Embedded Non-Volatile Memory Market: Innovation, Application and Market Dynamics

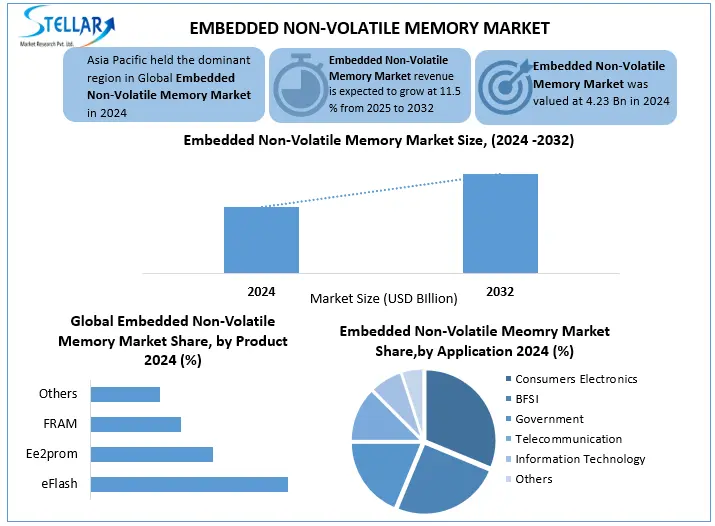

The Embedded non-volatile Market was valued at approximately USD 4.23 Bn in 2024. It is projected to reach around USD 10.11 Bn by 2032, exhibiting a CAGR of 11.5% during the forecast period 2025-2032.

Format : PDF | Report ID : SMR_2837

Embedded Non-Volatile Memory Market Overview

Embedded Non-Volatile Memories are special types of memory made directly into a computer chip. Unlike regular memory, which loses data when the power is closed, it also keeps its data without electricity. It can be removed several times and rewritten. Because it’s made correctly in the chip, it uses low power and works faster than external memory options. It is used to store important things like program instructions, settings, safety keys, updates, and adjustments for the chip.

Next-gen STT-MRAM and ReRAM enable faster speeds, infinite endurance, and sub-28nm scaling. In-memory computing and neuromorphic designs are unlocking AI/ML potential, while 3D stacking boosts density for automotive/edge devices. These advances address critical needs for low-power, high-performance memory.

The Embedded Non-Volatile Memory Market is rapidly expanding, due to IoT, 5G, and automotive electrification. The consumer leads to adoption due to mass demand for electronics smartphones and smart home equipment. Automotive applications, especially EV and ADAS systems, show the fastest growth. TSMC, Samsung and SMIC dominate Asia-Pacific production with leading construction.

Recent U.S. technology export bans and China's raw material restrictions have disrupted eNVM supply chains, causing price volatility. Tariffs (up to 25%) and localization incentives under the CHIPS Act are forcing manufacturers to diversify production to India/Southeast Asia. These trade barriers may fragment the market, impacting the automotive and IoT sectors most.

To get more Insights: Request Free Sample Report

Embedded Non-Volatile Memory Market Dynamics

Increased integration of electronics in automobiles to Drive the Embedded Non-Volatile Memory Market

Embedded non-volatile memory market is greatly increasing the demand for electronic automobiles. The advanced electronic systems for tasks such as infotainment, advanced driver-assistance systems (ADAS), engine control, and connectivity depend on Modern vehicles. These systems require memory solutions that are not only reliable but are also hard enough to work well in extreme conditions such as high temperature, vibration, or electric fluctuations. Such as excessive temperature, vibration, and electrical ups and downs. It is well suited to these demanding environments due to its durability, non-vaporing, and ability to maintain data without electricity. This ensures important data, such as firmware, configuration settings, and security-related information, is also intact in challenging scenarios.

Additionally, the reprogramming ability allows for over-the-air updates, enabling automakers to increase vehicle performance and security without physical hardware changes. Since the automotive industry develops towards electric and autonomous vehicles, the need for strong and efficient memory solutions such as ENVMs will only increase, making it an important originator of the next generation of automotive electronics.

