Microcontroller Socket Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

Microcontroller Socket Market size was valued at USD 1.52 Bn. in 2024, and the total Microcontroller Socket Market revenue is expected to grow at a CAGR of 5.6 % from 2025 to 2032, reaching nearly USD 2.35 Bn.

Format : PDF | Report ID : SMR_2734

Microcontroller Socket Market Overview:

A microcontroller socket known as IC socket or microcontroller holder, is a physical interface that allows for easy insertion and removal of a microcontroller chip (IC) from a circuit board. The growth of IoT devices and smart devices to drive the growth of the Microcontroller socket market. Recent trends in the microcontroller socket market are a rising demand from consumer electronics and wearables, increased use of Ball Grid Array (BGA) sockets for high-performance requirements, and a focus on miniaturization.

The Asia-Pacific region, mainly China, Japan and India, is the most dominant consumer due to the rate of industrialization and development in the electronics sector. TE Connectivity and Molex are major global companies in the microcontroller socket industry.

China and Vietnam maintain low or zero tariffs to attract electronics manufacturing, making their markets more competitive. In contrast, high tariffs in countries like India (up to 20% on components) increase production costs and reduce export competitiveness.

.webp)

To get more Insights: Request Free Sample Report

Microcontroller Socket Market Dynamics:

Growth of IoT and Smart Devices to Drive Microcontroller Socket Market growth

Rapid development of IoT and smart devices across areas such as consumer electronics, healthcare, agriculture, and manufacturing automation is the main cause for the Growth of IoT and Smart Devices, and they drive the Microcontroller Socket Market. Each IoT or smart device regularly has one or more microcontrollers for sensing, computation and connectivity. There is a rising need for microcontroller sockets that enable simple integration, testing, and replacement of microcontrollers, making hardware development more efficient, scalable, and repairable in a high-growth, modular environment.

Rising Demand for Automotive and Industrial Automation to Drive the Microcontroller Socket Market

Rising demand is due to the rapid electrification of vehicles and the growing adoption of Industry 4.0 technologies. The major consumer of microcontroller sockets is the automotive industry, accounting for the maximum market share among the whole application segments. The global automotive electronics market, which harshly depends on microcontroller integration. The automotive sector's move to electric vehicles (EVs) and autonomous driving technologies is enhancing the need for additional sophisticated and reliable microcontroller solutions, and it is driving the Microcontroller Socket Market. Modern vehicles and automated manufacturing equipment risingly depend on microcontrollers to manage composite functions like engine control, safety systems, communication networks, and process automation. These applications need microcontroller sockets that not only ensure reliable electrical connections but also maintain signal integrity during high-speed data transmission.

Increasing shift toward integrated and surface-mount microcontroller solutions to restrain the Microcontroller Socket Market

They reduce the need for Microcontroller sockets because they are traditionally used to allow easy insertion and replacement of components. With the rise of surface-mount technology (SMT) and system-on-chip (SoC) integration, producers are embedding microcontrollers straight onto printed circuit boards to save space, reduce costs, and improve durability in compact devices such as smartphones, wearables, and IoT sensors. Meanwhile, sockets take up more space and can introduce points of mechanical failure.

Microcontroller Socket Market Segmentation:

Based on Product, the Microcontroller Socket Market is segmented into DIP, SOIC, SOP, BGA and QFP. Dual-in-line package (DIP) sockets currently dominate the microcontroller socket market. Due to their simplicity, low cost, and ease of handling. Also they easily insert and remove microcontrollers without soldering, support rapid prototyping and testing. DIP sockets are favoured for prototypes, development, and educational purposes, as their design allows for easy handling and testing. DIP sockets are ideal for their through-hole mounting technology, offering durable mechanical stability and simplifying manual assembly and maintenance in consumer and industrial electronics. They are mainly suitable for environments where durability and repairability are serious, like industrial automation, automotive electronics, and educational applications.

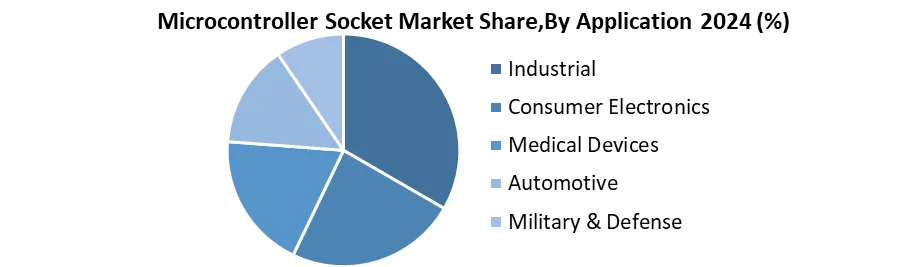

Based on Application, the microcontroller socket market is divided into industrial, consumer electronics, medical devices and automotive. Globally, the industrial segment is most dominant in the microcontroller socket market. microcontroller sockets are highly used in robotics, manufacturing automation and control systems. In this reliability and durability are important. In the industrial sector, microcontroller sockets simplify upgrading, replacing, and installing components, decreasing manufacturing process downtime. For instance, microcontroller sockets are significant in the rapid restoration and upgrades of programmable logic controllers (PLCs), which are utilised in automated assembly lines, without requiring the dismantlement of complete systems.

Microcontroller Socket Market Regional analysis:

increasing industrialization to boost Asia-Pacific microcontroller socket market growth

The Asia-Pacific region is the most dominant in the microcontroller socket industry. In 2024, Asia-Pacific was the highest share in the market, because of increasing industrialization, broad adoption of consumer electronics, and aggressive growth in the automotive and industrial automation industries. China, Japan, South Korea, and India are prominent contributors due to their solid manufacturing bases, continued investments in IoT and smart devices, and high density of semiconductor and electronics firms. This regional dominance is further supported by cost-effective production capabilities and a growing domestic demand for advanced electronic systems.

Microcontroller Socket Market Competitive Landscape

TE Connectivity and Molex are global leading companies in the microcontroller socket market. TE Connectivity focuses on high-reliability sockets for industrial, aerospace, and defense applications, offering advanced designs like MICROSPRING with strong thermal and mechanical performance. Molex excels in compact, high-volume, and cost-effective socket solutions, making it a preferred choice in automotive electronics and consumer devices. Its designs support faster assembly and tight board layouts, ideal for space-constrained products.

Microcontroller Socket Market Recent Developments:

In December 2024, the first microcontrollers designed particularly for edge AI and machine learning STM32N6 series introduced by STMicroelectronics. These chips are used for on-device image and audio processing, reducing reliance on cloud computation and enhancing the performance of IoT and smart electronics.

In 2024, Renesas Electronics, Altium a major PCB design software company, to develop into circuit design automation. These moves strengthen Renesas’s vertical integration and position in next-gen microcontroller and socket integration.

|

Microcontroller Socket Market Scope |

|

|

Market Size in 2024 |

USD 1.52 Bn. |

|

Market Size in 2032 |

USD 2.35 Bn. |

|

CAGR (2024-2032) |

5.6 % |

|

Historic Data |

2018-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product DIP SOIC SOP BGA QFP |

|

By Application Industrial Consumer Electronics Medical Devices Automotive Military & Defense |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia-Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Microcontroller Socket Market Key Players include:

North America

- Aries Electronics (USA)

- Mill-Max Manufacturing Corp. (USA)

- Samtec, Inc. (USA)

- Loranger International Corp. (USA)

- Molex (USA)

- Amphenol Corporation (USA)

Europe

- TE Connectivity (Switzerland)

- PRECI DIP SA (Switzerland)

- LEMO SA (Switzerland)

- STMicroelectronics (Switzerland)

- Nicomatic SA (France)

- Würth Elektronik (Germany)

Asia-Pacific

- Foxconn Technology Group (Taiwan)

