High Electron Mobility Transistor Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

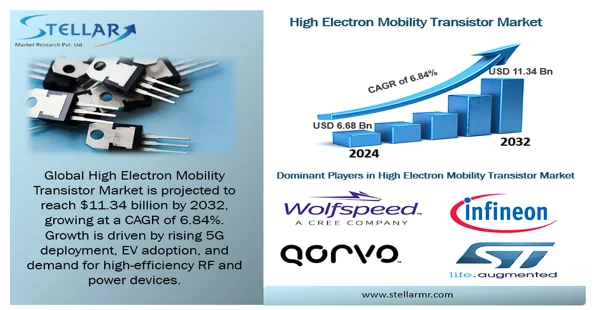

High Electron Mobility Transistors Market size was valued at USD 6.68 Billion in 2024 and the total High Electron Mobility Transistors revenue is expected reaching nearly USD 11.34 Billion by 2032 at 6.84% CAGR

Format : PDF | Report ID : SMR_2776

High Electron Mobility Transistors Market Overview:

High-electron-mobility transistors (HEMTs) are field-effect transistors using a heterojunction of materials with different band gaps. HEMTs deliver superior performance in high-frequency applications, thanks to their high gain and low noise features. These devices are invented using advanced epitaxial growth techniques, with exactly engineered layer structures that minimize defects. As a result, HEMTs allow the development of faster, more compact, and energy-efficient semiconductors. Their special capabilities make them ideal for use in imaging technologies, communication systems, and power switching applications.

According to SMR report, The Global High Electron Mobility Transistor Market Size is expected to reach USD 6.84 Billion by 2032, at a CAGR of 6.84% during the forecast period 2025 to 2032. This growth is driven by innovations in semiconductor fabrication and increasing investments in compound semiconductor technologies.

Technological Landscape of the High Electron Mobility Transistor Market:

The High Electron Mobility Transistor Market is experiencing rapid growth, fuelled by continuous technological developments that are transforming key sectors for instance automotive, telecommunications, and aerospace. At the core of this evolution is the drive to develop faster, more energy-efficient, and highly reliable electronic components.

A major innovation reshaping the High Electron Mobility Transistor Market is the incorporation of Gallium Nitride (GaN) technology. GaN-based HEMTs allow significantly higher power densities, superior thermal performance, and extended operational frequencies when compared to traditional silicon-based transistors. These features make them very well-suited for cutting-edge applications, including 5G infrastructure, satellite communication systems, and advanced radar technologies.

To get more Insights: Request Free Sample Report

Advancements in fabrication technologies like Metal-Organic Chemical Vapor Deposition (MOCVD) and Molecular Beam Epitaxy (MBE) are enabling precise control over material composition and interface quality. These techniques boost electron mobility and reduce power loss by forming enhanced heterostructures. As demand for high-speed and high-efficiency electronic solutions continues to increase, innovations in materials and manufacturing processes will remain pivotal to the growth of the High Electron Mobility Transistor Market globally.

Recent Developments in High Electron Mobility Transistor Market:

Leading companies in high electron mobility transistor market were focusing on research and development to innovate new products or improve existing ones. This could involve developing High Electron Mobility Transistor derivatives with enhanced properties or applications to cater to specific industry needs.

|

Year |

Description |

|

In June 2024 |

South Korean company SK Keyfoundry advanced its 650V GaN HEMT technology, offering superior thermal efficiency and signal control, setting a new standard for radar and power electronics. |

|

In October 2024 |

Infineon Technologies AG, a semiconductor leader in power systems and IoT, joined with Canada-based AWL-Electricity Inc, an MHz resonant capacitive coupling power transfer technology pioneer. Infineon offers AWL-E with CoolGaN™ GS61008P, allowing the growth of advanced wireless power solutions and enabling new ways to solve power challenges in many industries. |

High Electron Mobility Transistors Market Dynamics

The SMR report covers all the trends and technologies playing a major role in the growth of the High Electron Mobility Transistor Market over the forecast period. It highlights the drivers, restraints, and opportunities expected to influence the High Electron Mobility Transistor Market growth during 2025-2032.

Growth of Satellite Communication Systems

As worldwide connectivity becomes a strategic imperative, satellite communication is developing as a cornerstone for applications like internet access, remote sensing, weather forecasting, and national defence. Within this ecosystem, High Electron Mobility Transistors (HEMTs) play a significant role in satellite transceivers and ground stations, mainly for handling high-frequency Ka- and Ku-band transmissions with special precision. The High Electron Mobility Transistor Market is helping significantly from the rapid deployment of satellite mega-constellations like Starlink and OneWeb, which are designed to deliver low-latency, high-throughput connectivity across the globally. HEMTs, known for their high gain, low noise, and minimal power consumption, contribute to reducing satellite payload weight and covering operational lifespans—critical advantages in space-based systems.

Government and private sector investments in space infrastructure are further driving demand. For example, is Europe’s €10.6 billion Iris² satellite constellation project, launched in December 2024, which aims to offer secure, high-speed satellite communication across underserved regions. Such initiatives are projected to accelerate the adoption of advanced HEMT technologies, reinforcing the upward trajectory of the High Electron Mobility Transistor Market in satellite and aerospace applications.

Next-Gen Connectivity: 5G Infrastructure Catalyses High Electron Mobility Transistor Market Growth

The High Electron Mobility Transistor Market is experiencing an essential growth surge, driven by the worldwide deployment of 5G infrastructure. As telecom operators and countrywide governments accelerate efforts to build faster and more efficient communication networks, HEMTs have emerged as vital components for enabling high-speed, high-frequency signal processing with superior power efficiency and minimal noise interference.

HEMTs outperform conventional silicon-based transistors in both switching speed and thermal stability, making them mainly suited for 5G base stations, massive MIMO systems, and millimeter-wave (mmWave) applications. Their ability to handle wide bandwidth and operate at higher frequencies is vital for supporting next-generation technologies, including autonomous vehicles, industrial IoT, and smart city infrastructure—sectors that are heavily reliant on real-time data transmission and ultra-low latency.

For example, in October 2024, when Pegatron 5G showed its latest Open RAN (O-RAN) compliant solutions at the India Mobile Congress. The company introduced the PR1450 O-RU and a Fronthaul Multiplexer (FHM), considered to strengthen in-building 5G coverage. These products align with India’s “Make in India” creativity and are intended to deliver seamless indoor connectivity while simplifying network configurations.

High Electron Mobility Transistor Market Segmentation Insight:

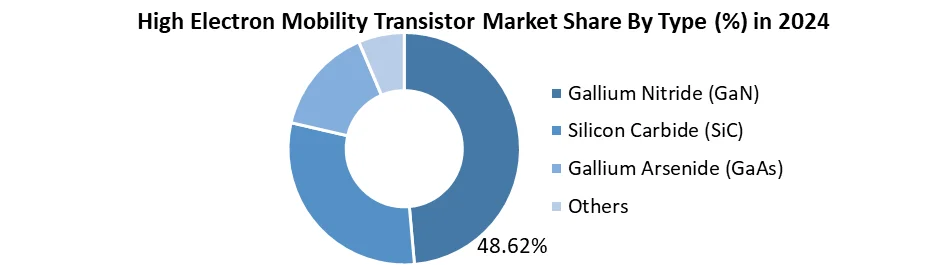

Based on Type, Gallium Nitride (GaN) segment held the largest 48.62% High Electron Mobility Transistor market share in 2024. This growth is driven by its performance and versatility features. GaN-based HEMTs are better than silicon-based transistors in terms of low resistance, high electron mobility, and improved power handling capabilities, thus making them ideal for high frequency and high-power applications. In applications like aerospace, telecommunications, and automotive industries where efficient power conversion and high-speed data transmission are crucial, GaN HEMTs are widely used. The rising acceptance of GaN technology in emerging areas such as 5G wireless communication, electric vehicles and renewable energy is also expected to dive High electron mobility transistor market growth.

