Tire Retreading Market Surges on Eco and Budget Trends

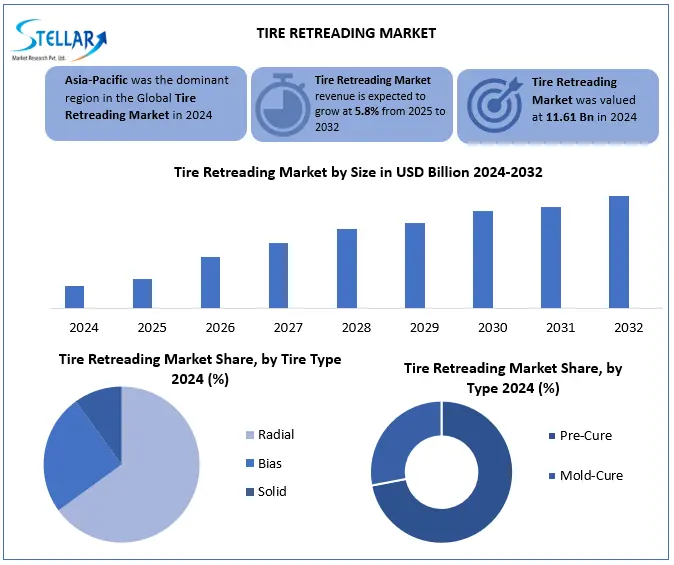

Tire Retreading Market size was USD 11.61 billion in 2024 with a CAGR of 5.8%. Cost savings and eco goals fuel adoption across fleets, reaching nearly USD 18.32 billion in 2032.

Format : PDF | Report ID : SMR_2785

Tire Retreading Market Overview:

Tire retreading is a process where a worn-out tyre's tread is replaced with a new one, effectively giving the tyre a new life. Tire Retreading Market is experiencing major growth, driven by rising commercial vehicle use in sectors like logistics, construction and mining. As fleet operators seek cost-effective and sustainable solutions, retreaded tires offer savings of till 41–50% compared to new tires. India leads in adoption, with over 70% of truck tires retreaded at least once. Technological advancements in pre-cure and mold-cure methods have enhanced durability, making retreads viable for heavy duty applications. Pre-cure dominates by lower investment needs and faster processing, mainly among small to mid-sized retreaders. Environmental sustainability also fuels market expansion, with retreading reducing raw material use and tire waste. Consumer concerns around safety and quality persist, particularly among individual buyers, hindered by inconsistent service standards and availability of cheap new tires.

Tire Retreading Market Recent Developments

|

Date |

Development |

Details |

|

March 20, 2025 |

TyreXpo Asia 2025 |

Event in Singapore highlighted retreading’s growing but cautious profile, with Malaysian companies attending and regional strategy discussions. |

|

June 20, 2024 |

US bill introduced to incentivize retreaded tires |

Senators Brown and Sykes introduced the “Retreaded Truck Tire Jobs, Supply Chain Security and Sustainability Act,” offering 30% tax credit to encourage retread purchases. |

|

March 21, 2024 |

Continental opens Retread Solutions Development Center |

Launched in Rock Hill, SC, to drive innovation, virtual training, and tracking tech in retreading. |

Recent trade policies are impacting the tire retreading market. In October 2024, U.S. Department of Commerce imposed anti-dumping duties on truck and bus tires imported from Thailand, with Bridgestone Corporation facing a 48.37% tariff and other Thai manufacturers subject to a 12.33% rate. These measures aim to protect domestic retreaders from low-cost imports that undercut market prices. U.S. has implemented tariffs ranging from 26% - 46% on tire imports from Thailand, Indonesia, Vietnam and South Korea, leading to increased costs for imported tires and potentially boosting demand for domestically retreaded options. Tariffs are supporting local industries, they also raise concerns about higher prices for consumers and potential supply chain disruptions.

To get more Insights: Request Free Sample Report

Tire Retreading Market Dynamics

Rising Commercial Vehicle Use to Drive the Tire Retreading Market Growth

Rising demand for commercial vehicles across logistics, transportation, and mining sectors is a side by side boost to tire retreading market. Fleet operators, mainly in cost-sensitive regions like India, are a increasingly opting for retreaded tires to manage expenses effectively. In India more than 72% of truck tires are retreaded at least once and highlighting the practice prevalence in commercial vehicle segment. Retreaded tires provide cost savings up to 41% compared to new tires, making them an attractive option for fleet operator, which aims to reduce operating costs.

Environmental ideas also play an important role in reducing the consumption of raw materials and reducing waste, combining global stability goals. Since industry continues to prioritize cost-effectiveness and environmental responsibility, the demand for retreaded tires in commercial vehicle sectors is expected to increase continuously.

Consumer Concerns Impacts to Boost the Tire Retreading Adoption

Perception of Tire Retreading as inferior to new ones remains a major challenge in the market. Many consumers associate retreading with poor quality and safety concerns by their past experiences with outdated technology. Despite modern advancements that ensure high durability and performance, this negative image persists, especially among individual vehicle owners. Lack of global quality standards and inconsistent results across service providers adds to mistrust, the availability of low cost new tires makes buyers hesitant to opt for retreads. the availability of low-cost new tires, particularly imports from Asia, priced 20–30% lower than retreads, makes buyers hesitant to opt for retreads. Educating consumers and enforcing strict certification, such as ISO 14001 and ECE Regulation 108/109, can help rebuild confidence and increase adoption.

Modern Fleet Management to Boost the Tire Retreading Market

Fleet management recent trends indicates growing adoption of tire retreading programs among larger fleets, by their dual objectives of cost reduction and environmental sustainability. Provides substantial cost savings up to 50% compared to new tires making them attractive option for fleet operator aiming to cut expenses. Retreading extends life of tire casings, allowing for multiple retread cycles and further enhancing cost efficiency. By environmental perspective, retreading reduces raw material consumption by approximately 70% and cuts down solid waste generation by over 400 pounds per tire compared to manufacturing new ones. Retread programs are becoming integral to fleet management strategies focused on economic and ecological benefits.

Tire Retreading Market Segment Analysis

Based on Type, tire retreading market is divided in pre-cure and mold-cure. Pre-Cure method dominates the tire retreading market in 2024 and is expected to hold largest market share during the forecast period, by cost-effectiveness, requires low capital investment than the mold-treatment process, which appeals to small and medium-sized retreaders and commercial fleet operators. Pre-Cure Retreading allows various tires to process simultaneously, improve operational efficiency and reduce production time by up to 25%. Variety of running design and rubber compounds, which makes it suitable for diverse vehicle applications. Environmental stability is another driving factor, as the process significantly reduces the waste of tire and expands the service life of the tire, which contributes to low carbon emissions. Technical development has further enhanced the bonding strength and durability of Pre-Cure trades now lasting up to 80% as long as new tires. These advantages collectively establish pre-treatment as the most widely adopted retrieved method in the market.

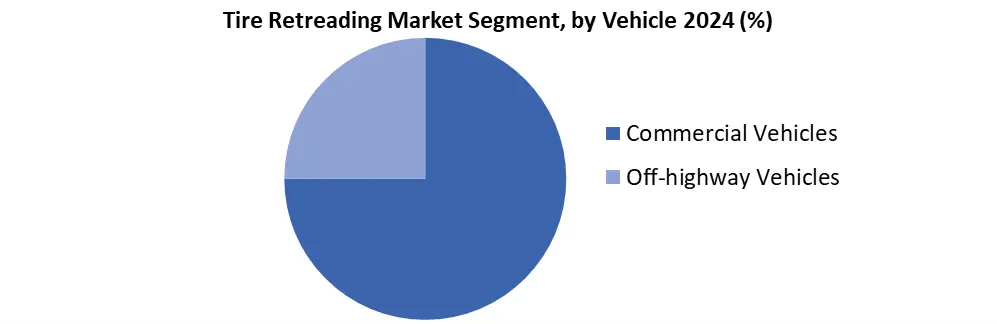

Based on Vehicle Type, tire retreading market is divided in commercial vehicles and off-highway vehicles. Commercial Vehicles dominated the tire retreading market in 2024 holding 70 % of total market share and is expected to hold largest market share during the forecast period. Trucks and buses cover long distances and with heavy loads, which affect tires to wear out faster. Retreading is smart solution as it expands tire life at up to 40-50% lower cost than purchasing new tires. Many commercial fleet owners choose retreaded tires to save money and reduce waste, making it largest in market. Single commercial tire can be retreaded up to three times, depending on its condition. Retreaded tires are also widely accepted in logistics, freight, and public transport sectors, especially in North America, Europe, and Asia-Pacific regions.

Tire Retreading Market Regional Analysis:

Asia-Pacific dominates tire retreading market, which is accounting for more than 40% market share. This leadership is inspired by industrialization, expanding commercial vehicle fleet and emphasizing a strong cost-effectiveness and durable transport solutions. China, India and Japan have seen significant growth in logistics and infrastructure projects, increasing demand for retreaded tires. Government initiative promoting environmental stability and resource conservation leads to this trend. Presence of major rubber producers in Southeast Asia ensures a stable supply of raw materials, providing cost benefits to regional manufacturers.

Tire Retreading Market Competitive Landscape

Major players in tire retreading market include Michelin, Bridgestone Corporation and Goodyear Tire and Rubber Company holds collectively 55% of global market share in 2024. Tire retreading manufacturers focus on expanding their product portfolio, sales networks and partnerships. Bridgestone is one of the leading tires retreading manufacturers. Company focuses on research and development to develop high quality new products with better capabilities. It also develops, manufactures and distribution of equipmentTire retreading is a process where a worn-out tyre's tread is replaced with a new one, effectively giving the tyre a new life.

Tire Retreading Market is experiencing major growth, driven by rising commercial vehicle use in sectors like logistics, construction and mining. As fleet operators seek cost-effective and sustainable solutions, retreaded tires offer savings of till 41–50% compared to new tires. India leads in adoption, with over 70% of truck tires retreaded at least once. Technological advancements in pre-cure and mold-cure methods have enhanced durability, making retreads viable for heavy duty applications. Pre-cure dominates by lower investment needs and faster processing, mainly among small to mid-sized retreaders. Environmental sustainability also fuels market expansion, with retreading reducing raw material use and tire waste. Consumer concerns around safety and quality persist, particularly among individual buyers, hindered by inconsistent service standards and availability of cheap new tires.

|

Tire Retreading Market Scope |

|

|

Market Size in 2024 |

USD 11.61 Bn. |

|

Market Size in 2032 |

USD 18.32 Bn. |

|

CAGR (2025-2032) |

5.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Tire Type Radial Bias Solid |

|

By Type Pre-cure Mold-cure |

|

|

By Vehicle Commercial Vehicles Off-highway Vehicles |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Tire Retreading Market Key Players are:

North America

- Goodyear Tire & Rubber Company (USA)

- Marangoni Tread (USA)

- Oliver Rubber Company (USA)

- Bandag (USA)

- Purcell Tire & Rubber Co. (USA)

- Southern Tire Mart (USA)

- Retread Solutions Inc. (Canada)

Europe

- Michelin Retread Technologies (France)

- Marangoni S.p.A. (Italy)

- Continental AG (Germany)

- Vaculug Ltd. (United Kingdom)

- Insa Turbo (Spain)

- Galgo Pre-Q (Germany)

Asia-Pacific

- Bridgestone Corporation (Japan)

- Indag Rubber Ltd. (India)

- Treadsdirect Ltd. (India)

- Elgi Rubber Company Ltd. (India)

- Royal Rubber Works (India)

- Yokohama Rubber Co. Ltd. (Japan)

- Maxrubber Industries (Malaysia)

- Goodway Rubber Industries (Malaysia)

Middle East & Africa

- Al Dobowi Group (UAE)

- TrenTyre (South Africa)

South America

- Borrachas Vipal (Brazil)

- Tipler Tread (Brazil)

- Retread do Ltd (Brazil)

Frequently Asked Questions

The growth rate of the Tire Retreading Market is 5.8% CAGR.

Rising demand for commercial vehicles across logistics, transportation, and mining sectors is a side by side boost to tire retreading market and Fleet management recent trends indicates growing adoption of tire retreading programs among larger fleets.

Asia-Pacific is the dominating region in the Tire Retreading Market.

Bridgestone Corporation (Japan), Indag Rubber Ltd. (India), Treads direct Ltd. (India), Elgi Rubber Company Ltd. (India), Royal Rubber Works (India), Yokohama Rubber Co. Ltd. (Japan) are some of the key players of Tire Retreading Market.

1. Tire Retreading Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Tire Retreading Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Tire Retreading Market: Dynamics

3.1. Tire Retreading Market Trends

3.2. Tire Retreading Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Tire Retreading Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Tire Retreading Market Size and Forecast, By Type (2024-2032)

4.1.1. Pre-Cure

4.1.2. Mold-Cure

4.2. Tire Retreading Market Size and Forecast, By Vehicle Type 2024-2032)

4.2.1. Commercial Vehicle

4.2.2. Off-highway Vehicle

4.3. Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

4.3.1. Radial

4.3.2. Bias

4.3.3. Solid

4.4. Tire Retreading Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Tire Retreading Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Tire Retreading Market Size and Forecast, By Type (2024-2032)

5.1.1. Pre-Cure

5.1.2. Mold-Cure

5.2. North America Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

5.2.1. Commercial Vehicle

5.2.2. Off-highway Vehicle

5.3. North America Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

5.3.1. Radial

5.3.2. Bias

5.3.3. Solid

5.4. North America Tire Retreading Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Tire Retreading Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Pre-Cure

