US Bioplastics Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

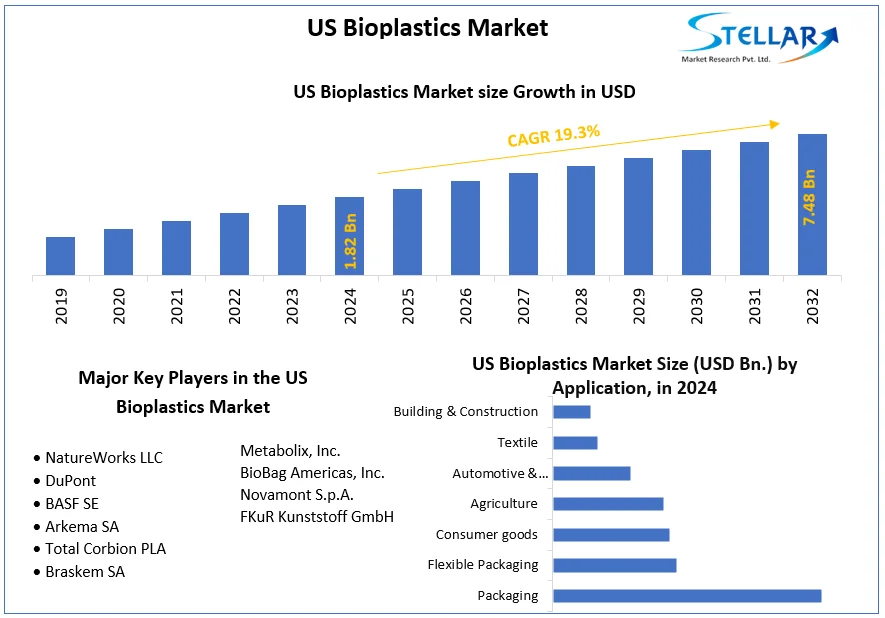

The US Bioplastics Market size was valued at USD 1.82 Bn. in 2024 and the total US Bioplastics revenue is expected to grow at a CAGR of 19.3% from 2025 to 2032, reaching nearly USD 7.48 Bn. in 2032.

Format : PDF | Report ID : SMR_1619

US Bioplastics Market Overview

Bioplastics, derived from renewable sources such as cornstarch or sugarcane provide an eco-friendly alternative to traditional petroleum-based plastics. Their advantage lies in reduced environmental impact, offering faster decomposition and lower greenhouse gas emissions during manufacturing. Despite these benefits, bioplastics currently constitute a small fraction and hold promise as a sustainable solution amid growing environmental awareness. In 2024, consumer electronics, catering, agriculture, automotive, and textiles show growth. Polylactic Acid (PLA) is the primary material, alongside Polyhydroxyalkanoates (PHA), bio-based polyethylene (PE), and polypropylene (PP). The US Bioplastics Market drivers include a rising demand for sustainable alternatives, although challenges such as higher costs, limited composting infrastructure, and unclear regulations persist.

The comprehensive report covers a detailed analysis of the US Bioplastics Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the US Bioplastics Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

US Bioplastics Market Dynamics:

Increasing Demand for Bio-Based Polymers to Drive the US Bioplastics Market

Bio-based polymers present environmental benefits as alternatives to fossil fuel-derived plastics, potentially curbing greenhouse gas emissions and non-renewable resource dependence. Their increased adoption promotes sustainability, curbing deforestation, and enhancing land management for biomass feedstock. Growing demand stimulates US Bioplastics market growth, fostering innovations, performance improvements, and cost reductions. This growth potentially leads to job creation across agriculture, manufacturing, and recycling sectors. As consumer awareness of environmental concerns rises, the demand for eco-friendly products further fuels the preference for bio-based alternatives.

The growing demand for biomass feedstock raises land-use concerns, potentially impacting food production or biodiversity. Feedstock competition raises food prices and prompts ethical concerns about resource allocation. Meeting long-term demand for bio-based polymers is challenged by limited biomass availability. Ongoing research is necessary to address technical limitations in some bio-based polymers for broader adoption. There is a potential for companies to exploit the "bio-based" label without addressing the environmental impact, leading to potential greenwashing and consumer confusion.

The rising demand for bio-based polymers offers a significant opportunity for the US bioplastics market and fosters sustainability. Addressing land-use concerns and ethical resource allocation requires careful management and policy measures. Transparency, accurate labeling, and effective collaborations are crucial to prevent greenwashing and maintain consumer trust. Considerations include the types of bio-based polymers and production methods, while technological advancements and collaborations are vital for addressing sustainability and performance limitations.

