Bike Sharing Market Global Industry Analysis and Forecast (2026-2032) by Bike Type, Bike Model, Sharing System, and Region

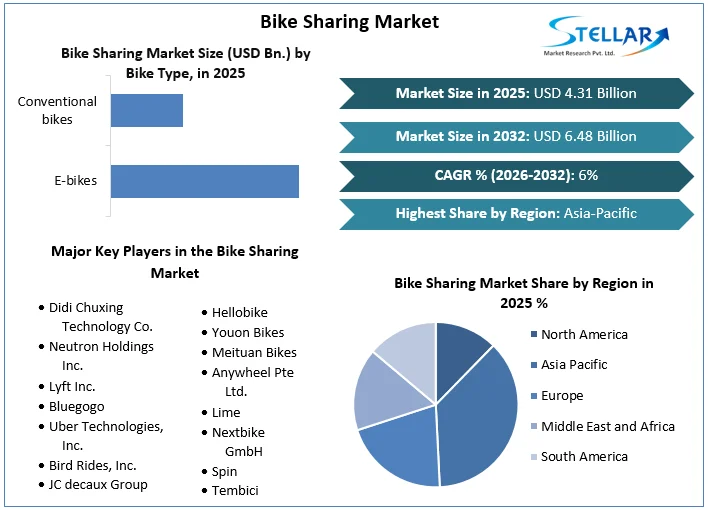

Bike Sharing Market size was valued at US$ 4.31 Billion in 2025 and the total Global Bike Sharing Market revenue is expected to grow at 6% through 2026 to 2032, reaching nearly US$ 6.48 Billion.

Format : PDF | Report ID : SMR_2439

Bike Sharing Market Overview:

Bike sharing is an innovative urban transportation option that gives individuals quick access to bicycles for travelling within the city. Bike sharing system have emerged as a cost-effective and environmentally friendly alternative to public transportation in several cities throughout the world in recent years. Bike sharing (BS) has rapidly evolved from its early appearance approximately a decade ago to its consolidation in recent years, proving to be a transportation paradigm that provides major societal advantages for both its riders and the cities that accept it. The provide inhabitants with a quick method of transportation for short commutes, a vibrant choice for tourists to explore multiple local monuments and attractions, and an efficient way for riders to navigate cities in a healthy and engaging manner. Similarly, from a city's standpoint, BSS have evolved into a natural platform for decreasing traffic and pollution, promoting healthy habits among inhabitants, and improving general living conditions. Bike sharing market report covers the segment analysis on the basis of bike type, model, sharing system and region

To get more Insights: Request Free Sample Report

Bike Sharing Market Dynamics:

These systems are known for providing major benefits to users in the form of a healthy and efficient mode of transportation, as well as to cities as a cost-effective solution to reduce CO2 emissions and traffic congestion, which drives the growth of bike sharing market. Bike sharing systems must maintain a high-quality service that focuses on coverage and bike accessibility in order to be considered viable. In order to attract and service potential users, bike sharing systems rely significantly on the operator's ability to efficiently shift bicycles from low to high demand regions as needed.

To propel the bike sharing market, governments all around the world are supporting e-bikes and taking various efforts to encourage their use. Developing countries, such as China and India, are driving the E-bike market. China, for example, is the world's largest e-bike market. China has traditionally been the world's leading exporter of electric motorcycles, with high import and export volumes. According to China's Ministry of Industry and Information Technology, the country's electric bicycle production hit 25.48 million units in the first ten months of 2020, up 33.4% year over year. The income of major bicycle manufacturing companies reached around USD 22 billion during this time, an increase of 16.8%.

Most system operators utilize static models that are only based on historical demand averages to design bike redistribution logistics. These models frequently overlook crucial user data that the system collects dynamically through online searches. Periodic and reactive bike redistribution excursions are then only made when bike stations are near empty or full, but they are rarely planned and guided by predictive models that can predict bike shortages based on consumer behavior. With new technical innovations fast pervading most bike-sharing systems (e.g., GPS-tracked journeys, online locking and payment systems, and smart data collection via smartphone apps), predictive analytic models have the potential to drastically alter how bike-sharing systems are run.

The rise of the bike sharing market is being driven by increased government initiatives for the creation of reliable bike-sharing infrastructure, as well as the spread of smart cities around the world. Various governments are providing subsidies to service providers in order to help them establish stations and reach a larger number of commuters. Municipal governments in China supported the development of the Public Bike Sharing Program (PBSP) in 2018 to stimulate non-motorized transportation and provide convenient, flexible, and low-cost mobility options. Due to rising traffic congestion and fuel prices, these services are primarily employed in urban areas. Growing environmental concerns are driving to the adoption of environmentally friendly transportation solutions such as bicycles and electric bikes, which is fueling industry growth.

Increasing theft cases for undocked bikes and increasing need for infrastructure developments across developing nations are the key restraints and challenges for the bike sharing market across the globe.

