Ozempic Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Ozempic Market was valued at USD 8.47 billion in 2024 and is forecast to reach USD 15.91 Billion by 2032, growing at 8.2% CAGR

Format : PDF | Report ID : SMR_2744

Ozempic Market Overview:

The Ozempic (semaglutide) market remarkable expansion is fueled by Ozempic dual approval for type 2 diabetes management and more recently, chronic weight management, positioning it as blockbuster therapy in GLP-1 receptor agonist class. Novo Nordisk's flagship product now commands 62% of anti-diabetic injectables market while its off-label use for obesity accounts for 38% of total prescriptions (CDC, 2024), despite ongoing regulatory scrutiny of this application.

The Ozempic market is being reshaped by a several critical factors. The global diabetes epidemic continues to escalate, with 537 million adults currently affected worldwide (WHO, 2024), creating sustained demand for effective glucose-lowering therapies. The obesity crisis has reached alarming proportions, particularly in developed markets where 42% of U.S. adults now meet clinical criteria for obesity (NIH, 2024), driving unprecedented off-label use. Ozempic clinical superiority has been demonstrated in the SUSTAIN trial series, showing 1.5% greater HbA1c reduction compared to competitors and 15% average body weight loss in obesity studies (NEJM, 2023). These therapeutic advantages, combined with its convenient once-weekly dosing regimen, have made Ozempic preferred choice for both patients and providers.

The characteristics of both market opportunities and challenges operate within a complex regulatory environment. While the FDA is strictly monitored by off-label marketing, recent approval for Wegovy (higher-dose semaglutide) has created formal routes for the treatment of obesity. Although the lack of global supply remains due to manufacturing obstacles, the FDA has maintained Ozempic in its drug shortage list through 2025. The competitive landscape is intense, with Elli Lily's Mounjaro (tirzepatide) occupying more market share in 2024. Meanwhile, the end of the patent starting in 2026 in the major markets is expected to catalyze the biosimilars competition, potentially reducing prices to 30–40% in later years.

To get more Insights: Request Free Sample Report

Ozempic Market Dynamics:

Increasing Prevalence of Diabetes Driving the Ozempic Market

The Ozempic market is witnessing substantial growth, Driven Primarily by the Increase in Population suffering from Diabetes, Especially Type 2 Diabetes. It has become more prevalent because the population is beginning to embrace a sedentary lifestyle in association with unhealthy eating habits. More and more people are being diagnosed with this condition, and managing it has become the need of the hour due to its complications and record. As a GLP-1 Receptor Agonist, Ozempic has been Beneficial in Blood Sugar Control for Patients and in the Mitigation of Loose Diabetic Complications.

The demand for pharmaceutical alternatives is growing hand in hand with the increased diabetic populace, which enriches the Ozempic Market as more patients are seeking the medication. There is indeed an increase in the concern towards diabetes management, making effective treatment measures more sought after. This increase in need is multi-faceted and stems from the health campaigns and education on diabetes and the possible consequences if left ignored. In addition, the greater awareness on effective treatment of diabetes for prevention of long-lasting repercussions is shifting patients towards therapeutic intervention with Ozempic.

Ozempic is expected to have growing marketing initiatives and programs that would endeavour to enhance diabetes management. It is expected that for years to come, demand for Ozempic, as well as for other patients' needs, will escalate due to increased focus of health care systems on diabetes management as a result of strong growth potential.

Technological Advancements in Drug Delivery Systems Providing Opportunities to the Ozempic Market

Progress in drug delivery systems, such as enhanced pen devices and injectable formulations, has had an adequate impact on the Ozempic market industry. These innovations not only improve the patient's adherence but also result in better drug program management. Since patients become more comfortable with advanced distribution techniques, the possibility of consistent and accurate dosage increases. Additionally, integration with digital health technologies, such as monitoring apps associated with these devices, promotes the patient's engagement and supports better health results.

The demand for Ozempic, leading to efficacy and patient satisfaction with increased drug distribution systems, is expected to increase continuously as this progress becomes an integral part of diabetes management.

