North America LNG Market Demand, Technology Trends and Growth (2025-2032)

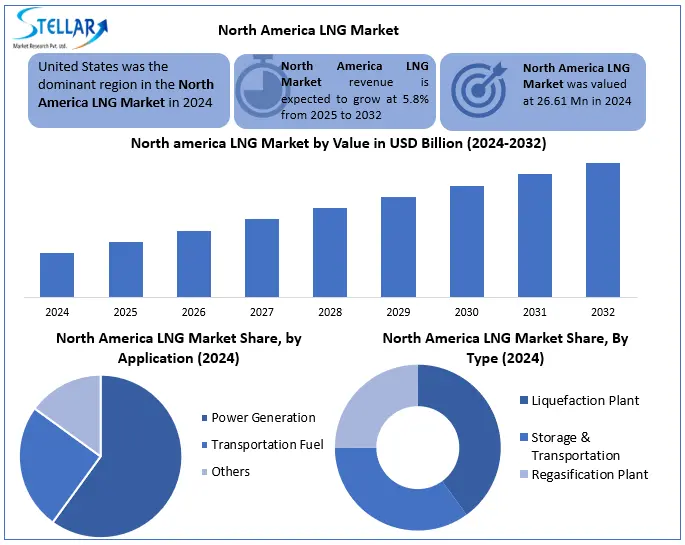

The North America LNG Market size was valued at USD 26.61 Billion in 2024, and the total LNG Market revenue is expected to grow at a CAGR of 5.8% and is expected to reach at USD 41.78 Billion by 2032.

Format : PDF | Report ID : SMR_2875

North America LNG Market Overview:

Liquefied Natural Gas (LNG) is natural gas converted into liquid form at around -162°C for efficient storage and transportation. It is increasingly used as a cleaner energy source globally. Rising demand for energy transition has driven North America LNG consumption, with global natural gas production reaching 416 billion cubic meters (bcm) in 2024 and consumption increasing from 3,929.2 bcm in 2019 to 6,435 bcm in 2024. United States leads the global LNG market, driven by abundant shale gas reserves, rapid infrastructure expansion, and as a top LNG exporter.

Key players such as ExxonMobil, ConocoPhillips and Chevron dominate the market through strong global projects and technological advancements. Power generation is the largest end-user segment due to North America LNG efficiency and lower emissions, followed by transportation, especially in marine and heavy-duty vehicles.

North America LNG Market Recent Developments

|

Date |

Development |

Details |

|

December 30, 2024 |

Cheniere produces first LNG at Corpus Christi Stage?3 |

The Corpus Christi expansion produced its first LNG, adding 10?MTPA capacity. As of Nov 2024, project was 75.9% complete. |

|

December 12, 2024 |

Venture Global’s Plaquemines starts LNG production |

The Plaquemines plant in Louisiana began commissioning, aiming for full commercial operations over a two-year window. |

|

March 5, 2025 |

DOE extends Golden Pass export deadline |

U.S. DOE granted an 18-month extension for Golden Pass to start LNG exports new deadline Mar?31,?2027. |

|

February- March 2025 |

DOE resumes and extends multiple LNG export authorizations |

DOE authorized Commonwealth LNG and CP2 exports, granted extensions to Golden Pass and Delfin, and eased bunker-fuel rules . |

|

June 10, 2025 |

Petronas and Shell reaffirm commitment to LNG Canada (Phase?1 Launch) |

Petronas reaffirmed investment; Shell noted Phase?2 depends on opportunities. First cargoes expected mid-2025. |

To get more Insights: Request Free Sample Report

North America LNG Market Dynamics

Growing demand for gas for power generation to drive the North America LNG Market

Natural gas witnessed significant growth in its production and consumption by its countries shifting from coal to natural gas as a primary energy source for cleaner energy. Leading players in natural gas sector are United States with a production volume of 1036.468 billion cubic meters and Russia, with over 685.4 billion cubic meters in 2024. Growing demand for natural gas for power generation are increased natural gas consumption from 3,929.2 bcm in 2019 to 6435 bcm in 2024. Similar trend is predicted to continue, with more countries committing to reducing carbon emissions. So, increasing demand for North America LNG is likely to foster investment in the LNG terminal and LNG carrier during the forecast period and thereby drive the market being studied.

