Asia Pacific Caravan and Motorhome Market- Size, Share & Growth Trends (2025-2032)

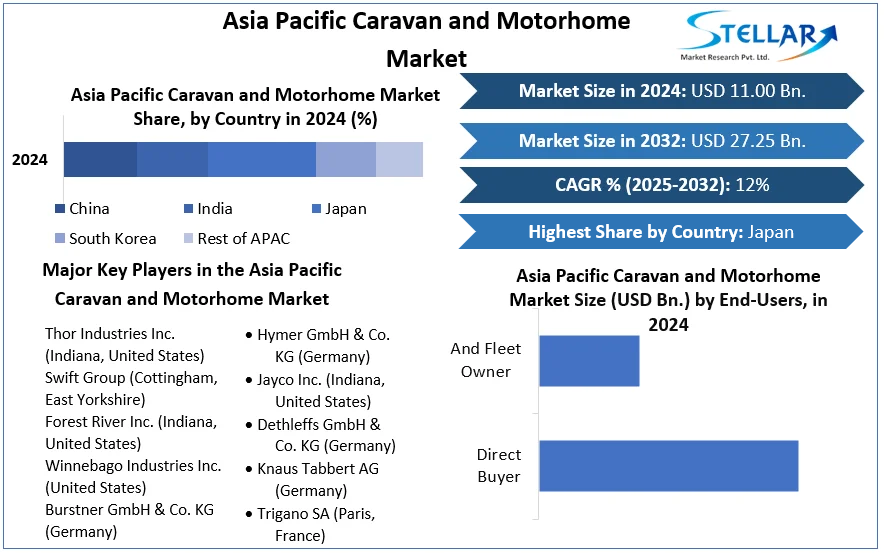

Asia Pacific Caravan and Motorhome Market was valued at USD$ 11.00 billion in 2024. Asia Pacific Caravan and Motorhome Market size is estimated to grow at a CAGR of 12% over the forecast period.

Format : PDF | Report ID : SMR_1209

Asia Pacific Caravan and Motorhome Market Definition:

Caravans are generally regularly utilized for temporary accommodation when traveling. Besides, a great many people use them as their primary home because of advantages, for example, effectively towable units, low fuel utilization, lower maintenance and insurance costs, and depreciation value. Moreover, the limit of a RV to be modified quiet is invigorating RV's innovative patterns at huge speed. The smart home framework in RVs is one of the significant elements in choosing the client's decision. Setting up camp and travelling are growing being famous among millennials, as a part of recreational activity.

Further, the Asia Pacific Caravan and Motorhomes market is segmented by Product Type Caravan & Motorhome, End User and geography. On the basis of Product type Caravan & Motorhomes, the Caravan and Motorhomes market is segmented under. Travel Trailers, Fifth-Wheel Trailers, Folding Camp Trailers, Truck Campers and Motorhomes Type A, Type B, and Type C. Based on the End User, the Caravan and Motorhomes market is segmented under the channels of Direct buyers and Fleet owners. By geography, the market covers the major countries in Asia Pacific i.e., India, China, Japan, Australia and Rest of Asia Pacific For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion).

To get more Insights: Request Free Sample Report

Asia Pacific Caravan and Motorhome Market Dynamics:

The camping and caravanning markets are growing exponentially. More and more people are adopting caravans as their preferred accommodations. They offer flexible options for those who live in remote areas far from hotels or lodging facilities. By choosing to stay in a caravan, you'll save money without sacrificing comfort.

The rising working population stays as a huge variable for broadened per capita pay. Subsequently, different HNWI (High Net Worth Individuals) spending on showing works out, for instance, traveling and camping out are seeing areas of strength for an across the world. The United States is the world's most conspicuous economy and is home to an immense piece of HNWI of the world. China, being the world's most unmistakable individuals, got along with the constantly making economy, with huge business open entrances in the country, are beast factors for the more essential number of HNWI in the country. With the rising per capita pay and development in the amount HNWI, the typical spending on shaking works out, for instance, traveling and camping out, is seeing an anticipated extension across the world. Similarly, a rising number of HNWIs and continuous school graduates ought to drive the market during the forecasted time period.

Caravan and Motorhomes are especially extreme to buy, inferable from which a colossal people can't deal with the expense of them which has hampered the Asia Pacific guards and Motorhome market improvement over the check period. In any case, the openness of rental key people is attracting clients who have spending plan targets and clients not prepared to place assets into the procurement of another vehicle.

Asia Pacific Caravan and Motorhome Market Segment Analysis:

By Product Caravan, the travel trailers portion of the market examined was esteemed at USD 17.68 billion of in 2024. Travel trailers are monstrous holders considering top of a standard trailer frame. These trailers have sufficient dwelling space, with comforts like that of a house. For example, these vehicles have a kitchen, water supply, washroom, and cooler, dependent upon the size of the trailer. Another interesting piece of these trailers is that they can be associated after they are bound from the vehicle and can give extra leg space to the explorers. Overlooking the way that they offer various comforts, moving could be one of the issues. A fifth-wheel trailer is staggeringly similar to an improvement trailer, with the essential exception of a gooseneck connector. The gooseneck joins to the tow vehicle, streamlining towing a remarkable course of action. Close by this extra flexibility, the gooseneck gives extra room, which can be used for various purposes. It looks like way gives an ideal relationship with the vehicle over the ball hitches used in various kinds of trailers.

By Motorhome, The Type A Motorhome (for the most part called normal Motorhome) have a wonderfully coordinated motor vehicle underside that is wide and ground breaking for the substance with living of up to six people. These Motorhomes go with home-like comforts, for instance, joined warming and cooling systems, kitchens, bathrooms, and standing regions with redirection centres. The size of these Motorhomes routinely goes between 21 ft to 45 ft, and they are fuelled by either diesel or gas engines. The decision of Motorhomes reached out in 2020 more than 2019, stood separated from band figures, as would be viewed as normal to drive the Type A piece of the market from here on out. The Type B Motorhomes (by and large called camper vans) are worked around auto vans or board trucks. Taking into account their more unpretentious size, they can be used for a regular drive. The rising pay for Type B wearing vehicles coexists with its practicability for standard use should drive the Asia Pacific train and Motorhome market improvement for the Type B area during the estimate time span.

By End-Users, the quick buyer's part consolidates pay made from the proposal of Motorhome directly to individuals. The quick buyer's part kept an eye on the colossal piece of the market in 2024. The segmental progress not completely settled by the rising per capita pay of individuals across the world. The improvement of the armada proprietor owner section not totally settled by a rising tendency for rental Motorhome across the world. The more reasonable use and the rising openness of RV rental affiliations are driving the social occasion of RV rental. Amidst the COVID-19 pandemic, various individuals across the world truly leaned toward Motorhome and packs as their procedure for transport while camping out and journeys. Various individuals leaned toward renting a RV or train rather than getting one. This ought to drive the team proprietor fragment of the market during the figure time span.

Asia Pacific Caravan and Motorhome Market Regional Insights:

Japan will witness the highest growth in Asia pacific market, with 12% of CAGR. As per Japan Recreational Vehicle Association, in 2005, the quantity of RV proprietors in Japan is around 50,000, yet by end of 2015 the number had almost multiplied to 95,100, and in 2018 the quantity of units was 112,500. Likewise, the quantity of units transported was expanding consistently, and generally speaking deals denoted another record in 2018 of 45.8 billion yen.

JRVA advances RV culture through leading meetings creating a unique distribution, oddity merchandise, and plans and oversees tradeshows and setting up camp vehicle occasions in Japan to open more individuals to the joy of the RV culture. JRVA has comprised collaboration with authoritative organizations, camping areas, and relaxation related ventures. For example, JRVA laid out a client club named Kurumatabi Club, which presented a You-Yu Park administration which permits clients to exploit administrations and stopping of part lodgings.