Developing global 5G infrastructure deployment, growing demand for high-speed data transmission, and increased adoption of GaN devices in aerospace and defense are major factors reinforcing the GaN segment’s foremost position in the high electron mobility transistor market globally. As these applications continue to increase, GaN-based HEMTs are expected to remain the preferred choice across industries.

Based on End User, the consumer electronics segment dominated the electron mobility transistor market and accounted for a market share of nearly 28.12% in 2024. This high demand driven by growing need for smaller, more efficient, and high-performance electronic equipment. HEMTs are foremost this transformation, as they offer a new blend of low power consumption, high-speed operation, and superior high-frequency performance. On the other hand, the aerospace & defense segment is expected to register the fastest CAGR of 7.12% from 2025 to 2033 owing to the crucial role played by HEMTs in advancing technology within the aerospace & defense sector.

High Electron Mobility Transistor Market Regional Insight:

Globally, North America region held the dominant position in the high electron mobility transistor market in 2024. North America, led by the U.S., remains a dominant force in the high electron mobility transistor market, maintained by a mature semiconductor ecosystem and considerable investments in R&D. The accelerating disposition of 5G technology and the rising penetration of electric vehicles (EVs) have shaped strong demand for high-efficiency power management solutions.

Asia-Pacific represents a rapidly expanding high electron mobility transistor market, with China, Japan, and South Korea at the forefront of HEMT adoption. Japan’s deep-rooted expertise in precision semiconductor industrial supports its drive toward high-performance electronics. Meanwhile, China's strategic focus on renewable energy and electric mobility is fuelling a surge in demand for HEMTs across power electronics applications. Government initiatives helping green technologies have led to significant investments in HEMT-based solutions, mainly in solar inverters, EV chargers, and grid power systems, aligning with worldwide sustainability targets.

Competitive Landscape: High Electron Mobility Transistor Market

The high electron mobility transistor market is highly competitive, driven by the rising need for high-efficiency, high-frequency devices across telecom, automotive, and industrial sectors. A significant trend is the shift toward GaN-based HEMTs, which outperform traditional silicon in, radar, 5G and power systems. Companies are strengthening their positions over strategic collaborations and innovations. For example, ROHM Semiconductor, in collaboration with Ancora Semiconductors and Delta Electronics, launched 650V GaN HEMTs in 2023 for high-efficiency power supplies—highlighting the push for energy-saving solutions using advanced materials like SiC and GaN.

Analyst Insight: Growth Outlook for the High Electron Mobility Transistor Market

According to our analysis, the global high electron mobility transistor market is undergoing a phase of faster growth, propelled by the growing demand for high-frequency, high-efficiency electronic components across a broad range of segments. Key growth drivers contain the global rollout of 5G networks, the growth of satellite communications, and growing investments in advanced radar, aerospace, and defence systems. Materials such as Gallium Arsenide (GaAs) and Gallium Nitride (GaN) are at the forefront owing to their advantages in thermal performance, switching speed, and high-voltage endurance, making HEMTs vital in applications from telecom infrastructure to automotive electrification.

Leading economies such as the U.S., Japan, China, and Germany continue to dominate through strategic R&D funding and growth of domestic semiconductor ecosystems. At the same time, developing markets like India are accelerating adoption, driven by infrastructure development and defence modernization creativities.

