Neuromodulation Market - Global Industry Analysis and Forecast (2025-2032) by Product Type, Biomaterial and Region

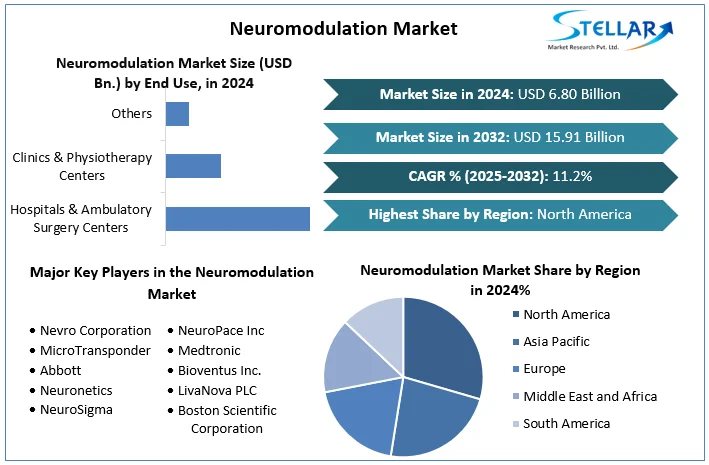

Global Neuromodulation Market size was valued at USD 6.80 Bn. in 2024 and is expected to reach USD 15.91 Bn. by 2032, at a CAGR of 11.2%.

Format : PDF | Report ID : SMR_2226

Neuromodulation Market Overview

Neuromodulation is a series of techniques that act directly on the nervous system. Neurological disorders are conditions that affect the functioning of the nervous system, including the brain, spinal cord, and nerves throughout the body. According to the World Health Organization (WHO), around 50 million people worldwide were diagnosed with epilepsy as of February 2022. The prevalence of epilepsy is driving the growth in the neuromodulation market. The increasing geriatric population is contributing to the growth of the neuromodulation market, as older adults are more prone to neurological diseases like Alzheimer's. In 2023, 6.7 million Americans aged 65 and older were diagnosed with Alzheimer's dementia.

Medtronic Plc holds the highest market share in North America's neuromodulation market and reported worldwide revenue of XX billion in fiscal year 2024. Global Neuromodulation Market growth is driven by the prevalence of neurological disorders and nerve injuries, increasing focus on the development of advanced neuromodulation and neurostimulation technologies, government support for research on neurological disorders, growing geriatric population, and subsequent increase in the prevalence of neurological disorders, availability of reimbursement of neuromodulation devices, collaborations among device manufacturers, healthcare providers, and research institutions to develop neuromodulation devices.

To get more Insights: Request Free Sample Report

Neuromodulation Market Dynamics

Neuromodulation Market Poised for Rapid Growth Driven by Neurological Disorders and Technological Advancements

The growth of the neuromodulation market is driven by the increasing prevalence of neurological disorders and the rising adoption of neuromodulation devices in developed countries. Deep brain stimulation (DBS) systems are used to treat conditions like epilepsy and Parkinson's disease. The rise in the global prevalence of epilepsy is a key factor boosting the neuromodulation market. According to the World Health Organization, around 50 million people worldwide were diagnosed with epilepsy as of February 2022. Additionally, the growing geriatric population is contributing to market growth, as older adults are more prone to neurological diseases like Alzheimer's. The Alzheimer's Association estimates that in 2021, around 6.2 million Americans aged 65 and older were diagnosed with Alzheimer's dementia

Neuromodulation Market Technological Advancements in 2023

- The emergence of closed-loop neuromodulation systems that can automatically adjust electrical stimulation based on recorded neurological activity is a key innovation allowing patients to live more normal lives. Companies like Saluda Medical are developing these closed-loop devices for spinal cord stimulation (SCS) and deep brain stimulation (DBS). Ongoing innovations in SCS device design, such as improved lead designs, are also expected to drive SCS adoption further, as it is the largest neuromodulation market segment.

Challenges: Neuromodulation and Neurostimulation Devices Face Regulatory Hurdles

Neuromodulation and neurostimulation devices face stringent regulatory approval processes in the US, which pose significant challenges for companies operating in this neuromodulation market. Medical devices are classified into three risk-based classes (I, II, and III) in the US, with neuromodulation and neurostimulation devices typically falling under the higher-risk Class II or III categories. These devices require premarket notification via the 510(k) process for approval and launch in the US market. However, the number of premarket approvals granted has declined over the years, and the time required for FDA internal review and abbreviated 510(k) approvals has increased. This regulatory environment creates major hurdles for companies seeking to bring their neuromodulation products to the US market.

Neuromodulation Market Segment Analysis

By Applications, the global Parkinson's disease is dominating the global neuromodulation market with a size estimated to be worth USD 8.31 billion in 2024. Parkinson's disease dominated the global neuromodulation market with a revenue share of over 25.0% in 2024 due to its high product efficacy in treating the disease and the lack of treatment choices. Parkinson's disease is a chronic neurodegenerative brain disorder that causes movement problems. According to the Global Burden of Diseases (GBD) study in 2020, about 6.2 million people were suffering from Parkinson's disease globally.

The chronic pain segment is expected to register the fastest growth rate of 11.3% over the forecast period. This is due to the rise in the incidence rate of chronic diseases, increased investments by private players in the Neurotherapy field, and an increase in research and development activities in the sector. According to the National Institutes of Health (NIH), chronic pain is a discomfort that lasts more than 12 weeks.

By Biomaterials, In 2024, the metallic biomaterials segment held a significant share of over XX% in the global neuromodulation market due to advancements and research in neuromodulation solutions. This segment is expected to continue its dominance during the forecast period. The biomaterials market is categorized into polymeric, metallic, and ceramic biomaterials. The polymeric biomaterials segment is projected to grow at a rate of XX% during the forecast period, driven by its flexibility and ability to be shaped into support structures like electrospun matrices, nerve conduits, and scaffolds, which can regenerate damaged neural tissues. Polymers are widely used in medical implantable devices that offer various mechanical and biocompatible characteristics.

By End User, the hospitals and ambulatory surgery centers segment accounted for the largest revenue share of over XX% in 2024 in the global neuromodulation market and is expected to maintain its dominance during the forecast period. It is also expected to exhibit the fastest compound annual growth rate (CAGR) over the forecast period. The market is segmented by end-use into hospitals, ambulatory surgery centers, clinics and physiotherapy centers, and others. Hospitals offer neuromodulation surgery and implantable device therapy for patients with neurological disorders, with spinal cord stimulation being a popular treatment for neurological disorders. Ambulatory surgery centers have revolutionized the outpatient experience by providing a more convenient, efficient, and cost-effective alternative to neurological outpatient procedures.

Neuromodulation Market Competitive Landscape

The global Neuromodulation market is dominated by a few major players, with the top 3-4 companies holding over 90% market share. Medtronic Plc holds the highest market share of around 30-35% in 2024, thanks to its vast product portfolio, strong brand recognition, global reach, and robust distribution network. Boston Scientific Corporation held the second largest market share in 2024, with a focus on organic and inorganic strategies like product launches and acquisitions to strengthen its position. Abbott Laboratories held around 10-15% market share in 2024, leveraging its wide product portfolio and investments in R&D, production, marketing, and distribution.

Other notable players include LivaNova Plc, Nevro Corp, NeuroPace Inc, Bioventus Inc, Neuronetics, Sonova Group, St. Jude Medical, Cyberonics, Cochlear Ltd, and Advanced Bionics. The top players have achieved their leading positions through a combination of broad product portfolios, strong brand recognition, extensive geographic reach, continuous innovation, and strategic acquisitions. This high market concentration is expected to continue as the dominant players leverage their advantages to maintain their stronghold in this lucrative and rapidly growing market.

Neuromodulation Market Regional Insights, North America dominated the neuromodulation market in 2024 and is expected to continue leading the global market during the forecast period. This is attributed to the high prevalence of neurological disorders, the presence of major neuromodulation device manufacturers, and the well-developed healthcare infrastructure in the region. In North American neuromodulation market, led by the United States, dominates the global market due to the high prevalence of neurological disorders, the presence of major device manufacturers, and the well-developed healthcare infrastructure in the region. Medtronic Plc: Holds the highest market share in 2024.

Medtronic reported worldwide revenue of $31.227 billion in fiscal year 2023. The increasing incidence of neurological diseases like Parkinson's disease, which is expected to affect 1.2 million people in the U.S. by 2030, is fueling the demand for innovative neuromodulation devices in the region. Additionally, continuous product approvals by the FDA are increasing competition and creating opportunities for developing advanced neuromodulation solutions in North America. For example,

- In 2022, Medtronic received FDA approval for its Intellis and Vanta neurostimulators for treating chronic pain associated with diabetic peripheral neuropathy. The robust healthcare infrastructure and favorable reimbursement policies in the region further contribute to the growth of the North American neuromodulation market.

The report aims to provide industry stakeholders with a thorough study of the global Neuromodulation market. The research presents the industry's historical and present state together with projected market size and trends, analyzing complex data in an easy-to-read manner. The research includes PORTER and PESTEL analyses along with the possible effects of market microeconomic factors. The analysis of both internal and external elements that could have a good or negative impact on the firm will provide decision-makers with a clear picture of the industry's future. By understanding the market segments and projecting the size of the global Neuromodulation market, the reports also help in understanding the market's dynamics and structure.

Neuromodulation Market Scope

|

Neuromodulation Market |

|

|

Market Size in 2024 |

USD 6.80 Bn. |

|

Market Size in 2032 |

USD 15.91 Bn. |

|

CAGR (2025 - 2032) |

11.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Neuromodulation Market Segments |

By Product Type Spinal Cord Stimulators Deep Brain Stimulators Sacral Nerve Stimulators Vagus Nerve Stimulators Transcranial Magnetic Stimulators Other |

|

By Biomaterial Polymeric Biomaterial Metallic Biomaterial Ceramic Biomaterial |

|

|

By Application Chronic Pain Low-carb Neuromodulation Urinary and Fecal Incontinence Migraine Tremor Other Applications |

|

|

By End Use Hospitals & Ambulatory Surgery Centers Clinics & Physiotherapy Centers Others |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Neuromodulation Market Key players

- Nevro Corporation

- MicroTransponder

- Abbott

- Neuronetics

- NeuroSigma

- NeuroPace Inc

- Medtronic

- Bioventus Inc.

- LivaNova PLC

- Boston Scientific Corporation

Frequently Asked Questions

Europe is expected to dominate the Neuromodulation Market during the forecast period.

The Neuromodulation Market size is expected to reach USD 6.80 Billion in 2024.

The Neuromodulation Market size is expected to reach USD 15.91 Billion by 2032.

The major top players in the Global Neuromodulation Market include Medtronic, Nevro Corporation, MicroTransponder, Abbott, LivaNova PLC, Boston Scientific Corporation, and others.

Increasing demand for closed-loop neuromodulation systems is expected to drive market growth during the forecast period.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Neuromodulation Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Neuromodulation Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Approvals

3.5. Neuromodulation Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Neuromodulation Market: Dynamics

4.1. Neuromodulation Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Neuromodulation Market Drivers

4.3. Neuromodulation Market Restraints

4.4. Neuromodulation Market Opportunities

4.5. Neuromodulation Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Neuromodulation Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

5.1.1. Spinal Cord Stimulators

5.1.2. Deep Brain Stimulators

5.1.3. Sacral Nerve Stimulators

5.1.4. Vagus Nerve Stimulators

5.1.5. Transcranial Magnetic Stimulators

5.1.6. Other

5.2. Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

5.2.1. Polymeric Biomaterial

5.2.2. Metallic Biomaterial

5.2.3. Ceramic Biomaterial

5.3. Neuromodulation Market Size and Forecast, by Application (2024-2032)

5.3.1. Chronic Pain

5.3.2. Low-carb Neuromodulation

5.3.3. Urinary and Fecal Incontinence

5.3.4. Migraine

5.3.5. Tremor

5.3.6. Other Applications

5.4. Neuromodulation Market Size and Forecast, by End Use (2024-2032)

5.4.1. Hospitals & Ambulatory Surgery Centers

5.4.2. Clinics & Physiotherapy Centers

5.4.3. Others

5.5. Neuromodulation Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Neuromodulation Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

6.1.1. Spinal Cord Stimulators

6.1.2. Deep Brain Stimulators

6.1.3. Sacral Nerve Stimulators

6.1.4. Vagus Nerve Stimulators

6.1.5. Transcranial Magnetic Stimulators

6.1.6. Other

6.2. North America Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

6.2.1. Polymeric Biomaterial

6.2.2. Metallic Biomaterial

6.2.3. Ceramic Biomaterial

6.3. North America Neuromodulation Market Size and Forecast, by Application (2024-2032)

6.3.1. Chronic Pain

6.3.2. Low-carb Neuromodulation

6.3.3. Urinary and Fecal Incontinence

6.3.4. Migraine

6.3.5. Tremor

6.3.6. Other Applications

6.4. North America Neuromodulation Market Size and Forecast, by End Use (2024-2032)

6.4.1. Hospitals & Ambulatory Surgery Centers

6.4.2. Clinics & Physiotherapy Centers

6.4.3. Others

6.5. North America Neuromodulation Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Neuromodulation Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

7.2. Europe Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

7.3. Europe Neuromodulation Market Size and Forecast, by Application (2024-2032)

7.4. Europe Neuromodulation Market Size and Forecast, by End Use (2024-2032)

7.5. Europe Neuromodulation Market Size and Forecast, by Country (2024-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Russia

7.5.8. Rest of Europe

8. Asia Pacific Neuromodulation Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

8.2. Asia Pacific Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

8.3. Asia Pacific Neuromodulation Market Size and Forecast, by Application (2024-2032)

8.4. Asia Pacific Neuromodulation Market Size and Forecast, by End Use (2024-2032)

8.5. Asia Pacific Neuromodulation Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. India

8.5.3. Japan

8.5.4. South Korea

8.5.5. Australia

8.5.6. ASEAN

8.5.7. Rest of Asia Pacific

9. Middle East and Africa Neuromodulation Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

9.2. Middle East and Africa Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

9.3. Middle East and Africa Neuromodulation Market Size and Forecast, by Application (2024-2032)

9.4. Middle East and Africa Neuromodulation Market Size and Forecast, by End Use (2024-2032)

9.5. Middle East and Africa Neuromodulation Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Rest of the Middle East and Africa

10. South America Neuromodulation Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Neuromodulation Market Size and Forecast, by Product Type (2024-2032)

10.2. South America Neuromodulation Market Size and Forecast, by Biomaterial (2024-2032)

10.3. South America Neuromodulation Market Size and Forecast, by Application (2024-2032)

10.4. South America Neuromodulation Market Size and Forecast, by End Use (2024-2032)

10.5. South America Neuromodulation Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Nevro Corporation

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. MicroTransponder

11.3. Abbott

11.4. Neuronetics

11.5. NeuroSigma

11.6. NeuroPace Inc

11.7. Medtronic

11.8. Bioventus Inc.

11.9. LivaNova PLC

11.10. Boston Scientific Corporation

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook