Veterinary CRO and CDMO Market: Global Market Growth by Animal Type, Service, Application and Region Forecast (2024-2032)

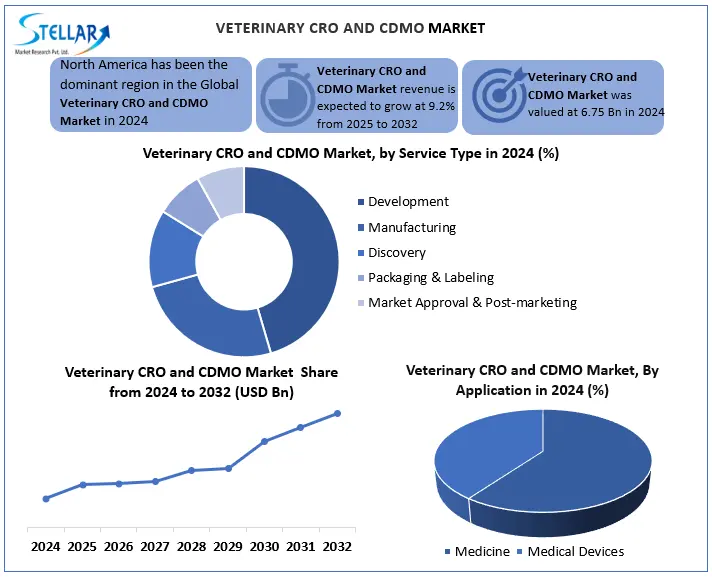

The Veterinary CRO and CDMO Market was valued at USD 6.75 Bn in 2024 and is expected to reach USD 13.65 Bn by 2032, at a CAGR of 9.2% during the forecast period.

Format : PDF | Report ID : SMR_2811

Veterinary CRO and CDMO Market Overview

A Veterinary Contract Research Organisation (CRO) specialises in conducting preclinical and clinical trials, regulatory support, and data management for animal health products, ensuring drug safety and efficacy. A Veterinary Contract Development and Manufacturing Organisation (CDMO) focuses on drug formulation, process optimisation, and scalable production of veterinary pharmaceuticals while maintaining compliance with industry standards. Together, CROs and CDMOs accelerate the development and commercialisation of innovative veterinary medicines by providing end-to-end research, development, and manufacturing solutions.

Veterinary CRO and CDMO are experiencing significant growth due to increasing demand for market health products, increasing ownership of pets and progress in veterinary. These organisations provide essential services such as pharmaceuticals, vaccines and medical equipment for clinical testing and manufacturing assistance. The veterinary CRO and CDMO market is stimulated by the growing requirement for specialised treatments for partner animals and livestock, as well as regulatory requirements for animal health products.

Trade and tariffs influence markets by altering the cost and availability of goods, impacting supply chains and consumer prices. Higher tariffs can reduce imports, protect domestic industries, but may also lead to retaliatory measures and higher costs for businesses and consumers. Conversely, free trade agreements typically boost competition, lower prices, and expand market access for exporters.

To get more Insights: Request Free Sample Report

Veterinary CRO and CDMO Market Dynamics

Population and Intensified Livestock Production to Boost the Veterinary CRO and CDMO Market

The extended global pet population is an important driver for increasing the veterinary CROs and the CDMO market. With more people embracing pets as partners, the need for special veterinary drugs and treatments increases. This boom in demand requires expertise and services of CRO and CDMO providers, which promote adequate growth in the veterinary pharmaceutical industry, to develop and create innovative pharmaceuticals, vaccines and medical solutions to suit the diverse health requirements of companion animals.

Also, the demand increased research and development activities, and veterinary companies rapidly moved to CROs and CDMO services for developing these essential products, specialising in testing and construction. As a result, acute livestock production promotes the development of the veterinary CRO and CDMO market.