Asia Pacific Caravan and Motorhome Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Asia Pacific, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Regional Asia Pacific Caravan and Motorhome market to the stakeholders in the industry. The report provides trends that are most dominant in the Regional Asia Pacific Caravan and Motorhome market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Regional Asia Pacific Caravan and Motorhome Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Regional Asia Pacific Caravan and Motorhome market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Regional Asia Pacific Caravan and Motorhome market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Regional Asia Pacific Caravan and Motorhome market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Regional Asia Pacific Caravan and Motorhome market. The report also analyses if the Regional Asia Pacific Caravan and Motorhome market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Regional Asia Pacific Caravan and Motorhome market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Regional Asia Pacific Caravan and Motorhome market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Regional Asia Pacific Caravan and Motorhome market is aided by legal factors.

Asia Pacific Caravan and Motorhome Market Scope:

|

Asia Pacific Caravan and Motorhome Market |

|

|

Market Size in 2024 |

USD 11.00 Bn. |

|

Market Size in 2032 |

USD 27.25 Bn. |

|

CAGR (2025-2032) |

12% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Product Type Caravan

|

|

By Product Type Motorhomes

|

|

|

By End-Users

|

|

|

Country Scope |

|

Asia Pacific Caravan and Motorhome Market Key Players:

- Thor Industries Inc. (Indiana, United States)

- Swift Group (Cottingham, East Yorkshire)

- Forest River Inc. (Indiana, United States)

- Winnebago Industries Inc. (United States)

- Burstner GmbH & Co. KG (Germany)

- Triple E Recreational Vehicles (Winkler, Canada)

- Hymer GmbH & Co. KG (Germany)

- Jayco Inc. (Indiana, United States)

- Dethleffs GmbH & Co. KG (Germany)

- Knaus Tabbert AG (Germany)

- Trigano SA (Paris, France)

Frequently Asked Questions

Japan region is expected to hold the highest share in the Asia Pacific Caravan and Motorhome Market.

The market size of the Asia Pacific Caravan and Motorhome Market by 2032 is expected to reach USD$ 27.25 Billion.

The forecast period for the Asia Pacific Caravan and Motorhome Market is 2025-2032.

The market size of the Asia Pacific Caravan and Motorhome Market in 2024 was valued at USD$ 11.00 Billion.

1. Asia Pacific Caravan and Motorhome Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific Caravan and Motorhome Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific Caravan and Motorhome Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia Pacific Caravan and Motorhome Market: Dynamics

4.1. Asia Pacific Caravan and Motorhome Market Trends

4.2. Asia Pacific Caravan and Motorhome Market Drivers

4.3. Asia Pacific Caravan and Motorhome Market Restraints

4.4. Asia Pacific Caravan and Motorhome Market Opportunities

4.5. Asia Pacific Caravan and Motorhome Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. Asia Pacific Caravan and Motorhome Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Caravan and Motorhome Market Size and Forecast, by Product Type Caravan (2024-2032)

5.1.1. Travel Trailers

5.1.2. Fifth-Wheel Trailers

5.1.3. Folding Camp Trailers

5.1.4. Truck Campers

5.2. Asia Pacific Caravan and Motorhome Market Size and Forecast, by Product Type Motorhomes (2024-2032)

5.2.1. Type A

5.2.2. Type B

5.2.3. Type C

5.3. Asia Pacific Caravan and Motorhome Market Size and Forecast, by End-Users (2024-2032)

5.3.1. Direct Buyer

5.3.2. And Fleet Owner

5.4. Asia Pacific Caravan and Motorhome Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. India

5.4.3. Japan

5.4.4. South Korea

5.4.5. Australia

5.4.6. ASEAN

5.4.7. Rest of APAC

6. Company Profile: Key Players

6.1. Thor Industries Inc. (Indiana, United States)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Swift Group (Cottingham, East Yorkshire)

6.3. Forest River Inc. (Indiana, United States)

6.4. Winnebago Industries Inc. (United States)

6.5. Burstner GmbH & Co. KG (Germany)

6.6. Triple E Recreational Vehicles (Winkler, Canada)

6.7. Hymer GmbH & Co. KG (Germany)

6.8. Jayco Inc. (Indiana, United States)

6.9. Dethleffs GmbH & Co. KG (Germany)

6.10. Knaus Tabbert AG (Germany)

6.11. Trigano SA (Paris, France)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook