US Automotive Engine Oil Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

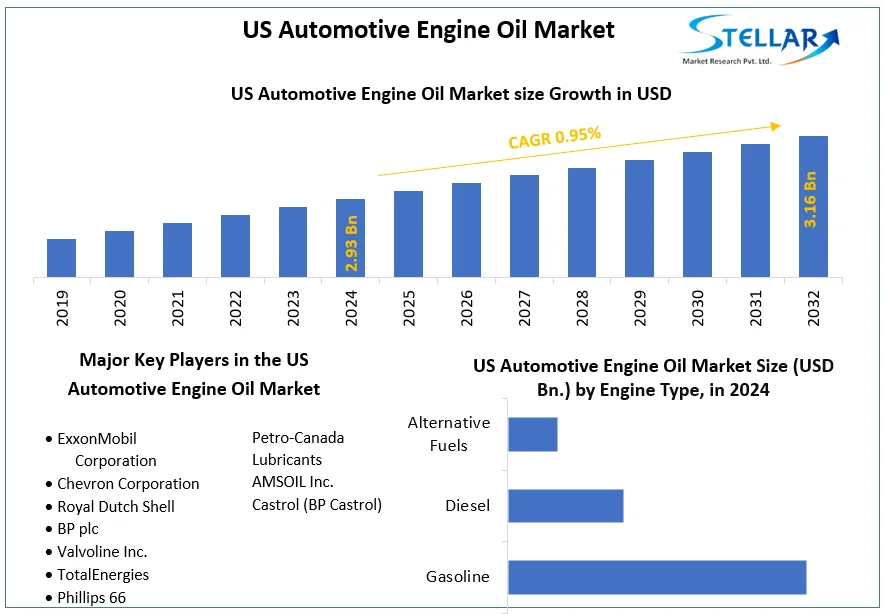

The US Automotive Engine Oil Market size was valued at USD 2.93 Bn. in 2024 and the total US Automotive Engine Oil revenue is expected to grow at a CAGR of 0.95% from 2025 to 2032, reaching nearly USD 3.16 Bn.

Format : PDF | Report ID : SMR_1612

US Automotive Engine Oil Market Overview

Automotive engine oil, or motor oil, is vital for engine health. It reduces friction between moving parts, ensuring efficient operation and preventing wear. It also acts as a coolant, absorbing and dissipating heat generated during combustion to prevent overheating. The oil's cleaning properties collect contaminants, preventing sludge buildup and maintaining engine cleanliness. Additionally, it provides corrosion protection by neutralizing acids and preventing rust. Engine oil aids in sealing gaps between components, ensuring optimal performance and fuel efficiency.

- The US had 276 million registered vehicles in 2023.

- Routine oil changes, suggested every 5,000-7,500 miles, vary based on oil type and driving conditions.

- On average, each vehicle consumes 1-2 gallons annually.

The comprehensive report covers a detailed analysis of the US Automotive Engine Oil Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the US Automotive Engine Oil Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Increasing Vehicle Sales and Fleet Size Drives the US Automotive Engine Oil Market

Increasing vehicle numbers drive demand for engine oil and foster US Automotive Engine Oil market growth for producers. Growing fleets with diverse vehicle types present opportunities for oil producers to meet specific requirements. The growing vehicle aftermarket, driven by heightened maintenance needs, favors service stations, quick lube shops, and oil change franchises. Rising demand stimulates innovation in engine oil technology, driving advancements in performance, efficiency, and sustainability.

Growing demand attracts new market entrants improving competition and potentially impacting established US Automotive Engine Oil companies' profit margins. Fluctuations in crude oil prices, a vital engine oil component, lead to price instability for producers and consumers. The surge in vehicles raises environmental concerns, prompting stricter regulations and higher compliance costs. Increased oil consumption strains finite resources, highlighting sustainability and long-term availability concerns. Expanding fleets stress waste management infrastructure, necessitating investments in expansion or alternative solutions for used oil disposal.

