Pickup Truck Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

Pickup Truck Market was valued at USD 218.51 Bn in 2024 and is expected to reach USD 312.89 Bn by 2032, at a CAGR of 4.59% during the forecast period.

Format : PDF | Report ID : SMR_2749

Pickup Truck Market Overview

A pickup truck is a light-duty or heavy-duty motor vehicle featuring an enclosed passenger cabin and an open cargo bed, designed for versatile transportation of goods and passengers. It serves as a multi-purpose asset in commercial, industrial, and personal applications, offering payload capacity, towing capability, and rugged durability for various operational demands.

The pickup truck market is experiencing steady development due to increasing demand for versatile utility vehicles in both commercial and individual sectors. With the expansion of construction, agriculture and logistics industries, increasing adoption in emerging economies is promoting sales. Progress in electric pickup trucks (eg, Ford F-150 Lightning, Tesla Cybertuck) and Hybrid models is attracting environmentally conscious consumers and fleet operators. Pickup truck market is benefiting from better towing capabilities, luxury features in high end models and government incentives for commercial vehicle procurement, further promoting its expansion.

Business policies and tariffs affect pickup truck market by significantly affecting cost and pricing. Imported steel, aluminium, or vehicle components can increase high tariff manufacturing expenses, which can increase retail prices. Additionally, trade agreements or disputes, like USMCA, affect the supply chain, encouraging local production or changing competitive mobility between domestic and foreign vehicle manufacturers.

To get more Insights: Request Free Sample Report

Pickup Truck Market Dynamics

E-Commerce Expansion and Outdoor Adventures Fuel Global Pickup Truck Market Growth

The rapid expansion of e-commerce has greatly increased demand for pickup trucks as they are ideal for last mile delivery by versatility, mobility and cargo capacity. Industries favour mild, fuel-efficient trucks for rapid, effective logistics. Manufacturers are responding with advanced, high-performing models, further increasing in pickup truck market share.

Off-road recreation is another major driver, mainly in North America, where pickup trucks are preferred for their ruggedness, power and ability to handle rough terrain. Increase in camping, boating and adventure sports has increased demand for off road competent trucks, inspiring automakers to increase features like Off-road durability. Combined with the e-commerce growth these trends are expediting global pickup truck market expansion.

Stringent Emission Regulations to Restrain Pickup Truck Market

Stringent emission rules worldwide are challenging the traditional pickup truck market, especially for diesel and gasoline models. Governments are imposing strict CO2 and NOX boundaries, forcing manufacturers to make heavy investments in cleaner technologies or face punishment. These compliance costs often turn into high vehicle prices, potentially preventing cost-sensitive buyers. Additionally, some cities are implementing low-fasting zones that restrict old diesel trucks, squeezing further demand. While these rules push industry towards electrification, the transition period creates uncertainty for vehicle manufacturers and consumers.

Recently, U.S. EPA introduced stricter tailpipe emission standards, requiring pickup trucks to reduce CO2 emissions by 10% annually through 2026. This forced automakers like Ford and Ram to accelerate their hybrid/electric plans, while discontinuing some high-performance diesel variants due to compliance costs.

Electric & Hybrid Models to Create Opportunity for the Pickup Truck Market

Rapid advancement of electric and hybrid pickup trucks creates a major growth opportunity, with models like Ford F-150 Lightning and Tesla Cybertruck driving Consumer Interest. Governments across world are offering tax credits and subsidies to accelerate adoption, while businesses are faster to adopt these models for low operating costs and stability goals. Automakers are also investing in a fast-charging infrastructure and battery innovation to address range limitations. Since demand increases for environmentally friendly trucks with high performance, this segment is ready to capture an important pickup truck market share in coming years.

In 2024, Ram's Rev Electric Pickup received a record pre-order, while Toyota unveiled a hybrid Hilux targeting emerging markets. Meanwhile, Ford dropped Lightning prices to $ 10,000 to promote demand between rising EV competition, reflecting aggressive market strategies in this space.

Zero-Emissions Trucking (ZET) technologies vs. diesel trucks

|

|

DIESEL TRUCK |

BATTERY ELECTRIC TRUCK |

FUEL CELL ELECTRIC TRUCK |

|

Fuel |

Diesel |

Electricity |

Green Hydrogen |

|

Advantages |

use cases |

shifts to renewable energy) |

|

|

Challenges/ Drawbacks |

|

could lead to a weight penalty that reduces payload capacity

|

|

Pickup Truck Market Segment Analysis

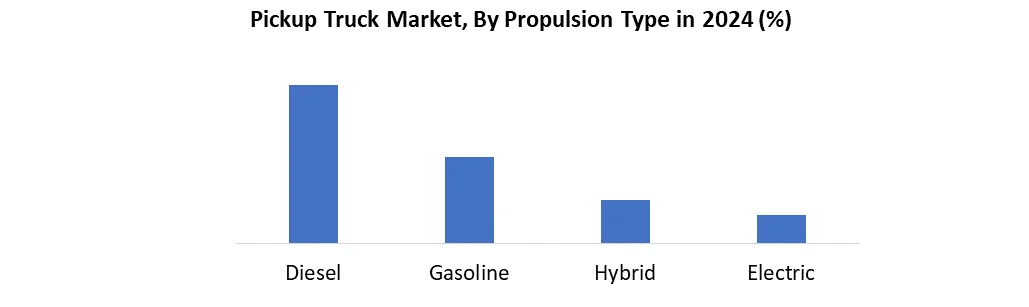

Based on Propulsion Type, pickup truck market is segmented into diesel, gasoline, hybrid and electric. Diesel segment dominated pickup trucks market mainly in North America, due to their better payload capacity, fuel efficiency and long-term durability. These engines produce high torque at low RPM, which makes them ideal for heavy-duty applications, like hauling and off-road usage. Diesel pickups often have longer engine lifetime and better resale value than their gasoline counterparts. While strict emission rules have faced challenges, progress in clean diesel technology has helped maintain its popularity among commercial users and truck enthusiasts. Rise of electric and hybrid models is gradually transferring dynamics of pickup truck market.

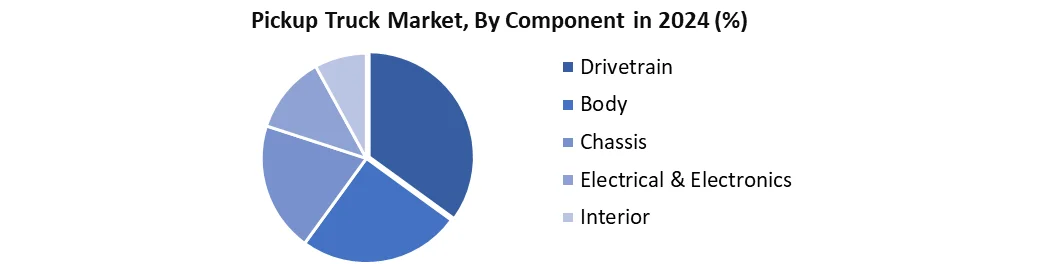

Based on Component, the Pickup Truck market is segmented into drivetrain, interior, body, electrical & Electronics and chassis. The drivetrain segment is set to hold a leading pickup truck market share over the forecast period. Drivetrain is a vital component and consists of an engine, transmissions, fuel system, exhaust system, cradle, and oil & grease. Suspensions, steering & braking systems, and axles can be more complex and 5-15% more expensive for an electric pickup vehicle. Also, technological innovations in drivetrains have contributed to its high market share. For instance, Magna, a mobility tech firm, introduced its new drivetrain technology for pickup trucks to make it easy for automakers to convert existing Internal Combustion Engine (ICE) designs into hybrid or electric powertrain vehicles

Pickup Truck Market Regional Analysis

North America, mainly the United States, leads the global pickup truck market by large consumer demand and cultural importance. Pickup trucks are not just vehicles, but a way of life, which meet both individual and professional needs in industries such as construction, agriculture and also logistics. The presence of major vehicle manufacturers such as Ford, General Motors ensures a stable supply of versatile and high-performance models to suit diverse requirements.

Favourable economic conditions easy financing options and government incentives drive further pickup truck market growth. Region vast rural landscape and infrastructure projects continuously maintain the demand, while the innovations in electric and hybrid pickups are at the forefront of North America in the pickup truck industry. With a strong commercial sector and consumer preferences, the region continues to set a benchmark in the pickup truck market.

Pickup Truck Market Competitive Landscape

The global pickup truck market in 2024 is highly competitive due to a mixture of heritage vehicle manufacturers and emerging EV manufacturers. Prominent players such as Ford, Toyota, General Motors and Stallantis dominate with strong global portfolios and installed distribution networks. Companies such as Tesla and Rivian are re-shaping the segment with electric pickups, targeting both North American and international pickup truck markets. In Asia, firms such as Isuzu, Great Wall Motors and Toyota maintained dominance through strong offerings and expanded export strategies. European and Chinese manufacturers are also increasing their footprints in Africa, Middle East and South America. Innovation, electrification and regional adaptations remain central to achieving pickup truck market share.

Recent Developments in the Pickup Truck Market

- In March 2024, Nissan entered advanced talks to invest over $400 million in electric vehicle startup Fisker, aiming to co-develop the Alaska electric pickup truck and manufacture it at U.S. facilities starting in 2026.

- In October 2024, Ford Motor Company reported a 64% increase in sales of its F-150 Hybrid pickup trucks in Q3 2024, reaching 20,129 units, indicating strong market acceptance of hybrid pickups.

|

Pickup Truck Market Scope |

|

|

Market Size in 2024 |

USD 218.51 Bn. |

|

Market Size in 2032 |

USD 312.89 Bn. |

|

CAGR (2025-2032) |

4.59% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Truck Type Small Size Midsize Full Size |

|

By Propulsion Type Diesel Gasoline Hybrid Electric |

|

|

By Component Drivetrain Interior Body Electrical & Electronics Chassis |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Pickup Truck Market

North America

- Ford Motor Company (USA)

- General Motors – Chevrolet/GMC (USA)

- Stellantis – Ram (USA)

- Tesla, Inc. (USA)

- Rivian Automotive, Inc. (USA)

- Lordstown Motors (USA)

- Hennessey Performance Engineering (USA)

- Bollinger Motors (USA)

Europe

- Volkswagen AG (Germany)

- Daimler Truck – Mercedes-Benz (Germany)

- Stellantis – Fiat/Peugeot (France)

- Land Rover (UK)

Asia Pacific

- Toyota Motor Corporation (Japan)

- Nissan Motor Co., Ltd. (Japan)

- Honda Motor Co., Ltd. (Japan)

- Mitsubishi Motors Corporation (Japan)

- Isuzu Motors Ltd. (Japan)

- Mazda Motor Corporation (Japan)

- Tata Motors Limited (India)

- Mahindra & Mahindra Ltd. (India)

- Hyundai Motor Company (South Korea)

- Kia Corporation (South Korea)

- SsangYong Motor Company (South Korea)

- Great Wall Motors (China)

- Foton Motor (China)

Frequently Asked Questions

According to the Pickup Truck market revenue forecast market is expected to grow at a compounded annual growth rate (CAGR) of over 4.59% during the forecast till 2032.

By Propulsion Type, the diesel segment is the leading segment in the pickup truck market.

The growing use of trucks by the e-commerce sector and rise in off-road activities in North America will be the driving factors for the market growth.

The top Pickup Truck companies in 2024 include Ford Motor Company, Toyota Motor Corporation, General Motors, Stellantis, Volkswagen AG, Tesla, Inc., Great Wall Motors, and Isuzu Motors Ltd.

1. Pickup Truck Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Pickup Truck Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Service Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Pickup Truck Market: Dynamics

3.1. Pickup Truck Market Trends

3.2. Pickup Truck Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Pickup Truck Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

4.1.1. Small Size

4.1.2. Midsize

4.1.3. Full Size

4.2. Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

4.2.1. Diesel

4.2.2. Gasoline

4.2.3. Hybrid

4.2.4. Electric

4.3. Pickup Truck Market Size and Forecast, By Component (2024-2032)

4.3.1. Drivetrain

4.3.2. Interior

4.3.3. Body

4.3.4. Electrical & Electronics

4.3.5. Chassis

4.4. Pickup Truck Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Pickup Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

5.1.1. Small Size

5.1.2. Midsize

5.1.3. Full Size

5.2. North America Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

5.2.1. Diesel

5.2.2. Gasoline

5.2.3. Hybrid

5.2.4. Electric

5.3. North America Pickup Truck Market Size and Forecast, By Component (2024-2032)

5.3.1. Drivetrain

5.3.2. Interior

5.3.3. Body

5.3.4. Electrical & Electronics

5.3.5. Chassis

5.4. North America Pickup Truck Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

5.4.1.1.1. Small Size

5.4.1.1.2. Midsize

5.4.1.1.3. Full Size

5.4.1.2. United States Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

5.4.1.2.1. Diesel

5.4.1.2.2. Gasoline

5.4.1.2.3. Hybrid

5.4.1.2.4. Electric

5.4.1.3. United States Pickup Truck Market Size and Forecast, By Component (2024-2032)

5.4.1.3.1. Drivetrain

5.4.1.3.2. Interior

5.4.1.3.3. Body

5.4.1.3.4. Electrical & Electronics

5.4.1.3.5. Chassis

5.4.2. Canada

5.4.2.1. Canada Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

5.4.2.1.1. Small Size

5.4.2.1.2. Midsize

5.4.2.1.3. Full Size

5.4.2.2. Canada Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

5.4.2.2.1. Diesel

5.4.2.2.2. Gasoline

5.4.2.2.3. Hybrid

5.4.2.2.4. Electric

5.4.2.3. Canada Pickup Truck Market Size and Forecast, By Component (2024-2032)

5.4.2.3.1. Drivetrain

5.4.2.3.2. Interior

5.4.2.3.3. Body

5.4.2.3.4. Electrical & Electronics

5.4.2.3.5. Chassis

5.4.3. Mexico

5.4.3.1. Mexico Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

5.4.3.1.1. Small Size

5.4.3.1.2. Midsize

5.4.3.1.3. Full Size

5.4.3.2. Mexico Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

5.4.3.2.1. Diesel

5.4.3.2.2. Gasoline

5.4.3.2.3. Hybrid

5.4.3.2.4. Electric

5.4.3.3. Mexico Pickup Truck Market Size and Forecast, By Component (2024-2032)

5.4.3.3.1. Drivetrain

5.4.3.3.2. Interior

5.4.3.3.3. Body

5.4.3.3.4. Electrical & Electronics

5.4.3.3.5. Chassis

6. Europe Pickup Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.2. Europe Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.3. Europe Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4. Europe Pickup Truck Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.1.2. United Kingdom Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.1.3. United Kingdom Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.2. France

6.4.2.1. France Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.2.2. France Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.2.3. France Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.3.2. Germany Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.3.3. Germany Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.4.2. Italy Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.4.3. Italy Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.5.2. Spain Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.5.3. Spain Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.6.2. Sweden Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.6.3. Sweden Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.7.2. Russia Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.7.3. Russia Pickup Truck Market Size and Forecast, By Component (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

6.4.8.2. Rest of Europe Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

6.4.8.3. Rest of Europe Pickup Truck Market Size and Forecast, By Component (2024-2032)

7. Asia Pacific Pickup Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.2. Asia Pacific Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.3. Asia Pacific Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4. Asia Pacific Pickup Truck Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.1.2. China Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.1.3. China Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.2.2. S Korea Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.2.3. S Korea Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.3.2. Japan Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.3.3. Japan Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.4. India

7.4.4.1. India Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.4.2. India Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.4.3. India Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.5.2. Australia Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.5.3. Australia Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.6.2. Indonesia Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.6.3. Indonesia Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.7.2. Malaysia Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.7.3. Malaysia Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.8.2. Philippines Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.8.3. Philippines Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.9.2. Thailand Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.9.3. Thailand Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.10.2. Vietnam Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.10.3. Vietnam Pickup Truck Market Size and Forecast, By Component (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Pickup Truck Market Size and Forecast, By Component (2024-2032)

8. Middle East and Africa Pickup Truck Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.2. Middle East and Africa Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.3. Middle East and Africa Pickup Truck Market Size and Forecast, By Component (2024-2032)

8.4. Middle East and Africa Pickup Truck Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.4.1.2. South Africa Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.4.1.3. South Africa Pickup Truck Market Size and Forecast, By Component (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.4.2.2. GCC Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.4.2.3. GCC Pickup Truck Market Size and Forecast, By Component (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.4.3.2. Egypt Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.4.3.3. Egypt Pickup Truck Market Size and Forecast, By Component (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.4.4.2. Nigeria Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.4.4.3. Nigeria Pickup Truck Market Size and Forecast, By Component (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

8.4.5.2. Rest of ME&A Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

8.4.5.3. Rest of ME&A Pickup Truck Market Size and Forecast, By Component (2024-2032)

9. South America Pickup Truck Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.2. South America Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.3. South America Pickup Truck Market Size and Forecast, By Component (2024-2032)

9.4. South America Pickup Truck Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.4.1.2. Brazil Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.4.1.3. Brazil Pickup Truck Market Size and Forecast, By Component (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.4.2.2. Argentina Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.4.2.3. Argentina Pickup Truck Market Size and Forecast, By Component (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.4.3.2. Colombia Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.4.3.3. Colombia Pickup Truck Market Size and Forecast, By Component (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.4.4.2. Chile Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.4.4.3. Chile Pickup Truck Market Size and Forecast, By Component (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Pickup Truck Market Size and Forecast, By Truck Type (2024-2032)

9.4.5.2. Rest Of South America Pickup Truck Market Size and Forecast, By Propulsion Type (2024-2032)

9.4.5.3. Rest Of South America Pickup Truck Market Size and Forecast, By Component (2024-2032)

10. Company Profile: Key Players

10.1. Ford Motor Company (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. General Motors – Chevrolet/GMC (USA)

10.3. Stellantis – Ram (USA)

10.4. Tesla, Inc. (USA)

10.5. Rivian Automotive, Inc. (USA)

10.6. Lordstown Motors (USA)

10.7. Hennessey Performance Engineering (USA)

10.8. Bollinger Motors (USA)

10.9. Volkswagen AG (Germany)

10.10. Daimler Truck – Mercedes-Benz (Germany)

10.11. Stellantis – Fiat/Peugeot (France)

10.12. Land Rover (UK)

10.13. Toyota Motor Corporation (Japan)

10.14. Nissan Motor Co., Ltd. (Japan)

10.15. Honda Motor Co., Ltd. (Japan)

10.16. Mitsubishi Motors Corporation (Japan)

10.17. Isuzu Motors Ltd. (Japan)

10.18. Mazda Motor Corporation (Japan)

10.19. Tata Motors Limited (India)

10.20. Mahindra & Mahindra Ltd. (India)

10.21. Hyundai Motor Company (South Korea)

10.22. Kia Corporation (South Korea)

10.23. SsangYong Motor Company (South Korea)

10.24. Great Wall Motors (China)

10.25. Foton Motor (China)

11. Key Findings

12. Industry Recommendations

13. Pickup Truck Market: Research Methodology