Commodity Contracts Brokerage Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

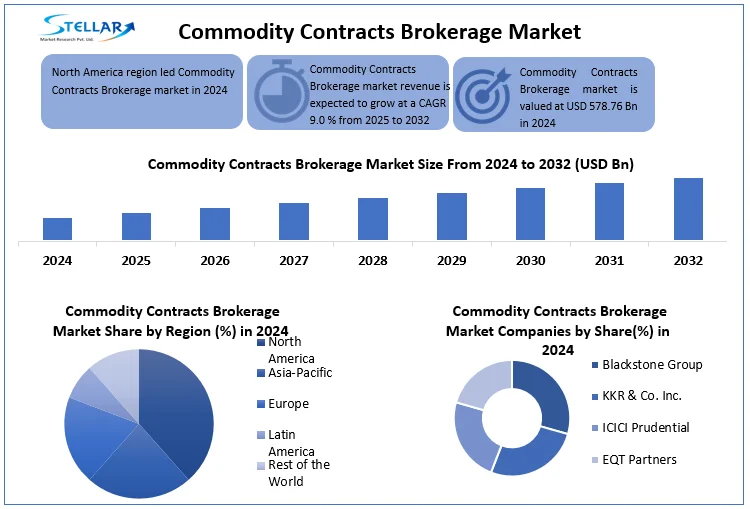

Commodity Contracts Brokerage Market Size was valued at over USD 578.76 Bn in 2024 and is expected to grow to USD 1,153.22 Bn in 2032 at a CAGR of 9.0 %.

Format : PDF | Report ID : SMR_2761

Commodity Contracts Brokerage Market Overview

Commodity Contracts Brokerage is a middleman service in which they contract to trade based on their future prices. These brokers help people and businesses to buy or sell. Commodity Contracts Brokers make it easier for traders, investors, and businesses to deal in commodity-related financial deals without handling the physical goods.

In the Commodity Contracts Brokerage Market, the increased price volatility of up to 60-70% compels hedgers and speculators alike to seek protection and gain through commodity contracts, thereby boosting trade volumes by 70%. In parallel with this is supply chain volatility, whether caused by logistics bottlenecks, export embargoes, or natural catastrophes that compel more participants to hedge risk through derivative instruments. To this, drivers are added the growing interests of institutional players such as hedge funds, pension managers, and even banks, who, more and more, are relying on commodities for diversification and yield gains outside equities and bonds, depending up to 60%. Their entry is enriching market liquidity and broadening the client universe for brokerages. Segment-wise, cloud-based systems are becoming popular over on-premise solutions because they are flexible and less expensive and the other segments affect product customisation, pricing strategies, and service delivery differently.

Geographically, North America has the highest share of the Commodity Contracts Brokerage Market up to 34%, particularly the U.S., due to its mature financial infrastructure, regulatory clarity, and location of large brokerage firms. The region, is catching up quickly and financialization and growing institutional demand up to 70%. Competitively, large multinationals such as Interactive Brokers and Charles Schwab continue to evolve with AI-based trading systems, tailor-made dashboards, and low-cost models. These firms are based on transparency, real-time analysis, and linked research facilities to bring in clients of all types, ranging from retail traders to institutions.

To get more Insights: Request Free Sample Report

Commodity Contracts Brokerage Market Dynamics

Price Volatility and Supply Chain to Drive the Commodity Contracts Brokerage Market

The Commodity Contracts Brokerage Market is influenced by fluctuations in commodity prices 40% and determined supply constraints 45% across various sectors. Supply-demand imbalances in OPEC’s oil production cuts and agricultural shortages due to geopolitical tensions or poor harvests and it increase trading activity as both hedgers and speculators rush to reduce risks or capitalise on price movements. Climate change and weather change are particularly disruptive to soft commodities like wheat and coffee, making futures contracts essential tools for producers and buyers to stabilise prices among uncertainty. In the metals sector, critical raw materials like copper and lithium are experiencing supply delays due to environmental rules and regulations, labour issues, and mining limitations, which strengthen market assumptions and hedging needs in derivative markets.

Increase in Institutional Participation to create the opportunity for the Commodity Contracts Brokerage Market

In Commodity Contracts Brokerage Market, Big financial players like banks, hedge funds, and investment managers have started to use trading commodity contracts. It protects them from risk as well as it gives them extra profit that is 70% beyond what the general market offers. The banks and other institutions manage money in large amounts, therefore, it create the market opportunity for brokerage firms to buy or sell the contracts to these clients through research and analysis, risk management strategy or by Multi-Asset Access that gives the ability to trade across multiple exchanges and commodity types in 1 place.