- Renesas Electronics (Japan)

- Yamaichi Electronics Co., Ltd. (Japan)

- WinWay Technology Co., Ltd. (Taiwan)

- JAE Electronics (Japan)

- Samsung Electro-Mechanics Co., Ltd. (South Korea)

Middle East & Africa

- Ghabbour Electronics (Egypt)

- Yekta Pad Novin (Iran)

- ACTOM (South Africa)

- Helukabel Middle East (UAE)

- Radix ElectroSystems (South Africa)

- Relisys Technologies (Turkey)

South America

- Chiptronic Tecnologia Automotiva (Brazil)

- Furukawa Electric LatAm (Brazil)

- Datacom (Brazil)

- Grupo Condumex (Mexico – operations in South America)

- TCA Connectors (Argentina)

- WEG Industries (Brazil)

Frequently Asked Questions

Simplicity, low cost, and ease of handling. And also, easily insert and remove microcontrollers without soldering, and support for rapid prototyping and testing.

The growth of IoT and Smart Devices is the key driver of the Microcontroller Socket Market.

Asia-Pacific is the dominating region in the Microcontroller Socket Market.

TE Connectivity and Molex are global key players in the microcontroller socket market.

1. Microcontroller Socket Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Microcontroller Socket Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Microcontroller Socket Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Microcontroller Socket Market: Dynamics

3.1. Microcontroller Socket Market Trends by Region

3.1.1. North America Microcontroller Socket Market Trends

3.1.2. Europe Microcontroller Socket Market Trends

3.1.3. Asia Pacific Microcontroller Socket Market Trends

3.1.4. Middle East & Africa Microcontroller Socket Market Trends

3.1.5. South America Microcontroller Socket Market Trends

3.2. Microcontroller Socket Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Battery IoT Industry

4. Microcontroller Socket Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

4.1.1. DIP

4.1.2. SOIC

4.1.3. SOP

4.1.4. BGA

4.1.5. QFP

4.2. Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

4.2.1. Industrial

4.2.2. Consumer Electronics

4.2.3. Medical Devices

4.2.4. Automotive

4.2.5. Military & Defense

4.3. Microcontroller Socket Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East & Africa

4.3.5. South America

5. North America Microcontroller Socket Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

5.1.1. DIP

5.1.2. SOIC

5.1.3. SOP

5.1.4. BGA

5.1.5. QFP

5.2. North America Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

5.2.1. Industrial

5.2.2. Consumer Electronics

5.2.3. Medical Devices

5.2.4. Automotive

5.2.5. Military & Defense

5.3. North America Microcontroller Socket Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

5.3.1.1.1. DIP

5.3.1.1.2. SOIC

5.3.1.1.3. SOP

5.3.1.1.4. BGA

5.3.1.1.5. QFP

5.3.1.2. United States Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

5.3.1.2.1. Industrial

5.3.1.2.2. Consumer Electronics

5.3.1.2.3. Medical Devices

5.3.1.2.4. Automotive

5.3.1.2.5. Military & Defense

5.3.2. Canada

5.3.2.1. Canada Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

5.3.2.1.1. DIP

5.3.2.1.2. SOIC

5.3.2.1.3. SOP

5.3.2.1.4. BGA

5.3.2.1.5. QFP

5.3.2.2. Canada Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

5.3.2.2.1. Industrial

5.3.2.2.2. Consumer Electronics

5.3.2.2.3. Medical Devices

5.3.2.2.4. Automotive

5.3.2.2.5. Military & Defense

5.3.3. Mexico

5.3.3.1. Mexico Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

5.3.3.1.1. DIP

5.3.3.1.2. SOIC

5.3.3.1.3. SOP

5.3.3.1.4. BGA

5.3.3.1.5. QFP

5.3.3.2. Mexico Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

5.3.3.2.1. Industrial

5.3.3.2.2. Consumer Electronics

5.3.3.2.3. Medical Devices

5.3.3.2.4. Automotive

5.3.3.2.5. Military & Defense

6. Europe Microcontroller Socket Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032)

6.1. Europe Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.2. Europe Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3. Europe Microcontroller Socket Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.1.2. United Kingdom Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.2. France

6.3.2.1. France Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.2.2. France Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.3. Germany

6.3.3.1. Germany Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.3.2. Germany Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.4. Italy

6.3.4.1. Italy Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.4.2. Italy Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.5. Spain

6.3.5.1. Spain Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.5.2. Spain Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.6.2. Sweden Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.7. Austria

6.3.7.1. Austria Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.7.2. Austria Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

6.3.8.2. Rest of Europe Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Microcontroller Socket Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032)

7.1. Asia Pacific Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.2. Asia Pacific Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Microcontroller Socket Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.1.2. China Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.2.2. S Korea Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.3. Japan

7.3.3.1. Japan Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.3.2. Japan Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.4. India

7.3.4.1. India Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.4.2. India Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.5. Australia

7.3.5.1. Australia Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.5.2. Australia Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.6. ASEAN

7.3.6.1. ASEAN Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.6.2. ASEAN Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

7.3.7. Rest of Asia Pacific

7.3.7.1. Rest of Asia Pacific Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

7.3.7.2. Rest of Asia Pacific Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Microcontroller Socket Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032)

8.1. Middle East and Africa Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

8.2. Middle East and Africa Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Microcontroller Socket Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

8.3.1.2. South Africa Microcontroller Socket Market Size and Forecast, By Application Model (2024-2032)

8.3.2. GCC

8.3.2.1. GCC Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

8.3.2.2. GCC Microcontroller Socket Market Size and Forecast, By Application Model (2024-2032)

8.3.3. Nigeria

8.3.3.1. Nigeria Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

8.3.3.2. Nigeria Microcontroller Socket Market Size and Forecast, By Application Model (2024-2032)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

8.3.4.2. Rest of ME&A Microcontroller Socket Market Size and Forecast, By Application Model (2024-2032)

9. South America Microcontroller Socket Market Size and Forecast by Segmentation (by Value USD Bn..) (2024-2032)

9.1. South America Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

9.2. South America Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

9.3. South America Microcontroller Socket Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

9.3.1.2. Brazil Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

9.3.2.2. Argentina Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Microcontroller Socket Market Size and Forecast, By Product (2024-2032)

9.3.3.2. Rest Of South America Microcontroller Socket Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. TE Connectivity (Switzerland)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Aries Electronics (USA)

10.3. Mill-Max Manufacturing Corp. (USA)

10.4. Johnstech International Corp. (USA)

10.5. Loranger International Corp. (USA)

10.6. Molex (USA)

10.7. Amphenol Corporation (USA)

10.8. PRECI DIP SA (Switzerland)

10.9. LEMO SA (Switzerland)

10.10. Fischer Connectors (Switzerland)

10.11. Nicomatic SA (France)

10.12. Würth Elektronik (Germany)

10.13. Foxconn Technology Group (Taiwan)

10.14. Enplas Corporation (Japan)

10.15. Yamaichi Electronics Co., Ltd. (Japan)

10.16. WinWay Technology Co., Ltd. (Taiwan)

10.17. Kyocera Corporation (Japan)

10.18. Samsung Electro Mechanics Co., Ltd. (South Korea)

10.19. Ghabbour Electronics (Egypt)

10.20. Yekta Pad Novin (Iran)

10.21. ACTOM (South Africa)

10.22. Helukabel Middle East (UAE)

10.23. Radix ElectroSystems (South Africa)

10.24. Relisys Technologies (Turkey)

10.25. Chiptronic Tecnologia Automotiva (Brazil)

10.26. Furukawa Electric LatAm (Brazil)

10.27. Datacom (Brazil)

10.28. Grupo Condumex (Mexico – operations in South America)

10.29. TCA Connectors (Argentina)

10.30. WEG Industries (Brazil)

11. Key Findings

12. Industry Recommendations

13. Microcontroller Socket Market: Research Methodology