High Electron Mobility Transistor Market Report Scope:

|

High Electron Mobility Transistor Market Scope |

|

|

Market Size in 2024 |

USD 6.68 Bn. |

|

Market Size in 2032 |

USD 11.34 Bn. |

|

CAGR (2025-2032) |

6.84 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Type Gallium Nitride (GaN) Silicon Carbide (SiC) Gallium Arsenide (GaAs) Others |

|

by End User Consumer Electronics Automotive Industrial Aerospace & Defense Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the High Electron Mobility Transistor Market

North America

- Wolfspeed (United States)

- Qorvo (United States)

- MACOM Technology Solutions (United States)

- Analog Devices Inc. (United States)

- Texas Instruments (United States)

- Microsemi Corporation (United States)

- Intel Corporation (United States )

Europe

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Ampleon (Netherlands)

- NXP Semiconductors (Netherlands)

Asia-Pacific

- Sumitomo Electric Device Innovations (Japan)

- Mitsubishi Electric (Japan)

- Fujitsu Limited (Japan)

- Renesas Electronics Corporation (Japan)

- ROHM Semiconductor (Japan)

- Oki Electric Industry Co., Ltd. (Japan)

- Toshiba Corporation (Japan)

Frequently Asked Questions

The Global High Electron Mobility Transistor Market is growing at a significant rate of 6.84% during the forecast period.

North America is expected to dominate the High Electron Mobility Transistor Market during the forecast period.

Asia Pacific is expected to Grow highest CAGR of Global High Electron Mobility Transistor Market during forecast period.

The High Electron Mobility Transistor Market size is expected to reach USD 11.34 Bn. by 2032.

1. High Electron Mobility Transistor Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global High Electron Mobility Transistor Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. High Electron Mobility Transistor Market: Dynamics

3.1. High Electron Mobility Transistor Market Trends

3.2. High Electron Mobility Transistor Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. High Electron Mobility Transistor Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

4.1.1. Gallium Nitride (GaN)

4.1.2. Silicon Carbide (SiC)

4.1.3. Gallium Arsenide (GaAs)

4.1.4. Others

4.2. High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Industrial

4.2.4. Aerospace & Defense

4.2.5. Others

4.3. High Electron Mobility Transistor Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America High Electron Mobility Transistor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

5.1.1. Gallium Nitride (GaN)

5.1.2. Silicon Carbide (SiC)

5.1.3. Gallium Arsenide (GaAs)

5.1.4. Others

5.2. North America High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

5.2.1. Consumer Electronics

5.2.2. Automotive

5.2.3. Industrial

5.2.4. Aerospace & Defense

5.2.5. Others

5.3. North America High Electron Mobility Transistor Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Gallium Nitride (GaN)

5.3.1.1.2. Silicon Carbide (SiC)

5.3.1.1.3. Gallium Arsenide (GaAs)

5.3.1.1.4. Others

5.3.1.2. United States High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

5.3.1.2.1. Consumer Electronics

5.3.1.2.2. Automotive

5.3.1.2.3. Industrial

5.3.1.2.4. Aerospace & Defense

5.3.1.2.5. Others

5.3.2. Canada

5.3.2.1. Canada High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

5.3.2.1.1. Gallium Nitride (GaN)

5.3.2.1.2. Silicon Carbide (SiC)

5.3.2.1.3. Gallium Arsenide (GaAs)

5.3.2.1.4. Others

5.3.2.2. Canada High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

5.3.2.2.1. Consumer Electronics

5.3.2.2.2. Automotive

5.3.2.2.3. Industrial

5.3.2.2.4. Aerospace & Defense

5.3.2.2.5. Others

5.3.3. Mexico

5.3.3.1. Mexico High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

5.3.3.1.1. Gallium Nitride (GaN)

5.3.3.1.2. Silicon Carbide (SiC)

5.3.3.1.3. Gallium Arsenide (GaAs)

5.3.3.1.4. Others

5.3.3.2. Mexico High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

5.3.3.2.1. Consumer Electronics

5.3.3.2.2. Automotive

5.3.3.2.3. Industrial

5.3.3.2.4. Aerospace & Defense

5.3.3.2.5. Others

6. Europe High Electron Mobility Transistor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.2. Europe High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3. Europe High Electron Mobility Transistor Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.1.2. United Kingdom High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.2. France