High Development Costs and Regulatory Hurdles to Impede Veterinary CRO and CDMO Market Growth

Veterinary drug development and manufacturing are expensive processes; they could be even better if the market for veterinary drugs were as large as it is for human pharmaceuticals. This impacts the variety of projects CROs and CDMOs can execute and, consequently, their potential revenue. That said, growth in this market is now driven by increased valuing of animal health, and with time and further investment, economies of scale may help temper at least some of these cost challenges a little.

Ensuring compliance with a complex, changing veterinary drug regulatory landscape is a significant challenge for veterinary CROs and CDMOs market regarding compliance and time-to-market. Keeping pace with changing regulations and following guidelines requires substantial resources. However, those CROs and CDMOs with robust regulatory expertise can set themselves apart and create a competitive edge.

Next-Gen Solutions to Shape the Future of Veterinary CRO and CDMO Market

Veterinary CROs and CDMO market offer important development opportunities, operated by technical integration and pharmacovigilance services. Adopting AI, data analytics, and digital platforms is revolutionising drug development, increasing efficiency, and accelerating time-to-market for veterinary pharmaceuticals. These innovations improve real-time monitoring, data management and accuracy in R&D, which highlights service providers with advanced technical capabilities. Additionally, increasing demand for pharmacovigilance services ensures drug safety and regulatory compliance, especially as tightening animal health rules are being implemented globally. Veterinary companies promote rapid safety monitoring and specialised CROs/CDMOs risk evaluation, trust and market expansion. Together, these trends create an attractive opportunity for service providers to meet the increasing requirement of integrated, technology-driven and safety-transport solutions in animal healthcare.

Veterinary CRO and CDMO Market Regional Analysis

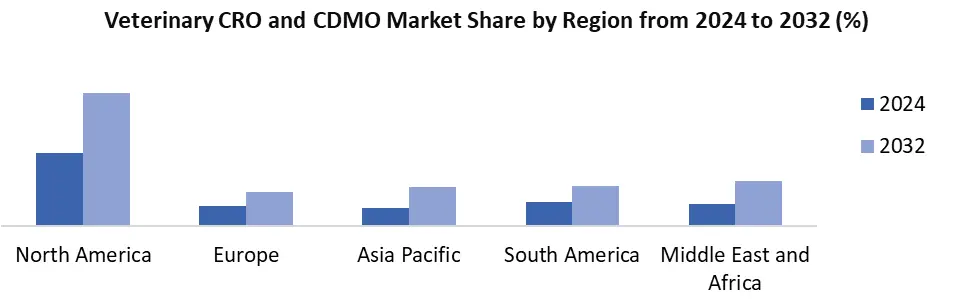

North America is dominating the Veterinary CRO and CDMO market in 2024 and holding the largest revenue share due to advanced animal health infrastructure, high R&D investment and strict regulatory standards that drive outsourcing to specialised service providers. The presence of major pharmaceutical companies, frequent outbreaks in livestock (eg avian flu), and growing pet ownership are further promoted. Additionally, U.S. The home of several major CROs/CDMOs is supported by government funding and cooperation with educational institutions. Europe follows closely, while Asia-Pacific emerges as the fastest-growing market due to the expansion of animal health industries and cost benefits.

