Non-Thermal Pasteurization Market: Global Industry Analysis and Forecast (2025-2032)

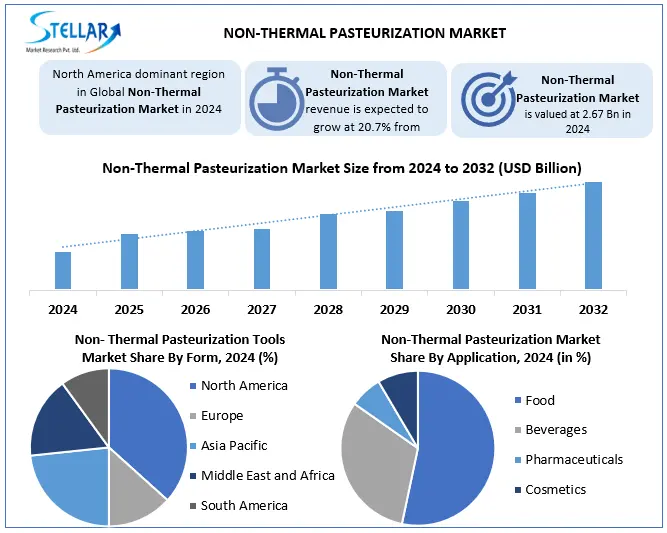

The Non-Thermal Pasteurization Market size was valued at USD 2.67 Bn in 2024. The total Non-Thermal Pasteurization Market revenue is expected to grow by 20.7% from 2024 to 2032, reaching nearly USD 12.03 Bn.

Format : PDF | Report ID : SMR_2818

Non-Thermal Pasteurization Market Overview

Non-thermal pasteurization means the food processing techniques that inactivate microorganisms and enzymes without using high temperatures, in contrast to traditional thermal pasteurization. This technique helps to preserve the flavour, colour, texture, and nutritional value of food and reduce heat-induced damage in food.

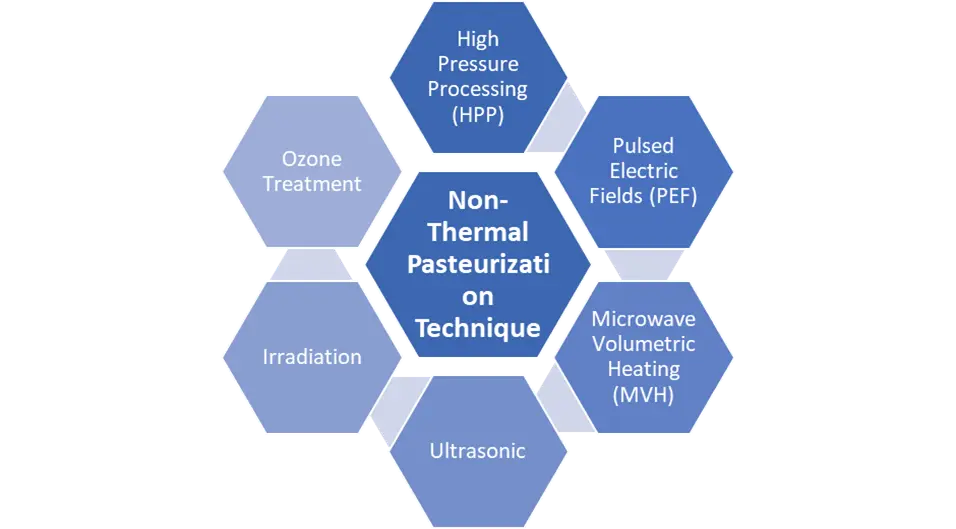

Non-thermal pasteurization methods would conserve food without heat, applying several techniques such as high-pressure processing or HPP, pulsed electric fields which may be PEF, ultraviolet irradiation, and ozone treatments among others to keep quality intact while prolonging shelf life. The high-pressure processing is regarded as cold pasteurization since it applies ultra-high pressure for deactivation of bacteria retaining freshness along with the real taste and nutritional value of food. JBT Corporation based in the US is one of the major key players in this non-thermal pasteurization activity well recognized for its HPP solution. JBT Corporation based in the US is one of the participants in this non-thermal pasteurization activity well recognized for its HPP solution.

