Asia Pacific Automotive Power Distribution Block Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

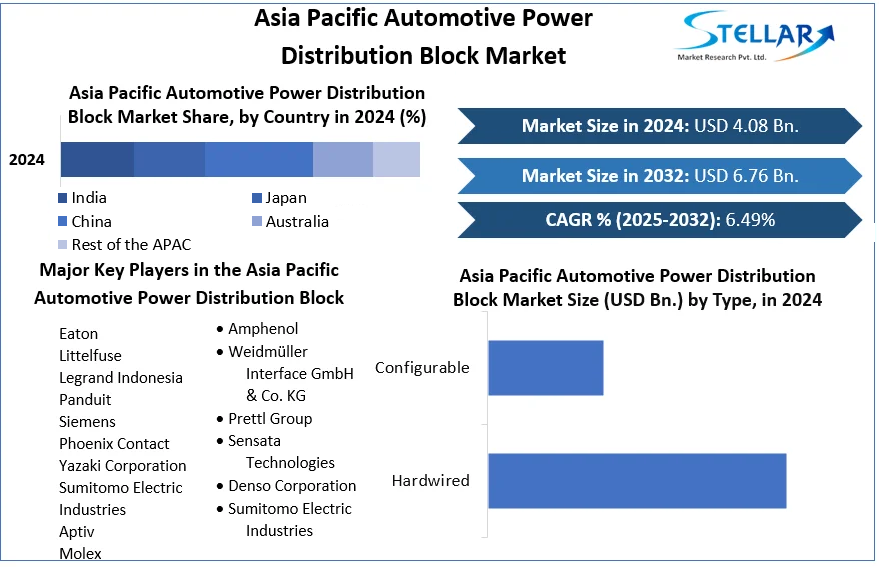

The Asia Pacific Automotive Power Distribution Block Market size was valued at USD 4.08 Bn. in 2024 and the total Asia Pacific Automotive Power Distribution Block Market size is expected to grow at a CAGR of 6.49 % from 2025 to 2032, reaching nearly USD 6.76 Bn.

Format : PDF | Report ID : SMR_2281

Asia Pacific Automotive Power Distribution Block Market Overview

An automotive power distribution block is a part that ensures effective power management and protection by combining and distributing electrical power from a car's battery to different circuits and electrical systems.

The Asia Pacific automotive power distribution block market exhibited strong performance in 2024, driven by robust vehicle production, technological advancements, and government support for electric vehicles (EVs). Power distribution blocks for cars saw increased demand, particularly in China, which produced over 25 million vehicles, accounting for nearly 30% of global automotive production. Innovations in power block solutions, such as advanced safety features and enhanced energy efficiency, contributed to market growth. Key manufacturers like Denso Corporation and Sumitomo Electric Industries led the market with cutting-edge products and extensive manufacturing capabilities.

Denso's revenue has increased by 14% in 2024 driven by the strong sales of cars, highlighting its dominance in the region. The market's growth is further supported by cost-effective manufacturing in countries like India and Vietnam, along with strong export activities from South Korea.

To get more Insights: Request Free Sample Report

Asia Pacific Automotive Power Distribution Block Market Dynamics

Growth and Innovation in the Asia Pacific Automotive Power Distribution Blocks Market

The Asia Pacific Automotive Power Distribution Blocks Market has grown rapidly owing to rising consumer demand and increased vehicle production in the area. Automobile production increased globally in 2022 despite supply chain disruptions and inflationary pressures, with China seeing a 3 percent increase and South America seeing an 8 percent increase. The increasing number of vehicles produced highlights how important power distribution blocks are to the effective operation of automotive electrical systems. For example, Advanced Driver Assistance Systems (ADAS) rely heavily on Amphenol's automotive-grade interconnect solutions, such as wire-to-board and board-to-board connectors.