Veterinary CRO and CDMO Market Segment Analysis

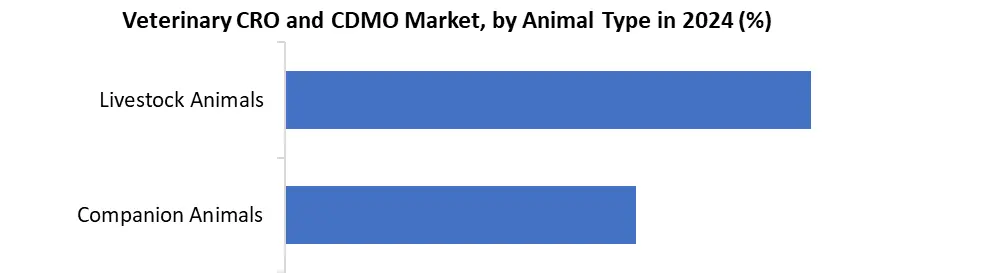

Based on Animal Type, the veterinary CRO and CDMO market is divided into companion animals and livestock animals. The livestock animal segment dominated the veterinary CRO and CDMO market in 2024 due to high demand for vaccines, pharmaceuticals, and diagnostic products to combat infectious diseases. Frequent disease outbreaks, such as the 2024 multi-state bird flu (HPAI A H5N1) in U.S. dairy cows, have accelerated R&D efforts and increased outsourcing to CROs/CDMOs for rapid vaccine and treatment development. Additionally, increasing investment in livestock health, such as Ceva's Hungary vaccine feature which further strengthened the dominance of this segment.

Based on Service Type, the veterinary CRO and CDMO market is divided into Discovery, Development, Manufacturing, Packaging & Labeling and Market Approval & Post-marketing. In the development segment dominate the veterinary CRO and CDMO market due to the growing focus of animal health companies on novel vaccines, drugs and medical equipment for livestock and companion animals. Many manufacturers exclude both beginners (preclinical testing, toxicology) and late-phase (clinical trial, regulatory submission) to special CROs and CDMOs to reduce outsources to reduce costs and leverage expertise. Additionally, a Pharma Almanack Survey found that 94% of veterinary product manufacturers outsourced late phase development and manufacturing due to challenges in quality materials. Contract organisations provide advanced technical abilities, efficient product development and regulatory compliance, strengthening the market leadership of this section.

Veterinary CRO and CDMO Market Competitive Landscape

The veterinary CRO and CDMO market is leading some companies like Charles River Laboratories, Labcorp, and Zoetis dominate through their end-to-end solutions, global access and strong R&D abilities. Also, the niche CROs and CDMOs are receiving traction by offering special services in biology, diagnosis and precise medicine for animals. Strategic partnerships, mergers and acquisitions are common because the firms expand their service portfolio and geographical presence. The veterinary CRO and CDMO market has also seen growing competition from emerging biotech firms, AI and advanced analytics to accelerate drug development. With the increasing demand for individual veterinary treatment and regulatory compliance, companies are separating themselves through technology integration, rapid turnaround time, and cost efficiency. This dynamic environment fosters innovation while driving consolidation among key players.

Recently, Charles River expanded its veterinary biosafety testing capabilities in 2024 to meet growing demand for livestock vaccines, while Zoetis acquired a gene therapy startup to advance personalised treatments for companion animals.

|

Veterinary CRO and CDMO Market Scope |

|

|

Market Size in 2024 |

USD 6.75 Bn. |

|

Market Size in 2032 |

USD 13.65 Bn. |

|

CAGR (2024-2032) |

9.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Animal Type Companion Animals Livestock Animals |

|

By Service Type Discovery Development Manufacturing Packaging & Labeling Market Approval & Post-marketing |

|

|

By Application Medicines Medical Devices |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe– UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Veterinary CRO and CDMO Market

North America

- Labcorp Drug Development (USA)

- Charles River Laboratories (USA)

- IDEXX Laboratories Inc. (USA)

- Inotiv Inc. (USA)

- Vetio Animal Health (USA)

- Zoetis Inc. / Nexvet (USA)

- Pharmaceutical Product Development, LLC - PPD (USA)

- Syneos Health Inc. (USA)

- ICON plc (Ireland / USA operations)

- Medpace (USA)

- Envigo (USA)

- VetPharm, Inc. (USA)

- MPI Research (USA)

Europe

- KLIFOVET GmbH (Germany)

- Knoell – Triveritas (Germany)

- VETSPIN Srl (Italy)

- Veterinary Research Management – VRM Ltd. (United Kingdom)

- Cebiphar (France)

- Ondax Scientific UK Ltd. (United Kingdom)