The North America region is the dominant market for non-thermal pasteurization. This dominance is attributed to a well-established food processing industry, particularly in the United States, and the increasing adoption of non-thermal pasteurization equipment. Consumers are increasingly drawn to fresh-tasting, additive-free, and health-oriented food products, aligning well with the benefits of non-thermal pasteurization. Non-thermal pasteurization technologies are widely used across various applications, including beverages (particularly cold-pressed juices and dairy alternatives), meat products, ready-to-eat meals, and plant-based foods.

To get more Insights: Request Free Sample Report

Non-Thermal Pasteurization Market Dynamics

Consumers are seeking minimum processed and healthy foods. Quality preservation and shelf life maintenance are leading factors in the demand for non-thermal pasteurization technologies to become safe. The transformation of the non-thermal pasteurization market is due to change in consumer preference, innovation, technology, regulation development, and environmental issues. More methods of food preservation fall under non-thermal pasteurization. These technologies are now gaining more acceptance as effective alternatives to the traditional thermal methods of pasteurization but with added value to quality products, retention of nutrients, and sensory attributes that most modern consumers strive for.

High capital equipment costs such as HPP and PEF systems may most probably be the reasons for small and medium enterprises not to get involved. There is a learning curve that comes with the needs of these technologies, having to also need specialized food microbiology engineering, and packaging compatibility. The growth trajectory of the market for non-thermal pasteurization is very optimistic because consumer demand reinforces it with an immediate desire for fresher, safer, and cleaner food products. Regulatory endorsement together with sustainability goals and continuous scientific research contributes significantly to reinforcing its value proposition in almost all food and beverage segments. While cost and scalability are barriers presently, greater familiarity in the industry will translate technologically into much wider adoption in further coming years.

As Compared to traditional Method of thermal pasteurization, non-thermal methods often consume less energy and water, produce fewer emissions, and reduce waste. For example, HPP systems reuse water within their chambers for multiple cycles, while PEF and UV systems typically require less energy input than heat-based pasteurizers. As food manufacturers prioritize sustainability and seek to meet corporate social responsibility goals, non-thermal pasteurization technologies align well with these objectives.

Technological Advancement in Non-Thermal Pasteurization Market

The market for non-thermal pasteurization has seen tremendous technological growth due to consumer demand for safe, nutrient-dense, minimally processed food products. Non-thermal pasteurization technologies, in contrast to conventional thermal methods, are designed to prolong shelf life and inactivate pathogens without sacrificing nutritional or sensory quality. With recent advancements concentrating on automation, higher throughput systems, and integration with IoT for real-time monitoring, High Pressure Processing (HPP) is one of the most established technologies. Since continuous-flow systems and better electrode designs were introduced, pulsed electric field (PEF) technology has developed, becoming more energy-efficient and appropriate for large-scale uses in the dairy and juice industries.

The use of ultraviolet (UV) irradiation, particularly UV-C LED technology, for surface decontamination and liquid food sterilization has increased due to advancements in energy efficiency, safety, and uniform light distribution. A more recent entrant, cold plasma has drawn interest for its portable and modular systems that allow for efficient surface treatment of fruits, vegetables, and packaging materials. Reactive species can now be better controlled thanks to technological advancements, which lowers the possibility of detrimental effects on food quality. Hybrid systems like thermosonication and manosonication, which combine ultrasound with low pressure or heat to enhance microbial inactivation while maintaining food texture and flavour, are examples of how ultrasound or sonication technology has advanced.

With closed-loop designs that improve safety and lessen environmental concerns, ozone treatment systems have also advanced in sophistication. Better process control and quality assurance are also made possible by the growing integration of non-thermal pasteurization technologies with smart manufacturing techniques like artificial intelligence, machine learning, and predictive analytics. These developments are supporting clean-label and sustainability trends in addition to increasing the scalability and operational efficiency of non-thermal pasteurization. The market is anticipated to grow in a number of industries, including dairy, meat, beverages, and ready-to-eat foods, as long as regulatory bodies continue to support these technologies.