5.4.1.1.2. Mold-Cure

5.4.1.2. United States Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

5.4.1.2.1. Commercial Vehicle

5.4.1.2.2. Off-highway Vehicle

5.4.1.3. United States Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

5.4.1.3.1. Radial

5.4.1.3.2. Bias

5.4.1.3.3. Solid

5.4.2. Canada

5.4.2.1. Canada Tire Retreading Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Pre-Cure

5.4.2.1.2. Mold-Cure

5.4.2.2. Canada Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

5.4.2.2.1. Commercial Vehicle

5.4.2.2.2. Off-highway Vehicle

5.4.2.3. Canada Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

5.4.2.3.1. Radial

5.4.2.3.2. Bias

5.4.2.3.3. Solid

5.4.3. Mexico

5.4.3.1. Mexico Tire Retreading Market Size and Forecast, By Type (2024-2032)

5.4.3.1.1. Pre-Cure

5.4.3.1.2. Mold-Cure

5.4.3.2. Mexico Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

5.4.3.2.1. Commercial Vehicle

5.4.3.2.2. Off-highway Vehicle

5.4.3.3. Mexico Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

5.4.3.3.1. Radial

5.4.3.3.2. Bias

5.4.3.3.3. Solid

6. Europe Tire Retreading Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.2. Europe Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.3. Europe Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4. Europe Tire Retreading Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.1.3. United Kingdom Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.2. France

6.4.2.1. France Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.2.3. France Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Tire Retreading Market Size and Forecast, By Vehicle Type 2025-2032)

6.4.3.3. Germany Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.4.3. Italy Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.5.3. Spain Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.6.3. Sweden Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Russia Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.7.3. Russia Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Tire Retreading Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

6.4.8.3. Rest of Europe Tire Retreading Market Size and Forecast By Tire Type (2024-2032)

7. Asia Pacific Tire Retreading Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.3. Asia Pacific Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4. Asia Pacific Tire Retreading Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.1.3. China Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.2.3. S Korea Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.3.3. Japan Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.4. India

7.4.4.1. India Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.4.3. India Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.5.3. Australia Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.6.3. Indonesia Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Malaysia Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.7.3. Malaysia Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Philippines Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.8.3. Philippines Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Thailand Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.9.3. Thailand Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Vietnam Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.10.3. Vietnam Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Tire Retreading Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8. Middle East and Africa Tire Retreading Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.3. Middle East and Africa Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8.4. Middle East and Africa Tire Retreading Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.4.1.3. South Africa Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.4.2.3. GCC Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Egypt Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.4.3.3. Egypt Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Nigeria Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.4.4.3. Nigeria Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Tire Retreading Market Size and Forecast, By Type (2024-2032)

8.4.5.2. Rest of ME&A Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

8.4.5.3. Rest of ME&A Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9. South America Tire Retreading Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.2. South America Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.3. South America Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9.4. South America Tire Retreading Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.4.1.3. Brazil Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.4.2.3. Argentina Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Colombia Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.4.3.3. Colombia Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.4.4.2. Chile Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.4.4.3. Chile Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

9.4.5. Rest of South America

9.4.5.1. Rest of South America Tire Retreading Market Size and Forecast, By Type (2024-2032)

9.4.5.2. Rest of South America Tire Retreading Market Size and Forecast, By Vehicle Type (2024-2032)

9.4.5.3. Rest of South America Tire Retreading Market Size and Forecast, By Tire Type (2024-2032)

10. Company Profile: Key Players

10.1. Bridgestone Corporation (Japan)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Goodyear Tire & Rubber Company (USA)

10.3. Marangoni Tread (USA)

10.4. Oliver Rubber Company (USA)

10.5. Bandag (USA)

10.6. Purcell Tire & Rubber Co. (USA)

10.7. Southern Tire Mart (USA)

10.8. Retread Solutions Inc. (Canada)

10.9. Michelin Retread Technologies (France)

10.10. Marangoni S.p.A. (Italy)

10.11. Continental AG (Germany)

10.12. Vaculug Ltd. (United Kingdom)

10.13. Insa Turbo (Spain)

10.14. Galgo Pre-Q (Germany)

10.15. Indag Rubber Ltd. (India)

10.16. Treadsdirect Ltd. (India)

10.17. Elgi Rubber Company Ltd. (India)

10.18. Royal Rubber Works (India)

10.19. Yokohama Rubber Co. Ltd. (Japan)

10.20. Maxrubber Industries (Malaysia)

10.21. Goodway Rubber Industries (Malaysia)

10.22. Al Dobowi Group (UAE)

10.23. TrenTyre (South Africa)

10.24. Borrachas Vipal (Brazil)

10.25. Tipler Tread (Brazil)

10.26. Retread do Brasil Ltd (Brazil)

11. Key Findings

12. Analyst Recommendations

13. Tire Retreading Market: Research Methodology