Intense competition and fee compression to restrain the Commodity Contracts Brokerage Market

In Commodity Contracts Brokerage Market, the high demand for a low-cost trading platform, AI-driven Analytics, and zero commission models attracts clients with their faster performance, better user experience, and transparent pricing structure and eventually, the existing brokers have to lower their fees to remain competitive. In India, many traditional brokers have slashed their per-trade charges by over 30–50% after the entry of online brokers like Zerodha and Upstox

Commodity Contracts Brokerage Market Segment Analysis

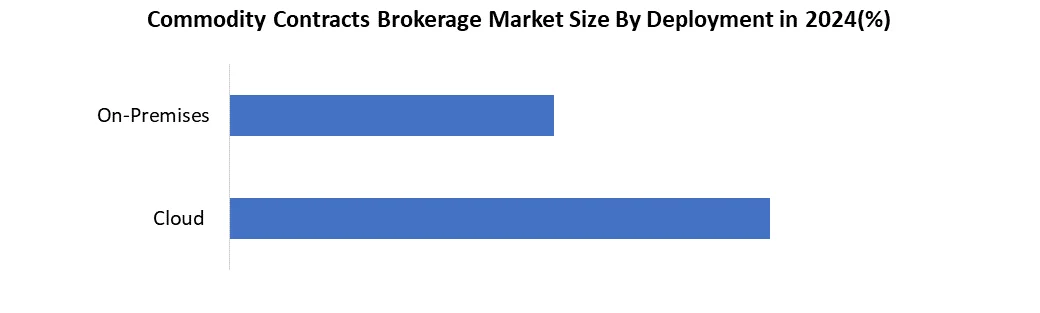

Based on the Deployment, the Commodity Contracts Brokerage Market is segmented into cloud and on-premises. In this segment, cloud dominated the market in 2024 and is expected to dominate in the forecast period. It holds 40-45% of shares .The cloud-based solution offers scalability, remote accessibility and real-time data access, which is important in commodity trading as well as the digitalisation and algorithmic trading future influence cloud adoption.

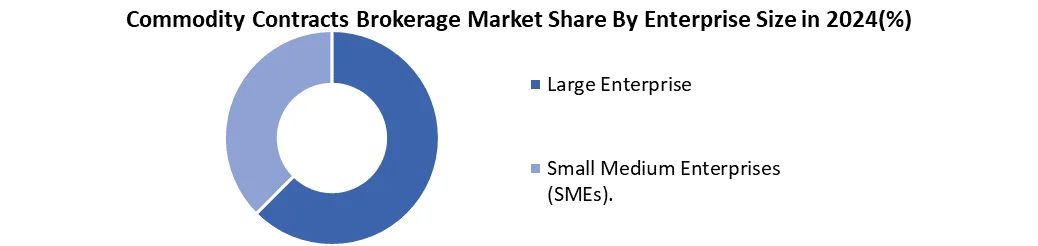

Based on Enterprise Size, the Commodity Contracts Brokerage Market is segmented into Large Enterprise and Small Medium Enterprises (SMEs).In this segment, Large Enterprise dominated the market in 2024 and is expected to dominate in the forecast period also. It holds 42-46% of shares. Large enterprises get involved in high-volume trading, and they handle complex commodity contracts as they have high capital, Infrastructure and Regulatory Capacity. Also, Large Enterprises are early adopters of several tech innovations like AI-driven risk analysis and high-frequency trading platforms.