Non-Thermal Pasteurization Market Segment Analysis

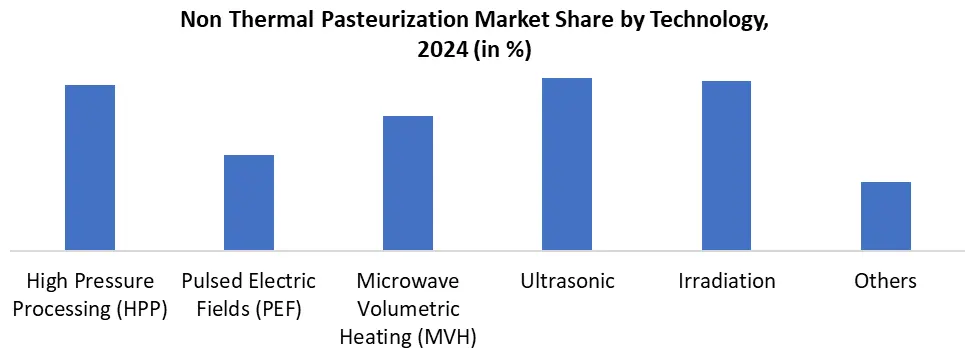

Based on Technique, The non-thermal pasteurization products have attracted the attention of many different sectors due to the increasing demand for safe, nutritious, and low-processed products with maximum nutrients. Industries such as food, pharmaceutical, and agriculture are increasingly focusing on non-thermal pasteurization products. This specific market comprises High Pressure Processing (HPP), Pulsed Electric Fields (PEF), Microwave Volumetric Heating (MVH), irradiation, ultrasonic, among a few more developing technologies. Among these markets, High Pressure Processing (HPP) is adopted the most. PEF stands for Pulsed Electric Fields which is an equally promising non-thermal technology that uses short, high voltage pulses on liquids, semi-liquids. MVH technology is extensively beneficial when processing liquids with high viscosities because it evenly distributes energy, preventing localized overheating or under processing. Ultrasonic processing retains product quality because it shortens treatment duration and reduces energy expenditure. Last but not least, ultra-sound cavitation thermally damages microbial cells to achieve pasteurization.

Based on Application, the food, beverage, pharmaceutical, and cosmetics industries are among those that use non-thermally pasteurized products. Non-thermal pasteurization techniques have become more popular as consumer demand for clean-label, preservative-free, and minimally processed foods has increased. The microbial safety of heat-sensitive substances, including probiotics, enzyme solutions, and biologically active formulations, is guaranteed by non-thermal pasteurization. These technologies are appropriate for applications where thermal methods are impractical because they help preserve the integrity of pharmaceutical products. Non-thermal pasteurization is used by the cosmetics industry to preserve the stability and safety of formulations that contain natural extracts, essential oils, or active ingredients. Sterilization without changing chemical properties is essential for preserving the effectiveness and caliber of products.

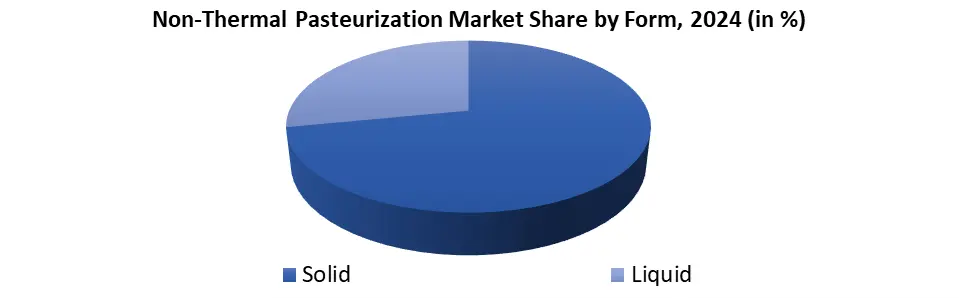

Based on Form, Non-thermal pasteurization is effective for two kinds of products. solids and liquids. The market is dominated by liquid forms, mostly because of the high demand in beverage processing. Non-thermal methods like HPP and PEF are particularly beneficial for juices, plant-based beverages, and milk substitutes. Consumer acceptance depends on these techniques' ability to maintain freshness and nutritional value without compromising flavor or texture. Additionally, liquid products are simpler to manage in continuous processing systems, increasing the economic viability of non-thermal technologies. Applications for solid forms are becoming more popular, especially in processed meats, ready-to-eat foods, and prepackaged meals. For example, HPP is frequently used to guarantee food safety without the use of preservatives or thermal degradation for vacuum-packed meats and deli goods. The capacity to pasteurize goods in their final.

Non-Thermal Pasteurization Market Regional Insights

The North America region is the leading market in the non-thermal pasteurization market globally. The region's highly industrialized and established food processing sector, particularly in the United States, is responsible for this dominance. Existence of sophisticated infrastructure, combined with the high concern for food safety and innovation, has prompted global uptake of advanced non-thermal pasteurization technologies like HPP, PEF, and UV treatment. The regulatory environment in the United States, via agencies like FDA and USDA, also plays an instrumental role through advocating the consumption of safe and effective food processes, further supporting market growth. North America has the advantage of a dense network of major technology suppliers and equipment makers, who continue to invest in R&D and commercialization activities. This has placed the region on the cutting edge of innovation and early adoption of advanced non-thermal methods. In addition, growing consumer demand for clean-label, minimally processed food items have further supported the trend toward non-thermal processes, making North America the leader in this new market.

Non-Thermal Pasteurization Market Competitive Landscape:

JBT Corporation (US) belongs to the non-thermal pasteurization sector and uses its experience gathered over the years in providing solutions for food preservation through quality enhancement. Though major parts of its thermal processing technologies bring fame to JBT, it has also integrated non-thermal techniques increasingly in its area in order to fulfill the demand for less processed food with an extended shelf life. Product quality optimization, food safety, and utility efficiency are the priorities of the company and global Research & Technology Centres lend support towards these targets by helping customers develop strategies for processing that are customized and effective. JBT leverage expertise across multiple geographies as a sound collaborator for introducing advanced pasteurization technology across increasing varieties of packaged foods.

Hiperbaric (Spain) has good reasons to be considered the world champion in high-pressure processing (HPP) technology for the arena of non-thermal pasteurization. Since its birth in 1999, this company has installed industrial equipment over more than 40 countries all around the globe with a very strong presence. Its innovation-driven approach has helped open new lines of business such as Hot Isostatic Pressing (HIP) and high-pressure hydrogen compression, thus leading both food and industrial high-pressure applications. This company is known for its HPP systems that are reliable, flexible, and able to scale for food and beverage processors who want to keep freshness, safety, and nutritional integrity without using thermal methods.

Thyssenkrupp AG (Germany), the company provides custom HPP solutions especially tailored for non-thermal pasteurization by its subsidiary Uhde High Pressure Technologies (Uhde HPT). Founded on a legacy of engineering expertise that goes back to 1930, thyssenkrupp has earned a strong reputation for building high-performance HPP systems tailored to the specific needs of every customer. Its interdisciplinary group of engineers and scientists collaborates closely with food producers to create tailor-made systems that meet strict safety and quality requirements. The company's long experience in high-pressure technology enhances its competitive position in the non-thermal pasteurization market, especially in high-end and high-demand food segments.

Non-Thermal Pasteurization Market Scope

|

Non-Thermal Pasteurization Market Scope |

|

|

Market Size in 2024 |

USD 2.67 Bn. |

|

Market Size in 2032 |

USD 12.03 Bn. |

|

CAGR (2025-2032) |

20.7% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Technique High Pressure Processing (HPP) Pulsed Electric Fields (PEF) Microwave Volumetric Heating (MVH) Ultrasonic Irradiation others |

|

By Form Solid Liquid |

|

|

By Application Food Beverages Pharmaceuticals Cosmetics |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top Non-Thermal Pasteurization Market Key Players:

- JBT Corporation (US)

- Hiperbaric (Spain)

- Thyssenkrupp AG (Germany)

- Lyras (Denmark)

- Syntegon (Germany)

- Multivac (Germany)

- Stansted Fluid Power Ltd. (UK)

- Pulsemaster (Netherlands)

- Elea (Germany)

- Symbios Technologies (US)

- Clextral (France)

- Dukane (US)

- FresherTech (China) and Nordion (Canada)

- ADM (US)

- Cargill, Incorporated (US)

- Tereos (France)

- Südzucker AG (US)

- MGP Ingredients (US)

- Roquette Frères (France)

- Glico Nutrition Foods Co., Ltd. (Japan)

- Kerry Group PLC (Ireland)

- Manildra Group (Australia)

- Kröner-Stärke (Germany)

- Crespel & Deiters Group (Germany)

- Batory Foods (US)

- Agridiënt B.V. (Netherlands)

- Tate & Lyle (UK)

- The Scoular Company (US)

Frequently Asked Questions

The global Non-Thermal Pasteurization market is expected to grow at a CAGR of 20.7%, reflecting steady revenue growth over the forecast period.

North America dominates the market due to rapid urbanization and industrial development, while Asia Pacific, Europe, and South America also contribute significantly with advanced technology integration and high consumer spending.

Technological advancements in non-thermal processing methods, rising demand for minimally processed and clean-label food products, increased adoption of IoT and automation in food processing, and strong investments in food safety infrastructure are major factors fueling market expansion in the Non-Thermal Pasteurization Market.

1. Non-Thermal Pasteurization Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Non-Thermal Pasteurization Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product

2.3.3. End-user

2.3.4. Revenue (2023)

2.3.5. Market Share (%)

2.3.6. Global Reach

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Non-Thermal Pasteurization Market: Dynamics

3.1. Non-Thermal Pasteurization Market Trends

3.2. Non-Thermal Pasteurization Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

4. Non-Thermal Pasteurization Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

4.1.1. High Pressure Processing (HPP)

4.1.2. Pulsed Electric Fields (PEF)

4.1.3. Microwave Volumetric Heating (MVH)

4.1.4. Ultrasonic

4.1.5. Irradiation

4.1.6. others

4.2. Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

4.2.1. Solid

4.2.2. Liquid

4.3. Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

4.3.1. Food

4.3.2. Beverages

4.3.3. Pharmaceuticals

4.3.4. Cosmetics

4.4. Non-Thermal Pasteurization Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Non-Thermal Pasteurization Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

5.1.1. High Pressure Processing (HPP)

5.1.2. Pulsed Electric Fields (PEF)

5.1.3. Microwave Volumetric Heating (MVH)

5.1.4. Ultrasonic

5.1.5. Irradiation

5.1.6. others

5.2. North America Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

5.2.1. Solid

5.2.2. Liquid

5.3. North America Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

5.3.1. Food

5.3.2. Beverages

5.3.3. Pharmaceuticals

5.3.4. Cosmetics

5.4. North America Non-Thermal Pasteurization Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Non-Thermal Pasteurization Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

6.2. Europe Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

6.3. Europe Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

6.4. Europe Non-Thermal Pasteurization Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Non-Thermal Pasteurization Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

7.2. Asia Pacific Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

7.3. Asia Pacific Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

7.4. Asia Pacific Non-Thermal Pasteurization Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Non-Thermal Pasteurization Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

8.2. Middle East and Africa Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

8.3. Middle East and Africa Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

8.4. Middle East and Africa Non-Thermal Pasteurization Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Egypt

8.4.4. Nigeria

8.4.5. Rest of the Middle East and Africa

9. South America Non-Thermal Pasteurization Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

9.1. South America Non-Thermal Pasteurization Market Size and Forecast, By Technique (2024-2032)

9.2. South America Non-Thermal Pasteurization Market Size and Forecast, By Form (2024-2032)

9.3. South America Non-Thermal Pasteurization Market Size and Forecast, by Application (2024-2032)

9.4. South America Non-Thermal Pasteurization Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest of South America

10. Company Profile: Key Players

10.1. JBT Corporation (US)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2. Hiperbaric (Spain)

10.3. Thyssenkrupp AG (Germany)

10.4. Lyras (Denmark)

10.5. Syntegon (Germany)

10.6. Multivac (Germany)

10.7. Stansted Fluid Power Ltd. (UK)

10.8. Pulsemaster (Netherlands)

10.9. Elea (Germany)

10.10. Symbios Technologies (US)

10.11. Clextral (France)

10.12. Dukane (US)

10.13. FresherTech (China) and Nordion (Canada)

10.14. ADM (US)

10.15. Cargill, Incorporated (US)

10.16. Tereos (France)

10.17. Südzucker AG (US)

10.18. MGP Ingredients (US)

10.19. Roquette Frères (France)

10.20. Glico Nutrition Foods Co., Ltd. (Japan)

10.21. Kerry Group PLC (Ireland)

10.22. Manildra Group (Australia)

10.23. Kröner-Stärke (Germany)

10.24. Crespel & Deiters Group (Germany)

10.25. Batory Foods (US)

10.26. Agridiënt B.V. (Netherlands)

10.27. Tate & Lyle (UK)

10.28. The Scoular Company (US)

11. Key Findings

12. Analyst Recommendations

13. Non-Thermal Pasteurization Market: Research Methodology