The superior electrical performance, vibration resistance, and high-speed data transmission that these connectors guarantee are critical to the dependability and efficiency of contemporary automobiles. Additionally, the market benefits from macroeconomic factors like credit availability, interest rates, fuel prices, consumer confidence, and employment trends that influence the production of new cars and, in turn, the demand for automotive components.

Asia Pacific Automotive Power Distribution Blocks Market Trends and Opportunities

Electric vehicle (EV) adoption, smart city initiatives, and technological advancements are driving a significant transformation of the Asia Pacific Automotive Power Distribution Blocks market. The move to software-defined cars, which are becoming essential to the automotive ecosystem, is a significant trend. Power distribution blocks need to meet stringent requirements, including vibration resistance and EMI protection, to ensure secure data, power, and signal transfer in these advanced vehicles. For example, connectors used in LIDAR sensors, cameras, and radar systems in ADAS applications must support high-speed data transmission while withstanding harsh automotive environments.

The market is also seeing an increased demand for components capable of handling various conductor types, such as copper, aluminum, and flat conductors, which aligns with the push for versatile and robust solutions. The integration of innovative technologies in power distribution blocks enhances their functionality, making them suitable for collecting and distributing potentials within sub-distribution boxes and switchgear. Products like Amphenol’s power clamping blocks, which feature a slim design for high wiring density and finger-safe protection according to EN 50274 standards, exemplify these advancements. The short-circuit resistance following the SCCR standard (200 kA) further ensures safety and reliability.

The special coating on the brass body of the distribution blocks enables the connection of various conductor designs, enhancing their applicability in diverse industrial and international markets. As the automotive industry evolves with new entrants such as mobility providers and electric vehicle developers, the demand for advanced power distribution blocks is expected to rise, presenting significant opportunities for innovation and market growth.

Asia Pacific Automotive Power Distribution Block Market Segment Analysis

Based on Type, The market was led by the Hardwired Power Distribution Blocks segment in 2024, and this trend is predicted to continue with a growing CAGR throughout the forecast period. Because of its dependability, affordability, and simplicity of integration into current vehicle architectures. For the safety and functionality of automotive electronics, hardwired systems provide reliable and constant power distribution. Because these systems are less vulnerable to electromagnetic interference, the integrity of vehicle operations can be preserved.

Furthermore, compared to their wireless counterparts, hardwired solutions are usually easier to install and maintain, which lowers complexity and potential failure points. Hardwired power distribution blocks, for instance, offer strong and dependable connections for vital systems like electric drive units and battery management systems in electric vehicles, guaranteeing both safety and optimum performance.

Based on vehicle Type, in 2024, the passenger car segment held a dominant market share and is predicted to continue to do so with a compound annual growth rate (CAGR) of rising. The increasing complexity of electronic systems in modern vehicles, the large volume of passenger cars produced and sold in the Asia Pacific, and the rising demand from consumers for cutting-edge convenience and safety features all contribute to this. To support multiple electronic components, including infotainment systems, advanced driver-assistance systems (ADAS), and powertrain controls, passenger cars—which come in a variety of models, from economy to luxury need complex electrical architectures.

To ensure effective and dependable power distribution throughout the vehicle, for example, the integration of multiple power distribution blocks is crucial in luxury sedans such as the Mercedes-Benz S-Class. This allows for the management of an extensive network of electronic devices. Because passenger cars use a lot of electronic systems, there is a growing need for reliable power distribution solutions, which is why the segment is dominating the Asia-Pacific automotive power distribution block market.

Asia Pacific Automotive Power Distribution Block Market Country Analysis

In the Asia Pacific automotive power distribution block market, South Korea, China, and Japan hold the leading positions. Thanks to the strong automotive sector in Japan, which is driven by well-known brands like Nissan, Honda, and Toyota, the country has a sizable market share. Japan demonstrated its strong export capabilities in 2024 with over 45 million vehicles exported by the automotive sector. In addition, China is the biggest automobile market in the world. The demand for advanced power distribution blocks is further increased by China's government's push for electric vehicles (EVs), which accounted for nearly 30% of all vehicles produced globally in 2023 with over 25 million produced there.