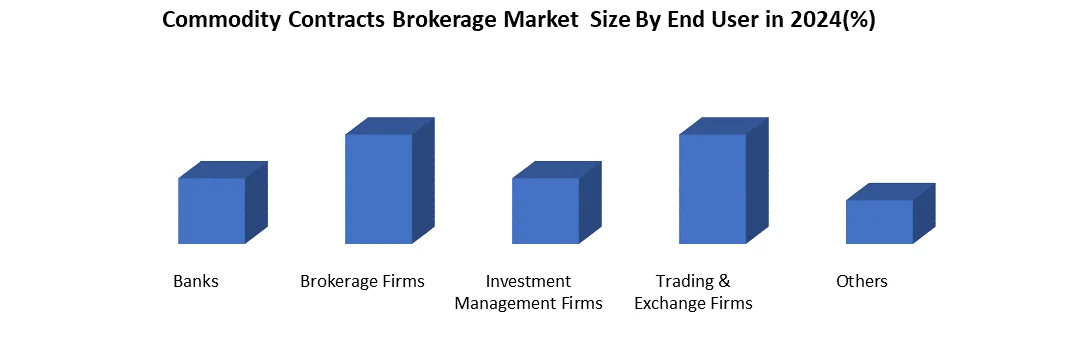

Based on End User, the Commodity Contracts Brokerage Market is segmented into Banks, Brokerage Firms, Investment Management Firms, Trading & Exchange Firms and Others. In this segment, Brokerage Firms dominated the market in 2024 and is expected to dominate in the forecast period. It holds 40-43% of share.The Commodity brokerage firms are the core facilitators in trading commodity contracts. They access the commodity exchanges directly, provide a platform to customers, and charge a commission on high-volume transactions.

Commodity Contracts Brokerage Market Regional Insights

North America dominated the Commodity Contracts Brokerage Market in 2024 due to the best Trading Platforms

The United States and North America, in a wider sense, hold prominent leadership positions in the global Commodity Contracts Brokerage Market with a market share of about 34%. The big players, such as TD Ameritrade, Charles Schwab, and Interactive Brokers have established their names as offering advanced trade platforms at cheaper prices, with good digital experiences. The U.S., too is favoured by its mature yet accommodating financial system, and the widespread use of cloud-based trading applications. All these then attracted a good number of individual and institutional investors. Also, this ability to react quickly to economic changes, such as those arising from global trade changes or changes in financial technologies, has kept it at the forefront.

Commodity Contracts Brokerage Market Competitive landscape

Interactive Brokers and Charles Schwab are two major players operating in the Commodity Contracts Brokerage Market worldwide, each with its own abilities. Interactive Brokers is recognised for its global presence and its robust electronic trading platform, which offers trading opportunities over a vast array of commodities and derivatives for institutional and active retail traders. The approach has been a focus on automation, ultra-low commissions, and top-tier access to maybe 150 markets around the world, appealing to the customers that might be technologically savvy and would not like to bear high brokerage fees. On the other side, Charles Schwab has built strength through a client focus, combining excellent educational tools, personalised advisory services, and a smooth trading process. With the acquisition of TD Ameritrade, Schwab brought more depth to its products as well as its technology infrastructure, positioning itself as a brokerage option among professional traders and casual investors alike. Together, these firms set the competitive environment in the country, constantly pushing innovations in their delivery of speed, accessibility, and value to their clients.

Key Developments in Commodity Contracts Brokerage Market

- June 3 2023; Banco BTG Pactual- Issued largest?ever Brazilian Agribusiness Receivables Certificates (CRAs), raising R$?3.5?billion via Engelhart commodities arm also launched USD account and international investment platform with access to U.S. equities ,by Q3 2023 (25% YoY growth).

- July 5 2023; Interactive Brokers- Launched trading on the Taiwan Stock Exchange

- November 27–28, 2024; Mirae Asset Securities- Completed acquisition of Indian broker Sharekhan (?3,000?crore), rebranding to Mirae Asset Sharekhan. Over 120 branches, ~3.1M clients.

- March 29, 2024;ICICI Securities- Shareholders approved delisting; to merge as wholly-owned ICICI Bank subsidiary.

- March 10, 2025; Saxo Bank- J.?Safra?Sarasin Group agreed to acquire 70% stake from Geely & Mandatum.

|

Commodity Contracts Brokerage Market |

|

|

Market Size in 2024 |

USD 578.76 Bn |

|

Market Size in 2032 |

USD 1,153.22 Bn |

|

CAGR (2025-2032) |

9.0% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Deployment Cloud On-Premises |

|

By Enterprise Size Large Enterprise Small Medium Enterprises (SMEs) |

|

|

By End User Banks Brokerage Firms Investment Management Firms Trading & Exchange Firms Others. |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, South Korea, India, Japan, Australia, Taiwan, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific region Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Commodity Contracts Brokerage Market