The Impact of Trade Bans on Semiconductor Memory Innovation to Restrain the Embedded Non-Volatile Memory Market

Geophysical stress between the US and China has severely disrupted Embedded Non-Volatile Memories supply chains through trade restrictions and export controls. American restrictions on semiconductor devices have hampered the ability of SMICs to proceed from 55 nm eFlash production using domestic options. These boundaries force Chinese manufacturers to focus on mature nodes for motor vehicle and industrial applications. The trade war has accelerated China's push for a large-scale government subsidy for a semiconductor self-sufficiency.

Global OEMs face supply chain uncertainties because they bring diversity in production for Southeast Asia and India. The restrictions are fragmented the embedded non-volatile memory market between the U.S.-based and Chinese technical ecosystems. Companies should now balance technical competition with flexible supply strategies in this new regulatory scenario. These developments are re-shaping global Embedded Non-Volatile Memories production and innovation routes.

Advancing EV Safety with ReRAM-Based Battery Monitoring to Boost the Embedded Non-Volatile Memory Market

Embedded Non-Volatile Memory Market is important for EV battery management systems (BMS), which enables real-time logging of voltage, temperature and charge cycles. The ReRAM of Infineon stands with rapid writing, low power and high endurance are ideal for continuous BMS data recording. Unlike traditional eFlash, ReRAM handles continuous updates without degradation. EV battery is important for safety. Its 40 nm+ compatibility motor vehicle allows compact BMS integration while understanding the harsh conditions.

As the EVS demands smart battery analytics, to balance of the speed, reliability and energy efficiency makes it a major option. Technology supports future maintenance by securing historical battery performance data safely. With the automakers that prefer battery longevity, ReRAM-based eNVM Next-generation is becoming an important environment for BMS architecture.

Application in Embedded Non-Volatile Memory in Modern Electronics

|

Sr. No. |

Application areas |

Details |

|

1 |

Consumer Electronics |

Allow device customization on TV, smartphones, etc. |

|

2 |

Automotive |

Storing the calibration of engine control units |

|

3 |

Industrial automation |

Storing encryption keys in PLC, robot controller, etc |

Embedded Non-volatile Memory Market Segment Analysis

Based on Product Type, the embedded non-volatile memory market provides different types of products such as eFlash, eE2PROM, FRAM, and Others. eFlash leads the Embedded Non-Volatile Memory (eNVM) market due to its high density, scalability, and cost-effectiveness in mass production. It dominates automotive and IoT applications, offering reliable storage for MCUs and SoCs. While eE2PROM is used in low-cost devices, its slower speeds limit its adoption. FRAM excels in write endurance but remains niche due to higher costs. Emerging memories like RRAM/MRAM show potential but face yield and scalability challenges. With strong demand from AI and smart devices, eFlash remains the top choice, though alternatives may grow as technology advances.

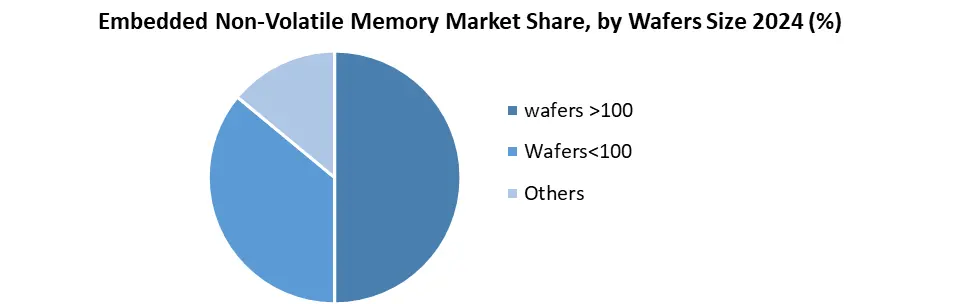

Based on Wafer Size, the embedded non-volatile memory market is divided into <100 mm, and >100 mm. Wafers size >100 mm are the most popular, the >100mm wafer segment dominates the embedded non-volatile memory market due to better cost efficiency and production scalability. Modern fabs mainly use 200 mm and 300 mm wafers for high-volume manufacturing of advanced eNVM solutions such as eFlash and MRAM. Large wafers are important for better dying yields and low per unit cost, consumer electronics and motor vehicle applications. They also support the small procedure nodes (28nm and below). While <100 mm wafers serve top applications such as Legacy EPROMs, their limited production scale keeps them marginal. The industry's focus on cost optimization and miniaturization ensures continued dominance of >100mm wafers in eNVM manufacturing.

Based on Application, the embedded non-volatile memory market is divided into BFSI, government, consumer electronics, telecommunication, information technology, and others. The consumer electronics dominate the embedded non-volatile memory market, due to large-scale demand from smartphones, wearbals and IOT devices. This area depends a lot on firmware storage and low-power operation, high density efficient ??eFlash memory. Emerging smart home gadgets and AI-powered devices further boost adoption. While automotive (ADAS/infotainment) and industrial applications show rapid growth, they can't match consumer electronics' volume. Niche segments like BFSI and government use specialized secure memory but have limited market share. With continuous IoT expansion and 5G adoption, consumer electronics will maintain leadership in eNVM applications for foreseeable future.

Embedded Non-Volatile Memory Market Regional Analysis

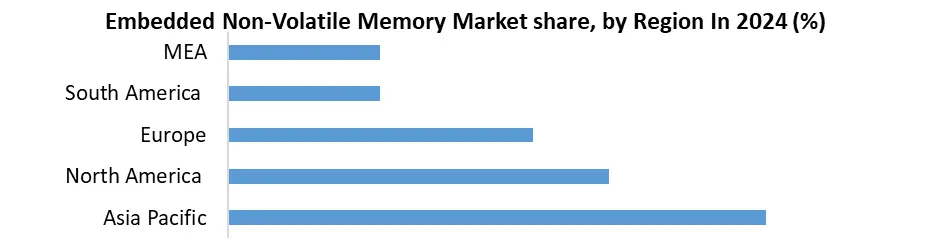

Asia-Pacific is dominating region in embedded non-volatile memory market (eNVM), mainly due to its strong semiconductor manufacturing ecosystem, high demand for consumer and motor vehicle electronics and strong government support for chip production. The APAC TSMC (Taiwan), Samsung (South Korea), and SK Hynix (South Korea) are giant companies, which run innovation and large-scale production of eNVM technologies such as flash, MRAM and RRAM. Additionally, the rapid development of IoT, AI and Electric vehicles (EVS) in countries such as China, Japan and South Korea fuel demands embedded memory solutions. Government initiatives such as China's "Made in China 2025" and heavy investment in advanced memory technologies further strengthen the market leadership of APAC. While North America and Europe excel in R&D, they have large-scale lack of construction capacity that APAC has, making the region an undisputed leader in the global embedded non-volatile memory market.

Embedded Non-Volatile Memory Market Competitive Landscape

The eNVM market is dominated by TSMC (eFlash), Samsung (MRAM), and GlobalFoundries (low-power solutions), leveraging advanced nodes and manufacturing scale. Microchip and Infineon lead niche segments (FRAM/ReRAM) with high-reliability offerings. Recent advances include Samsung's 14nm MRAM and TSMC's 40nm ReRAM, while startups like CrossBar challenge incumbents. Geopolitical tensions and U.S.-China restrictions are accelerating regional supply chains and innovation in AI/edge computing applications.

Samsung’s 14nm eMRAM Mass Production (2024)

- Samsung began volume production of 14nm embedded MRAM for automotive MCUs and AI edge devices, offering 10x faster write speeds than eFlash with near-infinite endurance.

|

Embedded Non-volatile Memory Market Scope |

|

|

Market Size in 2024 |

USD 4.23 Bn. |

|

Market Size in 2032 |

USD 10.11 Bn. |

|

CAGR (2025-2032) |

11.5 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Types eFlash eE2PROM FRAM Others |

|

By Wafer Size <100 mm >100 mm |

|

|

By Application BFSI Government Consumer Electronics Telecommunication Information Technology Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Embedded Non-Volatile Memory Market

North America

- Intel Corporation (USA)

- Micron Technology (USA)

- Microchip Technology (USA)

- Texas Instruments (USA)

- GlobalFoundries (USA)

- Crossbar Inc. (USA)