With its car exports expected to reach over USD 43 billion in 2024, South Korea home to important players like Hyundai and Kia contributes significantly. Growth drivers that have influenced the power distribution block demand for the automotive industry include improved EV technology, higher car production, and government programs. Owing to their substantial regional presence and sophisticated manufacturing and distribution networks, Denso Corporation (Japan), Sumitomo Electric Industries (Japan), and LEONI AG (Germany) are major players in this market.

Additionally, China has officially taken the crown as the world's largest vehicle exporter in 2024, surpassing Japan, according to data released by the Japan Automobile Manufacturers Association (JAMA).

China led the world as the largest producer of vehicles, manufacturing more than 21.4 million cars and 4.6 million commercial vehicles in 2021 for a total production of just over 26 million vehicles. As the country continues to dominate the Asia Pacific in car production in 2022, it is expected to maintain its dominance through the forecast period.

The Cars producing countries in the Asia Pacific are as follows:

|

Country |

Cars Produced In 2022 |

|

China |

27 M |

|

Japan |

7.8M |

|

South Korea |

3.8M |

|

Thailand |

1.9M |

|

Indonesia |

1.5 M |

Asia Pacific Automotive Power Distribution Block Market Competitive Landscape

Strong competition amongst industry leaders like Denso Corporation and Sumitomo Electric Industries is evident in the Asia Pacific automotive power distribution block market. To stay in their respective markets, these businesses make use of their broad manufacturing capacities, cutting-edge technologies, and robust distribution systems. China's and Japan's sophisticated car industries and large investments in electric vehicle (EV) technology make them important production hubs. Affordable production in countries like Vietnam and India has bolstered the region's competitiveness in the market, in addition to the robust export activity from South Korea, whose automobile exports exceeded USD 43 billion in 2023. Strategic alliances and joint ventures, like those between domestic producers and foreign companies, intensify the competitive environment even further.

Owing in large part to its creative technological innovations and large production capacity, Denso Corporation stands out as a dominant key player in the Asia Pacific automotive power distribution block industry. Given its wide range of products and solid clientele, Sumitomo Electric Industries, in contrast, likewise commands a sizeable portion of the market. The strategic alliances and purchases made by Denso, including the purchase of ASMO Co, Ltd. boosted its market leadership to improve its motor production capabilities.

Though, Sumitomo's competitive strategy is highlighted by its focus on increasing its global footprint through joint ventures and partnerships, like its partnership with Yazaki Corporation. In terms of production, Denso produces more than 10 million automotive components annually, while Sumitomo only produces 7 million. This highlights the competitive dynamics. Denso reported USD 47 billion in sales in 2023, while Sumitomo's automotive segment reported USD 33 billion.

Additionally, In Feb 2024, Power Distribution Units (PDUs) are the newest product that Panduit, a leader in network and electrical infsrastructure solutions globally, is offering. With its precise power monitoring and control, the launch represents a major advancement in customer-centric power management. With its extensive five-year warranty, the ES2P PDU epitomizes the company's commitment to providing top-notch power management solutions.

|

Asia Pacific Automotive Power Distribution Block Market Scope |

|

|

Market Size in 2024 |

USD 4.08 Bn. |

|

Market Size in 2032 |

USD 6.76 Bn. |

|

CAGR (2025-2032) |

6.49 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type

|

|

By Vehicle Type

|

|

|

By Material

|

|

|

By Application

|

|

|

Country Scope |

|

Asia Pacific Automotive Power Distribution Block Market Key Players

- Eaton

- Littelfuse

- Legrand Indonesia

- Panduit

- Siemens

- Phoenix Contact

- Yazaki Corporation

- Sumitomo Electric Industries

- Aptiv

- Molex

- Amphenol

- Weidmüller Interface GmbH & Co. KG

- Prettl Group

- Sensata Technologies

- Denso Corporation

- Sumitomo Electric Industries

- XX. Ltd.