North America

- Charles Schwab – USA

- Interactive Brokers – USA

- TD Ameritrade – USA

- CME Group – USA

- Marex North America LLC – USA

- R.J. O'Brien & Associates – USA

- Grupo Bursátil Mexicano (GBM) – Mexico

Europe

- Saxo Bank – Denmark

- ADM Investor Services – UK

- Euronext – France

- Sucden Financial – UK

- Amalgamated Metal Trading Ltd. (AMT) – UK

Asia Pacific

- Nanhua Futures – China

- CITIC Futures Co., Ltd. – China

- Rakuten Securities – Japan

- Phillip Futures – Singapore

- KGI Securities – Taiwan

- Mirae Asset Securities – South Korea

- ICICI Securities – India

Middle East & Africa

- SICO (Bahrain) – Bahrain

- EFG Hermes – Egypt/UAE

- SAFEX (South African Futures Exchange) – South Africa

- Al Ramz Capital – UAE

- Mashreq Securities – UAE

South America

- XP Investimentos – Brazil

- Banco BTG Pactual – Brazil

- Banco de Valores – Argentina

- Itaú BBA – Brazil

Frequently Asked Questions

The segmentation of the Commodity Contracts Brokerage Market is By Deployment, By Enterprise Size and by end-user.

The market is expected to grow steadily, fueled by heightened commodity price volatility, increased demand for risk management tools, and the expansion of digital trading platforms.

North America, particularly the United States, is leading the market, accounting for a major share due to the presence of advanced trading infrastructure and established brokerage firms.

Leading players include Charles Schwab, Interactive Brokers, Saxo Bank, ADM Investor Services, and ICICI Securities, among others.

1. Global Commodity Contracts Brokerage Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Commodity Contracts Brokerage Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Global Commodity Contracts Brokerage Market: Dynamics

3.1. Global Commodity Contracts Brokerage Market Trends

3.2. Global Commodity Contracts Brokerage Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Global Commodity Contracts Brokerage Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Global Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

4.1.1. Cloud

4.1.2. On-Premises

4.2. Global Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

4.2.1. Large Enterprise

4.2.2. Small Medium Enterprises (SMEs)

4.3. Global Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

4.3.1. Banks

4.3.2. Brokerage Firms

4.3.3. Investment Management Firms

4.3.4. Trading & Exchange Firms

4.3.5. Others.

4.4. Global Commodity Contracts Brokerage Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Commodity Contracts Brokerage Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

5.1.1. Cloud

5.1.2. On-Premises

5.2. North America Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

5.2.1. Large Enterprise

5.2.2. Small Medium Enterprises (SMEs)

5.3. North America Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

5.3.1. Banks

5.3.2. Brokerage Firms

5.3.3. Investment Management Firms

5.3.4. Trading & Exchange Firms

5.3.5. Others.

5.4. North America Commodity Contracts Brokerage Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

5.4.1.1.1. Cloud

5.4.1.1.2. On-Premises

5.4.1.2. United States Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

5.4.1.2.1. Large Enterprise

5.4.1.2.2. Small Medium Enterprises (SMEs)

5.4.1.3. United States Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

5.4.1.3.1. Banks

5.4.1.3.2. Brokerage Firms

5.4.1.3.3. Investment Management Firms

5.4.1.3.4. Trading & Exchange Firms

5.4.1.3.5. Others.

5.4.2. Canada

5.4.2.1. Canada Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

5.4.2.1.1. Cloud

5.4.2.1.2. On-Premises

5.4.2.2. Canada Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

5.4.2.2.1. Large Enterprise

5.4.2.2.2. Small Medium Enterprises (SMEs)

5.4.2.3. Canada Commodity Contracts Brokerage Market Size and Forecast, End User(2024-2032)

5.4.2.3.1. Banks

5.4.2.3.2. Brokerage Firms

5.4.2.3.3. Investment Management Firms

5.4.2.3.4. Trading & Exchange Firms

5.4.2.3.5. Others.

5.4.3. Mexico

5.4.3.1. Mexico Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

5.4.3.1.1. Cloud

5.4.3.1.2. On-Premises

5.4.3.2. Mexico Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

5.4.3.2.1. Large Enterprise

5.4.3.2.2. Small Medium Enterprises (SMEs)

5.4.3.3. Mexico Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

5.4.3.3.1. Banks

5.4.3.3.2. Brokerage Firms

5.4.3.3.3. Investment Management Firms

5.4.3.3.4. Trading & Exchange Firms

5.4.3.3.5. Others.

6. Europe Commodity Contracts Brokerage Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.2. Europe Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.3. Europe Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4. Europe Commodity Contracts Brokerage Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.1.2. United Kingdom Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.1.3. United Kingdom Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.2. France

6.4.2.1. France Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.2.2. France Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.2.3. France Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.3. Germany

6.4.3.1. Germany Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.3.2. Germany Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.3.3. Germany Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.4. Italy

6.4.4.1. Italy Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.4.2. Italy Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.4.3. Italy Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.5. Spain

6.4.5.1. Spain Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.5.2. Spain Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.5.3. Spain Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.6.2. Sweden Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.6.3. Sweden Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.7. Russia

6.4.7.1. Russia Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.7.2. Russia Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.7.3. Russia Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

6.4.8.2. Rest of Europe Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

6.4.8.3. Rest of Europe Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7. Asia Pacific Commodity Contracts Brokerage Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.2. Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.3. Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4. Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.1.2. China Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.1.3. China Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.2.2. S Korea Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.2.3. S Korea Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.3. Japan

7.4.3.1. Japan Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.3.2. Japan Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.3.3. Japan Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.4. India

7.4.4.1. India Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.4.2. India Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.4.3. India Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.5. Australia

7.4.5.1. Australia Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.5.2. Australia Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

7.4.5.3. Australia Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.6.2. Indonesia Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

7.4.6.3. Indonesia Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.7.2. Malaysia Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

7.4.7.3. Malaysia Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.8.2. Philippines Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.8.3. Philippines Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.9.2. Thailand Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

7.4.9.3. Thailand Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.10.2. Vietnam Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.10.3. Vietnam Commodity Contracts Brokerage Market Size and Forecast, By End User( 2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

7.4.11.2. Rest of Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

7.4.11.3. Rest of Asia Pacific Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8. Middle East and Africa Commodity Contracts Brokerage Market Size and Forecast (by Value in USD Billion) (2024-2032

8.1. Middle East and Africa Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.2. Middle East and Africa Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

8.3. Middle East and Africa Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8.4. Middle East and Africa Commodity Contracts Brokerage Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.4.1.2. South Africa Commodity Contracts Brokerage Market Size and Forecast, By Enterprise Size(2024-2032)

8.4.1.3. South Africa Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8.4.2. GCC

8.4.2.1. GCC Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.4.2.2. GCC Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

8.4.2.3. GCC Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.4.3.2. Egypt Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

8.4.3.3. Egypt Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.4.4.2. Nigeria Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

8.4.4.3. Nigeria Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

8.4.5.2. Rest of ME&A Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

8.4.5.3. Rest of ME&A Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9. South America Commodity Contracts Brokerage Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.2. South America Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.3. South America Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9.4. South America Commodity Contracts Brokerage Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.4.1.2. Brazil Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.4.1.3. Brazil Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.4.2.2. Argentina Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.4.2.3. Argentina Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.4.3.2. Colombia Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.4.3.3. Colombia Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9.4.4. Chile

9.4.4.1. Chile Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.4.4.2. Chile Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.4.4.3. Chile Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest of South America Commodity Contracts Brokerage Market Size and Forecast, By Deployment(2024-2032)

9.4.5.2. Rest of South America Commodity Contracts Brokerage Market Size and Forecast, By Investment Type(2024-2032)

9.4.5.3. Rest Of South America Commodity Contracts Brokerage Market Size and Forecast, By End User(2024-2032)

10. Company Profile: Key Players

10.1.1. Charles Schwab

10.1.1.1. Overview

10.1.1.2. Business Portfolio

10.1.1.3. Financial Strategic Analysis

10.1.1.4. Recent Developments

10.1.2. Interactive Brokers

10.1.3. TD Ameritrade

10.1.4. CME Group

10.1.5. Marex North America LLC

10.1.6. R.J. O'Brien & Associates

10.1.7. Saxo Bank

10.1.8. ADM Investor Services

10.1.9. Euronext

10.1.10. Sucden Financial

10.1.11. Amalgamated Metal Trading Ltd. (AMT)

10.1.12. Nanhua Futures

10.1.13. CITIC Futures Co., Ltd

10.1.14. Rakuten Securities

10.1.15. Phillip Futures

10.1.16. KGI Securities

10.1.17. Mirae Asset Securities

10.1.18. ICICI Securities

10.1.19. SICO (Bahrain)

10.1.20. EFG Hermes

10.1.21. SAFEX (South African Futures Exchange

10.1.22. Al Ramz Capital

10.1.23. Mashreq Securities

10.1.24. XP Investimentos

10.1.25. Banco BTG Pactual

10.1.26. Grupo Bursátil Mexicano (GBM)

10.1.27. Banco de Valores

10.1.28. Itaú BBA

11. Key Findings & Analyst Recommendations

12. The Commodity Contracts Brokerage Market : Research Methodology