Europe

- Infineon Technologies (Germany)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- CEA-Leti (France)

Asia-Pacific

- TSMC (Taiwan)

- Samsung Electronics (South Korea)

- SK Hynix (South Korea)

- Renesas Electronics (Japan)

- Kioxia (Japan)

- SMIC (China)

- Yangtze Memory Technologies (China)

- GigaDevice Semiconductor (China)

- United Microelectronics Corporation (Singapore)

- Tata Electronics (India)

Middle East & Africa

- Tower Semiconductor (Israel)

- G42 (UAE)

Frequently Asked Questions

Asia Pacific is the fastest-growing market for Embedded Non-Volatile Memory.

The major products are eflash (automotive, electronics), eE2PROM (wearables, IOT), FRAM (Fast Rights), and MRAM (high endurance).

BFSI (Safe Data), Consumer Electronics (IOT), Government (Defense), Telecom (5G), IT (data centers), healthcare, automotive and industrial automation.

Prominent players include Samsung (South Korea), TSMC (Taiwan), and SK Hynix (South Korea).

1. Embedded Non-Volatile Memory Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Embedded Non-Volatile Memory Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Embedded Non-Volatile Memory Market: Dynamics

3.1. Embedded Non-Volatile Memory Market Trends

3.2. Embedded Non-Volatile Memory Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Embedded Non-Volatile Memory Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2025-2032)

4.1. Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

4.1.1. eFlash

4.1.2. eE2PROM

4.1.3. FRAM

4.1.4. Others

4.2. Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

4.2.1. <100 mm

4.2.2. >100 mm

4.3. Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

4.3.1. BFSI

4.3.2. Government

4.3.3. Consumer Electronics

4.3.4. Telecommunication

4.3.5. Information Technology

4.3.6. Others

4.4. Embedded Non-Volatile Memory Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Embedded Non-Volatile Memory Market Size and Forecast by Segmentation (by Value in USD Bn) (2025-2032)

5.1. North America Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

5.1.1. eFlash

5.1.2. eE2PROM

5.1.3. FRAM

5.1.4. Others

5.2. North America Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

5.2.1. <100 mm

5.2.2. >100 mm

5.3. North America Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

5.3.1. BFSI

5.3.2. Government

5.3.3. Consumer Electronics

5.3.4. Telecommunication

5.3.5. Information Technology

5.3.6. Others

5.4. North America Embedded Non-Volatile Memory Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

5.4.1.1.1. eFlash

5.4.1.1.2. eE2PROM

5.4.1.1.3. FRAM

5.4.1.1.4. Others

5.4.1.2. United States Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

5.4.1.2.1. <100 mm

5.4.1.2.2. >100 mm

5.4.1.3. United States Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

5.4.1.3.1. BFSI

5.4.1.3.2. Government

5.4.1.3.3. Consumer Electronics

5.4.1.3.4. Telecommunication

5.4.1.3.5. Information Technology

5.4.1.3.6. Others

5.4.2. Canada

5.4.2.1. Canada Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

5.4.2.1.1. eFlash

5.4.2.1.2. eE2PROM

5.4.2.1.3. FRAM

5.4.2.1.4. Others

5.4.2.2. Canada Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

5.4.2.2.1. <100 mm

5.4.2.2.2. >100 mm

5.4.2.3. Canada Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

5.4.2.3.1. BFSI

5.4.2.3.2. Government

5.4.2.3.3. Consumer Electronics

5.4.2.3.4. Telecommunication

5.4.2.3.5. Information Technology

5.4.2.3.6. Others

5.4.3. Mexico

5.4.3.1. Mexico Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

5.4.3.1.1. eFlash

5.4.3.1.2. eE2PROM

5.4.3.1.3. FRAM

5.4.3.1.4. Others

5.4.3.2. Mexico Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

5.4.3.2.1. <100 mm

5.4.3.2.2. >100 mm

5.4.3.3. Mexico Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

5.4.3.3.1. BFSI

5.4.3.3.2. Government

5.4.3.3.3. Consumer Electronics

5.4.3.3.4. Telecommunication

5.4.3.3.5. Information Technology

5.4.3.3.6. Others

6. Europe Embedded Non-Volatile Memory Market Size and Forecast by Segmentation (by Value in USD Bn) (2025-2032)

6.1. Europe Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.2. Europe Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.3. Europe Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4. Europe Embedded Non-Volatile Memory Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.1.2. United Kingdom Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.1.3. United Kingdom Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.2. France

6.4.2.1. France Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.2.2. France Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.2.3. France Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.3.2. Germany Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.3.3. Germany Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.4.2. Italy Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.4.3. Italy Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.5.2. Spain Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.5.3. Spain Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.6.2. Sweden Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.6.3. Sweden Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.7. Russia

6.4.7.1. Russia Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.7.2. Russia Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.7.3. Russia Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

6.4.8.2. Rest of Europe Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

6.4.8.3. Rest of Europe Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7. Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast by Segmentation (by Value in USD Bn) (2025-2032)

7.1. Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.2. Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.3. Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4. Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.1.2. China Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.1.3. China Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.2.2. S Korea Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.2.3. S Korea Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.3.2. Japan Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.3.3. Japan Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.4. India

7.4.4.1. India Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.4.2. India Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.4.3. India Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.5.2. Australia Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.5.3. Australia Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.6.2. Indonesia Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.6.3. Indonesia Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.7.2. Malaysia Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.7.3. Malaysia Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.8. Philippines

7.4.8.1. Philippines Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.8.2. Philippines Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.8.3. Philippines Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.9. Thailand

7.4.9.1. Thailand Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.9.2. Thailand Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.9.3. Thailand Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.10.2. Vietnam Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.10.3. Vietnam Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

7.4.11.2. Rest of Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

7.4.11.3. Rest of Asia Pacific Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8. Middle East and Africa Embedded Non-Volatile Memory Market Size and Forecast (by Value in USD Bn) (2024-2032

8.1. Middle East and Africa Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.2. Middle East and Africa Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.3. Middle East and Africa Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8.4. Middle East and Africa Embedded Non-Volatile Memory Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.4.1.2. South Africa Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.4.1.3. South Africa Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.4.2.2. GCC Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.4.2.3. GCC Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8.4.3. Egypt

8.4.3.1. Egypt Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.4.3.2. Egypt Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.4.3.3. Egypt Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.4.4.2. Nigeria Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.4.4.3. Nigeria Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

8.4.5.2. Rest of ME&A Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

8.4.5.3. Rest of ME&A Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9. South America Embedded Non-Volatile Memory Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032

9.1. South America Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.2. South America Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.3. South America Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9.4. South America Embedded Non-Volatile Memory Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.4.1.2. Brazil Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.4.1.3. Brazil Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.4.2.2. Argentina Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.4.2.3. Argentina Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9.4.3. Colombia

9.4.3.1. Colombia Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.4.3.2. Colombia Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.4.3.3. Colombia Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9.4.4. Chile

9.4.4.1. Chile Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.4.4.2. Chile Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.4.4.3. Chile Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Embedded Non-Volatile Memory Market Size and Forecast, By Product Type (2025-2032)

9.4.5.2. Rest Of South America Embedded Non-Volatile Memory Market Size and Forecast, By Wafer Size (2025-2032)

9.4.5.3. Rest Of South America Embedded Non-Volatile Memory Market Size and Forecast, By Application (2025-2032)

10. Company Profile: Key Players

10.1. TSMC (Taiwan)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Intel Corporation (USA)

10.3. Micron Technology (USA)

10.4. Microchip Technology (USA)

10.5. Texas Instruments (USA)

10.6. GlobalFoundries (USA)

10.7. Crossbar Inc. (USA)

10.8. Infineon Technologies (Germany)

10.9. NXP Semiconductors (Netherlands)

10.10. STMicroelectronics (Switzerland)

10.11. CEA-Leti (France)

10.12. Samsung Electronics (South Korea)

10.13. SK Hynix (South Korea)

10.14. Renesas Electronics (Japan)

10.15. Kioxia (Japan)

10.16. SMIC (China)

10.17. Yangtze Memory Technologies (China)

10.18. GigaDevice Semiconductor (China)

10.19. United Microelectronics Corporation (Singapore)

10.20. Tata Electronics (India)

10.21. Tower Semiconductor (Israel)

10.22. G42 (UAE)

10.23. CEITEC (Brazil)

11. Key Findings

12. Industry Recommendations

13. Embedded Non-Volatile Memory Market: Research Methodology