Uncertainty Over Long-Term Health Impacts Poses Challenge to Ozempic Market Growth

The health impacts of Ozempic beyond a few years are still under investigation, with no definitive results yet published. The first clinical trial studying the effects of semaglutides on obesity was in 2021, and no studies have yet been published on the effects of semaglutides on mental health or cosmetic weight loss. When patients stop taking Ozempic, evidence suggests that two-thirds of the weight lost is regained within one year. Ongoing treatment is suggested, but no one seems certain how long is too long. In the United Kingdom, Ozempic is only recommended for a maximum of 2 years “as an adjunct to a reduced calorie diet and increased physical activity.” The National Institute for Health and Care Excellence (NICE) claims this combination is the most sustainable long-term. Furthermore, long-term use of the drug extends the potential for adverse side effects that are already present in short-term use, such as gallstones, kidney disease, loss of appetite, and thyroid complications. Given this uncertainty, continuing to glorify Ozempic in the United States as a quick and easy weight loss solution is not ideal.

Ozempic Market Segmentation

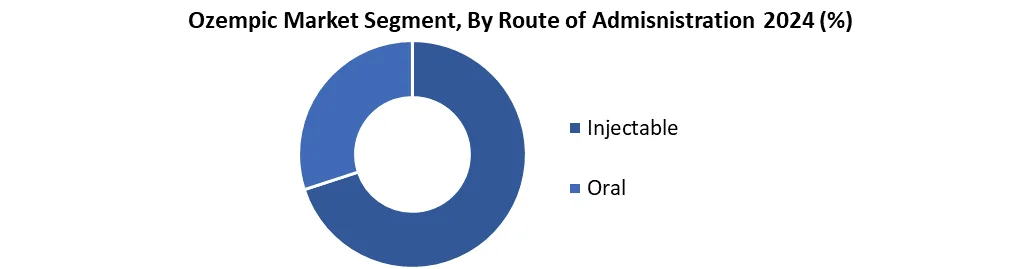

Based on Route of Administration, the Ozempic Market is segment is primarily categorized into Injectable and Oral methods, with injectables holding a significant share due to their effectiveness and faster action in managing blood sugar levels. Injectable forms dominate Ozempic market as they allow for a accurate doses and can be administered less frequently, which fulfills the patient's preferences.

In contrast, the oral route is becoming increasingly important as it provides the benefits of convenience and adherence. Various distribution methods reflect market growth, developing the needs and preferences of the patient, highlighting the need for continuous innovation in drug manufacturing. Overall, route of administration plays an important role in the Ozempic market segmentation, which affects market dynamics and consumer options. In order to customize its strategies in this competitive scenario, it is necessary to understand the importance of both injected and oral forms for stakeholders

Based on the Distribution channel, the revenue of the Ozempic market is greatly affected by its distribution channels, which reveals a strong demand in various segments. Among these channels, hospital pharmacies have played an important role with the ability to provide immediate access to Ozempics for inpatients and outpatients. Retail also dominates this market in pharmacies, providing convenience and access to the consumers, which promotes patient compliance and use of the ongoing drugs. The rise of online pharmacies is re-shaping landscape, which shows growing trend towards e-commerce in healthcare, especially among technology-savvy consumers.

These channels collectively increase overall Ozempic Market division, increase efficient distribution, increase market access, and improve patient access, which are important factors for market development. Ozempic market statistics show how the patient's preferences and technological progress are shaping the distribution structure, developing mobility in the industry that equally benefits both providers and consumers.

Ozempic Market Regional Analysis

North America: In 2024, the global Ozempic market was dominated by North America, mainly due to the clinical requirement and its correct storm of commercial infrastructure. The area stems from its double epidemic 37 million diabetic patients (CDC) and 42% obesity rate (NIH) creating the unprecedented amount of prescription, 85% of Medicare/Medicaid for diabetes removes comprehensive insurance coverage, financial obstacles, including reimbursement and increasing employer-proposed weight loss programs. The dense network of treatment centres of the American healthcare system has accelerated the treatment of obesity, while regulatory flexibility allows rapid patient onboarding compared to Europe's cost-control environment. This combination of urgency, financial access and clinical infrastructure of epidemiology strengthens the market leadership of North America, almost triple of other developed markets with prescription rates. Novo Nordisk's strategic focus on the U.S., evidenced by USD 1.2 billion in annual promotional spending, continues to reinforce this dominance as off-label use grows despite FDA cautions.

Ozempic Market Competitive Landscape:

Novo Nordisk: Market Leader

- Novo Nordisk, the maker of Ozempic, is the undisputed leader in the GLP-1 market, not just for Ozempic but for its entire diabetes care portfolio. Novo Nordisk's other leading drugs include Victoza (liraglutide) and Rybelsus (oral semaglutide). The company has built a reputation for leadership in the diabetes and obesity treatment markets through consistent innovation, strong clinical trials, and global distribution networks.

