3. Asia Pacific

14.7.4. Middle East and Africa

14.7.5. South America

15. North America Carbon Steel Tubes Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

15.1. North America Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

15.2. North America Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

15.3. North America Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

15.4. North America Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

15.5. North America Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

15.6. North America Carbon Steel Tubes Market Size and Forecast, By End-Use Industry (2025-2032)

15.7. North America Carbon Steel Tubes Market Size and Forecast, by Country (2025-2032)

15.7.1. United States

15.7.2. Canada

15.7.3. Mexico

16. Europe Carbon Steel Tubes Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units and Volume in 000’Units) (2025-2032)

16.1. Europe Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

16.2. Europe Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

16.3. Europe Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

16.4. Europe Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

16.5. Europe Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

16.6. Europe Carbon Steel Tubes Market Size and Forecast, By End-Use Industry (2025-2032)

16.7. Europe Carbon Steel Tubes Market Size and Forecast, by Country (2025-2032)

16.7.1. United Kingdom

16.7.2. France

16.7.3. Germany

16.7.4. Italy

16.7.5. Spain

16.7.6. Sweden

16.7.7. Russia

16.7.8. Rest of Europe

17. Asia Pacific Carbon Steel Tubes Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

17.1. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

17.2. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

17.3. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

17.4. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

17.5. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

17.6. Asia Pacific Carbon Steel Tubes Market Size and Forecast, By End-Use Industry (2025-2032)

17.7. Asia Pacific Carbon Steel Tubes Market Size and Forecast, by Country (2025-2032)

17.7.1. China

17.7.2. S Korea

17.7.3. Japan

17.7.4. India

17.7.5. Australia

17.7.6. Indonesia

17.7.7. Malaysia

17.7.8. Philippines

17.7.9. Thailand

17.7.10. Vietnam

17.7.11. Rest of Asia Pacific

18. Middle East and Africa Carbon Steel Tubes Market Size and Forecast (by Value in USD Billion and Volume in 000’Units) (2025-2032)

18.1. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

18.2. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

18.3. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

18.4. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

18.5. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

18.6. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, By End-Use Industry (2025-2032)

18.7. Middle East and Africa Carbon Steel Tubes Market Size and Forecast, by Country (2025-2032)

18.7.1. South Africa

18.7.2. GCC

18.7.3. Egypt

18.7.4. Nigeria

18.7.5. Rest of ME&A

19. South America Carbon Steel Tubes Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

19.1. South America Carbon Steel Tubes Market Size and Forecast, By Type (2025-2032)

19.2. South America Carbon Steel Tubes Market Size and Forecast, By Product Form (2025-2032)

19.3. South America Carbon Steel Tubes Market Size and Forecast, By Manufacturing Process (2025-2032)

19.4. South America Carbon Steel Tubes Market Size and Forecast, By Size (2025-2032)

19.5. South America Carbon Steel Tubes Market Size and Forecast, By Application (2025-2032)

19.6. South America Carbon Steel Tubes Market Size and Forecast, By End-Use Industry (2025-2032)

19.7. South America Carbon Steel Tubes Market Size and Forecast, by Country (2025-2032)

19.7.1. Brazil

19.7.2. Argentina

19.7.3. Colombia

19.7.4. Chile

19.7.5. Rest Of South America

20. Company Profile: Key Players

20.1. Webco

20.1.1. Company Overview

20.1.2. Business Portfolio

20.1.3. Financial Overview

20.1.4. SWOT Analysis

20.1.5. Strategic Analysis

20.1.6. Recent Developments

20.2. MORY Industries Inc.

20.3. Reliable Pipes & Tubes Ltd.

20.4. American Piping Products

20.5. UNIASEN (Tianjin) Co., Ltd.

20.6. Kelly Pipe

20.7. Permanent Steel Manufacturing Co. Ltd.

20.8. Hayward Pipe & Supply Co.

20.9. Octal Steel

20.10. Nansteel Manufacturing Co. Ltd.

20.11. DNOW

20.12. Geldbach UK Ltd.

20.13. Eastern Steel

20.14. Neo Impex Stainless Pvt. Ltd.

20.15. Hebei Sanvo Pipes & Fittings Co. Ltd.

20.16. Federal Steel Supply

20.17. FerroPipe

20.18. Dinesh Metal Industries

20.19. Baling Steel

20.20. Hengyang Steel Tube Co. Ltd.

20.21. Baosteel Group Corporation

20.22. Turner Industries Group, LLC

20.23. Tenaris

20.24. Allied Tube & Conduit Corp.

20.25. ArcelorMittal Tubular Products

20.26. JSW Steel (USA)

20.27. Metal-Matic, LLC

20.28. Welspun Tubular, LLC

20.29. Others

21. Key Findings

22. Analyst Recommendations

23. Carbon Steel Tubes Market: Research Methodology