Non-alcoholic Beverage Market Global Industry Analysis and Forecast (2026-2032) by Software, Deployment and Region

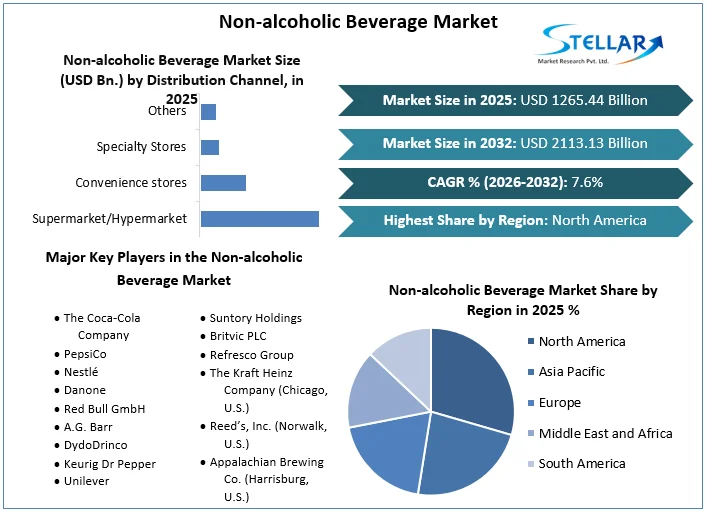

Global Non-alcoholic Beverage Market size was valued at USD 1265.44 Bn. in 2025 and is expected to reach USD 2113.13 Bn. by 2032, at a CAGR of 7.6%.

Format : PDF | Report ID : SMR_2374

Non-alcoholic Beverage Market Overview

The non-alcoholic beverage market encompasses a diverse range of products, from water, tea, and coffee to sweet drinks like soft drinks and juices. This industry not only provides ready-to-drink beverages but also mixes and concentrates. Driven by growing health consciousness, consumers are increasingly seeking out healthier beverage options, leading to a rise in demand for non-alcoholic drinks without sugar. Consumers are looking for drinks that not only quench their thirst but also provide additional health benefits, resulting in the introduction of a wide range of functional beverages such as energy drinks and sports drinks.

The North American Non-alcoholic Beverage market maintains its global leadership, in 2023, the United States was the world's biggest consumer of packaged beverages. The leading carbonated soft drink brands in the U.S. were Coca-Cola and Pepsi-Cola, while private-label bottled water brands made up the largest portion of bottled water sales. Among the leading global manufacturers, Nestlé topped the list with over $45 billion in global sales in 2022, followed closely by The Coca-Cola Company with $43 billion in sales. In 2023, bottled water was the most widely consumed packaged beverage globally, exceeding 506 billion liters. The energy and sports drinks sector generated $193 billion in global sales.

The relaxation of trade barriers has encouraged manufacturers to expand production capabilities worldwide, creating growth opportunities in emerging markets. Overall, the non-alcoholic beverage industry is poised for continued evolution, catering to the diverse and evolving needs of consumers across the globe.

To get more Insights: Request Free Sample Report

Non-alcoholic Beverage Market Dynamics

The Rise of Healthy Hydration drives the Non-alcoholic Beverage market

The Non-alcoholic beverage market growth is driven by the increasing emphasis on health and wellness among consumers. As individuals prioritize their well-being, there is a growing preference for beverages perceived as healthier alternatives to sugary sodas and alcoholic drinks. Consumers are actively seeking non-alcoholic options that contribute positively to their overall health and vitality. This demand has propelled the popularity of beverages with lower sugar content, natural ingredients, and functional benefits, such as flavoured waters, herbal teas, and vitamin-fortified drinks. The health and wellness trend has also sparked innovation within the non-alcoholic beverages market.

Companies are introducing new products that cater to specific health concerns and dietary preferences, such as plant-based milk for consumers seeking dairy alternatives. The emergence of functional beverages, like kombucha and cold-pressed juices, capitalizes on the growing interest in natural remedies and holistic wellness practices. As a result, the market has witnessed a proliferation of innovative offerings that satisfy consumer demand for healthier beverages and support overall well-being. Non-alcoholic beverage industry trends shift towards consumer preferences and consumption habits are expected to continue driving the growth of the non-alcoholic beverage industry in the coming years

E-commerce Expansion Boosts Growth and Market Reach in the Non-Alcoholic beverage market

E-commerce expansion presents significant opportunities for growth and market reach in the non-alcoholic beverage market. By leveraging online platforms and direct-to-consumer (DTC) sales models, non-alcoholic beverage brands can overcome traditional distribution barriers, reach a wider audience, and provide personalized shopping experiences. E-commerce allows these brands to enter global markets beyond their geographical limitations, enabling them to access consumers in regions where traditional retail presence may be limited or costly to establish. This expanded reach opens new revenue streams and growth opportunities for non-alcoholic beverage companies, allowing them to scale their businesses and increase market share in a digitally connected world.