The impact of rising vehicle sales and fleet size on the US automotive engine oil market is intricate. While offering growth opportunities and innovation, it triggers concerns about sustainability, competition, and environmental impact. The US Automotive Engine Oil market hinges on stakeholders navigating challenges, and investing in responsible practices, technological advancements, and alternative solutions. Specific impacts vary by segment and oil type, with government policies on fuel efficiency, emissions, and recycling playing a crucial role. The emergence of electric vehicles and alternative lubricants could potentially disrupt the traditional market landscape in the long term.

US Automotive Engine Oil Market Segment Analysis

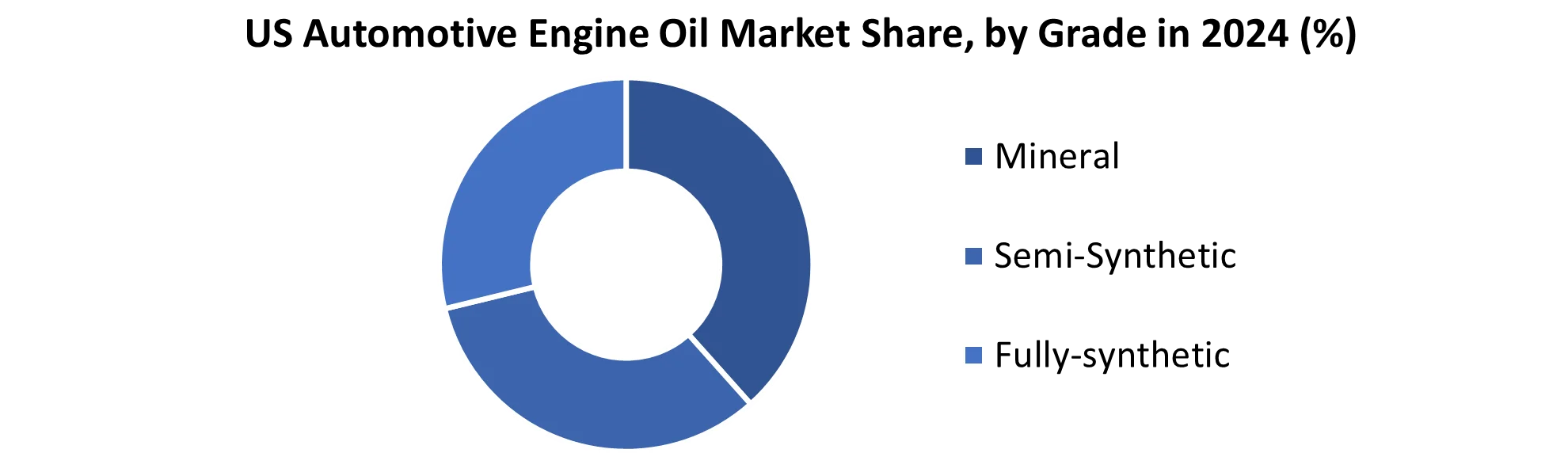

Based on Grade, the Mineral segment held the largest market share of about 57% in the US Automotive Engine Oil Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 0.95% during the forecast period. It stands out as the dominant segment within the US Automotive Engine Oil Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The US Automotive Engine Oil Industry Mineral oil stands out for affordability, making it a preferred choice for budget-conscious consumers and older vehicles. Widely accessible due to a straightforward manufacturing process, it's suitable for moderate-use vehicles, offering sufficient lubrication. Its basic composition allows for easy customization, making mineral oil a practical option for various engine needs.

Mineral oil exhibits inferior performance compared to synthetics, with higher wear susceptibility, increased volatility, and subpar extreme temperature performance. Its shorter lifespan necessitates more frequent oil changes, elevating maintenance costs and environmental impact. The higher refining demands and shorter longevity make mineral oil less environmentally friendly, contributing to declining US Automotive Engine Oil market demand as consumers increasingly prefer the superior performance and longer lifespans of synthetic and semi-synthetic oils.

Additionally, Mineral oil, valued for affordability and accessibility, faces a diminishing in the US market. Rising demand for high-performance vehicles, stringent environmental rules, and a consumer shift towards advanced lubricants are to reduce its market share. Its impact varies based on vehicle and driving conditions, while refining and additive advancements offer some performance improvements. Mineral oil's prospects lie in applications or cost-effective blends with other oil types.

|

US Automotive Engine Oil Market Scope |

|

|

Market Size in 2024 |

USD 2.93 Billion |

|

Market Size in 2032 |

USD 3.16 Billion |

|

CAGR (2025-2032) |

0.95% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Grade

|

|

By Engine Type

|

|

|

By Vehicle Type

|

|

Leading Key Players in the US Automotive Engine Oil Market

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell

- BP plc

- Valvoline Inc.

- TotalEnergies

- Phillips 66

- Petro-Canada Lubricants

- AMSOIL Inc.

- Castrol (BP Castrol)

Frequently Asked Questions

Stringent regulation and Rising manufacturing costs are expected to be the major restraining factors for the US Automotive Engine Oil market growth.

The US Automotive Engine Oil Market size was valued at USD 2.93 Billion in 2024 and the total US Automotive Engine Oil revenue is expected to grow at a CAGR of 0.95% from 2025 to 2032, reaching nearly USD 3.16 Billion By 2032.

1. US Automotive Engine Oil Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. US Automotive Engine Oil Market Trends

2.1 Market Consolidation

2.2 Adoption of Advanced Manufacturing Technologies

2.3 Pricing and Reimbursement Trends

3. US Automotive Engine Oil Market Import Export Landscape

3.1 Import Trends

3.2 Export Trends

3.3 Regulatory Compliance

3.4 Major Export Destinations

3.5 Import-Export Disparities

4. US Automotive Engine Oil Market: Dynamics

4.1.1 Market Driver

4.1.2 Market Restraints

4.1.3 Market Opportunities

4.1.4 Market Challenges

4.2 PORTER’s Five Forces Analysis

4.3 PESTLE Analysis

4.4 Regulatory Landscape

4.5 Analysis of Government Schemes and Initiatives for the US Automotive Engine Oil Industry

4.6 The Pandemic and Redefining of The US Automotive Engine Oil Industry Landscape

5. US Automotive Engine Oil Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

5.1 US Automotive Engine Oil Market Size and Forecast, by Grade (2024-2032)

5.1.1 Mineral

5.1.2 Semi-Synthetic

5.1.3 Fully-synthetic

5.2 US Automotive Engine Oil Market Size and Forecast, by Engine Type (2024-2032)

5.2.1 Gasoline

5.2.2 Diesel

5.2.3 Alternative Fuels

5.3 US Automotive Engine Oil Market Size and Forecast, by Vehicle Type (2024-2032)

5.3.1 Passenger Cars

5.3.2 Light Commercial Vehicles

5.3.3 Heavy-Duty Vehicles

5.3.4 Motorcycle

6. US Automotive Engine Oil Market: Competitive Landscape

6.1 STELLAR Competition Matrix

6.2 Competitive Landscape

6.3 Key Players Benchmarking

6.3.1 Company Name

6.3.2 Service Segment

6.3.3 End-user Segment

6.3.4 Revenue (2024)

6.3.5 Company Locations

6.4 Leading US Automotive Engine Oil Companies, by market capitalization

6.5 Market Structure

6.5.1 Market Leaders

6.5.2 Market Followers

6.5.3 Emerging Players

6.6 Mergers and Acquisitions Details

7. Company Profile: Key Players

7.1 ExxonMobil Corporation

7.1.1 Company Overview

7.1.2 Business Portfolio

7.1.3 Financial Overview

7.1.4 SWOT Analysis

7.1.5 Strategic Analysis

7.1.6 Scale of Operation (small, medium, and large)

7.1.7 Details on Partnership

7.1.8 Regulatory Accreditations and Certifications Received by Them

7.1.9 Awards Received by the Firm

7.1.10 Recent Developments

7.2 Chevron Corporation

7.3 Royal Dutch Shell

7.4 BP plc

7.5 Valvoline Inc.

7.6 TotalEnergies

7.7 Phillips 66

7.8 Petro-Canada Lubricants

7.9 AMSOIL Inc.

7.10 Castrol (BP Castrol)

8. Key Findings

9. Industry Recommendations

10. Terms and Glossary

11. US Automotive Engine Oil Market: Research Methodology