Strategic focus: Novo Nordisk has focused on expanding the global access to Ozempic, keeping it in a position as a gold standard for type 2 diabetes and weight management. Their marketing strategy includes direct-to-consumer campaign, strong relationship with healthcare providers and patient education on the benefits of GLP-1 therapy.

- Ellie Lilly: Eli Lilly's Trulicity (dulaglutide)is one of the top contestants of Ozempic. The company has a strong pipeline in GLP-1 space and is competing with Ozempic in both diabetes and obesity signs. Ellie Lily's important R&D investment keeps it well in terms of upcoming treatments and innovations.

- Sanofi: Lyxumia and other experimental GLP-1 treatments from Sanofi are positioning the company as a secondary player in the market. Sanofi’s strategy focuses on complementary therapies, combining GLP-1 agonists with other treatment types like insulin.

Recent Developments:

- In October 2024, Malan finalized an agreement with Novo Nordisk to resolve a legal dispute over drug patent in the United States. As part of the disposal, Natco Pharma -based in Natco Pharma obtained special rights to present a general option for semaglutide, positioning them as the first companies, which was authorized to bring a low -cost version to the US market. This step is expected to expand access to diabetes and weight management treatment while increasing competition in the drug field.

- In September 2023, Novo Nordisk informed Australia’s Therapeutic Goods Administration and Ozempic Medicine Shortage Action Group that supply constraints would persist into 2024. The company attributed shortage to soaring demand, particularly for lower-dose formulations, as off-label prescriptions surged beyond its approved indications.

|

Ozempic Market Scope |

|

|

Market Size in 2024 |

USD 8.47 Bn. |

|

Market Size in 2032 |

USD 15.91 Bn. |

|

CAGR (2025-2032) |

8.2% |

|

Historic Data |

2018-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Indication Type 2 Diabetes Weight Management Cardiovascular Risk Reduction |

|

By Route of Administration Injectable Oral |

|

|

By Distribution Channel Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

|

By Patient Demographics Adults Elderly Paediatric |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Vietnam, Thailand, Philippines, Rest of Asia-Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Ozempic Market Key Players:

North America

- Novo Nordisk Inc. (USA)

- Eli Lilly and Company (USA)

- Catalent, Inc. (USA)

- Pfizer Inc. (USA)

- Amgen Inc. (USA)

- AbbVie Inc. (USA)

- Johnson & Johnson (USA)

- Intarcia Therapeutics Inc. (USA)

- Adocia SA (USA)

- Structure Therapeutics (USA)

Europe

- AstraZeneca plc (UK)

- Sanofi S.A. (France)

- Roche Holding AG (Switzerland)

- Novartis International AG (Switzerland)

- GlaxoSmithKline plc (UK)

Asia-Pacific

- Biocon Limited (India)

- Shilpa Medicare Ltd. (India)

- Apicore Pharmaceuticals Pvt Ltd (India)

- Dr.Reddy's Laboratories Ltd. (India)

- Hanmi Pharmaceutical Co., Ltd. (South Korea)

- Apino Pharma Co., Ltd. (China)

- S D Fine Chem Limited (India)

- Takeda Pharmaceutical Company Limited (Japan)

Middle East & Africa

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla Limited (South Africa)

South America

- Eurofarma Laboratory S.A. (Brazil)

- EMS Pharma (Brazil)

- Laboratory Teuto Brasileiro S.A. (Brazil)

Frequently Asked Questions

The demand is rising due to the growing global prevalence of type 2 diabetes and obesity, especially in developed countries.

The growth rate of the Ozempic market is 8.2% CAGR.

North America is the dominating region in the Ozempic Market, due to the clinical requirement and its correct storm of commercial infrastructure.

Global supply shortages due to high demand, Regulatory restrictions on promoting off-label use, Emerging competition, are some of the challenges of Ozempic Market.

1. Ozempic Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Ozempic Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Ozempic Market: Dynamics

3.1. Ozempic Market Trends

3.2. Ozempic Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Ozempic Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Ozempic Market Size and Forecast, By Indication (2024-2032)

4.1.1. Type 2 Diabetes

4.1.2. Weight Management

4.1.3. Cardiovascular Risk Reduction

4.2. Ozempic Market Size and Forecast, By Route of Administration 2024-2032)

4.2.1. Injectable

4.2.2. Oral

4.3. Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

4.4.1. Adults

4.4.2. Elderly

4.4.3. Paediatric

4.5. Ozempic Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Ozempic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Ozempic Market Size and Forecast, By Indication (2024-2032)

5.1.1. Type 2 Diabetes

5.1.2. Weight Management

5.1.3. Cardiovascular Risk Reduction

5.2. North America Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

5.2.1. Injectable

5.2.2. Oral

5.3. North America Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Hospital Pharmacies

5.3.2. Retail Pharmacies

5.3.3. Online Pharmacies

5.4. North America Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

5.4.1. Adults

5.4.2. Elderly

5.4.3. Paediatric

5.5. North America Ozempic Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Ozempic Market Size and Forecast, By Indication (2024-2032)

5.5.1.1.1. Type 2 Diabetes

5.5.1.1.2. Weight Management

5.5.1.1.3. Cardiovascular Risk Reduction

5.5.1.2. United States Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

5.5.1.2.1. Injectable

5.5.1.2.2. Oral

5.5.1.3. United States Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.1.3.1. Hospital Pharmacies

5.5.1.3.2. Retail Pharmacies

5.5.1.3.3. Online Pharmacies

5.5.1.4. United States Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

5.5.1.4.1. Adults

5.5.1.4.2. Elderly

5.5.1.4.3. Paediatric

5.5.2. Canada

5.5.2.1. Canada Ozempic Market Size and Forecast, By Indication (2024-2032)

5.5.2.1.1. Type 2 Diabetes

5.5.2.1.2. Weight Management

5.5.2.1.3. Cardiovascular Risk Reduction

5.5.2.2. Canada Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

5.5.2.2.1. Injectable

5.5.2.2.2. Oral

5.5.2.3. Canada Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.2.3.1. Hospital Pharmacies

5.5.2.3.2. Retail Pharmacies

5.5.2.3.3. Online Pharmacies

5.5.2.4. Canada Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

5.5.2.4.1. Adults

5.5.2.4.2. Elderly

5.5.2.4.3. Paediatric

5.5.3. Mexico

5.5.3.1. Mexico Ozempic Market Size and Forecast, By Indication (2024-2032)

5.5.3.1.1. Type 2 Diabetes

5.5.3.1.2. Weight Management

5.5.3.1.3. Cardiovascular Risk Reduction

5.5.3.2. Mexico Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

5.5.3.2.1. Injectable

5.5.3.2.2. Oral

5.5.3.3. Mexico Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.3.3.1. Hospital Pharmacies

5.5.3.3.2. Retail Pharmacies

5.5.3.3.3. Online Pharmacies

5.5.3.4. Mexico Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

5.5.3.4.1. Adults

5.5.3.4.2. Elderly

5.5.3.4.3. Paediatric

6. Europe Ozempic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Ozempic Market Size and Forecast, By Indication (2024-2032)

6.2. Europe Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.3. Europe Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5. Europe Ozempic Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.1.2. United Kingdom Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.1.3. United Kingdom Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.1.4. United Kingdom Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.2. France

6.5.2.1. France Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.2.2. France Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.2.3. France Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.2.4. France Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.3.2. Germany Ozempic Market Size and Forecast, By Route of Administration 2024-2032)

6.5.3.3. Germany Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.3.4. Germany Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.4.2. Italy Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.4.3. Italy Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.4.4. Italy Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.5.2. Spain Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.5.3. Spain Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.5.4. Spain Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.6.2. Sweden Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.6.3. Sweden Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.6.4. Sweden Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.7.2. Russia Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.7.3. Russia Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

6.5.7.4. Russia Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Ozempic Market Size and Forecast, By Indication (2024-2032)

6.5.8.2. Rest of Europe Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

6.5.8.3. Rest of Europe Ozempic Market Size and Forecast By Distribution Channel (2024-2032)

6.5.8.4. Rest of Europe Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7. Asia Pacific Ozempic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Ozempic Market Size and Forecast, By Indication (2024-2032)

7.2. Asia Pacific Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.3. Asia Pacific Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5. Asia Pacific Ozempic Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.1.2. China Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.1.3. China Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.1.4. China Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.2.2. S Korea Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.2.3. S Korea Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.2.4. S Korea Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.3.2. Japan Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.3.3. Japan Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.3.4. Japan Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.4. India

7.5.4.1. India Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.4.2. India Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.4.3. India Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.4.4. India Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.5.2. Australia Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.5.3. Australia Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.5.4. Australia Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.6.2. Indonesia Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.6.3. Indonesia Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.6.4. Indonesia Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.7.2. Malaysia Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.7.3. Malaysia Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.7.4. Malaysia Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.8.2. Philippines Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.8.3. Philippines Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.8.4. Philippines Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.9.2. Thailand Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.9.3. Thailand Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.9.4. Thailand Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.10.2. Vietnam Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.10.3. Vietnam Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.10.4. Vietnam Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Ozempic Market Size and Forecast, By Indication (2024-2032)

7.5.11.2. Rest of Asia Pacific Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

7.5.11.3. Rest of Asia Pacific Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

7.5.11.4. Rest of Asia Pacific Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8. Middle East and Africa Ozempic Market Size and Forecast (by Value in USD Million) (2024-2032

8.1. Middle East and Africa Ozempic Market Size and Forecast, By Indication (2024-2032)

8.2. Middle East and Africa Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.3. Middle East and Africa Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8.5. Middle East and Africa Ozempic Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Ozempic Market Size and Forecast, By Indication (2024-2032)

8.5.1.2. South Africa Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.5.1.3. South Africa Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.1.4. South Africa Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Ozempic Market Size and Forecast, By Indication (2024-2032)

8.5.2.2. GCC Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.5.2.3. GCC Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.2.4. GCC Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Ozempic Market Size and Forecast, By Indication (2024-2032)

8.5.3.2. Egypt Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.5.3.3. Egypt Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.3.4. Egypt Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Ozempic Market Size and Forecast, By Indication (2024-2032)

8.5.4.2. Nigeria Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.5.4.3. Nigeria Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.4.4. Nigeria Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Ozempic Market Size and Forecast, By Indication (2024-2032)

8.5.5.2. Rest of ME&A Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

8.5.5.3. Rest of ME&A Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

8.5.5.4. Rest of ME&A Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9. South America Ozempic Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032

9.1. South America Ozempic Market Size and Forecast, By Indication (2024-2032)

9.2. South America Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.3. South America Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9.5. South America Ozempic Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Ozempic Market Size and Forecast, By Indication (2024-2032)

9.5.1.2. Brazil Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.5.1.3. Brazil Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.1.4. Brazil Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Ozempic Market Size and Forecast, By Indication (2024-2032)

9.5.2.2. Argentina Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.5.2.3. Argentina Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.2.4. Argentina Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Ozempic Market Size and Forecast, By Indication (2024-2032)

9.5.3.2. Colombia Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.5.3.3. Colombia Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.3.4. Colombia Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Ozempic Market Size and Forecast, By Indication (2024-2032)

9.5.4.2. Chile Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.5.4.3. Chile Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.4.4. Chile Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

9.5.5. Rest of South America

9.5.5.1. Rest of South America Ozempic Market Size and Forecast, By Indication (2024-2032)

9.5.5.2. Rest of South America Ozempic Market Size and Forecast, By Route of Administration (2024-2032)

9.5.5.3. Rest of South America Ozempic Market Size and Forecast, By Distribution Channel (2024-2032)

9.5.5.4. Rest of South America Ozempic Market Size and Forecast, By Patient Demographics (2024-2032)

10. Company Profile: Key Players

10.1. Novo Nordisk Inc. (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Eli Lilly and Company (USA)

10.3. Catalent, Inc. (USA)

10.4. Pfizer Inc. (USA)

10.5. Amgen Inc. (USA)

10.6. AbbVie Inc. (USA)

10.7. Johnson & Johnson (USA)

10.8. Intarcia Therapeutics Inc. (USA)

10.9. Adocia SA (USA)

10.10. Structure Therapeutics (USA)

10.11. AstraZeneca plc (UK)

10.12. Sanofi S.A. (France)

10.13. Roche Holding AG (Switzerland)

10.14. Novartis International AG (Switzerland)

10.15. GlaxoSmithKline plc (UK)

10.16. Biocon Limited (India)

10.17. Shilpa Medicare Ltd. (India)

10.18. Apicore Pharmaceuticals Pvt Ltd (India)

10.19. Dr.Reddy’s Laboratories Ltd. (India)

10.20. Hanmi Pharmaceutical Co., Ltd. (South Korea)

10.21. Apino Pharma Co., Ltd. (China)

10.22. S D Fine Chem Limited (India)

10.23. Takeda Pharmaceutical Company Limited (Japan)

10.24. Teva Pharmaceutical Industries Ltd. (Israel)

10.25. Cipla Limited (South Africa)

10.26. Eurofarma Laboratorios S.A. (Brazil)

10.27. EMS Pharma (Brazil)

10.28. Laboratorio Teuto Brasileiro S.A. (Brazil)

11. Key Findings

12. Industry Recommendations

13. Ozempic Market: Research Methodology