6.3.2.1. France High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.2.2. France High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.3. Germany

6.3.3.1. Germany High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.3.2. Germany High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.4. Italy

6.3.4.1. Italy High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.4.2. Italy High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.5. Spain

6.3.5.1. Spain High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.5.2. Spain High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.6.2. Sweden High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.7. Russia

6.3.7.1. Russia High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.7.2. Russia High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

6.3.8.2. Rest of Europe High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7. Asia Pacific High Electron Mobility Transistor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3. Asia Pacific High Electron Mobility Transistor Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.1.2. China High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.2.2. S Korea High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.3. Japan

7.3.3.1. Japan High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.3.2. Japan High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.4. India

7.3.4.1. India High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.4.2. India High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.5. Australia

7.3.5.1. Australia High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.5.2. Australia High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.6. Indonesia

7.3.6.1. Indonesia High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.6.2. Indonesia High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.7. Malaysia

7.3.7.1. Malaysia High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.7.2. Malaysia High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.8. Philippines

7.3.8.1. Philippines High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.8.2. Philippines High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.9. Thailand

7.3.9.1. Thailand High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.9.2. Thailand High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.10. Vietnam

7.3.10.1. Vietnam High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.10.2. Vietnam High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

7.3.11. Rest of Asia Pacific

7.3.11.1. Rest of Asia Pacific High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

7.3.11.2. Rest of Asia Pacific High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8. Middle East and Africa High Electron Mobility Transistor Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8.3. Middle East and Africa High Electron Mobility Transistor Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.3.1.2. South Africa High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8.3.2. GCC

8.3.2.1. GCC High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.3.2.2. GCC High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8.3.3. Egypt

8.3.3.1. Egypt High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.3.3.2. Egypt High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8.3.4. Nigeria

8.3.4.1. Nigeria High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.3.4.2. Nigeria High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

8.3.4.3. Nigeria High Electron Mobility Transistor Market Size and Forecast, By Age Group Type (2024-2032)

8.3.4.4. Nigeria High Electron Mobility Transistor Market Size and Forecast, By Gender Type (2024-2032)

8.3.5. Rest of ME&A

8.3.5.1. Rest of ME&A High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

8.3.5.2. Rest of ME&A High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9. South America High Electron Mobility Transistor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.2. South America High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9.3. South America High Electron Mobility Transistor Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.3.1.2. Brazil High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.3.2.2. Argentina High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9.3.3. Colombia

9.3.3.1. Colombia High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.3.3.2. Colombia High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9.3.4. Chile

9.3.4.1. Chile High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.3.4.2. Chile High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

9.3.5. Rest Of South America

9.3.5.1. Rest Of South America High Electron Mobility Transistor Market Size and Forecast, By Type (2024-2032)

9.3.5.2. Rest Of South America High Electron Mobility Transistor Market Size and Forecast, By End User (2024-2032)

10. Company Profile: Key Players

10.1. Wolfspeed

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Qorvo

10.3. Infineon Technologies AG

10.4. STMicroelectronics

10.5. MACOM Technology Solutions

10.6. Ampleon

10.7. Sumitomo Electric Device Innovations

10.8. Mitsubishi Electric

10.9. Fujitsu Limited

10.10. Texas Instruments

10.11. Renesas Electronics Corporation

10.12. NXP Semiconductors

10.13. Analog Devices Inc.

10.14. Microsemi Corporation

10.15. ROHM Semiconductor

10.16. Oki Electric Industry Co., Ltd.

10.17. Lake Shore Cryotronics, Inc.

10.18. Toshiba Corporation

10.19. Intel Corporation

11. Key Findings

12. Analyst Recommendations

13. High Electron Mobility Transistor Market: Research Methodology