Furthermore, e-commerce platforms offer non-alcoholic beverage brands unparalleled flexibility and agility in product offerings, pricing strategies, and marketing initiatives. Through e-commerce channels, brands can experiment with innovative flavours, limited-edition releases, and exclusive promotions to drive consumer engagement and loyalty. Moreover, direct interaction with consumers through e-commerce platforms enables brands to gather valuable data and insights into consumer preferences, purchasing behaviors, and market trends, empowering them to refine their product offerings and marketing strategies. These factors present numerous opportunities for the non-alcoholic beverage market

Non-alcoholic Beverage Market Segmentation

By Type, the Global Non-alcoholic beverage market is segmented into various types, including carbonated soft drinks, bottled water, ready-to-drink (RTD) tea & coffee, fruit juices, and others. Carbonated soft drinks held the largest market share in 2025. Consumers are drawn to new and flavored CSDs for their refreshing properties, and the market is driven by efforts to strengthen distribution channels at low costs. Developing markets like India and China contribute significantly to improving economic conditions. CSDs are popular for their effervescence and wide array of flavours, catering to diverse taste preferences. Convenience and availability in various packaging sizes also contribute to their popularity.

The functional beverages segment is anticipated to experience significant growth over the forecast period, driven by increasing awareness and emphasis on health and wellness. As consumers become more health-conscious, there is a growing demand for beverages that offer functional benefits, such as vitamins, minerals, antioxidants, and other health-promoting ingredients, aligning with the focus on preventive healthcare and overall well-being. Meanwhile, RTD drinks, juices, and sports drinks are expected to grow at a faster pace due to the global shift towards healthy drinks.

By Distribution channel, the supermarket/hypermarket segment dominated the global non-alcoholic beverage market in 2025 and is expected to continue its dominance during the forecast period. These retail outlets offer a wide range of non-alcoholic beverages, including carbonated sodas, fruit juices, flavoured water, and functional drinks, all under one roof. Consumers value the convenience of being able to purchase various beverages during their regular grocery shopping trips. Additionally, supermarkets and hypermarkets often offer competitive pricing, promotions, and bulk purchase options, making them popular destinations for both individual and social beverage purchases.

Non-alcoholic Beverage Market Competitive Landscape

Key players like The Coca-Cola Company, PepsiCo, Nestlé, and Keurig Dr Pepper are vying for market dominance through innovative product development, effective marketing, and sustainability initiatives. Smaller, niche firms cater to evolving consumer preferences for healthier, low-calorie beverages, while private-label brands offer affordable options with less brand recognition. Competition is driven by product innovation, sourcing, and alignment with consumer values around health and the environment.

Non-alcoholic Beverage Market Regional Analysis

The global non-alcoholic beverage market in 2025 continues to be dominated by North America, which accounted for a XX% market share. This long-standing market leadership is due to the strong presence of established brands, widespread distribution networks, and a culture of beverage consumption deeply rooted in the region's history. The popularity of soft drinks, juices, and bottled water has contributed to North America's market leadership, driven by factors such as convenience, lifestyle preferences, and effective marketing strategies. Additionally, the region's affluent population and high disposable income levels have supported premiumization trends, encouraging the growth of innovative and upscale non-alcoholic beverages.

The Coca-Cola Company is a global beverage giant with an iconic portfolio of brands, including Coca-Cola, Sprite, and Fanta. PepsiCo is another major player in the beverage industry, known for popular brands like Pepsi, Mountain Dew, Gatorade, and Tropicana. Keurig Dr Pepper has a strong presence in the coffee and tea categories. Danone owns well-known brands such as Evian, Smartwater, and Activia. Red Bull has gained significant popularity in the energy drink market

However, the Asia Pacific region is emerging as the fastest-growing market for non-alcoholic beverages, poised to become a significant player in the global industry. This growth is driven by the region's large and increasingly affluent population, coupled with rapid urbanization and changing consumer lifestyles. As disposable incomes rise and dietary preferences evolve, there is a growing demand for healthier and more diverse beverage options in Asia Pacific. The region's rich culinary heritage and cultural diversity provide a fertile ground for innovation and the introduction of unique flavors and ingredients in non-alcoholic beverages.

Increasing awareness of health and wellness, as well as government initiatives promoting healthy lifestyles, have further propelled the growth of the non-alcoholic beverages market in Asia Pacific. The booming e-commerce sector in the region has also facilitated greater accessibility and availability of non-alcoholic beverages, allowing companies to reach a wider audience. Asahi Group Holdings, Ltd. has expanded its non-alcoholic beverage portfolio in Asia Pacific with products like Mitsuya carbonated drinks, Wonda coffee, and Calpis lactic acid drinks, leveraging its beer brewing expertise to develop innovative non-alcoholic offerings like Dry Zero non-alcoholic beer.

The report aims to provide industry stakeholders with a thorough study of the global Non-alcoholic Beverage Market. The research presents the industry's historical and present state with projected market size and trends, analyzing complex data in an easy-to-read manner. The research includes PORTER and PESTLE analyses along with the possible effects of market microeconomic factors. Analyzing both internal and external elements that could have a good or negative impact on the firm will provide decision-makers with a clear picture of the industry's future. By understanding the market segments and projecting the size of the global Non-alcoholic Beverage market, the reports also help understand the market's dynamics and structure.

Non-alcoholic Beverage Market Scope

|

Non-alcoholic Beverage Market |

|

|

Market Size in 2025 |

USD 1265.44 Bn. |

|

Market Size in 2032 |

USD 2113.13 Bn. |

|

CAGR (2026-2032) |

7.6% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Non-alcoholic Beverage Market Segments |

By Type Carbonated Soft Drinks (CSD) Ready-to-Drink Coffee & Tea Bottled Water Fruit Beverages Others |

|

By Distribution Channel Supermarket/Hypermarket Convenience stores Specialty Stores Others |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Non-alcoholic Beverage Market Leading Players

- The Coca-Cola Company

- PepsiCo

- Nestlé

- Danone

- Red Bull GmbH

- A.G. Barr

- DydoDrinco

- Keurig Dr Pepper

- Unilever

- Suntory Holdings

- Britvic PLC

- Refresco Group

- The Kraft Heinz Company (Chicago, U.S.)

- Reed’s, Inc. (Norwalk, U.S.)

- Appalachian Brewing Co. (Harrisburg, U.S.)

- Arca Continental

- ITO EN Ltd

- Monster Beverage Corp

Frequently Asked Questions

North America is expected to dominate the Non-alcoholic Beverage Market during the forecast period.

The Non-alcoholic Beverage Market size is expected to reach USD 2113.13 billion by 2032.

The major top players in the Global Non-alcoholic Beverage Market are The Coca-Cola Company, PepsiCo, Nestlé, Danone, Red Bull GmbH, and others.

The global non-alcoholic beverage market is driven by factors such as the new generation's reduced interest in drinking alcohol and greater health consciousness is expected to drive market growth during the forecast period.

1. Non-alcoholic Beverage Market: Research Methodology

2. Non-alcoholic Beverage Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Non-alcoholic Beverage Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2025)

3.3.5. Company Headquarter

3.4. Leading Non-alcoholic Beverage Market Companies, by Market Capitalization

3.5. Market Structure

3.5.1. Market Leaders

3.5.2. Market Followers

3.5.3. Emerging Players

3.6. Mergers and Acquisitions Details

4. Non-alcoholic Beverage Market: Dynamics

4.1. Non-alcoholic Beverage Market Trends

4.2. Non-alcoholic Beverage Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Distribution Channel Roadmap

4.6. Regulatory Landscape by Region

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Middle East and Africa

4.6.5. South America

5. Non-alcoholic Beverage Market: Global Market Size and Forecast (Value in USD Million) (2025-2032)

5.1. Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

5.1.1. Carbonated Soft Drinks (CSD)

5.1.2. Ready-to-Drink Coffee & Tea

5.1.3. Bottled Water

5.1.4. Fruit Beverages

5.1.5. Others

5.2. Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

5.2.1. Supermarket/Hypermarket

5.2.2. Convenience stores

5.2.3. Specialty Stores

5.2.4. Others

5.3. Non-alcoholic Beverage Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Non-alcoholic Beverage Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

6.1. North America Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

6.1.1. Carbonated Soft Drinks (CSD)

6.1.2. Ready-to-Drink Coffee & Tea

6.1.3. Bottled Water

6.1.4. Fruit Beverages

6.1.5. Others

6.2. North America Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

6.2.1. Supermarket/Hypermarket

6.2.2. Convenience stores

6.2.3. Specialty Stores

6.2.4. Others

6.3. North America Non-alcoholic Beverage Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Non-alcoholic Beverage Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

7.1. Europe Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

7.2. Europe Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

7.3. Europe Non-alcoholic Beverage Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Russia

7.3.8. Rest of Europe

8. Asia Pacific Non-alcoholic Beverage Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

8.1. Asia Pacific Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

8.2. Asia Pacific Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

8.3. Asia Pacific Non-alcoholic Beverage Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. ASEAN

8.3.7. Rest of Asia Pacific

9. Middle East and Africa Non-alcoholic Beverage Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

9.1. Middle East and Africa Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

9.2. Middle East and Africa Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

9.3. Middle East and Africa Non-alcoholic Beverage Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Non-alcoholic Beverage Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

10.1. South America Non-alcoholic Beverage Market Size and Forecast, By Type (2025-2032)

10.2. South America Non-alcoholic Beverage Market Size and Forecast, By Distribution Channel (2025-2032)

10.3. South America Non-alcoholic Beverage Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. The Coca-Cola Company

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. PepsiCo

11.3. Nestlé

11.4. Danone

11.5. Red Bull GmbH

11.6. A.G. Barr

11.7. DydoDrinco

11.8. Keurig Dr Pepper

11.9. Unilever

11.10. Suntory Holdings

11.11. Britvic PLC

11.12. Refresco Group

11.13. The Kraft Heinz Company

11.14. Reed’s, Inc.

11.15. Appalachian Brewing Co.

11.16. Arca Continental SAB de CV

11.17. ITO EN Ltd

11.18. Monster Beverage Corp

12. Key Findings

13. Industry Recommendations