Rising number of LNG-fueled fleet to drive the North America LNG Market

The use of North America LNG as a fuel is both a proven and commercially available solution. LNG offers enormous advantages, especially for ships, in light of ever-tightening emission regulations. Conventional oil-based fuels are expected to remain the primary fuel option for most ships in the mid-term, while LNG is likely to emerge as a popular choice in a long-term scenario.

The LNG-fueled vessels plying the oceans comprise passenger ferries, offshore service vessels, coastguard vessels, tanker and many other types. Ship makers are increasingly focusing on using LNG as ship fuel, as owners, ports, and regulators are realizing benefit of this emerging technology. Also, to promote LNG-fueled vehicles, government in some nations is providing grants and other financial aid.

Capital-intensive Infrastructure Developments to Restrain the North America LNG Market

North America LNG Market is capital intensive nature of infrastructure development, establishing liquefaction terminals and regasification facilities requires substantial investments by their advanced technology and engineering involved. These facilities are crucial for liquefaction of natural gas into LNG and the subsequent regasification process before distribution and consumption. Financial burden of setting up these facilities can pose obstacles for new market entrants and countries seeking to expand their LNG capabilities. Also, the long lead time associated with constructing such infrastructure can impact supply chain timelines and the ability to respond quickly to changing market dynamics.

North America LNG Market Segment Analysis

Based on application, North America LNG market is segmented in transportation fuel, power generation and others. Power generation segment held largest North America LNG market share in 2024 by their rising global demand for cleaner and more efficient energy sources. Growing shift from coal and oil-fired power plants to natural gas powered facilities has significantly contributed to this dominance. North America LNG offers lower carbon emissions and higher efficiency compared to traditional fossil fuels, aligning with initiatives to reduce greenhouse gas emissions. Many countries prioritized LNG as transitional energy source in their path toward renewable energy adoption, further strengthening segment growth. Advancements in gas turbines and combined cycle technologies made power plants more efficient and cost-effective, supporting preference for North America LNG in electricity or power generation.

Transportation fuel segment is expected to grow at rapid pace during forecast period owing to a economic and environmental advantages of LNG over diesel and heavy fuel oil. Maritime and heavy duty trucking industries, mainly, are transitioning to gas based fuels, including LNG, to comply with stringent emission regulations like International Maritime Organization sulfur cap. Improved infrastructure for refuelling and development of North America LNG powered vehicles and vessels also supported growth of segment.

Based on Type, North America LNG market is segmented in liquefaction plants, storage and transportation and regasification plant, the Liquefaction plant segment held largest LNG market share in 2024 Liquefaction plants are specialized facilities where natural gas is cooled to approximately -162°C, converting it in liquid state for easier and more economical transport and segment is critical for exporting countries aiming to supply LNG to global markets. Storage and transportation are involve infrastructure required to safely store LNG in cryogenic tanks and transport it via LNG tankers, trucks or pipelines, ensuring efficient delivery across regions. Regasification plants play a vital role in converting LNG back in its gaseous form at destination, making it suitable for distribution through natural gas pipelines and consumption in residential, industrial and power generation sectors segments forming the backbone of LNG value chain, enabling its global trade and usage.

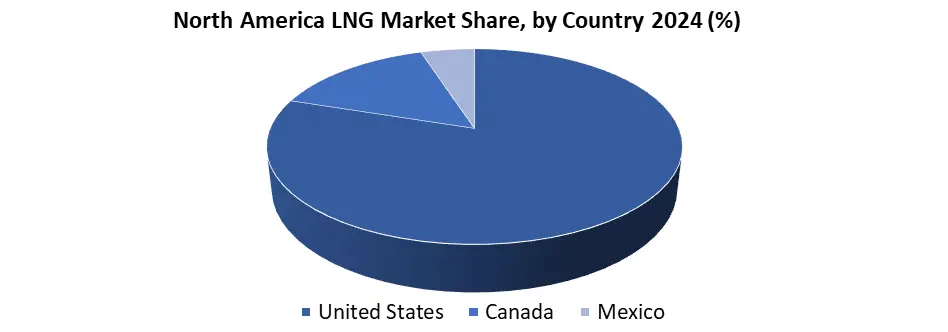

North America LNG Market Country Analysis:

North America LNG market is dominated by their abundant shale gas reserves, expanding infrastructure and rising global demand for cleaner energy. U.S. led as a top exporter with export capacity projected to double by 2032, supported by an extensive pipeline network and flexible contract terms. Uites States dominates North America LNG exports, growing by rapid infrastructure growth, including liquefaction plants and storage terminals. Key markets U.S., Canada and Mexico are expected to see significant expansion, shifting focus from pipeline gas to LNG exports. Major projects like Freeport LNG boost capacity, with Trains 2 and 3 operational since 2020 and Train 4 slated for 2026. Six U.S. export facilities, including Sabine Pass and Corpus Christi, continue to expand, reinforcing the region position as a fastest growing LNG hub.

