Mexico Ethanolamine Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

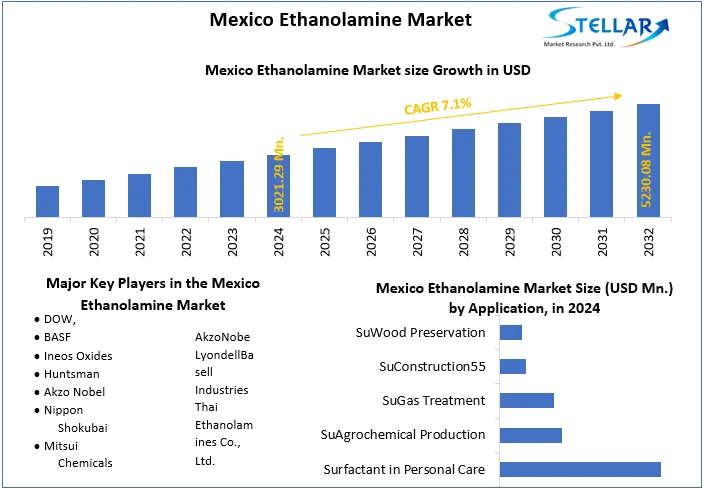

The Mexico Ethanolamine Market size was valued at USD 3021.29 Mn. in 2024 and the total Mexico Ethanolamine revenue is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 5230.08 Mn. in 2032.

Format : PDF | Report ID : SMR_1652

Mexico Ethanolamine Market Overview

Ethanolamines, a product of ammonia and ethylene oxide, serve various purposes like surfactants, cement grinding, and gas treatment. Market growth is propelled by demand in agriculture and construction, but concerns arise in healthcare due to environmental impact. In Mexico, constraints arise from increased chemical oxygen demand and total nitrogen. Ethanolamine use spans gas treating, soaps, detergents, personal care, herbicides, pesticides, pharmaceuticals, and pulp and paper.

The Mexico Ethanolamine Market report precisely examines the dynamic landscape, offering stakeholders in-depth analysis and strategic insights. Through a comprehensive approach involving primary and secondary research, it uncovers nuanced trends, drivers, challenges, and opportunities. The report accurately portrays market dimensions, growth patterns, size, and key trends, identifying pivotal factors driving growth and highlighting emerging opportunities.

To get more Insights: Request Free Sample Report

Mexico Ethanolamine Market Dynamics:

Growing Demand from the Oil and Gas Industry to Drive the Mexico Ethanolamine Market.

Rising demand for Monoethanolamine (MEA) in Mexico's oil and gas sector, vital for gas treatment, aligns with growing exploration activities. This surge not only drives Mexico Ethanolamine market growth but also generates economic benefits by fostering job creation across MEA production, transportation, and application. Additionally, MEA's role in enhancing energy security aligns with Mexico's focus on cleaner energy sources.

In Mexico Ethanolamine industry Monoethanolamine (MEA) poses environmental risks, being corrosive and toxic, raising concerns in production, transportation, and handling. Heightened environmental awareness drives stricter regulations, potentially increasing costs for manufacturers. The industry's long-term sustainability is questioned, emphasizing the need for exploring alternative, more sustainable technologies, and feed stocks for ethanolamine production.

The growing demand in Mexicoethanolamine market, run by the oil and gas industry, necessitates addressing environmental and sustainability concerns. Achieving a balance requires strict observance of regulations, investment in cleaner production technologies, exploration of alternative feed stocks, and a proactive search for greener alternatives to ethanolamines.

Mexico Ethanolamine Market Segment Analysis

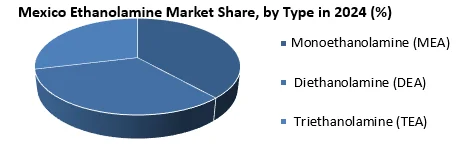

Based on Type, the Monoethanolamine (MEA)segment held the largest market share of about 40% in the Mexico Ethanolamine Market in 2024.According to the STELLAR analysis, the segment is expected to grow at a CAGR of 7.2% during the forecast period. It stands out as the dominant segment within the Mexico Ethanolamine Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Monoethanolamine (MEA) significantly influences the Mexico Ethanolamine Market and offers versatility in applications such as gas treatment, personal care products, and pharmaceuticals. It efficiently removes acidic gases, acts as a neutralizing agent in personal care items, and ensures cost-effective production. With an established production and supply chain, MEA maintains reliability across diverse industries in Mexico.

Mexico Ethanolamine Industry Monoethanolamine (MEA) poses environmental concerns due to its corrosiveness and toxicity, with potential harm during production, transportation, and use. Stringent regulations addressing environmental sustainability may restrict its application in certain sectors. Additionally, health risks, including respiratory issues and skin irritation, mandate stringent safety measures, impacting production costs and complexity.

MEA holds significance in the Mexico ethanolamine market for its versatility and established presence. Additionally, environmental and health concerns necessitate careful consideration, emphasizing the need for responsible production, handling, and exploration of sustainable alternatives.

|

Mexico Ethanolamine Market Scope |

|

|

Market Size in 2024 |

USD 3021.29 Million |

|

Market Size in 2032 |

USD 5230.08 Million |

|

CAGR(2025-2032) |

7.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Application

|

|

Leading Key Players in the Mexico Ethanolamine Market

- DOW,

- BASF

- Ineos Oxides

- Huntsman

- Akzo Nobel

- Nippon Shokubai

- Mitsui Chemicals

- AkzoNobe

- LyondellBasell Industries

- Thai Ethanolamines Co., Ltd.

Frequently Asked Questions

Stringent regulation and Rising costs are expected to be the major restraining factors for the Mexico Ethanolamine market growth.

The Mexico Ethanolamine Market size was valued at USD 3021.29 Million in 2024 and the total Mexico Ethanolamine revenue is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 5230.08 Million By 2032.

1. Mexico Ethanolamine Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Mexico Ethanolamine Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 - 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Mexico Ethanolamine Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Headquarter

3.3.3. Product Segment

3.3.4. End-User Segment

3.3.5. Y-O-Y%

3.3.6. Revenue (2024)

3.3.7. Profit Margin

3.3.8. Market Share

3.3.9. Company Locations

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.5.1. Strategic Initiatives and Developments

3.5.2. Mergers and Acquisitions

3.5.3. Collaboration and Partnerships

3.5.4. Product Launches and Innovations

4. Mexico Ethanolamine Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Mexico Ethanolamine Market Size and Forecast by Segments (by Value USD Million)

5.1. Mexico Ethanolamine Market Size and Forecast, By Type (2024-2032)

5.1.1. Monoethanolamine (MEA)

5.1.2. Diethanolamine (DEA)

5.1.3. Triethanolamine (TEA)

5.2. Mexico Ethanolamine Market Size and Forecast, By Application (2024-2032)

5.2.1. Surfactant in Personal Care

5.2.2. SuAgrochemical Production

5.2.3. SuGas Treatment

5.2.4. SuConstruction55

5.2.5. SuWood Preservation

6. Company Profile: Key players

6.1. DOW,

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.2.1. Total Revenue

6.1.2.2. Segment Revenue

6.1.3. Product Portfolio

6.1.3.1. Product Name

6.1.3.2. Product Details

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. BASF

6.3. Ineos Oxides

6.4. Huntsman

6.5. Akzo Nobel

6.6. Nippon Shokubai

6.7. Mitsui Chemicals

6.8. AkzoNobe

6.9. LyondellBasell Industries

6.10. Thai Ethanolamines Co., Ltd.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook