Collectibles Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2026–2032)

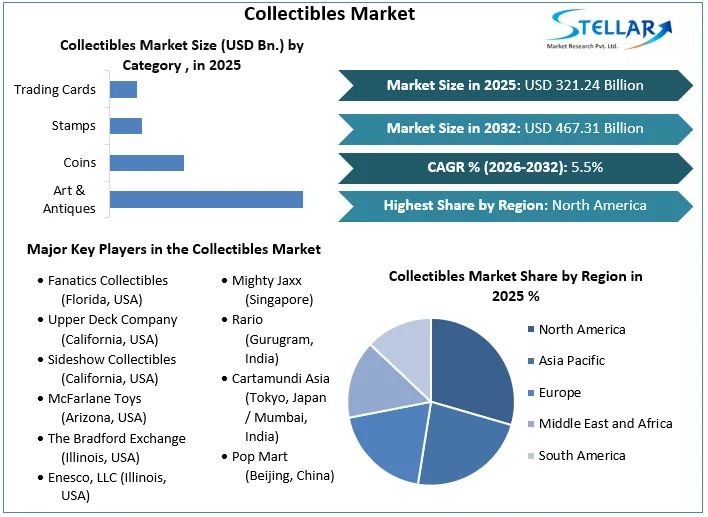

Collectibles Market was valued at USD 321.24 Bn in 2025. The total Collectibles Market revenue is expected to grow by CAGR 5.5% from 2026 to 2032 and reach nearly USD 467.31 Bn. in 2032.

Format : PDF | Report ID : SMR_2732

Collectibles Market Overview:

The collectibles market, covering various assets, such as art, rare books and sports memories, faces significant challenges in authentication, provenance tracking and liquidity. The collectible industry has experienced robust growth in revenue generation in recent years due to the on -line sales of antiques and collectibles worldwide. The significant increase in the global collectible market is attributed to the growing economic condition and emerging e -commerce platforms. In addition, accelerating the customer's available income encouraged them to spend more money on collectible items. This factor benefits the long -term expansion of the sector. In addition, collecting as a form of investment and digital sale of collectible items are the two new trends that positively shape the trajectory of the global collectible market.

The recommendation of financial consultants and experts, investors are investing 5% to 10% of their portfolio in collectibles Market. Increased investment in collectibles is driven by the assessment of capital, secure financial port and portfolio diversification. On the other hand, the trading of collectibles through digital platforms must witness significant growth. The sale of these luxurious items increased even after the appearance of the COVID-19 pandemic. The collectible market has undergone a significant and lasting change in the on -line channels for antique trade and other collectibles. In addition, growing popularity and growing awareness of people in relation to the digital sale of collectible items will further increase market growth during the forecast period.

Trade and tariffs significantly impact the global collectibles market by influencing the cost and movement of items across borders. Import duties on art, antiques, and other high-value collectibles raise prices for buyers, while customs regulations often require detailed documentation and compliance with cultural property laws. Some countries restrict the export of historically significant items, adding complexity to international transactions. However, free trade agreements can reduce tariffs in some regions. Meanwhile, the rise of digital collectibles like NFTs presents new opportunities by eliminating traditional trade barriers and simplifying global exchange.

To get more Insights: Request Free Sample Report

Collectibles Market Dynamics:

Nostalgia and emotional connection to boost the Collectibles Market growth

Nostalgia and emotional connection play a powerful role in conducting the collectible market, as consumers are often attracted to items that good memories and personal experiences of the past. This sentimental desire creates a profound emotional resonance, especially with objects associated with childhood, cultural moments or family traditions such as vintage toys, trading letters, comics or memories.

Collection of these items offers comfort, sense of identity and emotional stability, particularly in times of uncertainty. It also promotes social connections and a feeling of belonging to shared interests and communities. Psychologically, nostalgic collection serves as a form of escapism, allowing individuals to revisit happier times and reinforce their personal narratives. This emotional appeal makes collectibles more than just physical objects they become significant symbols of the past. Brands and companies capitalize this projecting retro style products, launching reminiscent marketing campaigns and launching limited editions that exploit these powerful feelings. As a result, nostalgia not only feeds the consumer's desire, but also improves customer loyalty, making it a cavity force behind the sustained growth and value of the collectibles market.

Digital Transformation is Significant Opportunity for boost Collectibles Market

Continuous shift to digital technology is to create new opportunities for creativity in the collectibles industry, especially in online authentication, virtual exhibitions and digital asset property. NFTs, which are exclusive digital assets stored on block chain platforms, have become popular as a new type of collectible, providing digital rarity and proven property.

By incorporating digital tools into traditional collection methods, it can make the collection more accessible, encourage community involvement, and attract a younger generation of collectors who feel comfortable with digital technology. Embracing digital transformation can position market participants to capitalise on consumer evolution preferences and market trends, boosting long-term creation and innovation in the global collectibles market.

Authenticity Verification and Trust highly impact Collectibles market growth

Ensuring the authenticity of collectible items and establishing confidence between buyers and sellers are continuous challenges in the collectible market. With the proliferation of online markets and the ease of digital reproduction, verifying the authenticity of rare or high value items is critical to maintain the integrity of the Collectibles Market. The implementation of robust authentication measures, such as third-party certification, more evident provenance documentation and packaging, helps to mitigate the risk of counterfeit products enter the market. Building confidence between collectors requires transparency, responsibility and adherence to ethical standards throughout the supply chain.

Collectibles market Segment Analysis:

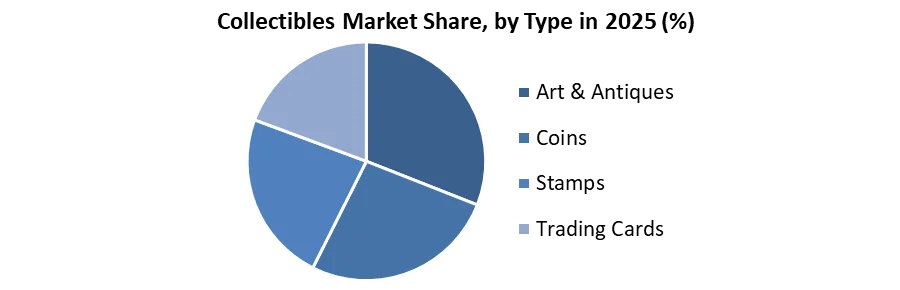

Based on Category the Collectibles Market is segmented into Art & antiques. Coins (Numismatics), Stamp and Trading cards. Art & Antiques dominated the market in 2025 and is expected to hold the largest market share over the forecast period. The emergence of global auction platforms and on-line markets have greatly expanded access to these precious items, providing them to a more diverse audience. There is also a growing desire among individuals to customise their decoration with different items, which further drives the demand for such unique art effects.

On the other hand, it is expected that the toys and action figures segment experience the fastest growth rate. The Attractiveness of limited edition launches and exclusive variants generates a high sense of urgency among collectors, forcing them to act quickly to secure sought items. In addition, the widespread influence of pop culture and media, especially with the launch of new movies and series with beloved characters, significantly increases the demand for these collectibles items.

Based on Type the Collectibles Market is segmented into Ancient, Vintage, Modern and Contemporary. Vintage Collectibles segments dominate the market in 2025 and is expected to hold the largest share during the forecast period. Many collectors run with the desire to live or maintain favourite memories associated with the previous decades. Some rare vintage collectors, especially demand, is dramatically appreciated in value, making them an opportunity for amazing investment for sensible collectors. Market has simplified the process of finding, purchasing and selling vintage items for enthusiasts in the nail markets and the auction platforms, expanding the market.

Based on Region, North America dominated the Market in 2025 and is expected to hold largest share over the forecast period. This sector benefits from a strong economy together with a high disposable income level, which allows a large number of individuals to invest in valuable collectors, whether it is rare sports cards, fine art or other high-value substances. Comic-con, various sports events, and events such as leading music festivals in North America, stimulate interest and connection in the collections community.

Collectibles Market Competitive Landscape:

The Collectibles Industry is highly dynamic and fragmented, featuring a mix of traditional players, digital disruptors, niche specialists and global markets. On -Line platforms such as eBay, Etsy, Amazon and Stock dominate mainstream, offering vast range in categories such as toys, negotiating cards, comics and vintage memories. Meanwhile, specialized retailers and classification services such as Funko, Comic connect, PSA and CGC serve enthusiasts with authenticated and curated offers. The rise of digital transformation has introduced a new wave of competition through NFT platforms such as Opensea, NBA Top Shot, Rail and Sorare, which leverage block chain technology to ensure scarcity, provenance and property of digital collectibles. Luxury auction houses such as Sotheby's, Christie and Phillips have also entered the market, dealing with state of the art, rare physical items and exclusive NFTs. The main strategies in this competitive environment include authentication services, limited edition launches, gamification, community involvement and brands collaborations.

|

Global Collectibles Market Scope Table |

|

|

Market Size in 2025 |

USD 321.24 Bn. |

|

Market Size in 2032 |

USD 467.31 Bn. |

|

CAGR (2026-2032) |

5.5% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Category Art & Antiques Coins Stamps Trading Cards |

|

By Type Ancient Vintage Modern Contemporary Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Collectibles Market:

North America

- Fanatics Collectibles (Florida, USA)

- Upper Deck Company (California, USA)

- Sideshow Collectibles (California, USA)

- McFarlane Toys (Arizona, USA)

- The Bradford Exchange (Illinois, USA)

- Enesco, LLC (Illinois, USA)

Asia Pacific

- Mighty Jaxx (Singapore)

- Rario (Gurugram, India)

- Cartamundi Asia (Tokyo, Japan / Mumbai, India)

- Pop Mart (Beijing, China)

- Bandai Namco (Tokyo, Japan)

- Hot Toys (Hong Kong)

Europe

- Cartamundi (Turnhout, Belgium)

- Panini Group (Modena, Italy)

- Topps Europe Ltd. (Milton Keynes, UK)

- Corgi Toys (Leicester, UK)

- Schleich (Schwäbisch Gmünd, Germany)

- Playmobil (Zirndorf, Germany)

Middle East

- Mouawad (Dubai, UAE)

- Ahmed Seddiqi & Sons (Dubai, UAE)

- Damas Jewellery (Dubai, UAE)

- Pharaonic Village Souvenirs (Cairo, Egypt)

- Mesopotamia Treasures (Baghdad, Iraq)

- Persian Artifacts (Tehran, Iran)

South America

- Iron Studios (São Paulo, Brazil)

- Mini Co (São Paulo, Brazil)

- Estrela (São Paulo, Brazil)

- Toy Show (Buenos Aires, Argentina)

- Coleccionables La Nación (Buenos Aires, Argentina)

- Planeta De Agostini (São Paulo, Brazil)

Frequently Asked Questions

Online Sales, disposable income, form of investment, e-commerce platform and nostalgia are the factors which are driving the growth of Collectibles Market.

Art and Antique segment dominated the market and Toys and Action figures are expected to fastest growth during the forecast period.

Online authentication and Virtual exhibition creating the new opportunities in the Collectibles market.

The collectibles market faces challenges such as the risk of counterfeit products due to digital reproduction due to Authenticity and Consumer Trust.

1. Collectibles Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Collectibles Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2025)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Collectibles Market: Dynamics

3.1. Collectibles Market Trends by Region

3.1.1. North America Collectibles Market Trends

3.1.2. Europe Collectibles Market Trends

3.1.3. Asia Pacific Collectibles Market Trends

3.1.4. Middle East and Africa Collectibles Market Trends

3.1.5. South America Collectibles Market Trends

3.2. Collectibles Market Dynamics

3.2.1. Global Collectibles Market Drivers

3.2.2. Global Collectibles Market Restraints

3.2.3. Global Collectibles Market Opportunities

3.2.4. Global Collectibles Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Industry

4. Collectibles Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

4.1. Collectibles Market Size and Forecast, By Category (2025-2032)

4.1.1. Art & Antiques

4.1.2. Coins

4.1.3. Stamps

4.1.4. Trading Cards

4.2. Collectibles Market Size and Forecast, By Type (2025-2032)

4.2.1. Ancient

4.2.2. Vintage

4.2.3. Modern

4.2.4. Contemporary

4.2.5. Others

4.3. Collectibles Market Size and Forecast, by Region (2025-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Collectibles Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

5.1. North America Collectibles Market Size and Forecast, By Category (2025-2032)

5.1.1. Art & Antiques

5.1.2. Coins

5.1.3. Stamps

5.1.4. Trading Cards

5.2. North America Collectibles Market Size and Forecast, By Type (2025-2032)

5.2.1. Ancient

5.2.2. Vintage

5.2.3. Modern

5.2.4. Contemporary

5.2.5. Others

5.3. North America Collectibles Market Size and Forecast, by Country (2025-2032)

5.3.1. United States

5.3.1.1. United States Collectibles Market Size and Forecast, By Category (2025-2032)

5.3.1.1.1. Art & Antiques

5.3.1.1.2. Coins

5.3.1.1.3. Stamps

5.3.1.1.4. Trading Cards

5.3.1.2. United States Collectibles Market Size and Forecast, By Type (2025-2032)

5.3.1.2.1. Ancient

5.3.1.2.2. Vintage

5.3.1.2.3. Modern

5.3.1.2.4. Contemporary

5.3.1.2.5. Others

5.3.2. Canada

5.3.2.1. Canada Collectibles Market Size and Forecast, By Category (2025-2032)

5.3.2.1.1. Art & Antiques

5.3.2.1.2. Coins

5.3.2.1.3. Stamps

5.3.2.1.4. Trading Cards

5.3.2.2. Canada Collectibles Market Size and Forecast, By Type (2025-2032)

5.3.2.2.1. Ancient

5.3.2.2.2. Vintage

5.3.2.2.3. Modern

5.3.2.2.4. Contemporary

5.3.2.2.5. Others

5.3.3. Mexico

5.3.3.1. Mexico Collectibles Market Size and Forecast, By Category (2025-2032)

5.3.3.1.1. Art & Antiques

5.3.3.1.2. Coins

5.3.3.1.3. Stamps

5.3.3.1.4. Trading Cards

5.3.3.2. Mexico Collectibles Market Size and Forecast, By Type (2025-2032)

5.3.3.2.1. Ancient

5.3.3.2.2. Vintage

5.3.3.2.3. Modern

5.3.3.2.4. Contemporary

5.3.3.2.5. Others

6. Europe Collectibles Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

6.1. Europe Collectibles Market Size and Forecast, By Category (2025-2032)

6.2. Europe Collectibles Market Size and Forecast, By Type (2025-2032)

6.3. Europe Collectibles Market Size and Forecast, By region (2025-2032)

6.4. Europe Collectibles Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.1.2. United Kingdom Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.2. France

6.4.2.1. France Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.2.2. France Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.3.2. Germany Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.4.2. Italy Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.5.2. Spain Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.6.2. Sweden Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.7.2. Austria Collectibles Market Size and Forecast, By Type (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Collectibles Market Size and Forecast, By Category (2025-2032)

6.4.8.2. Rest of Europe Collectibles Market Size and Forecast, By Type (2025-2032)

7. Asia Pacific Collectibles Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

7.1. Asia Pacific Collectibles Market Size and Forecast, By Category (2025-2032)

7.2. Asia Pacific Collectibles Market Size and Forecast, By Type (2025-2032)

7.3. Asia Pacific Collectibles Market Size and Forecast, By region (2025-2032)

7.4. Asia Pacific Collectibles Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.1.2. China Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.2.2. S Korea Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.3.2. Japan Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.4. India

7.4.4.1. India Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.4.2. India Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.5.2. Australia Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.6.2. Indonesia Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.7.2. Philippines Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.8.2. Malaysia Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.9.2. Vietnam Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.10. Taiwan

7.4.10.1. Taiwan Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.10.2. Taiwan Collectibles Market Size and Forecast, By Type (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Collectibles Market Size and Forecast, By Category (2025-2032)

7.4.11.2. Rest of Asia Pacific Collectibles Market Size and Forecast, By Type (2025-2032)

8. Middle East and Africa Collectibles Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

8.1. Middle East and Africa Collectibles Market Size and Forecast, By Category (2025-2032)

8.2. Middle East and Africa Collectibles Market Size and Forecast, By Type (2025-2032)

8.3. Middle East and Africa Collectibles Market Size and Forecast, By region (2025-2032)

8.4. Middle East and Africa Collectibles Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Collectibles Market Size and Forecast, By Category (2025-2032)

8.4.1.2. South Africa Collectibles Market Size and Forecast, By Type (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Collectibles Market Size and Forecast, By Category (2025-2032)

8.4.2.2. GCC Collectibles Market Size and Forecast, By Type (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Collectibles Market Size and Forecast, By Category (2025-2032)

8.4.3.2. Nigeria Collectibles Market Size and Forecast, By Type (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Collectibles Market Size and Forecast, By Category (2025-2032)

8.4.4.2. Rest of ME&A Collectibles Market Size and Forecast, By Type (2025-2032)

9. South America Collectibles Market Size and Forecast by Segmentation (by Value in USD Bn.) (2025-2032)

9.1. South America Collectibles Market Size and Forecast, By Category (2025-2032)

9.2. South America Collectibles Market Size and Forecast, By Type (2025-2032)

9.3. South America Collectibles Market Size and Forecast, By region (2025-2032)

9.4. South America Collectibles Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Collectibles Market Size and Forecast, By Category (2025-2032)

9.4.1.2. Brazil Collectibles Market Size and Forecast, By Type (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Collectibles Market Size and Forecast, By Category (2025-2032)

9.4.2.2. Argentina Collectibles Market Size and Forecast, By Type (2025-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Collectibles Market Size and Forecast, By Category (2025-2032)

9.4.3.2. Rest of South America Collectibles Market Size and Forecast, By Type (2025-2032)

10. Company Profile: Key Player

10.1. Fanatics Collectibles (Florida, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Upper Deck Company (California, USA)

10.3. Sideshow Collectibles (California, USA)

10.4. McFarlane Toys (Arizona, USA)

10.5. The Bradford Exchange (Illinois, USA)

10.6. Enesco, LLC (Illinois, USA)

10.7. Mighty Jaxx (Singapore)

10.8. Rario (Gurugram, India)

10.9. Cartamundi Asia (Tokyo, Japan / Mumbai, India)

10.10. Pop Mart (Beijing, China)

10.11. Bandai Namco (Tokyo, Japan)

10.12. Hot Toys (Hong Kong)

10.13. Cartamundi (Turnhout, Belgium)

10.14. Panini Group (Modena, Italy)

10.15. Topps Europe Ltd. (Milton Keynes, UK)

10.16. Corgi Toys (Leicester, UK)

10.17. Schleich (Schwäbisch Gmünd, Germany)

10.18. Playmobil (Zirndorf, Germany)

10.19. Mouawad (Dubai, UAE)

10.20. Ahmed Seddiqi & Sons (Dubai, UAE)

10.21. Damas Jewellery (Dubai, UAE)

10.22. Pharaonic Village Souvenirs (Cairo, Egypt)

10.23. Mesopotamia Treasures (Baghdad, Iraq)

10.24. Persian Artifacts (Tehran, Iran)

10.25. Iron Studios (São Paulo, Brazil)

10.26. MiniCo (São Paulo, Brazil)

10.27. Estrela (São Paulo, Brazil)

10.28. ToyShow (Buenos Aires, Argentina)

10.29. Coleccionables La Nación (Buenos Aires, Argentina)

10.30. Planeta DeAgostini (São Paulo, Brazil)

11. Key Findings

12. Analyst Recommendations

13. Collectibles Market: Research Methodology