US Bioplastics Market Segment Analysis

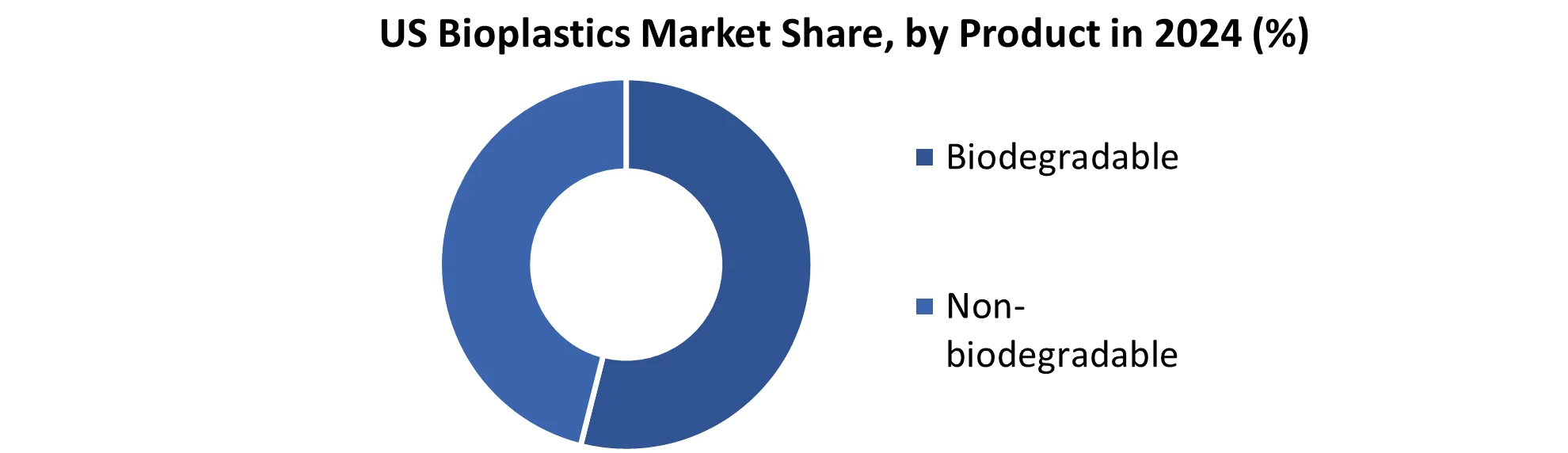

Based on Product, the Biodegradable segment held the largest market share of about 57% in the US Bioplastics Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 19.5 % during the forecast period. It stands out as the dominant segment within the US Bioplastics Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The US Bioplastics Market Biodegradable plastics offer reduced environmental impact by breaking down into harmless components through microbial processes, unlike traditional plastics that persist for centuries. Enhanced sustainability is achieved by using renewable, plant-based resources, reducing reliance on fossil fuels, and lowering greenhouse gas emissions. Compliance with evolving regulations favoring alternatives to conventional plastics provides a US Bioplastics market advantage. Adopting biodegradable plastics improves a company's image by showcasing environmental responsibility, and appealing to eco-conscious consumers. Additionally, certain biodegradable plastics offer the potential for compostable waste streams, diverting organic waste from landfills and creating nutrient-rich compost.

Additionally, the US Bioplastics Biodegradable industry faces challenges such as higher costs, stemming from production expenses and limited economies of scale. Performance limitations, including reduced strength and heat resistance, constrain their applications compared to traditional plastics. Limited composting facilities create end-of-life management challenges. Misconceptions and greenwashing may arise due to variations in degradation and composting requirements. Despite their biodegradability, improper disposal leads to litter, emphasizing the importance of consumer education and effective waste management systems.

Biodegradable bioplastics are pivotal in the US Bioplastics market, presenting a sustainable alternative to conventional plastics. Overcoming cost challenges, performance limitations, and infrastructure gaps is vital for broader adoption. Emphasizing consumer education and responsible waste management is key to maximizing their environmental advantages.

|

US Bioplastics Market Scope |

|

|

Market Size in 2024 |

USD 1.82 Billion |

|

Market Size in 2032 |

USD 7.48 Billion |

|

CAGR (2025-2032) |

19.3 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product

|

|

By Application

|

|

Leading Key Players in the US Bioplastics Market

- NatureWorks LLC

- DuPont

- BASF SE

- Arkema SA

- Total Corbion PLA

- Braskem SA

- Metabolix, Inc.

- BioBag Americas, Inc.

- Novamont S.p.A.

- FKuR Kunststoff GmbH

Frequently Asked Questions

High Cost and Low Product Availability are expected to be the major restraining factors for the US Bioplastics market growth.

The US Bioplastics Market size was valued at USD 1.82 Billion in 2024 and the total US Bioplastics revenue is expected to grow at a CAGR of 19.3% from 2025 to 2032, reaching nearly USD 7.48 Billion By 2032.

1. US Bioplastics Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. US Bioplastics Market Trends

2.1 Market Consolidation

2.2 Adoption of Advanced Manufacturing Technologies

2.3 Pricing and Reimbursement Trends

3. US Bioplastics Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the US Bioplastics Industry

3.6 The Pandemic and Redefining of The US Bioplastics Industry Landscape

4. US Bioplastics Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 US Bioplastics Market Size and Forecast, by Product (2024-2032)

4.1.1 Biodegradable

4.1.1.1 Polylactic Acid

4.1.1.2 Polybutylene Adipate Terephthalate (PBAT)

4.1.1.3 Polybutylene Succinate (PBS)

4.1.1.4 Starch blends

4.1.2 Non-biodegradable

4.1.2.1 Polyethylene

4.1.2.2 Polyethylene Terephthalate

4.1.2.3 Polytrimethylene Terephthalate

4.1.2.4 Polyamide

4.2 US Bioplastics Market Size and Forecast, by Application (2024-2032)

4.2.1 Packaging

4.2.1.1 Rigid Packaging

4.2.1.1.1 Bottle & Jar

4.2.1.1.2 Trays

4.2.2 Flexible Packaging

4.2.2.1 Pouches

4.2.2.2 Shopping/Waste Bags

4.2.3 Consumer goods

4.2.4 Agriculture

4.2.5 Automotive & Transportation

4.2.6 Textile

4.2.7 Building & Construction

5. US Bioplastics Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading US Bioplastics Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 NatureWorks LLC

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 DuPont

6.3 BASF SE

6.4 Arkema SA

6.5 Total Corbion PLA

6.6 Braskem SA

6.7 Metabolix, Inc.

6.8 BioBag Americas, Inc.

6.9 Novamont S.p.A.

6.10 FKuR Kunststoff GmbH

7. Key Findings

8. Industry Recommendations

9. US Bioplastics Market: Research Methodology