- Ridgeway Research Ltd. (United Kingdom)

- Drayton Animal Health Ltd. (United Kingdom)

- Arcoblu S.r.l. (Italy)

Asia Pacific

- WuXi AppTec (China)

- Sai Life Sciences Ltd. (India)

- Elanco India Private Limited (India)

Middle East and Africa

- Dawa Life Sciences (Kenya)

- Botswana Vaccine Institute – BVI (Botswana)

- Julphar – Gulf Pharmaceutical Industries (United Arab Emirates)

South America

- Eurofarma Laboratórios S.A. (Brazil)

- Ourofino Saúde Animal (Brazil)

Frequently Asked Questions

The driving factors of the veterinary CRO and CDMO market are the growing global pet population and intensified livestock production.

The Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The veterinary contract research organisation and contract development and manufacturing organisation industry size was USD 6.75 billion in 2024 and will grow at 9.2% CAGR through 2032 due to the increasing prevalence of diseases in animals, such as cancer and zoonotic infections.

The top players in the market are Zoetis Inc., Charles River Laboratories, WuXi AppTec, Eurofins Scientific SE, Vetio Animal Health, Inotiv Inc., KLIFOVET GmbH, and Ourofino Saúde Animal.

1. Veterinary CRO and CDMO Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Veterinary CRO and CDMO Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Veterinary CRO and CDMO Market: Dynamics

3.1. Veterinary CRO and CDMO Market Trends

3.2. Veterinary CRO and CDMO Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Veterinary CRO and CDMO Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

4.1.1. Companion Animals

4.1.2. Livestock Animals

4.2. Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

4.2.1. Discovery

4.2.2. Development

4.2.3. Manufacturing

4.2.4. Packaging & Labeling

4.2.5. Market Approval & Post-marketing

4.3. Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

4.3.1. Medicines

4.3.2. Medical Devices

4.4. Veterinary CRO and CDMO Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Veterinary CRO and CDMO Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

5.1.1. Companion Animals

5.1.2. Livestock Animals

5.2. North America Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

5.2.1. Discovery

5.2.2. Development

5.2.3. Manufacturing

5.2.4. Packaging & Labeling

5.2.5. Market Approval & Post-marketing

5.3. North America Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

5.3.1. Medicines

5.3.2. Medical Devices

5.4. North America Veterinary CRO and CDMO Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

5.4.1.1.1. Companion Animals

5.4.1.1.2. Livestock Animals

5.4.1.2. United States Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

5.4.1.2.1. Discovery

5.4.1.2.2. Development

5.4.1.2.3. Manufacturing

5.4.1.2.4. Packaging & Labeling

5.4.1.2.5. Market Approval & Post-marketing

5.4.1.3. United States Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Medicines

5.4.1.3.2. Medical Devices

5.4.2. Canada

5.4.2.1. Canada Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

5.4.2.1.1. Companion Animals

5.4.2.1.2. Livestock Animals

5.4.2.2. Canada Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

5.4.2.2.1. Discovery

5.4.2.2.2. Development

5.4.2.2.3. Manufacturing

5.4.2.2.4. Packaging & Labeling

5.4.2.2.5. Market Approval & Post-marketing

5.4.2.3. Canada Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

5.4.2.3.1. Medicines

5.4.2.3.2. Medical Devices

5.4.3. Mexico

5.4.3.1. Mexico Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

5.4.3.1.1. Companion Animals

5.4.3.1.2. Livestock Animals

5.4.3.2. Mexico Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

5.4.3.2.1. Discovery

5.4.3.2.2. Development

5.4.3.2.3. Manufacturing

5.4.3.2.4. Packaging & Labeling

5.4.3.2.5. Market Approval & Post-marketing

5.4.3.3. Mexico Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Medicines

5.4.3.3.2. Medical Devices

6. Europe Veterinary CRO and CDMO Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.2. Europe Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.3. Europe Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4. Europe Veterinary CRO and CDMO Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.1.2. United Kingdom Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.1.3. United Kingdom Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.2.2. France Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.2.3. France Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.3.2. Germany Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.3.3. Germany Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.4.2. Italy Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.4.3. Italy Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.5.2. Spain Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.5.3. Spain Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.6.2. Sweden Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.6.3. Sweden Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.7.2. Russia Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.7.3. Russia Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

6.4.8.2. Rest of Europe Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

6.4.8.3. Rest of Europe Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Veterinary CRO and CDMO Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.2. Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.3. Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.1.2. China Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.1.3. China Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.2.2. S Korea Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.2.3. S Korea Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.3.2. Japan Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.3.3. Japan Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.4.2. India Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.4.3. India Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.5.2. Australia Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.5.3. Australia Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.6.2. Indonesia Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.6.3. Indonesia Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.7.2. Malaysia Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.7.3. Malaysia Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.8.2. Philippines Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.8.3. Philippines Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.9.2. Thailand Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.9.3. Thailand Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.10.2. Vietnam Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.10.3. Vietnam Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Veterinary CRO and CDMO Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.2. Middle East and Africa Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.3. Middle East and Africa Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Veterinary CRO and CDMO Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.4.1.2. South Africa Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.4.1.3. South Africa Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.4.2.2. GCC Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.4.2.3. GCC Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.4.3.2. Egypt Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.4.3.3. Egypt Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.4.4.2. Nigeria Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.4.4.3. Nigeria Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

8.4.5.2. Rest of ME&A Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

8.4.5.3. Rest of ME&A Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9. South America Veterinary CRO and CDMO Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.2. South America Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

9.3. South America Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9.4. South America Veterinary CRO and CDMO Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.4.1.2. Brazil Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

9.4.1.3. Brazil Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.4.2.2. Argentina Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

10. Company Profile: Key Players

9.4.2.3. Argentina Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.4.3.2. Colombia Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

9.4.3.3. Colombia Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.4.4.2. Chile Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

9.4.4.3. Chile Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

9.4.5. Rest of South America

9.4.5.1. Rest of South America Veterinary CRO and CDMO Market Size and Forecast, By Animal Type (2024-2032)

9.4.5.2. Rest of South America Veterinary CRO and CDMO Market Size and Forecast, By Service Type (2024-2032)

9.4.5.3. Rest of South America Veterinary CRO and CDMO Market Size and Forecast, By Application (2024-2032)

10.1. Zoetis Inc. / Nexvet (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Labcorp Drug Development (USA)

10.3. Charles River Laboratories (USA)

10.4. IDEXX Laboratories Inc. (USA)

10.5. Inotiv Inc. (USA)

10.6. Vetio Animal Health (USA)

10.7. Pharmaceutical Product Development, LLC - PPD (USA)

10.8. Syneos Health Inc. (USA)

10.9. ICON plc (Ireland / USA operations)

10.10. Medpace (USA)

10.11. Envigo (USA)

10.12. VetPharm, Inc. (USA)

10.13. MPI Research (USA)

10.14. KLIFOVET GmbH (Germany)

10.15. Knoell – Triveritas (Germany)

10.16. VETSPIN Srl (Italy)

10.17. Veterinary Research Management – VRM Ltd. (United Kingdom)

10.18. Cebiphar (France)

10.19. Ondax Scientific UK Ltd. (United Kingdom)

10.20. Ridgeway Research Ltd. (United Kingdom)

10.21. Drayton Animal Health Ltd. (United Kingdom)

10.22. Arcoblu S.r.l. (Italy)

10.23. WuXi AppTec (China)

10.24. Sai Life Sciences Ltd. (India)

10.25. Elanco India Private Limited (India)

10.26. Dawa Life Sciences (Kenya)

10.27. Botswana Vaccine Institute – BVI (Botswana)

10.28. Julphar – Gulf Pharmaceutical Industries (United Arab Emirates)

10.29. Eurofarma Laboratórios S.A. (Brazil)

10.30. Ourofino Saúde Animal (Brazil)

11. Key Findings

12. Analyst Recommendations

13. Veterinary CRO and CDMO Market: Research Methodology