North America LNG Market Competitive Landscape

North America LNG market are dominated by Cheniere Energy, ExxonMobil and Venture Global LNG. Cheniere Energy leads the market with over 45 million tonnes per annum of North America LNG export capacity through its Sabine Pass and Corpus Christi terminals, accounting for nearly 50% of total U.S. LNG exports. ExxonMobil, through Golden Pass LNG joint venture with QatarEnergy, is set to add 18 MTPA capacity by 2025, strengthening its role as a global LNG supplier. Venture Global LNG is rapidly rising with Calcasieu Pass operational and Plaquemines LNG under development, targeting a combined output more than 30 MTPA, and has secured long term deals with major buyers like Shell, BP and CNOOC. These three players collectively holds largest export volumes, infrastructure investments and shape the North America LNG competitiveness.

|

North America LNG Market Scope |

|

|

Market Size in 2024 |

USD 26.61 Billion. |

|

Market Size in 2032 |

USD 41.78 Billion. |

|

CAGR (2025-2032) |

5.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Liquefication Plant Storage & Transportation Regasification Plant |

|

By Application Transportation fuel Power Generation Others |

|

North America LNG Market Key Players

USA

- Cheniere Energy (US)

- Chevron Corporation (US)

- ExxonMobil (US)

- ConocoPhillips (US)

- Sempra Energy (US)

- Freeport LNG Development (US)

- Venture Global LNG (US)

- Kinder Morgan Inc. (US)

- Tellurian Inc. (US)

- Dominion Energy (US)

Canada

- Pieridae Energy (Canada)

Frequently Asked Questions

1. North America LNG Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America LNG Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquater

2.2.3. Service Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America LNG Market: Dynamics

3.1. North America LNG Market Trends

3.2. North America LNG Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America LNG Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. North America LNG Market Size and Forecast, By Application (2024-2032)

4.1.1. Transportation fuel

4.1.2. Power Generation

4.1.3. Others

4.2. North America LNG Market Size and Forecast, By Type (2024-2032)

4.2.1. Liquefication Plant

4.2.2. Storage & Transportation

4.2.3. Regasification Plant

4.3. North America LNG Market Size and Forecast, by Country (2024-2032)

4.3.1. United States

4.3.1.1. United States LNG Market Size and Forecast, By Application (2024-2032)

4.3.1.1.1. Transportation fuel

4.3.1.1.2. Power Generation

4.3.1.1.3. Others

4.3.1.2. United States LNG Market Size and Forecast, By Type (2024-2032)

4.3.1.2.1. Liquefication Plant

4.3.1.2.2. Storage & Transportation

4.3.1.2.3. Regasification Plant

4.3.2. Canada

4.3.2.1. Canada LNG Market Size and Forecast, By Application (2024-2032)

4.3.2.1.1. Transportation fuel

4.3.2.1.2. Power Generation

4.3.2.1.3. Others

4.3.2.2. Canada LNG Market Size and Forecast, By Type (2024-2032)

4.3.2.2.1. Liquefication Plant

4.3.2.2.2. Storage & Transportation

4.3.2.2.3. Regasification Plant

4.3.3. Mexico

4.3.3.1. Mexico LNG Market Size and Forecast, By Application (2024-2032)

4.3.3.1.1. Transportation fuel

4.3.3.1.2. Power Generation

4.3.3.1.3. Others

4.3.3.2. Mexico LNG Market Size and Forecast, By Type (2024-2032)

4.3.3.2.1. Liquefication Plant

4.3.3.2.2. Storage & Transportation

4.3.3.2.3. Regasification Plant

5. Company Profile: Key Players

5.1. Exxon Mobil (US)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Cheniere Energy (US)

5.3. Chevron Corporation (US)

5.4. ConocoPhillips (US)

5.5. Sempra Energy (US)

5.6. Freeport LNG Development (US)

5.7. Venture Global LNG (US)

5.8. Kinder Morgan Inc. (US)

5.9. Tellurian Inc. (US)

5.10. Dominion Energy (US)

5.11. Pieridae Energy (Canada)

6. Key Findings & Industry Recommendations

7. North America LNG Market: Research Methodology