For Global Scenario:

Automotive Power Distribution Block Market: Global Industry Analysis and Forecast (2024 -2030)

Frequently Asked Questions

High-cost materials are expected to restrain market growth.

The Market size was valued at USD 4.08 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 6.49 % from 2025 to 2032, reaching nearly USD 6.76 Billion.

The segments covered in the market report are by Type, Vehicle Type, Material, and Application.

Asia Pacific region held the highest share in 2024.

1. Asia Pacific Automotive Power Distribution Block Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

1.4. Emerging Technologies

1.5. Market Projections

1.6. Strategic Recommendations

2. Asia Pacific Automotive Power Distribution Block Market Trends

2.1. Market Consolidation

2.2. Adoption of Advanced Technologies

2.3. Pricing and Reimbursement Trends

3. Asia Pacific Automotive Power Distribution Block Market: Dynamics

3.1.1. Market Drivers

3.1.2. Market Restraints

3.1.3. Market Opportunities

3.1.4. Market Challenges

3.2. PORTER’s Five Forces Analysis

3.3. PESTLE Analysis

3.4. Regulatory Landscape

3.5. Analysis of Government Schemes and Initiatives for the Asia Pacific Automotive Power Distribution Block Industry

4. Asia Pacific Automotive Power Distribution Block Market Size and Forecast by Segments (by Value USD)

4.1. Asia Pacific Automotive Power Distribution Block Market Size and Forecast, by Type (2024-2032)

4.1.1. Hardwired

4.1.2. Configurable

4.2. Asia Pacific Automotive Power Distribution Block Market Size and Forecast, by Vehicle Type (2024-2032)

4.2.1. Passenger Vehicle

4.2.2. Light Commercial Vehicles (LCVs)

4.2.3. Heavy Commercial Vehicles (HCVs)

4.3. Asia Pacific Automotive Power Distribution Block Market Size and Forecast, by Material (2024-2032)

4.3.1. Metallic Power Distribution Block

4.3.2. Non-metallic/ Plastic Power Distribution Block

4.4. Asia Pacific Automotive Power Distribution Block Market Size and Forecast, by Application (2024-2032)

4.4.1. Engine Control System

4.4.2. Lighting System

4.4.3. Infotainment and Navigation System

4.4.4. Safety and Security System

4.4.5. Battery Management System

4.5. Asia Pacific Automotive Power Distribution Block Market Size and Forecast, by Country (2024-2032)

4.5.1. China

4.5.2. S Korea

4.5.3. Japan

4.5.4. India

4.5.5. Australia

4.5.6. ASEAN

4.5.7. Rest of Asia Pacific

5. Asia Pacific Automotive Power Distribution Block Market: Competitive Landscape

5.1. STELLAR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Leading Asia Pacific Automotive Power Distribution Block Market Companies, by market capitalization

5.5. Market Structure

5.5.1. Market Leaders

5.5.2. Market Followers

5.5.3. Emerging Players

5.6. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Eaton

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Scale of Operation (small, medium, and large)

6.1.7. Details on Partnership

6.1.8. Regulatory Accreditations and Certifications Received by Them

6.1.9. Awards Received by the Firm

6.1.10. Recent Developments

6.2. Littelfuse

6.3. Legrand Indonesia

6.4. Panduit

6.5. Siemens

6.6. Phoenix Contact

6.7. Yazaki Corporation

6.8. Sumitomo Electric Industries

6.9. Aptiv

6.10. Molex

6.11. Amphenol

6.12. Weidmüller Interface GmbH & Co. KG

6.13. Prettl Group

6.14. Sensata Technologies

6.15. Denso Corporation

6.16. Sumitomo Electric Industries

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary