Asia Pacific Bike Sharing Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

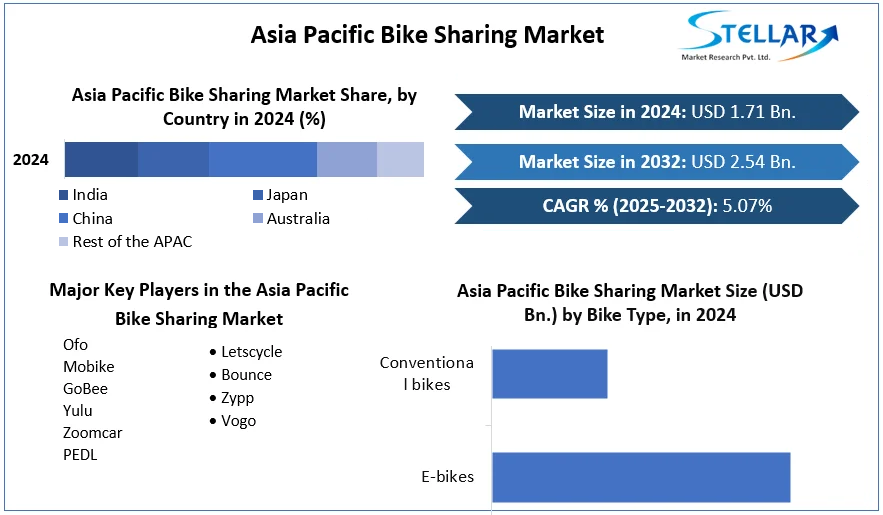

Asia Pacific Bike Sharing Market size was valued at US$ 1.71 Billion in 2024 and the total Asia Pacific Bike Sharing Market revenue is expected to grow at 5.07% through 2025 to 2032, reaching nearly US$ 2.54 Billion.

Format : PDF | Report ID : SMR_62

Asia Pacific Bike Sharing Market Overview:

Asia Pacific Bike Sharing market is expected to register CAGR of 5.07% during the forecast period. Concerns about globalization and climate change have sparked a surge in interest in environmentally friendly modes of transportation, such as bike sharing (the shared use of a bicycle fleet) in the Asia Pacific region. Bike sharing has increased in popularity in major five countries in APAC since 2015: China, India, Japan, Singapore, and ASEAN region.

To get more Insights: Request Free Sample Report

Asia Pacific Bike Sharing Market Dynamics:

Public bicycle sharing programmes (PBSPs) are gaining popularity around the world as a viable climate-friendly, active transportation option, which is one the strong reason behind the Asia Pacific Bike Sharing market growth. Despite becoming permanent features in the Western urban scene, PBSP implementation in Asia, with the exception of China, has been abysmal. Many of the pilot models were adapted from Western examples that did not adequately match the unique physical, cultural, economic, and political environment of Asia-Pacific cities (e.g., a varied range of land uses, dense urban centres, and formal/informal transportation interaction). This study looks into the localization of bike-sharing networks in five Asian cities. As the climate changes, Asian cities will be subjected to more regular rainfall, rising sea levels, and an increase in the number of extreme tropical storms.

Because three of the top five emitters are Asian countries – China, India, and Japan – significant action on climate change must be made within the Asian region. This will necessitate collaboration among Asian community members, including government, commercial sector, and civil society. Furthermore, urban transportation must be able to adapt to changing circumstances and demand for transportation services, ensuring that people and communities have adequate transportation, particularly through the availability of alternatives, to access social and economic possibilities. A public bicycle-sharing programme (PBSP), which is considered as a sustainable and inclusive urban transportation alternative, is one sustainable transportation solution that can ease some of these urban difficulties. This programme is expected to propel the Bike Sharing market growth throughout the forecast period.

PBSPs are non-motorized transportation services that provide point-to-point active transportation for short distance trips without requiring the use of a bicycle. The concept is that a person can borrow a bike from one station for a short trip (typically 30 minutes to an hour) and then return it to the same docking point or another in the network. Bike sharing is a public service that operates alongside public buses, ferries, and trains as part of a larger public transportation network. The integration of PBSPs into a country's urban infrastructure is thought to give a number of environmental, economic, and social benefits, including more flexible mobility and lower emissions.

According to the Journal of the Eastern Asia Society for Transportation Studies, the number of bicycle units operating in 125 cities has nearly doubled to 539,300. As of this writing, there are roughly 930 PBSPs with 1,069,000 bicycles installed in 54 countries throughout the world. Ten Asian countries have launched bike-sharing programmes. While the most of them are in East Asia, especially China. Europe and the Americas were the primary adaptors of the first and second generations of PBSPs. The programme was not released to the Asia Pacific Bike Sharing market until the third IT-based iteration of the programme. Despite joining the game later, Asia continues to be the fastest expanding region for bike share systems.

Asia Pacific Bike Sharing Market Key Advancements:

Hangzhou's bike system is planned to reach 278,000 bikes by 2022. In Southeast Asia, a trial PBSP has been introduced in Pasig City, Philippines, with intentions to expand. The Tituba network, Pasig's PBSP, was created by the Asian Development Bank, supported by the Japanese Fund for Poverty Reduction, and administered by Clean Air Asia. It is the first of its kind in the Philippines. Currently, there is only one station with ten bicycles that may be accessible using a card system at the station kiosk. One of the main goals of this PBSP is to show that the system can be cheap and long-term in a developing Asian country. In Bangkok, Thailand, a PBSP called Pun Pun Bike was implemented, consisting of 12 docking stations and 50 bicycles, to reduce traffic congestion and the high number of road traffic deaths in the metropolitan area. The introduction of the Bangkok PBSP has revealed a number of challenges in operating a PBSP in a huge, highly populated urban environment: people have generally ignored the deployment of bicycle lanes, monsoonal weather, excessive humidity, and unsafe shared roads have limited uptake.

Despite the fact that studies have indicated that weather and environment can sometimes act as a barrier to PBSP adoption, more bicycle riders on the roads are likely to usher in a cycle riding culture in the city. In June 2012, the Indonesian city of Bandung launched a PBSP called Bike.Bdg. The PBSP in Bandung was started by a local resident and the Bandung Creative City Forum. The goal of Bike.Bdg is to reduce traffic congestion and increase the number of people who cycle. The Bike.Bdg has grown in popularity, particularly among younger inhabitants, because to a marketing campaign on Instagram and Twitter. The effectiveness of this PBSP has inspired Jakarta and Solo to explore implementing their own. For their students, some institutions have implemented small-scale bike share programmes. The University of Indonesia, for example, has a first-generation bike-sharing programme on campus.

According to the Journal of the Eastern Asia Society for Transportation Studies, the Asian Development Bank planned to implement three pilot schemes in Southeast Asia, in the cities of Davao (Philippines), Vientiane (Lao PDR), and Jakarta (Indonesia), with plans to implement additional schemes in three South Asian cities: Dhaka (Bangladesh), Kathmandu (Nepal), and Thimphu (Thimphu) (Bhutan). The enormous capital necessary to implement a PBSP in Asian cities, particularly Southeast Asian cities, has hampered its broad adoption. As a result, better tactics must be adopted in order to make the system more financially feasible while simultaneously determining ways to ensure that it is operationally sustainable.

Business Models in APAC Bike Sharing market:

A variety of business and governance models have been examined and utilized in the implementation of PBSPs in the Asian environment. The majority of countries, including Europe, have established a business model based on collaboration between local governments and advertising agencies. According to ABSA, local governments control around 27% of PBSPs, while advertising businesses control approximately 39%. Other business models that have been adopted in the Asia Pacific Bike Sharing market include public agency funding (e.g., providing services under the supervision of a public authority to improve public transit), such as the popular Hangzhou, China system.

Not-for-profit business models (e.g., providing services with the help of government agencies or local governments) are also popular, as demonstrated by the Wuhan (China) and Kyushu (Japan) systems. While the reasons for its introduction vary from one jurisdiction to the next. In Asia Pacific Bike Sharing market, PBSP implementation is gaining traction among egovernment agncies and the general public. The project offers to provide people with a sustainable mode of transportation, assisting in the alleviation of transportation and transportation-related difficulties in the Asian region in general, and in developing Asian countries in particular.

Key facts in APAC Bike Sharing market:

Smaller competitors have been pushed out of Asia's shared bicycle sector, which has hindered some of the region's top platforms' rapid foreign expansion.

• Alibaba-backed start-up ofo said earlier this month that it would shut down its six-month-old operations in India, as well as its two Australian locations, Sydney and Adelaide, in the next two months. According to Chinese business journal Caixin, the corporation aims to scale back operations in four locations – Japan, South Korea, Singapore, and Hong Kong — due to a liquidity shortage. The decision represents a sharp reversal from the company's initial ambitions to deploy 20 million bikes across 20 nations by the end of 2019.

• According to research firm IDC, the Asia-Pacific sharing bike sector has seen an inflow of investment over the last two years, allowing as many as 60 platforms to build up bike fleets and subsidise rides in an effort to outbid competitors. China's leading platforms, Mobike and ofo, raised roughly $2 billion in 2017. The rise of shared bikes was most visible in China, where rows of colourful machines jostled for limited footpath space at their peak. However, a number of closures have occurred in recent months, as smaller start-ups have found their financial resources swiftly depleted by fierce rivalry and bike thefts.

• Surviving platforms have fought back by enlisting the help of China's biggest internet companies. Mobike, ofo's primary competitor, was entirely acquired by food services behemoth Meituan Dianping in a $3.7 billion deal that included debt in April. In order to obtain an advantage over its competitors, Mobike used some of the funds raised to waive $150 million in customer deposits on its bikes. Mobike claims it wants to make zero deposits a standard in the bike-sharing sector, which would effectively boost the cost of competitors' operations and push them out.

• The boom-bust cycle is similar to the spending war between Didi, the Chinese ride-hailing giant, and Uber, which competed for market share by providing passengers discounted trips.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Asia Pacific Bike Sharing market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants.

The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry. The research also aids in comprehending the Asia Pacific Bike Sharing market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Asia Pacific Bike Sharing market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Major breakthroughs in the Asia Pacific Bike Sharing industry are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations.

Asia Pacific Bike Sharing Market Scope:

|

Asia Pacific Bike Sharing Market Scope |

|

|

Market Size in 2024 |

USD 1.71 Bn. |

|

Market Size in 2032 |

USD 2.54 Bn. |

|

CAGR (2025-2032) |

5.07% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

|

Country Scope |

China |

Asia Pacific Bike Sharing Market Players

Country Breakdown:

Frequently Asked Questions

China, India, Japan, Singapore and South Korea are the top 5 countries in the APAC bike sharing market in terms of system installations.

Ofo, Mobike, GoBee, Yulu, Zoomcar PEDL, Letscycle, Bounce, Zypp, Vogo are the top players in the Asia Pacific Bike Sharing market.

China region have the highest growth rate of 7.35% in the Asia Pacific Bike Sharing market with total system installations of 530.

1. Asia Pacific Bike Sharing Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific Bike Sharing Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific Bike Sharing Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Service Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia Pacific Bike Sharing Market: Dynamics

4.1. Asia Pacific Bike Sharing Market Trends

4.2. Asia Pacific Bike Sharing Market Drivers

4.3. Asia Pacific Bike Sharing Market Restraints

4.4. Asia Pacific Bike Sharing Market Opportunities

4.5. Asia Pacific Bike Sharing Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Asia Pacific Bike Sharing Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Bike Sharing Market Size and Forecast, by Bike Type (2024-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. Asia Pacific Bike Sharing Market Size and Forecast, by Model (2024-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station-based

5.3. Asia Pacific Bike Sharing Market Size and Forecast, by Sharing System (2024-2032)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybrid

5.4. Asia Pacific Bike Sharing Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. India

5.4.3. Japan

5.4.4. South Korea

5.4.5. Australia

5.4.6. ASEAN

5.4.7. Rest of APAC

6. Company Profile: Key Players

6.1. Ofo

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Mobike

6.3. GoBee

6.4. Yulu

6.5. Zoomcar PEDL

6.6. Letscycle

6.7. Bounce

6.8. Zypp

6.9. Vogo

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook