E Bike Market Industry Analysis and Forecast (2026-2032) by Network Type, Hardware, Communication Type, End User, Services, and Region.

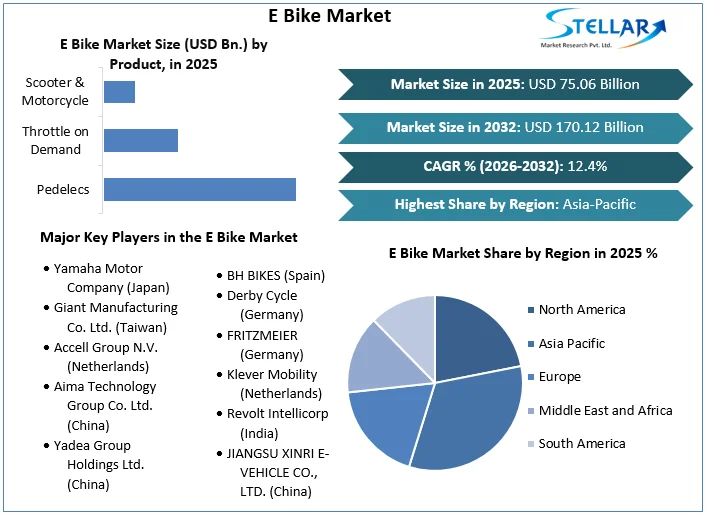

E Bike Market size was valued at US$ 75.06 Billion in 2025 and the total E Bike Market revenue is expected to grow at 12.4% through 2026 to 2032, reaching nearly US$ 170.12 Billion.

Format : PDF | Report ID : SMR_301

E Bike Market Overview:

A bicycle equipped with an electric motor drive mechanism and a battery that produces energy to exert or assist propulsion is called an electric bicycle. From electric bikes with small motors that assist the rider's pedaling power, more powerful electric bikes that generate electricity and drive the bike entirely on gas are available all over the world. Electric bicycles are a versatile, environmentally friendly and fashionable means of transportation. Customers see them as viable alternatives to scooters, smart cars, and public transport. Due to the small size of the electric bicycle, it can alleviate traffic congestion, and at the same time, achieve high speed with less effort and enjoy the health benefits of walking. Due to these factors, e bike market growth is gaining atraction over the world.

To get more Insights: Request Free Sample Report

E Bike Market Dynamics:

The e bike market became valued at $41.85 billion in 2020 and is anticipated to grow at a 12.4% CAGR (Compound Annual Growth Rate) throughout 2021 to 2027. Pedal-assisted electric powered bicycles ruled the market through the period. They managed 88.36% of the worldwide marketplace. By software kind, city e-motorcycles ruled the marketplace. Up to one hundred thirty million electric powered bicycles (the use of all battery technologies) are anticipated to be bought globally among 2020 and 2023. E-bikes income are anticipated to attain forty million gadgets global through 2023, producing approximately $20 billion in revenue.

Owing to an increasing number of aggravating existence and the want to trip on a day-by-day basis, proudly owning an automobile has nearly come to be a requirement, as public transportation is regularly unreliable. As a result, there may be a developing issue approximately maintaining and maintaining the surroundings for destiny generations, because of the shortage of herbal sources and environmental issues. This gives a one-of-a-type project for each society and governments. E-motorcycles are the right approach to this issue. They are environmentally pleasant and clear up the hassle of day-by-day commuting. This is growing call for E bike market.

People`s lives have become extra aggravating, necessitating extra travel. However, with ever-growing environmental and fitness issues, there may be a boom in transportation emission levels. As a result, governments and global companies all around the global are enacting stringent emission requirements on the way to lessen carbon emissions. Furthermore, the fast depletion of fossil gasoline reserves has raised issues approximately the sustainability of destiny generations. This element gives a large project to governments and society. As a result, E Bike Market is proving to be a superb approach to this hassle.

In latest years, e-MTBs have visible a fast boom in call for while in comparison to different forms of e-motorcycles, along with city/city and load e-motorcycles. It is right for off-street use, as its sturdiness guarantees protection even on moist and slick terrain. In many cities, e-MTBs are used now no longer best for mountain tours, however additionally for commuting to paintings or shopping. The primary cause for e-MTBs` developing recognition is their durability, which additionally makes them prime for street traffic. Because they seem extra high priced and stylish, e-MTBs have additionally come to be a standing symbol. In the case of e-motorcycles, authorities legal guidelines and terminologies vary. Although a few nations have countrywide rules, the authority and criminal rules governing street use are decided through states and provinces. As a result, any change/replace in e-bikes law influences E Bike Market call for.

For example, China, the biggest e bike market in globe, introduced an e-bikes law wherein bicycles can be categorized as e-motorcycles best if they are able to pedal-assist, have a pinnacle velocity of up to twenty-five km/h, and a motor electricity of as much as four hundred watts. Any e-bike with a pinnacle velocity of extra than 25 km/h is classed as a moped. Under the brand-new requirements, the e-bike can be extra high priced, nearly two times as much. On the alternative hand, the excessive fee of e-motorcycles is a chief element proscribing the marketplace`s growth. E-motorcycles are extra high priced than conventional bicycles, scooters, or bikes because of the fee of the battery and technology. As a result, customers take into account conventional scooters or bikes to be advanced in overall performance even as costing the identical or less. Furthermore, the usage of lithium–ion batteries or motor force mechanisms incurs the best fee, stifling marketplace growth. As a result, the adoption of e-motorcycles in nations apart from China is hampered through excessive costs. However, the worldwide E-bikes marketplace is increasing rapidly, which can also additionally mitigate the effect of this restraint withinside the close to destiny.

E Bike Market Segmentation:

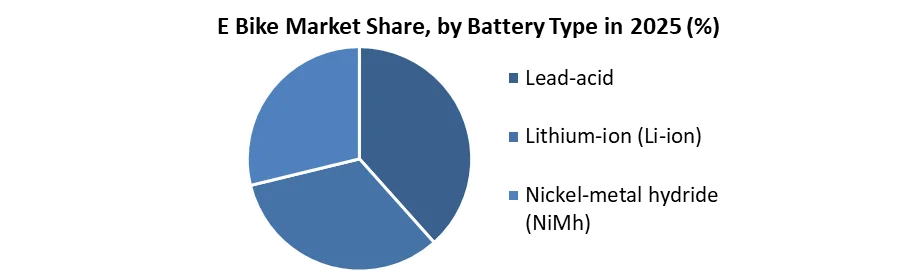

Li-Ion Batteries: Key Segment Driving the E Bike market:

By battery type, E bike market is segmented into Lead Acid, Li-ion and Nickel steel hydride. In current years, nearly all producers have relied nearly absolutely on Li-ion batteries. One of the motives China has visible one of these considerable growth in e-bike income is that manufacturing fees are plenty decrease than elsewhere. According to INSG, this became executed in element with the aid of using much less high priced and heavier lead-acid batteries. However, current tendencies have shifted in choose of extra subtle lithium-ion batteries (LIB).

In 2019, lead-acid batteries held more than 80% of all e-motorcycles synthetic and bought worldwide. Li-ion battery charges have dropped dramatically in current years. It is anticipated that two-fifths of all e-motorcycles bought globally will consist of LIBs. By 2020, its miles anticipated that Li-on batteries will strength 25% of electrical motorcycles. In contrast, that determine is anticipated to upward thrust to 60% with the aid of using 2023. Lithium-ion batteries at the moment are being synthetic for a number of programs in electric powered bicycles. Models are to be had for commuting, hauling cargo, and mountain biking.

The passenger car segment is expected to reach its peak during the forecast period:

The passenger car segment is a major contributor to the ADAS market. Increasing demand for safety systems in emerging markets can result from increased traffic safety standards, legal support, and increased consumer awareness. In addition, some countries in Europe, North America and Asia Pacific have introduced regulations that require different types of ADAS to be installed in the passenger car segment. For example, the European Union has outlined Vision Zero, an initiative to eliminate road deaths by 2050. The agency has set a goal of reducing casualties by 50% by 2030. The strategic plan also includes mandating major safety features such as lane departure warning, automatic emergency braking, and drowsiness & attention detection in new vehicles by 2022. Developed countries such as South Korea have mandated AEB and LDW systems for all new passenger vehicles from January 2019.

Recent Developments in the Market:

- In August 2021, Riese & Müller Business, a manufacturer of premium electric and cargo bikes, is expanding its portfolio of sustainable mobility concepts in its business customer segment. It caters to municipalities and businesses of all sizes, including retail, gastronomy, trade, healthcare and mobility companies, using four specific models developed for business, fleet and sharing. In March 2021, Cannondale will launch the Adventure Neoline, an electric bicycle for commuting. Cannondale launches a lineup of step-through electric bikes for city riding with Bosch. The Adventure Neoline has four different models, all with a Bosch drive system with an aluminum frame, deep design and a 400-625Wh battery.

- In December 2020, Merida announced three new electric bicycles. eSculturaDropbarRoad, eSpeeder Flatbar Hybrid, eSilex Gravelbike. All three e-bikes are equipped with Mahle ebikemotion X35 + rear hub electric motor. In August 2020, Shimano announced the Shimano STEPS DUE 8000, a state-of-the-art mountain bike e-bike system based on the new STEPS EP8 motor platform. etube project technology has comprehensively improved the driving experience.

- In July 2020, Yamaha Bicycles announced the launch of the new Civante Class 3 power-assisted bike, expanding the range of fitness-focused road bikes. Civante is powered by Yamaha's PW Series SE motors, which provide the purest, smoothest and most natural eBike support for Yamaha's triple sensor system. The system uses frictionless sensors to measure pedal torque, bike speed, and crankarm cadence, and provides the right amount of assistance based on changing terrain and riding conditions.

E Bike Market Regional Insights:

In China, the common charge of an electric powered bicycle with lead-acid batteries is $167. According to Chinese Sustainability Survey, e-motorcycles in North America fee a mean of $815, even as the ones in Western Europe fee a mean of $1,546. China dominates the worldwide marketplace, with estimates indicating that 83% of all e-motorcycles are offered on this Asian country. According to authorities estimates, there have been a hundred and eighty million e-motorcycles at the streets of China in 2013, that is considerably greater than everywhere else withinside the world.

Following the Asia-Pacific location, the European location debts for about 20% of the marketplace. Germany, France, and Italy are some of the main countries. However, the traits also can be visible in different countries, including the Netherlands, Denmark, and the opposite Scandinavian countries. When we do not forget the populace of each region, that is enormous. Only approximately 500,000 electric powered motorcycles have been offered in Europe in 2009. That discern jumped to 2.6 million in 2018, representing a greater than 500 percentage boom in only nine years. In Germany, e-bike income extended via way of means of 36% to at least one million units. According to the Royal Society for the Prevention of Accidents (ROSPA), Germany and the Netherlands are Europe`s main e-bike markets, accounting for 44% and 21% of general European income, respectively. Electric bicycle income in Germany accounted for 25% of the full bicycle marketplace in 2019. The majority of Germans journey electric powered bicycles now no longer handiest for activity and sports, however additionally as a clean, quiet, and space-saving mode of transportation. 99.5% of all e-motorcycles offered in Germany are 250W fashions with pinnacle speeds of 25 kph. The final 0.5% are velocity pedelecs with a pinnacle velocity of 45 kph that require coverage and a helmet.

The objective of the report is to present a comprehensive analysis of the E Bike Market to the stakeholders in the industry. The report provides trends that are most dominant in the E Bike Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the E Bike Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the E Bike Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the E Bike Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the E Bike Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the E Bike Market is aided by legal factors.

E Bike Market Scope:

|

E Bike Market Scope |

|

|

Market Size in 2025 |

USD 75.06 Bn. |

|

Market Size in 2032 |

USD 170.12 Bn. |

|

CAGR (2026-2032) |

12.4% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Product

|

|

by Battery Type

|

|

|

by Drive Mechanism

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

E Bike Market Players:

- Yamaha Motor Company (Japan)

- Giant Manufacturing Co. Ltd. (Taiwan)

- Accell Group N.V. (Netherlands)

- Aima Technology Group Co. Ltd. (China)

- Yadea Group Holdings Ltd. (China)

- Pedego Electric Bikes (USA)

- Merida Industry Co. Ltd (Taiwan)

- Trek Bicycle Corporation (USA)

- Specialized Bicycle Components, Inc. (USA)

- BH BIKES (Spain)

- Derby Cycle (Germany)

- FRITZMEIER (Germany)

- Klever Mobility (Netherlands)

- Revolt Intellicorp (India)

- JIANGSU XINRI E-VEHICLE CO., LTD. (China)

- Karbon Kinetics Ltd (UK)

- Solex Cycle North America Inc. (USA)

- ITALJET SPA (Italy)

- GenZe by Mahindra (India)

- A2B (India)

- Amego Electric Vehicles Inc. (Canada)

Frequently Asked Questions

APAC region have the highest growth rate in the E Bike market.

Yamaha Motor Company (Japan), Giant Manufacturing Co. Ltd. (Taiwan), Accell Group N.V. (Netherlands), Aima Technology Group Co. Ltd. (China), Yadea Group Holdings Ltd. (China), Pedego Electric Bikes (USA), Merida Industry Co. Ltd (Taiwan), Trek Bicycle Corporation (USA), Specialized Bicycle Components, Inc. (USA), BH BIKES (Spain), Derby Cycle (Germany), FRITZMEIER (Germany), Klever Mobility (Netherlands), Revolt Intellicorp (India) are the key players in the E Bike market.

Li-Ion battery segment is dominating the market owing to increasing demand for Li-ion batteries due to their higher efficiency and storage capacity.

1. E Bike Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global E Bike Market: Competitive Landscape

2.1. Stellar Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2025)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. E Bike Market: Dynamics

3.1. E Bike Market Trends by Region

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Middle East and Africa

3.1.5. South America

3.2. E Bike Market Dynamics

3.2.1. E Bike Market Drivers

3.2.2. E Bike Market Restraints

3.2.3. E Bike Market Opportunities

3.2.4. E Bike Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis and Supply Chain Analysis

3.6. Regulatory Landscape

3.7. Trade Analysis

3.7.1. Imports Scenario

3.7.2. Exports Scenario

3.8. Key Opinion Leaders Analysis

4. E Bike Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

4.1. E Bike Market Size and Forecast, by Product (2025-2032)

4.1.1. Pedelecs

4.1.2. Throttle on Demand

4.1.3. Scooter & Motorcycle

4.2. E Bike Market Size and Forecast, by Battery Type (2025-2032)

4.2.1. Lead-acid

4.2.2. Lithium-ion (Li-ion)

4.2.3. Nickel-metal hydride (NiMh)

4.3. E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

4.3.1. Hub Motor

4.3.2. Mid Drive

4.4. E Bike Market Size and Forecast, by Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America E Bike Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

5.1. North America E Bike Market Size and Forecast, by Product (2025-2032)

5.1.1. Pedelecs

5.1.2. Throttle on Demand

5.1.3. Scooter & Motorcycle

5.2. North America E Bike Market Size and Forecast, by Battery Type (2025-2032)

5.2.1. Lead-acid

5.2.2. Lithium-ion (Li-ion)

5.2.3. Nickel-metal hydride (NiMh)

5.3. North America E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

5.3.1. Hub Motor

5.3.2. Mid Drive

5.4. North America E Bike Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe E Bike Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

6.1. Europe E Bike Market Size and Forecast, by Product (2025-2032)

6.2. Europe E Bike Market Size and Forecast, by Battery Type (2025-2032)

6.3. Europe E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

6.4. Europe E Bike Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific E Bike Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

7.1. Asia Pacific E Bike Market Size and Forecast, by Product (2025-2032)

7.2. Asia Pacific E Bike Market Size and Forecast, by Battery Type (2025-2032)

7.3. Asia Pacific E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

7.4. Asia Pacific E Bike Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa E Bike Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

8.1. Middle East and Africa E Bike Market Size and Forecast, by Product (2025-2032)

8.2. Middle East and Africa E Bike Market Size and Forecast, by Battery Type (2025-2032)

8.3. Middle East and Africa E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

8.4. Middle East and Africa E Bike Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America E Bike Market Size and Forecast by Segmentation (by Value in USD Mn and Volume Units) (2025-2032)

9.1. South America E Bike Market Size and Forecast, by Product (2025-2032)

9.2. South America E Bike Market Size and Forecast, by Battery Type (2025-2032)

9.3. South America E Bike Market Size and Forecast, by Drive Mechanism (2025-2032)

9.4. South America E Bike Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. Yamaha Motor Company (Japan)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Giant Manufacturing Co. Ltd. (Taiwan)

10.3. Accell Group N.V. (Netherlands)

10.4. Aima Technology Group Co. Ltd. (China)

10.5. Yadea Group Holdings Ltd. (China)

10.6. Pedego Electric Bikes (USA)

10.7. Merida Industry Co. Ltd (Taiwan)

10.8. Trek Bicycle Corporation (USA)

10.9. Specialized Bicycle Components, Inc. (USA)

10.10. BH BIKES (Spain)

10.11. Derby Cycle (Germany)

10.12. FRITZMEIER (Germany)

10.13. Klever Mobility (Netherlands)

10.14. Revolt Intellicorp (India)

10.15. JIANGSU XINRI E-VEHICLE CO., LTD. (China)

10.16. Karbon Kinetics Ltd (UK)

10.17. Solex Cycle North America Inc. (USA)

10.18. ITALJET SPA (Italy)

10.19. GenZe by Mahindra (India)

10.20. A2B (India)

10.21. Amego Electric Vehicles Inc. (Canada)

11. Key Findings

12. Industry Recommendations

13. E Bike Market: Research Methodology