Bike Sharing Market Segment Analysis:

E bikes segment is dominating the Bike sharing market in terms of market share:

Pedal-assisted electric bicycles dominated the market by propulsion type. The pedal assisted bikes dominated the 88.36% of the global market. Urban e-bikes dominated the market in terms of application type. Between 2020 and 2023, up to 130 million electric bicycles (using all battery technologies) are predicted to be marketed globally. By 2025, global e-bike sales are estimated to surpass 40 million units, earning $20 billion in revenue.

Due to increasingly busy lifestyles and the need to commute on a daily basis, owning a car has virtually become a necessity, as public transportation is usually unreliable. As a result of the scarcity of natural resources and environmental problems, there is a growing concern about protecting and sustaining the environment for future generations. For both society and governments, this is a one-of-a-kind dilemma. Electric bicycles are the ideal solution to this problem. They are eco-friendly and provide a solution to the problem of daily transportation. The demand for e-bikes is rising as a result of the increasing demand for eco-friendliness among all demographics.

Dock based system is dominating the bike sharing market in terms of user implementation:

Dock based system is considered to dominate the bike sharing market with approximately 80% market share as larger cities, such as New York, San Francisco, China, UK, India and others have chosen a totally dock-based system, which is easier to administer and provides more customer reliability. Customers are rarely more than a few blocks away from a station on these networks, which have an average density of 28 per square mile in North America, 23 per Sq. km. in Europe and 38 per sq. km in APAC region. This allows consumers to rely on the system as they would any other mode of public transportation, resulting in high commuting usage rates.

The National Association of City Transportation Officials (NACTO) reports that morning and afternoon rush hours are the busiest times for station-based bike share systems. Furthermore, these systems are used more frequently on weekdays than their dockless equivalents, implying that station-based bike share systems are more likely to be used for commuting. These systems, while serving as a fantastic example of how user behaviors can be influenced by operational reliability, are difficult to replicate in less densely populated locations.

Several dockless micro mobility providers have established initiatives in less heavily populated locations in recent years, though. According to NACTO data, they are more commonly used for recreational purposes on weekends than by commuters. Dockless systems also pose difficulties for city planners, who are frequently faced with the task of controlling hundreds, if not thousands, of bicycles and scooters spread throughout the terrain. These systems, like Portland's Biketown, embed the technology in the vehicle itself rather than a station, allowing bikes and scooters to be unlocked and operated remotely.

Bike Sharing Market Regional Insights:

APAC is dominating the bike sharing market with 44% market share owing to high and rapid implementation of E bikes in the region. China alone constitutes of 88% of E bikes in the region and approximately 36% across the globe making it the most favorable market in terms of sales and penetration. An electric bicycle with lead-acid batteries costs $167 on average in China. E-bikes in North America cost an average of $815, while those in Western Europe cost an average of $1,546, according to the Chinese Sustainability Survey. China dominates the global market, with estimates estimating that the Asian country sells 85% of all e-bikes. According to government estimates, China had 180 million e-bikes on its streets in 2013, far more than any other country.

China has over 70 bike-sharing organizations, according to the Ministry of Transport (MoT), with 23 million bicycles and over 400 million riders across the country. Industry expansion is aided by expanding urbanization and a rapidly growing population in India and China. Due to the vast number of prospective clients in the region, several start-ups are investing in the Chinese market. Furthermore, around 30 Chinese cities, including Shanghai and Beijing, have enacted a number of regulations to guide bike-sharing maintenance, operation, and production, allowing service providers to remove broken bikes from the fleet.

Medina Bike was launched in November 2016 in time for the 22nd United Nations Conference of Parties (COP 22), and it was phased away in 2020 (with only 7 bikes available in October 2020). Six systems are now operational in Africa. Nigeria joined Egypt, South Africa, and Morocco in 2019 by launching free-floating systems in two cities (Ede and Lagos), which are run by a local business (AWA Bikes). In Latin America, there are now 60 operational systems (with three temporarily halted). Brazil, the continent's largest country, tops the list with 27 systems, followed by Colombia (18), Argentina (8), and Chile (8). (4). Station-based systems are the most widespread in South America, accounting for more than 75% of all installations.

Following the Asia-Pacific region, the European region accounts for almost 20% of the total market. The leading countries are Germany, France, and Italy. Other countries, such as the Netherlands, Denmark, and the other Scandinavian countries, are showing similar tendencies. This is tremendous when we consider the populations of both locations. In Europe, only over 500,000 electric bikes were sold in 2009.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Bike Sharing market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The market report examines all segments of the industry, with a focus on significant players such as market leaders, followers, and new entrants.

The report includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favorable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry. The research also aids in comprehending the Bike Sharing market dynamics and structure by studying market segments and forecasting market size. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Bike Sharing market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Major breakthroughs in the Bike Sharing industry are discussed, as well as organic and inorganic growth plans. Various companies are focusing on organic growth strategies such as new product releases, product approvals, and other items such as patents and events. Inorganic growth strategies used in the industry included acquisitions, partnerships, and collaborations.

|

Bike Sharing Market Scope |

|

|

Market Size in 2025 |

USD 4.31 Billion. |

|

Market Size in 2032 |

USD 6.48 Billion. |

|

CAGR (2026-2032) |

6% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Market Segments |

By Bike Type

|

|

By Model

|

|

|

By Sharing System

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Bike Sharing Market Players

- Didi Chuxing Technology Co.

- Neutron Holdings Inc.

- Lyft Inc.

- Bluegogo

- Uber Technologies, Inc.

- Bird Rides, Inc.

- JC decaux Group

- Hellobike

- Youon Bikes

- Meituan Bikes

- Anywheel Pte Ltd.

- Lime

- Nextbike GmbH

- Spin

- Tembici

Frequently Asked Questions

APAC region have the highest growth rate of 18% in the Bike Sharing market.

Didi Chuxing Technology Co., Neutron Holdings Inc., Lyft Inc., Bluegogo, Uber Technologies, inc., Bird Rides, Inc., JC decaux Group, Hellobike, Youon Bikes, Meituan Bikes, Anywheel Pte Ltd., Lime, Nextbike GmbH, Spin, Tembici

E bikes is the dominating segment in the market with 52% market share owing to high efficiency of the E bikes and lowering commute charges by the product.

1. Bike Sharing Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Bike Sharing Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End Use Segment

2.3.4. Revenue (2025)

2.3.5. Manufacturing Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Bike Sharing Market: Dynamics

3.1. Market Trends

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

4. Bike Sharing Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Bike Sharing Market Size and Forecast, By Bike Type (2025-2032)

4.1.1. E-bikes

4.1.2. Conventional bikes

4.2. Bike Sharing Market Size and Forecast, By Model (2025-2032)

4.2.1. Free-floating

4.2.2. P2P

4.2.3. Station based

4.3. Bike Sharing Market Size and Forecast, By Sharing System (2025-2032)

4.3.1. Dockless

4.3.2. Docked

4.3.3. Hybride

4.4. Bike Sharing Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Bike Sharing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. North America Bike Sharing Market Size and Forecast, By Bike Type (2025-2032)

5.1.1. E-bikes

5.1.2. Conventional bikes

5.2. North America Bike Sharing Market Size and Forecast, By Model (2025-2032)

5.2.1. Free-floating

5.2.2. P2P

5.2.3. Station based

5.3. North America Bike Sharing Market Size and Forecast, By Sharing System (2023-

2030)

5.3.1. Dockless

5.3.2. Docked

5.3.3. Hybride

5.4. North America Bike Sharing Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Bike Sharing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Europe Bike Sharing Market Size and Forecast, By Bike Type (2025-2032)

6.2. Europe Bike Sharing Market Size and Forecast, By Model (2025-2032)

6.3. Europe Bike Sharing Market Size and Forecast, By Sharing System (2025-2032)

6.4. Europe Bike Sharing Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.2. France 6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Russia

6.4.8. Rest of Europe

7. Asia Pacific Bike Sharing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Bike Sharing Market Size and Forecast, By Product Type (2025-2032)

7.2. Asia Pacific Bike Sharing Market Size and Forecast, By Model (2025-2032)

7.3. Asia Pacific Bike Sharing Market Size and Forecast, By Sharing System (2025-2032)

7.4. Asia Pacific Bike Sharing Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. ASEAN

7.4.7. Rest of Asia Pacific

8. Middle East and Africa Bike Sharing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Bike Sharing Market Size and Forecast, By Bike Type (2025-2032)

8.2. Middle East and Africa Bike Sharing Market Size and Forecast, By Model (2025-2032)

8.3. Middle East and Africa Bike Sharing Market Size and Forecast, By Sharing System (2025-2032)

8.4. Middle East and Africa Bike Sharing Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Bike Sharing Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. South America Bike Sharing Market Size and Forecast, By Bike Type (2025-2032)

9.2. South America Bike Sharing Market Size and Forecast, By Model (2025-2032)

9.3. South America Bike Sharing Market Size and Forecast, By Sharing System (2025-2032)

9.4. South America Bike Sharing Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Oo South America

10. Company Profile: Key Players

10.1. Didi Chuxing Technology Co.

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Neutron Holdings Inc.

10.3. Lyft Inc.

10.4. Bluegogo

10.5. Uber Technologies, Inc.

10.6. Bird Rides, Inc.

10.7. JC decaux Group

10.8. Hellobike

10.9. Youon Bikes

10.10. Meituan Bikes

10.11. Anywheel Pte Ltd.

10.12. Lime

10.13. Nextbike GmbH

10.14. Spin

10.15. Tembici

11. Key Findings

12. Industry Recommendation

13. Bike Sharing Market: Research Methodology