Radiotherapy Market: Trends, Growth Drivers and Future Opportunities

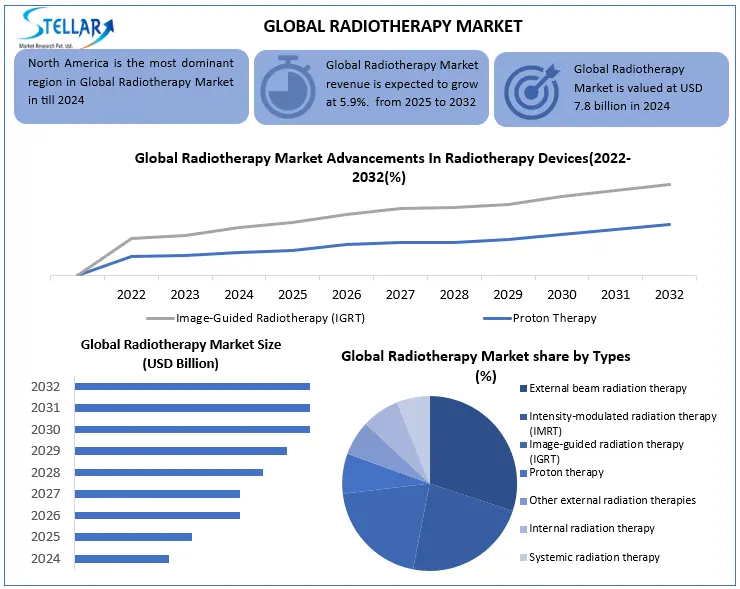

The Radiotherapy Market was expected to grow from USD 7.8 billion in 2024 to USD 12.34 billion in 2032, at a CAGR of 5.9% during the forecast period.

Format : PDF | Report ID : SMR_2834

Global Radiotherapy Market Overview:

Radiotherapy is one of the most popular types of cancer treatments, also referred to as radiation therapy, a therapy that comprises high-energy beams, such as X-rays, to destroy cancer cells and reduce tumors. It may be applied alone or in combination with other methods such as surgery or chemotherapy,

The rising developments in radiotherapy equipment are expected to drive their use throughout radiotherapy facilities, thus helping the market growth. Radiotherapy employs two popular technologies, including proton therapy alongside image-guided radiotherapy (IGRT). This supports market expansion over the forecast period. Integration of imaging techniques like computed tomography (CT), positron emission tomography (PET), and involvement of advanced dose calculation algorithms and delivery techniques have increased tumor dose distribution and decreased normal tissue toxicity.

There are two main types commonly used in the market is external beam radiation therapy (EBRT) and internal radiation therapy (brachytherapy). The radiotherapy centres & segments are estimated to grow significantly in the radiation therapy market during the forecast period. Advanced radiation equipment is being quickly adopted by the cancer clinic segment to deliver cutting-edge and efficient patient treatment.

North America dominated the radiation therapy market in 2024. This domination may be ascribed to a variety of things, including the region's high rate of cancer patients receiving radiation treatments, growing research, the existence of reputable medical institutions, advantageous reimbursement practices, and the industry's stronghold.

The market is growing because of the growing patient population's need for easier access to effective cancer treatments like radiation. The radiation therapy market is expanding as a result of continuous improvements in radiation therapy techniques and apparatus. . Radiation therapy has improved the quality of life for cancer patients by becoming faster and more precise, which has greatly decreased adverse effects.

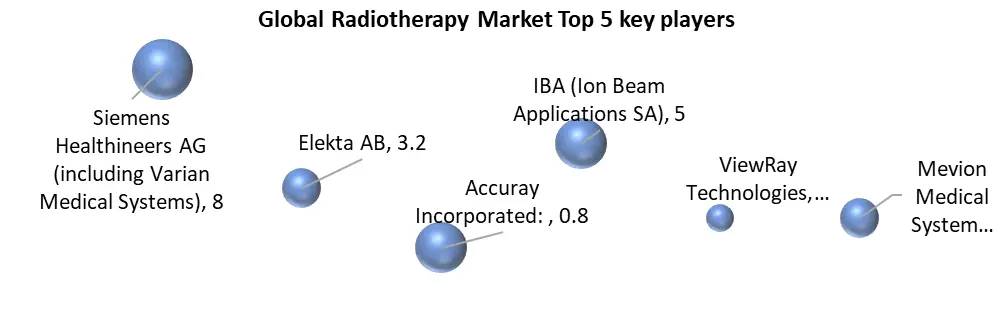

The top 5 key players of the radiotherapy market account for approximately 80.5% of the market share, which includes companies such as Varian Medical Systems, Elekta, Curium, Accuray, and IBA Radiopharma Solutions. A crucial aspect of market strategy involves the frequent introduction of innovations such as proton therapy, intensity-modulated radiation therapy (IMRT), image-guided radiotherapy (IGRT), among others. Moreover, key industry players command considerable influence in this dynamic landscape, often propelling forward advancements through substantial investments in research and development.

To get more Insights: Request Free Sample Report

Global Radiotherapy Market Dynamics:

Concentrating on the discovery and development of drugs helps to drive the Radiotherapy Market

Nowadays, particle therapy, particularly proton therapy, presents numerous benefits compared to traditional photon therapy. The global count of particle therapy centres is consistently rising. These advantages are fuelling the need for particle therapy, particularly in developed areas where the uptake of high-tech products is significant.

The complexity of radiotherapy has resulted in the restraint of the Radiotherapy Market.

Radiotherapy is a complex process that involves understanding the principles of medical physics, dosimetry, radiotherapy planning, radiobiology, delivery, and interaction of radiation therapy with other treatment modalities, and radiation safety. For instance, the introduction of high-precision IMRT has made cancer treatment complex owing to the need for implementation of additional technologies, such as computer software and imaging modalities; multidimensional QA programs for all new software; and various training and educational requirements for radiation oncologists, physicists, and radiation therapists. The development of advanced radiotherapy technologies has, in turn, resulted in an increased complexity of operations.

Positive shifts in the US radiotherapy reimbursement system to boost the opportunities in the Radiotherapy Market

The field of radiation oncology(the study and treatment of tumours)is likely to witness tremendous growth as a result of payers' payment model changes, quick technological developments, and changing strategies in cancer care. For example, the CMS created the advanced Radiation Oncology (RO) payment model, which is applicable for cancer patients receiving radiotherapy. Transitions from fee-for-service systems to value-based payment systems have led government and private payers to look for alternative ways of reimbursing radiotherapy services, focusing on cost-effectiveness and high quality.

Global Radiotherapy Market Segments Analysis:

Based on type, the Radiotherapy Market is segmented into External beam radiation, Intensity-modulated radiation therapy (IMRT), Image-guided radiation therapy (IGRT), Proton therapy, Other external radiation therapies, Internal radiation therapy, and Systemic radiation therapy. The external beam radiotherapy segment dominated the Radiotherapy Market in 2024. The most popular type of radiation oncology treatment is external beam radiation therapy (EBRT). Radiation therapy is given to around one-third of cancer patients. High-dose radiation is used to shrink tumors or kill malignant cells. External beam radiation treatment (EBRT) is used by medical experts to treat a variety of cancers. In addition, it is used to treat many non-cancerous tumors and other ailments.

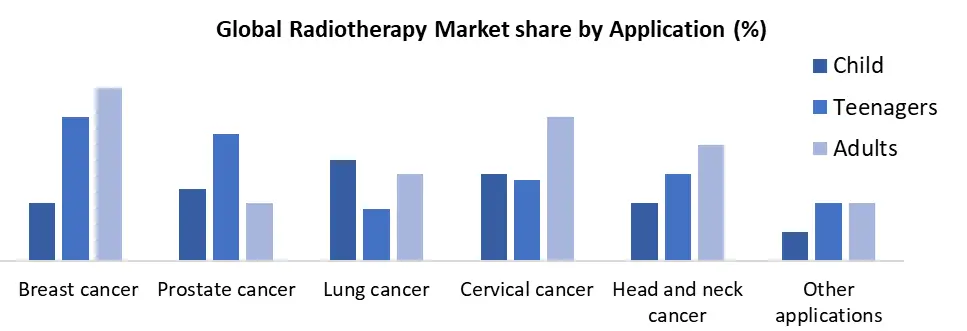

Based on application, the Radiotherapy Market is segmented into Lung cancer, Prostate cancer, Breast cancer, Cervical cancer, Head and neck cancer, and Other applications. The breast cancer segment captured the dominant share of the Radiotherapy Market in 2024. The radiotherapy market across the world is greatly influenced by the incidence of breast cancer, which is most commonly diagnosed in women worldwide, as well as within the United States. With the predictions indicating that there will be approximately 317,000 new cases of breast cancer in women in America alone in 2025, and with a diagnosis occurring every two minutes, the demand for efficient methods of treatment like radiotherapy is high. Even the projected 2,800 breast cancer cases expected among US men in 2025 is part of the necessity for this.

Based on End User: Radiotherapy Market segmented into Hospital and radiotherapy centres Additionally, hospitals collaborate with the manufactures to develop technological advanced radiotherapy system, Also, hospital is a one stop destination for various cancer therapies such as the chemotherapy, immunotherapy, surgeries such as tumor resection making this healthcare setting as one of the most preferred options for the treatment of cancer among the patients.

Global Radiotherapy Market Regional Analysis:

The rising cases of cancers have resulted the North America dominating into Radiotherapy Market

The North American radiotherapy market continues to expand rapidly because cancer cases are rising throughout the United States. The American Cancer Society expects 2 Billion new cancer diagnoses alongside 618,000 cancer-related deaths will occur in the U.S. during 2025. The rising cancer rates will propel market expansion for radiotherapy equipment because it demands advanced treatment options in the United States.

Global Radiotherapy Market Competitor Landscape:

The radiotherapy market is highly competitive globally and regionally. Globally, due to the availability of government support, increased reimbursements, and funds from private and public organizations, the threat of new entrants is high in the studied market. The radiotherapy market consists of a few major players. Canon Medical Systems Corporation, GE Healthcare, Elekta, ViewRay Technologies, Inc., Siemens Healthineers AG, Accuray Incorporated, Isoray Inc., Hitachi, Ltd., and ALCEN (PMB), among others, hold a substantial market share in the radiotherapy market.

|

Global Radiotherapy Market |

|

|

Market Size in 2024 |

USD 7.8 billion |

|

Market Size in 2032 |

USD 12.34 billion |

|

CAGR (2025-2032) |

5.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type External beam radiation therapy Intensity-modulated radiation therapy (IMRT) Image-guided radiation therapy (IGRT) Proton therapy Other external radiation therapies Internal radiation therapy Systemic radiation therapy |

|

By Application Lung cancer Prostate cancer Breast cancer Cervical cancer Head and neck cancer Other applications |

|

|

By End-User industry- Hospitals Radiotherapy centres Ambulatory surgery centres Cancer research institutes |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Taiwan, Philippines, Indonesia, Vietnam, Thailand, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in Global Radiotherapy Market:

North America

- Accuray Incorporated (United States)

- ViewRay Technologies, Inc. (United States)

- Isoray Inc. (United States)

- Mevion Medical Systems (United States)

- RefleXion (United States)

- Varian Medical Systems (United States)

- Nordion (Canada).

Europe

- Siemens Healthineers AG (Germany)

- Elekta AB (Sweden)

- IBA (Ion Beam Applications SA) (Belgium)

- Brainlab (Germany)

- Curium (France)

- PTW Freiburg (Germany)

Asia Pacific

- Hitachi, Ltd. (Japan)

- Canon Medical Systems (Japan)

- Mitsubishi Electric (Japan)

- Toshiba Energy Systems and Solutions (Japan)

- Sumitomo Heavy Industries, Ltd. (Japan)

- HCG Group (India)

- Panacea Medical Technologies Pvt. Ltd (India)

Middle East and Africa

- NTP Radioisotopes (South Africa)

Frequently Asked Questions

Some of the major players in the radiotherapy industry include Siemens Healthineers AG, Brainlab, Curium, Canon Medical Systems, Elekta, Hitachi High-Tech, IBA Radiopharma Solutions, Isoray Inc., and Mevion Medical Systems.

North America is the most dominant region in the Global Radiotherapy Market until 2024

Rashtriya Arogya Nidhi (RAN), The Health Minister’s Cancer Patient Fund (HMCPF) provides financial support of 5 lakh rupees for the patient living below the poverty line and suffering from cancer.

The U.S. radiotherapy industry was valued at USD 7.2 billion in 2023

1. Global Radiotherapy Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Radiotherapy Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user

2.3.4. Revenue (2024)

2.3.5. Revenue Growth

2.3.6. Geographical Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Global Radiotherapy Market: Dynamics

3.1. Global Radiotherapy Market Trends

3.2. Global Radiotherapy Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape

3.6. Technology Roadmap

3.7. Disease Perspective Analysis

4. Global Radiotherapy Market: Global Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

4.1 Global Radiotherapy Market Size and Forecast, by Type (2025-2032)

4.1.1. External beam radiation therapy

4.1.2. Intensity-modulated radiation therapy (IMRT)

4.1.3. Image-guided radiation therapy (IGRT)

4.1.4. Proton therapy

4.1.5. Other external radiation therapies

4.1.6. Internal radiation therapy

4.1.7. Systemic radiation therapy

4.2. Global Radiotherapy Market Size and Forecast, by Application (2025-2032)

4.2.1. Lung cancer

4.2.2. Prostate cancer

4.2.3. Breast cancer

4.2.4. Cervical cancer

4.2.5. Head and neck cancer

4.2.6. Other applications

4.3. Global Radiotherapy Market Size and Forecast, by End-User (2025-2032)

4.3.1. Hospitals

4.3.2. Radiotherapy centres

4.3.3. Ambulatory surgery centres

4.3.4. Cancer research institutes

4.4. Global Radiotherapy Market Size and Forecast, by Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Radiotherapy Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

5.1. North America Radiotherapy Market Size and Forecast, by Type (2025-2032)

5.1.1. External beam radiation therapy

5.1.2. Intensity-modulated radiation therapy (IMRT)

5.1.3. Image-guided radiation therapy (IGRT)

5.1.4. Proton therapy

5.1.5. Other external radiation therapies

5.1.6. Internal radiation therapy

5.1.7. Systemic radiation therapy

5.2. North America Radiotherapy Market Size and Forecast, by Application (2025-2032)

5.2.1. Lung cancer

5.2.2. Prostate cancer

5.2.3. Breast cancer

5.2.4. Cervical cancer

5.2.5. Head and neck cancer

5.2.6. Other applications

5.3. North America Radiotherapy Market Size and Forecast, by End-User (2025-2032)

5.3.1. Hospitals

5.3.2. Radiotherapy centres

5.3.3. Ambulatory surgery centres

5.3.4. Cancer research institutes

5.4. North America Radiotherapy Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Radiotherapy Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

6.1. Europe Radiotherapy Market Size and Forecast, by Type (2025-2032)

6.2. Europe Radiotherapy Market Size and Forecast, by Application (2025-2032)

6.3. Europe Radiotherapy Market Size and Forecast, by End-User (2025-2032)

6.4. Europe Radiotherapy Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Radiotherapy Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

7.1. Asia Pacific Radiotherapy Market Size and Forecast, by Type (2025-2032)

7.2. Asia Pacific Radiotherapy Market Size and Forecast, by Application (2025-2032)

7.3. Asia PacificRadiotherapy Market Size and Forecast, by End-User (2025-2032)

7.4. Asia Pacific Radiotherapy Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Radiotherapy Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

8.1. Middle East and Africa Radiotherapy Market Size and Forecast, by Type (2025-2032)

8.2. Middle East and Africa Radiotherapy Market Size and Forecast, by Application (2025-2032)

8.3. Middle East and Africa Radiotherapy Market Size and Forecast, by End-User (2025-2032)

8.4. Middle East and AfricaRadiotherapy Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Egypt

8.4.4. Nigeria

8.4.5. Rest of ME&A

9. South America Radiotherapy Market Size and Forecast by Segmentation (by Value USD Billion) (2025-2032)

9.1. South America Radiotherapy Market Size and Forecast, by Type (2025-2032)

9.2. South America Radiotherapy Market Size and Forecast, by Application (2025-2032)

9.3. South America Radiotherapy Market Size and Forecast, by End-User (2025-2032)

9.4. South America Radiotherapy Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Chile

9.4.4. Colombia

9.4.5. Rest Of South America

10. Company Profile: Key Players

10.1. Siemens Healthineers AG

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Sumitomo Heavy Industries, Ltd.

10.3. Elekta AB

10.4. Accuray Incorporated

10.5. IBA (Ion Beam Applications SA)

10.6. Hitachi, Ltd

10.7. ViewRay Technologies, Inc.

10.8. Brainlab

10.9. Curium

10.10. Canon Medical Systems

10.11. Isoray Inc.

10.12. Mevion Medical Systems

10.13. Mitsubishi Electric

10.14. Nordion

10.15. NTP Radioisotopes

10.16. RefleXion

10.17. Toshiba Energy Systems and Solutions

10.18. Varian Medical Systems

10.19. HCG Group

10.20. Panacea Medical Technologies Pvt. Ltd

10.21. PTW Freiburg

11. Key Findings

12. Industry Recommendations

13. Radiotherapy Market: Research Methodology